Volume Analysis | Flash Market Update - 1.16.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

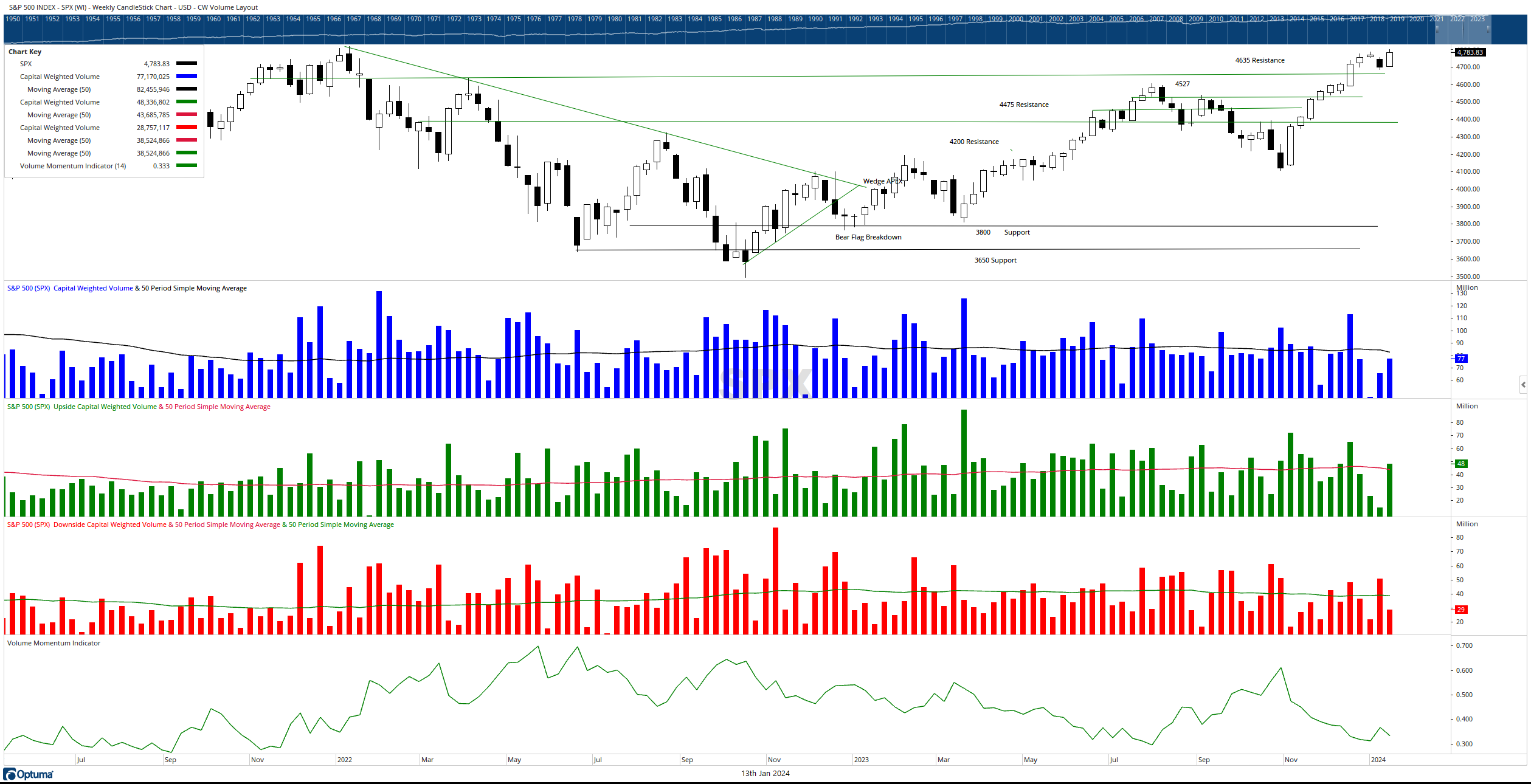

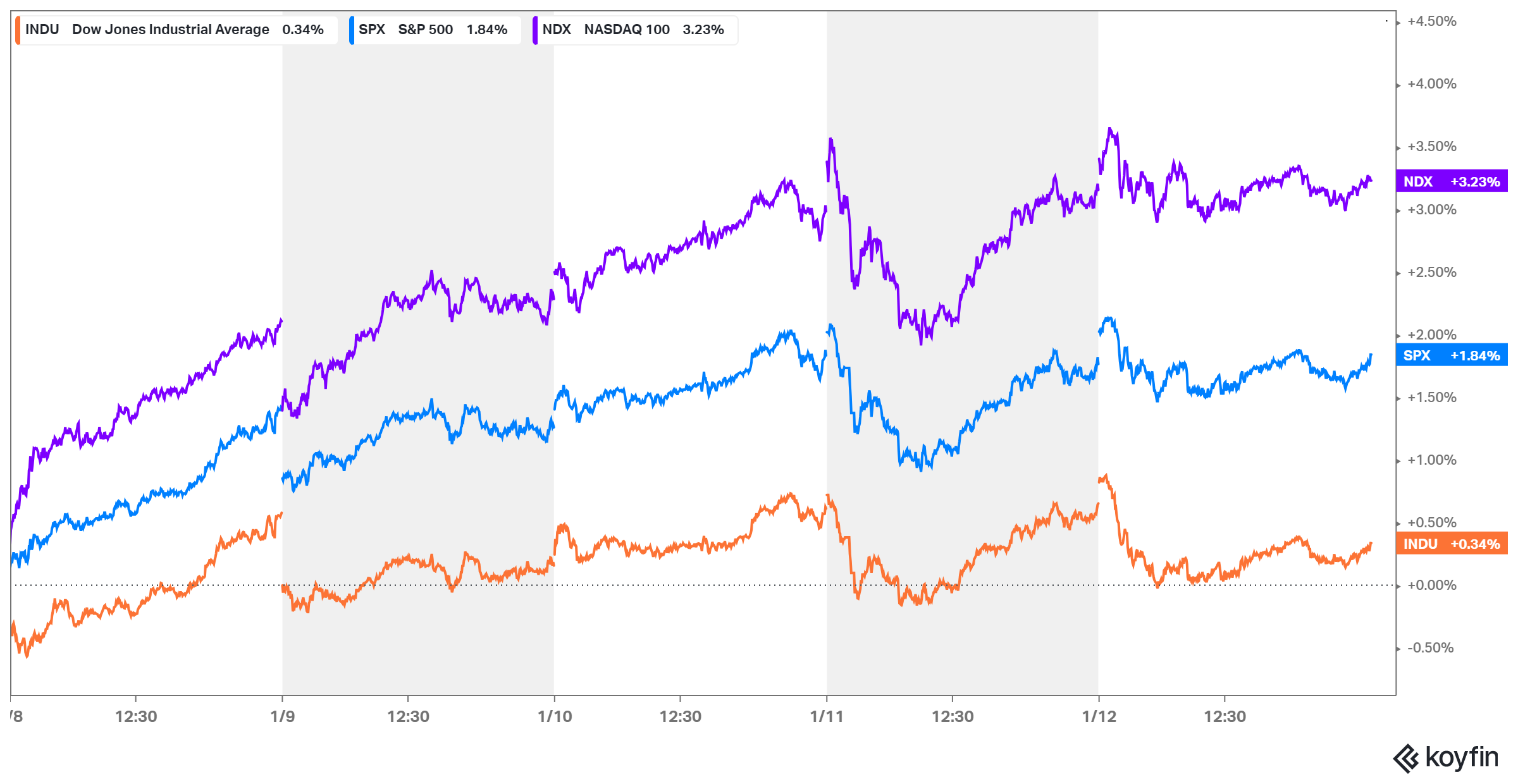

For the first full weekly session after a two-week hiatus, capital flows remained subdued despite the S&P 500 reaching new 52-week highs. Upside capital flows maintained an average pace, while downside capital flows were below average. From a pricing perspective, the S&P 500 closed the week near its 52-week high, marking a 1.84% increase. The generals (NDX 100) led with a robust 3.23% gain, while the troops (IWM / iShares Russell 2000 ETF) remained largely flat for the week.

