Volume Analysis | Flash Market Update - 1.22.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

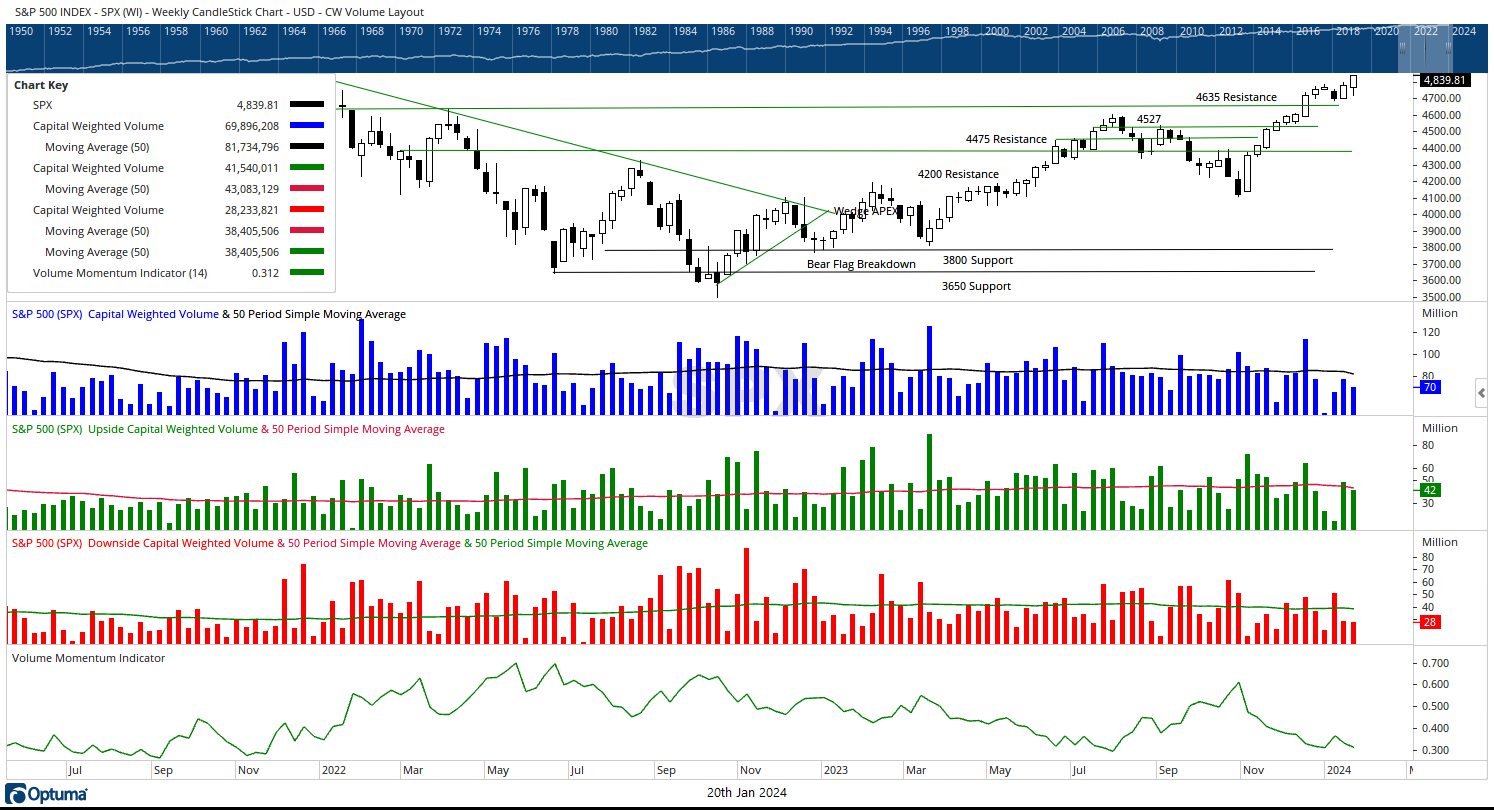

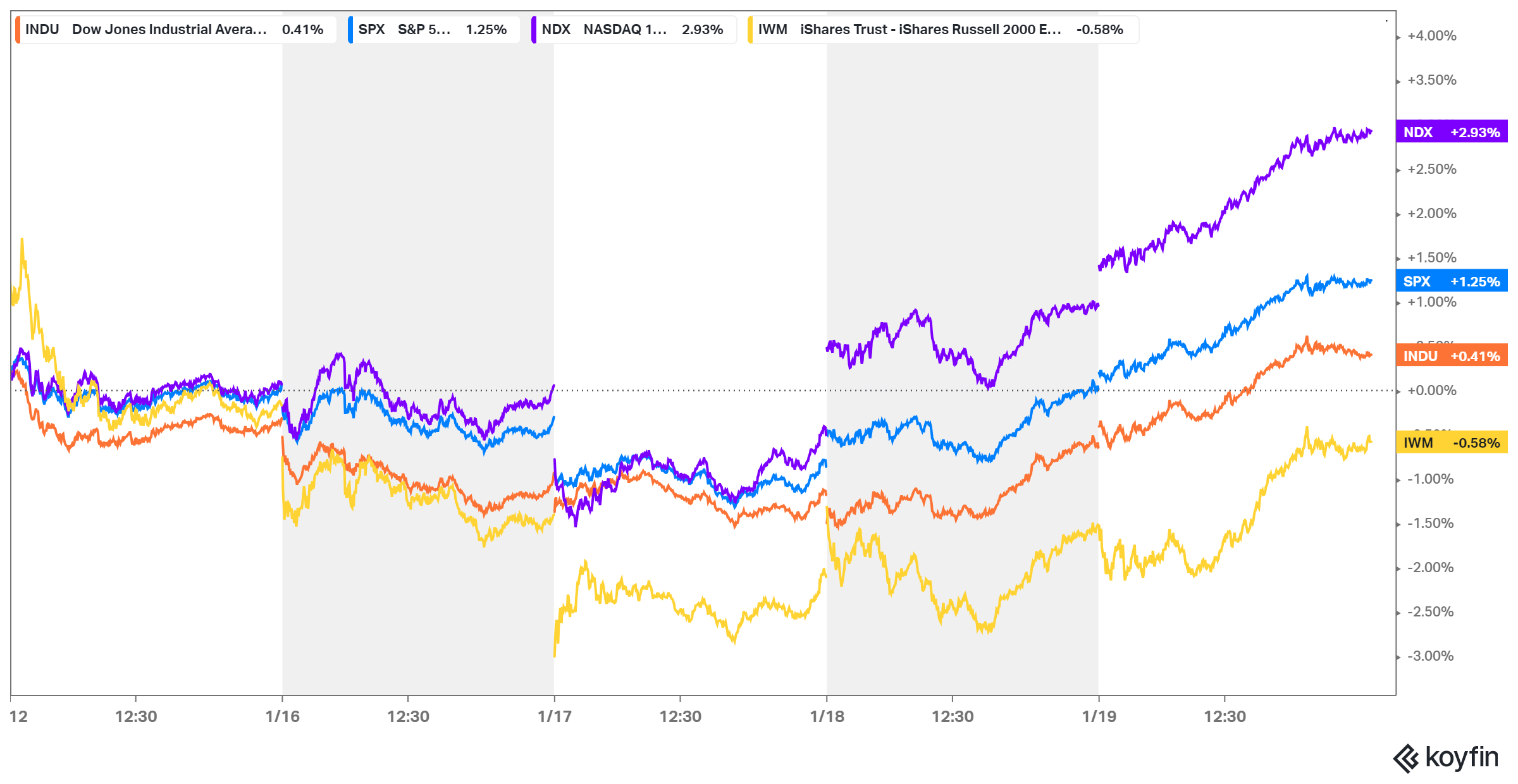

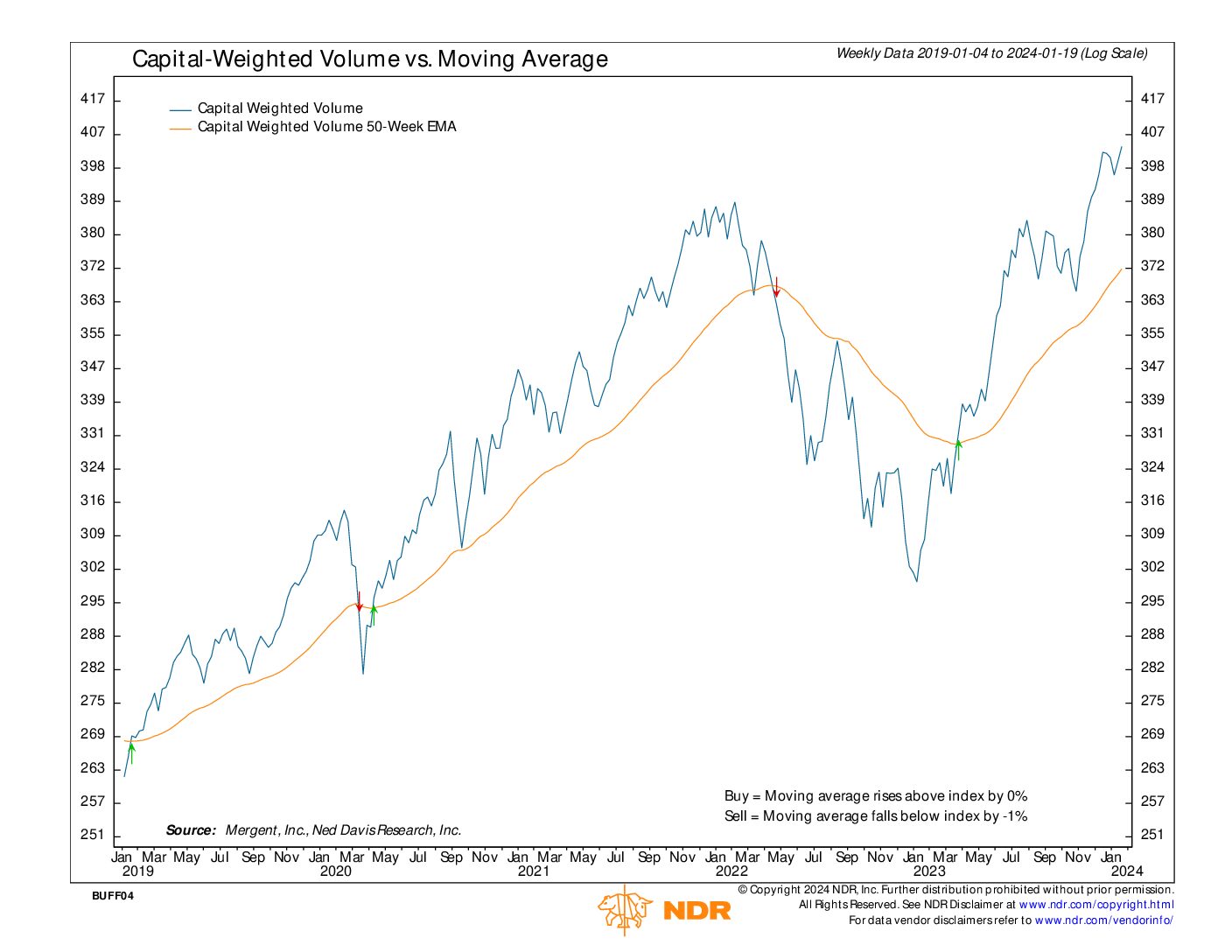

