Portfolio Manager Insights | How Oil Prices Impact Inflation, the Fed and Markets - 4.24.2024

Click here to download this commentary in PDF format.

The stock market has become increasingly jittery with the S&P 500 experiencing its first 5% pullback of the year. The possibility the Fed could delay its first rate cut, declines in technology and artificial intelligence stocks, and tensions in the Middle East have all contributed to the market swoon. In uncertain market environments such as these, investors should remember that short-term market declines are a natural part of investing. Rather than following daily market movements, what perspectives should investors consider to stay focused on the long run?

First, of the many factors driving markets today, perhaps the most uncertain is the impact geopolitical conflicts could have on the price of oil. The world is still highly dependent on oil with a global demand estimate of 102 million barrels per day in 2023 according to the International Energy Agency. Thus, oil is a way for geopolitical instability to be transmitted to the global economy since conflicts can disrupt oil production and supply chains, driving prices higher. Perhaps most importantly in today’s economic environment, rising oil prices lead to higher inflation, impacting consumers, Fed decision-making and interest rates.

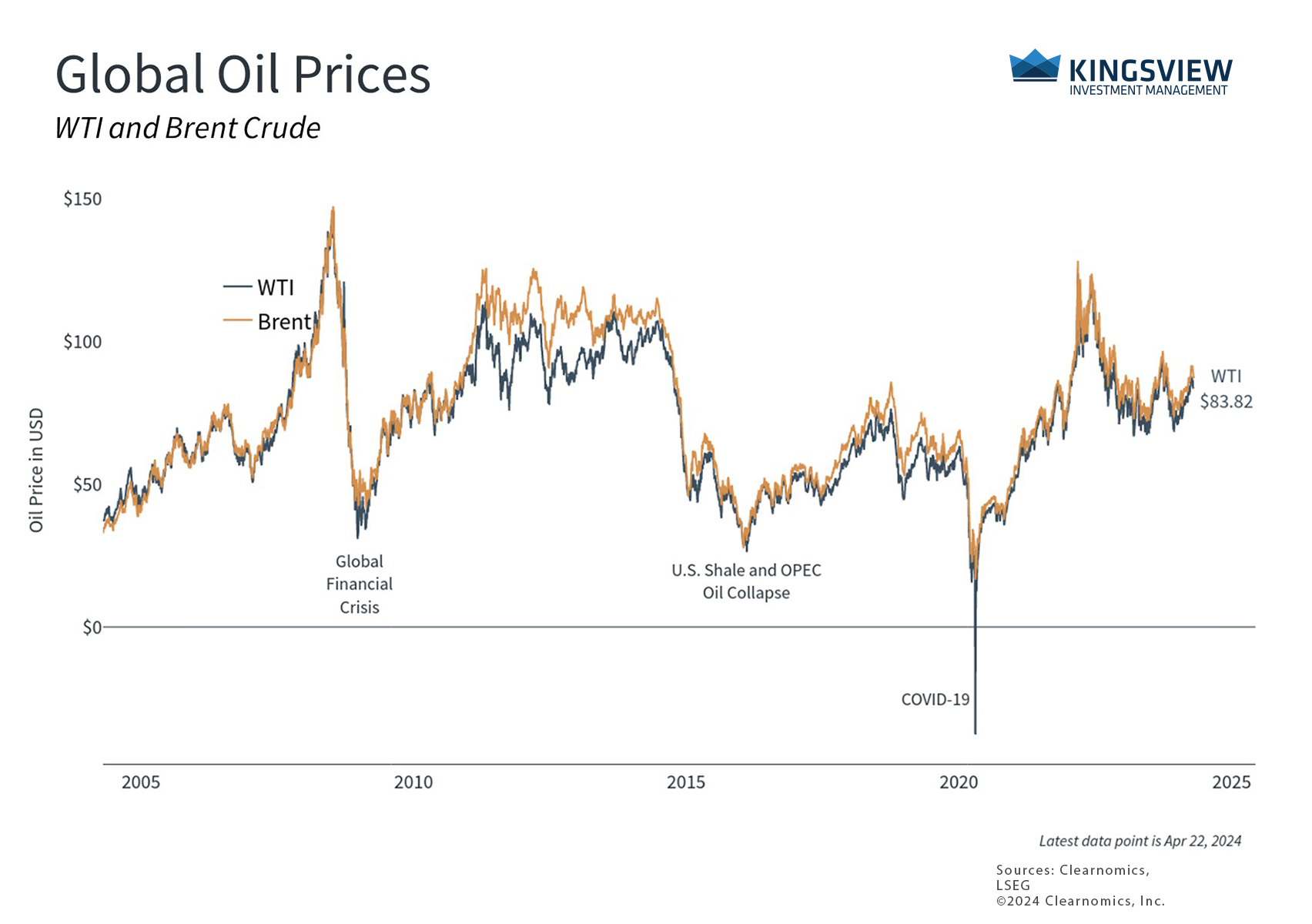

Oil prices have risen but remain below their historic peaks

For example, Russia’s invasion of Ukraine in early 2022 led to a spike in oil prices to over $127 a barrel. This is an important reason headline inflation, including the Consumer Price Index (CPI), jumped to four-decade highs a few months later. Gasoline prices at the pump rose to $5 on average across the country, hurting consumer sentiment and leading to fears of a recession. Oil prices did eventually settle and have been relatively calm in recent weeks amid rising tensions between Israel and Iran as well as shipping disruptions in the Red Sea.

Still, oil prices are about 8% higher this year with Brent crude and WTI recently trading around $87 and $83 per barrel, respectively. This pushed the energy component of CPI higher in February and March, propping up overall inflation. While economists tend to focus on core CPI which excludes food and energy prices, it’s impossible to ignore the impact higher oil prices have on consumers and economic growth. Thus, oil remains a wildcard when it comes to monetary policy and the timing of the Fed’s first rate cut.

