Tactical Allocation Models

Back to StrategiesInvestment Objective

Outperform a traditional multi-asset index by utilizing tactical and defined outcome investments. The goal is to build an asset allocation that attempts to provide investors with smoother investment outcomes than the stated benchmark provides.

Portfolio Philosophy

Tactical Investing – Utilize tactically managed investment choices to invest in areas of the market garnering capital flows.

Risk Management – Provide multi-layered downside protection utilizing a proprietary risk overlay and defined outcome ETFs.

Use Case – Designed for investors seeking a tactical approach to investing, including investments with capped upside and periods of increased cash and fixed income allocations.

Product Profile

S&P 1500 TR Index**

Lead Portfolio Manager

Buff Dormeier, CMT®

Chief Technical Analyst and Portfolio Manager

view profile >

* Depending on risk tolerance

** Bloomberg US Aggregate Bond Total Return Index/S&P 1500 Composite Total Return Index, % to each index dependent on risk tolerance

Performanceas of 9/30/2025

Balanced Portfolio

5.00%QTD

8.61%YTD

8.44%Since Inception

Moderate Aggressive Portfolio

6.79%QTD

10.74%YTD

10.81%Since Inception

Aggressive Portfolio

6.64%QTD

9.15%YTD

8.57%Since Inception

The performance data shown is through the date listed above and represents past performance for the composite. The composite includes all discretionary accounts managed in accordance with the strategy. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. There is no guarantee that any investment strategy will achieve its objectives. “Net of Max Fee” represents performance that has factored in an assumed fee of 1.50% (zero model fee plus 1.50% advisor fee).

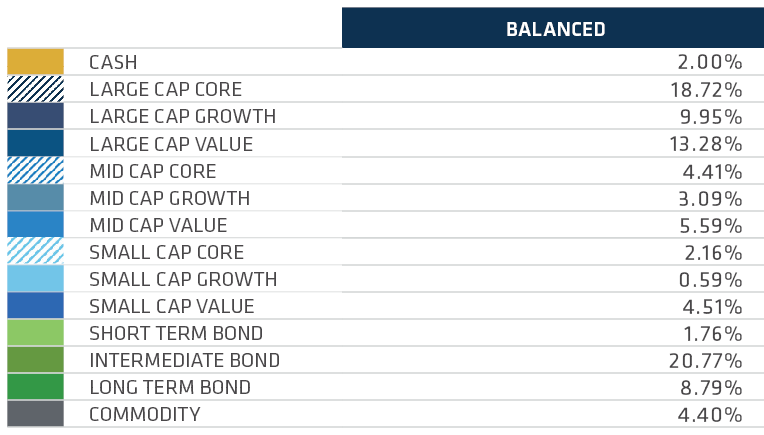

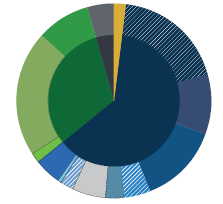

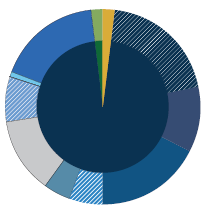

Allocationsas of 9/30/2025

Balanced Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

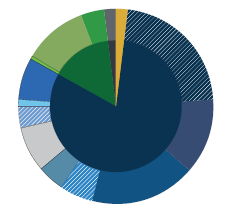

Moderate Aggressive Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

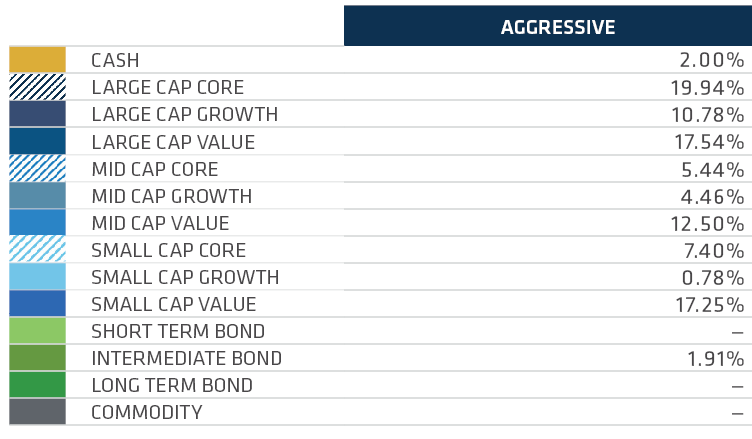

Aggressive Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.