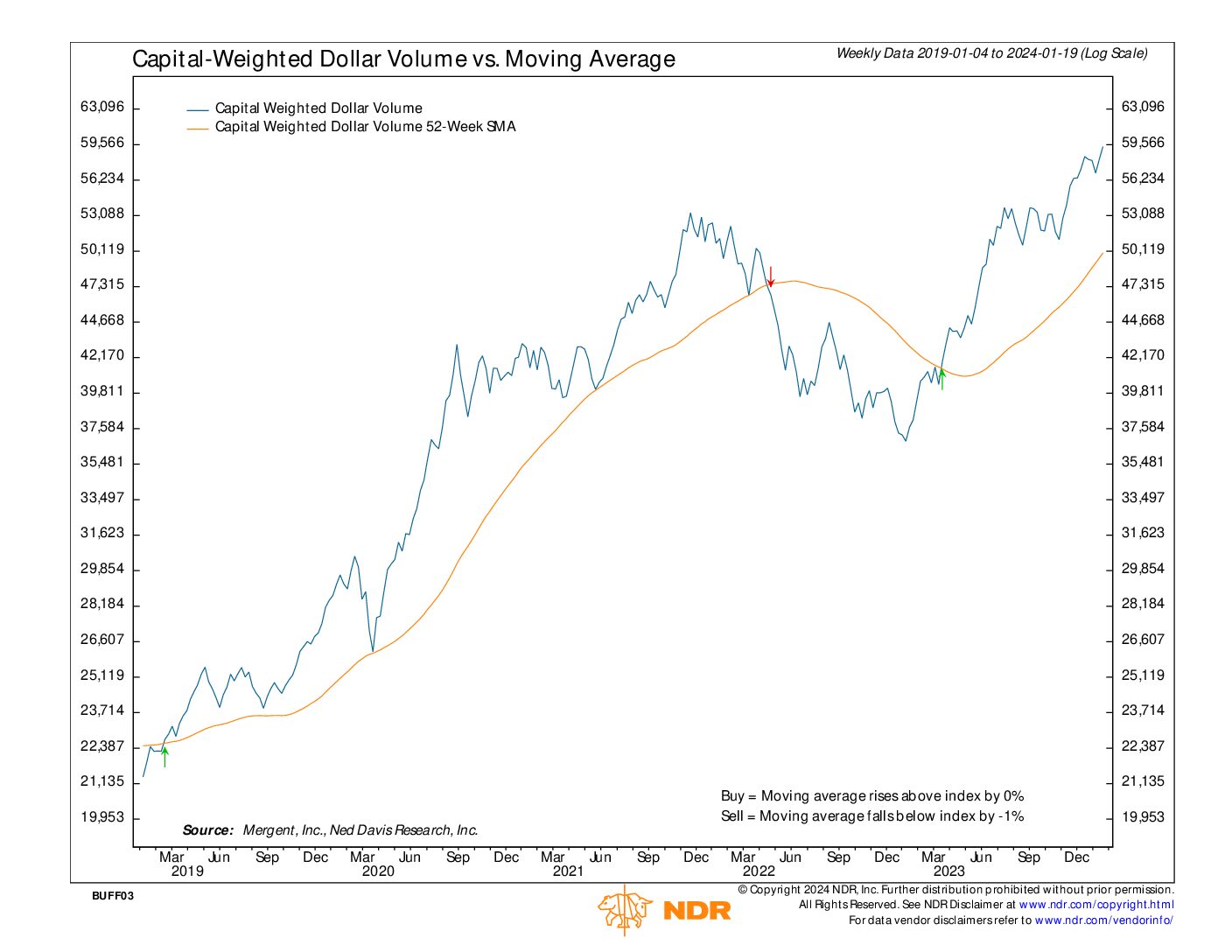

On Friday, both the S&P 500 and the generals (NDX100) reached new highs, but a closer examination reveals more than just these milestones. The same principle holds true for the S&P 500’s Volume. Despite the S&P 500 price index racking up new highs as well as Capital Weighted Volume, and Capital Weighted Dollar Volume all achieving new all-time highs, Capital Weighted Dollar Volume was below average for the week. The S&P 500 closed the week up by 1.25%, the generals (NDX 100) surged by 2.93%, while the troops (IWM – Russell 2000 ETF) retreated by -0.58%.

