Blue Chips

Back to StrategiesInvestment Objective

Outperform the S&P 500 Index by investing in the most fundamentally strong companies within the index, thus providing downside protection in the process.

Portfolio Philosophy

We believe a fundamental perspective paired with quantitative execution will result in long-term outperformance.

- Active Stock Selection – Invest in top 24 performing companies while avoiding unfavored companies relative to the current market fundamentals.

- Risk Management – Provide investors domestic equity exposure while adhering to strict portfolio mandates.

- Consistency – Aim to provide investors long term growth with the knowledge that their portfolio attempts to invest exclusively in high quality companies.

Product Profile

Lead Portfolio Manager

Performanceas of 9/30/2025

15.14%Standard Deviation

1.14%QTD

6.82%YTD

5.43%1-YR

9.34%5-YR

12.90%Since Inception

The performance data shown is through the date listed above and represents past performance for the composite. The composite includes all discretionary accounts managed in accordance with the strategy. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. There is no guarantee that any investment strategy will achieve its objectives. “Net of Max Fee” represents performance that has factored in an assumed fee of 2.10% (0.60% model fee plus 1.50% advisor fee).

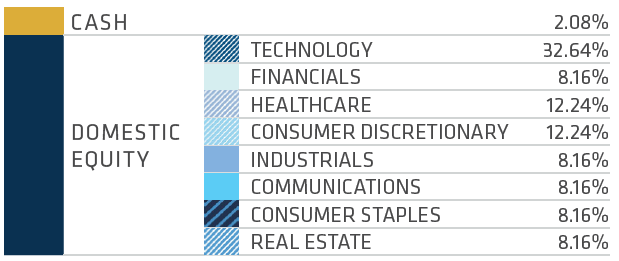

Allocationsas of 9/30/2025

Allocations are subject to change without notice.