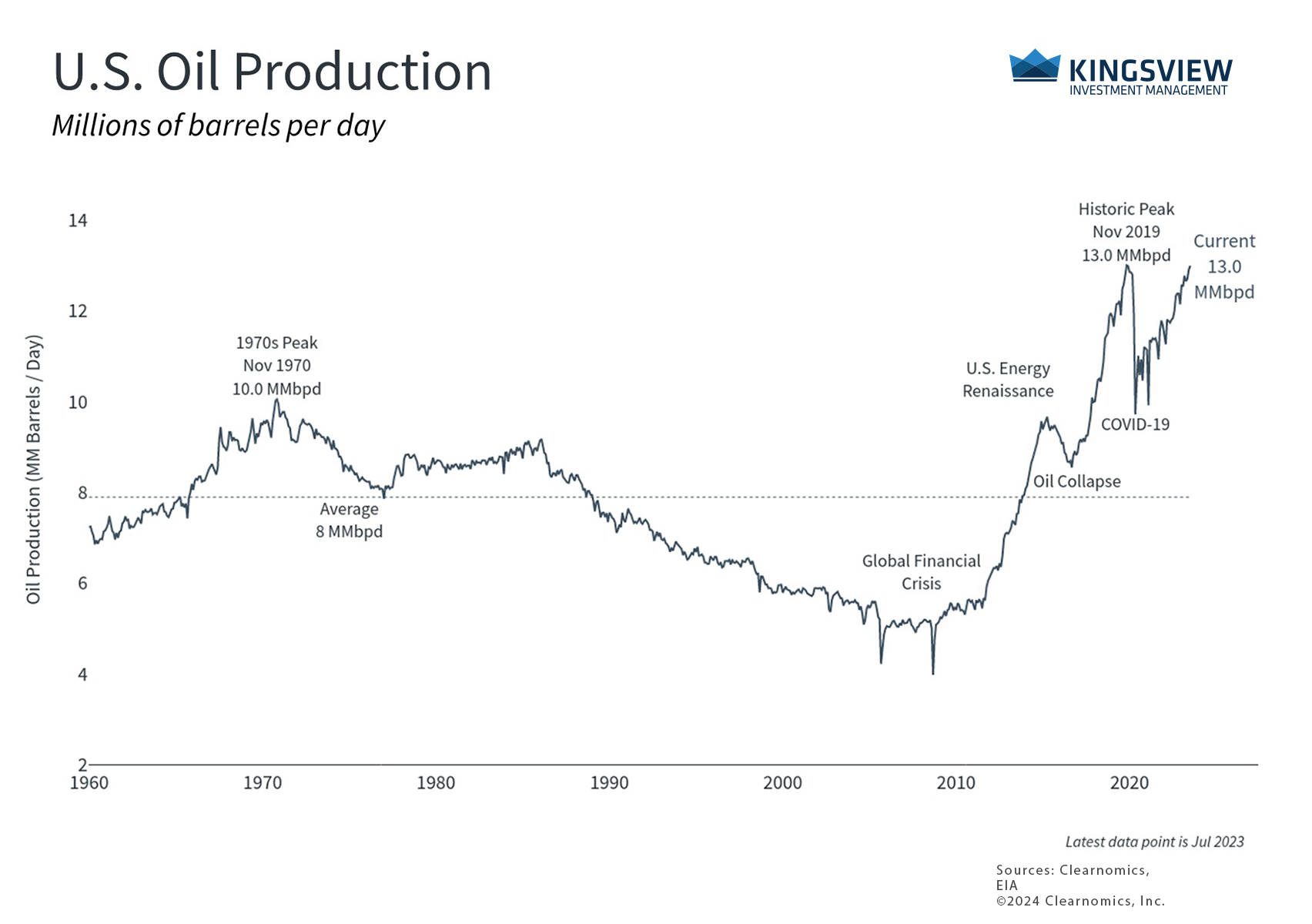

The U.S. is the largest producer of crude oil in the world

Second, an important difference between today’s inflationary environment and that of the 1970s and early 1980s is that the U.S. is now the largest producer of both oil and gas in the world. The U.S. has produced more crude oil than any other nation over the past few years. Domestic oil production has fully rebounded from the pandemic and now exceeds 13 million barrels per day, more than Saudi Arabia, Russia, and other members of OPEC+. There have also been hopes that the U.S. would play the role of a “swing producer” to raise production when required by global supply and demand. In theory, greater energy independence is one reason the U.S. may be more insulated from global events than in the past.

That said, the U.S. is still dependent on oil imports for a variety of reasons, including the type and quality of crude oil. Although the U.S. theoretically produces enough oil to meet its energy needs, overseas oil is often cheaper than domestically-produced crude due to a variety of other factors. In recent years, Canada, Mexico, and Saudi Arabia have been the largest sources of U.S. imports of foreign oil. U.S. imports from OPEC countries have declined to just 15% from a peak of over 70% of U.S. crude oil and petroleum imports in the late 1970s. However, since oil is a global commodity, price swings still impact U.S. producers and consumers despite strong U.S. oil production and strong trading partners.