Delving further, on Wednesday, January 17th, the bears nearly achieved a 90% Downside day, with 89% of S&P 500 Capital Flows recorded to the downside. This is a rare occurrence when considering the S&P 500 just hit new 52-week highs. However, on Friday, the bulls decisively regained control, with a remarkable 96% of the Capital Weighted recorded to the upside. Therefore, while the weekly volume stats may not fully confirm the price movement, daily Capital Weighted Volume appears to be echoing a more bullish sentiment.

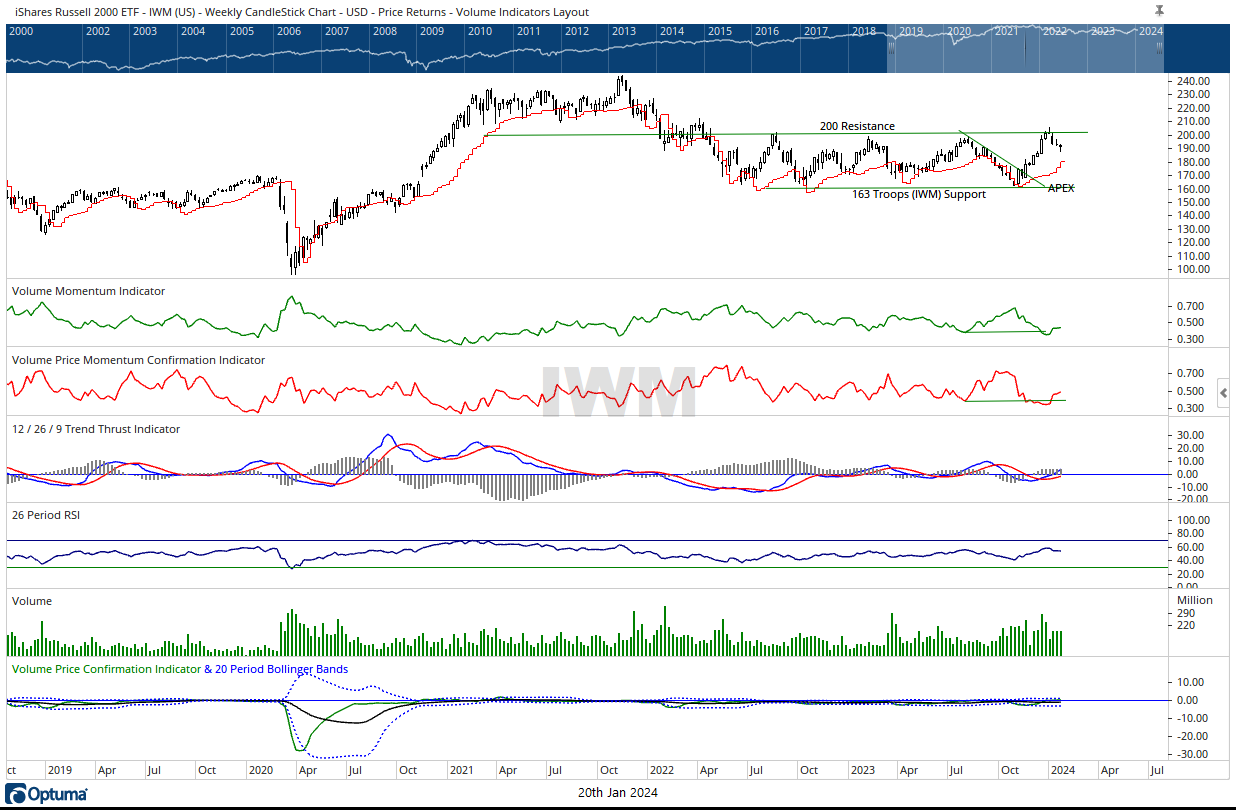

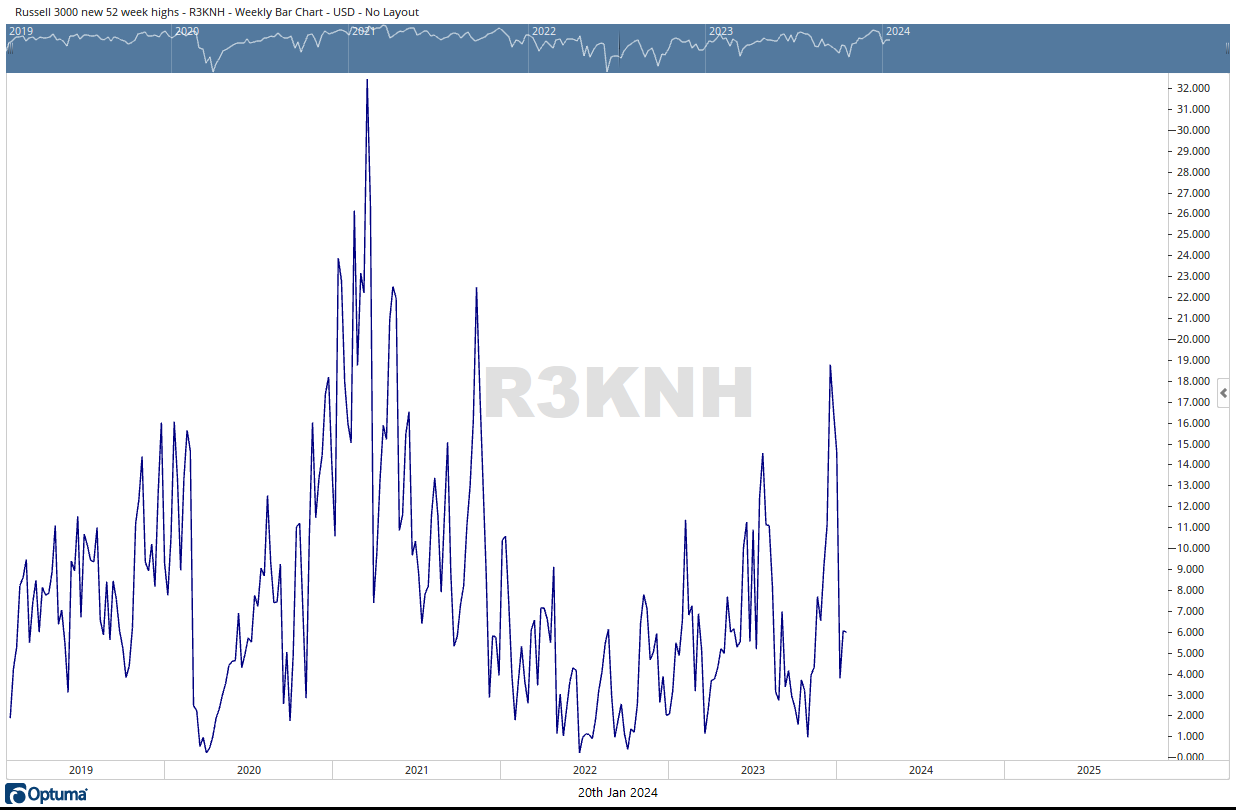

Scrutinizing the internals, the NYSE Advance-Decline Line finished close to its weekly highs. However, the AD Line experienced a significant downward gap on Monday, leading to a lower finish from the previous week’s close. Despite the strong performance of large caps, the number of stocks in Russell 3000 reaching new highs only marginally increased. In summary, the generals continue to advance, but there appears to be a pause in the market’s overall broadening out trend.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 1/22/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.