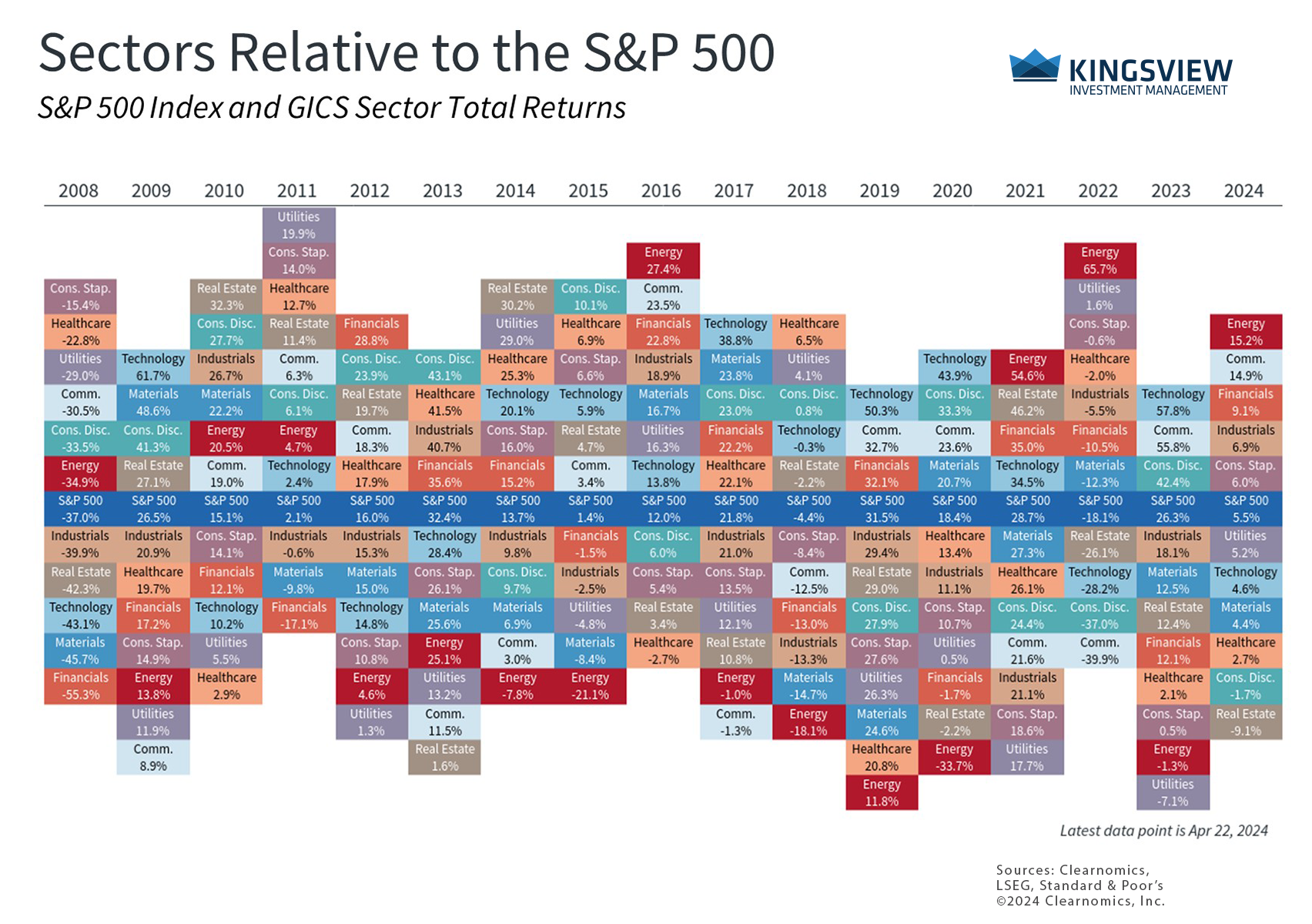

The energy sector has performed well this year

Finally, from an investment perspective, the energy sector is a volatile but important component of a diversified portfolio. Interestingly, the sector has behaved quite differently from the rest of the market over the past several years. For example, during the 2022 bear market caused by inflation and recession fears, rising oil prices propelled the energy sector to a total return of 65.7%, adding to its significant gain in 2021. This was also a reversal of the trend that began in 2014 when the energy sector was among the worst performers most years due to overproduction and low oil prices.

This year, the energy sector has generated a total return of 14.5% and is now the best performing sector. While there is no guarantee that the energy sector will always perform well during periods of geopolitical uncertainty, it remains an important part of a balanced portfolio that can help investors to weather volatility and stay focused on long-term financial goals.

The bottom line? Geopolitical instability can drive up oil prices and spur inflation, muddying the economic and interest rate outlook. Investors should continue to stay invested and focused on long run trends.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2024)