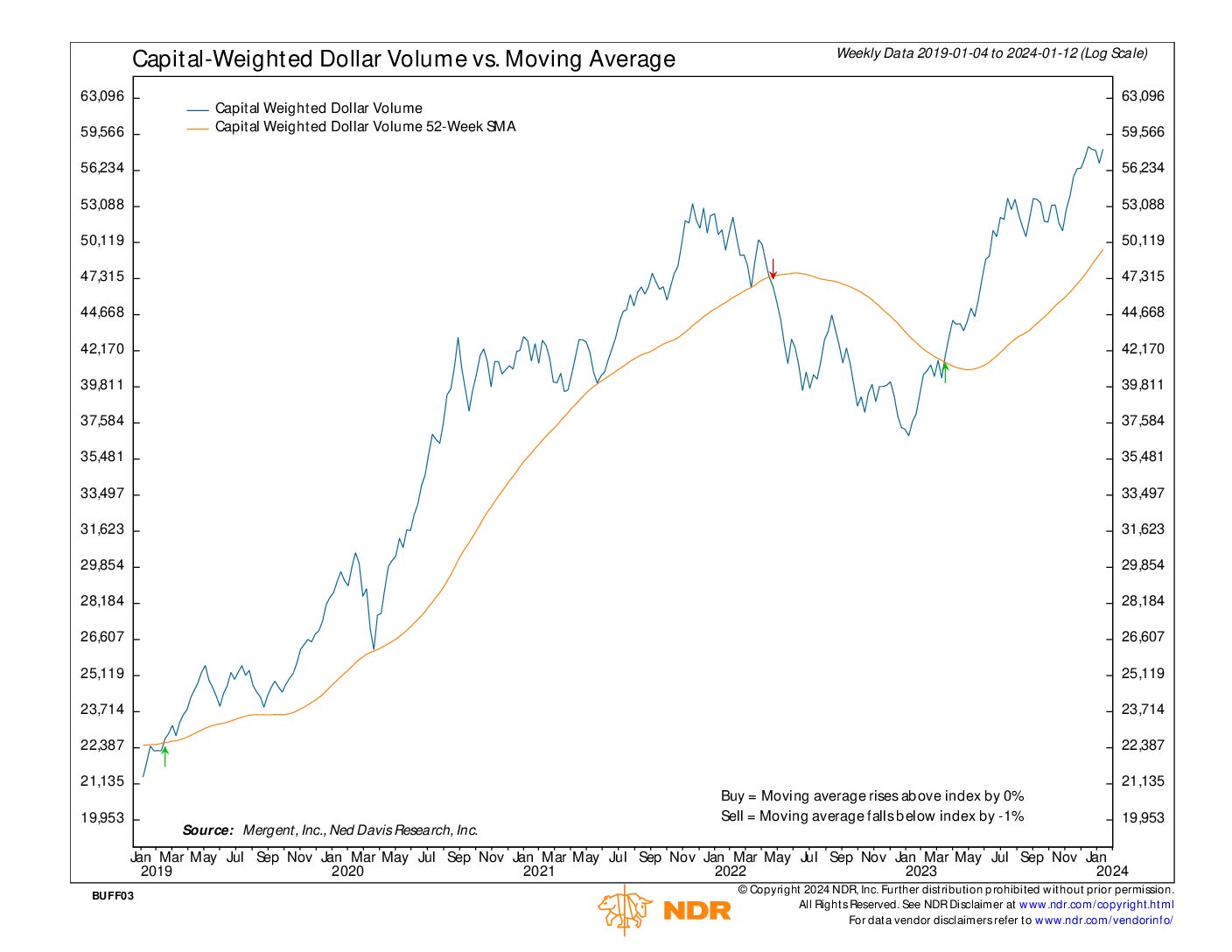

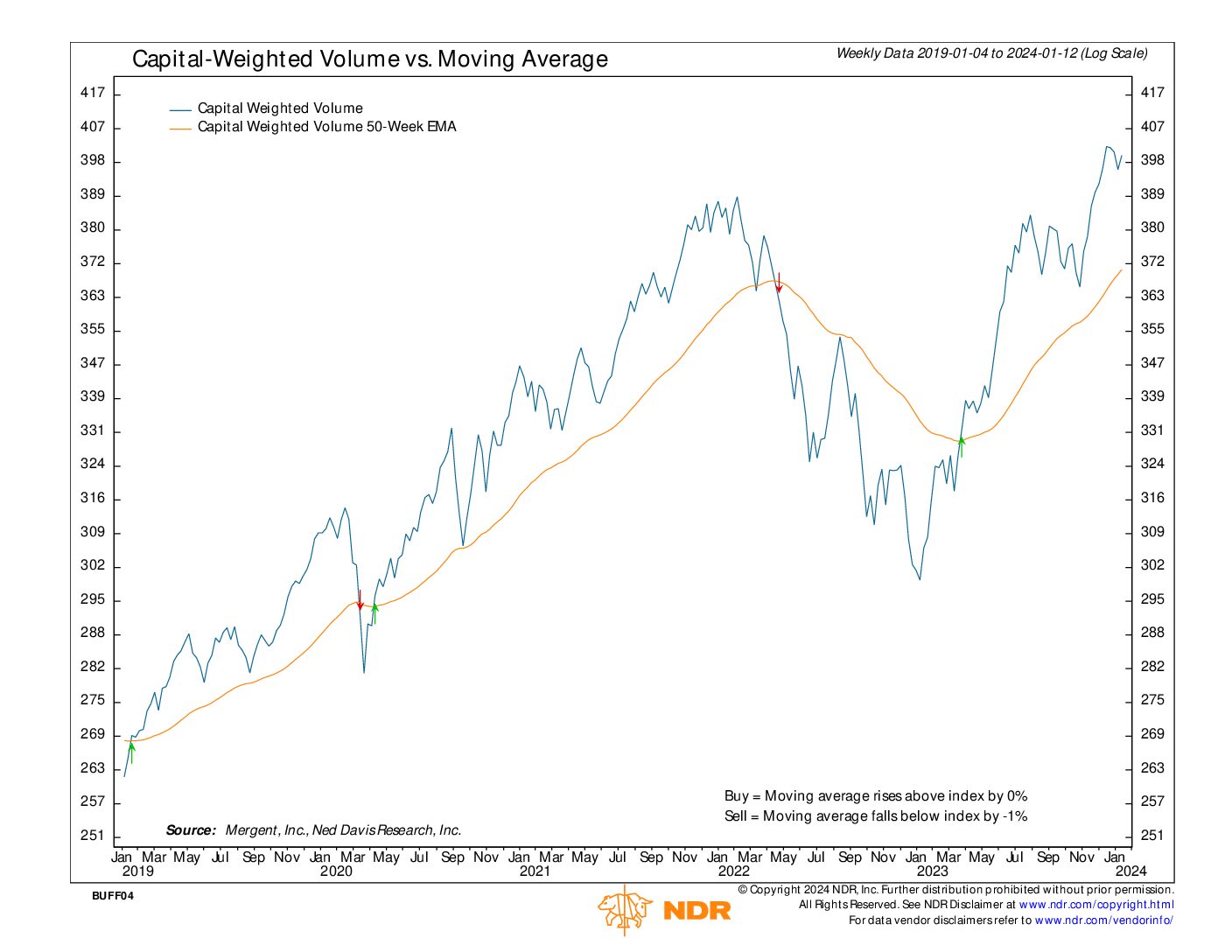

At first glance, these conditions may seem favorable, but a more in-depth analysis reveals some potentially concerning developments. Unlike the S&P 500’s price action, S&P 500 Capital Weighted Dollar Volume Flows, although advancing, fell just short of its December all-time high peak. Additionally, accumulated Capital Weighted Volume barely eked out a positive gain. Long term, volume continues to take precedence over price, signaling its bullish leadership role. Conversely, in the short term, price has surged to the forefront, taking the lead in present market dynamics.

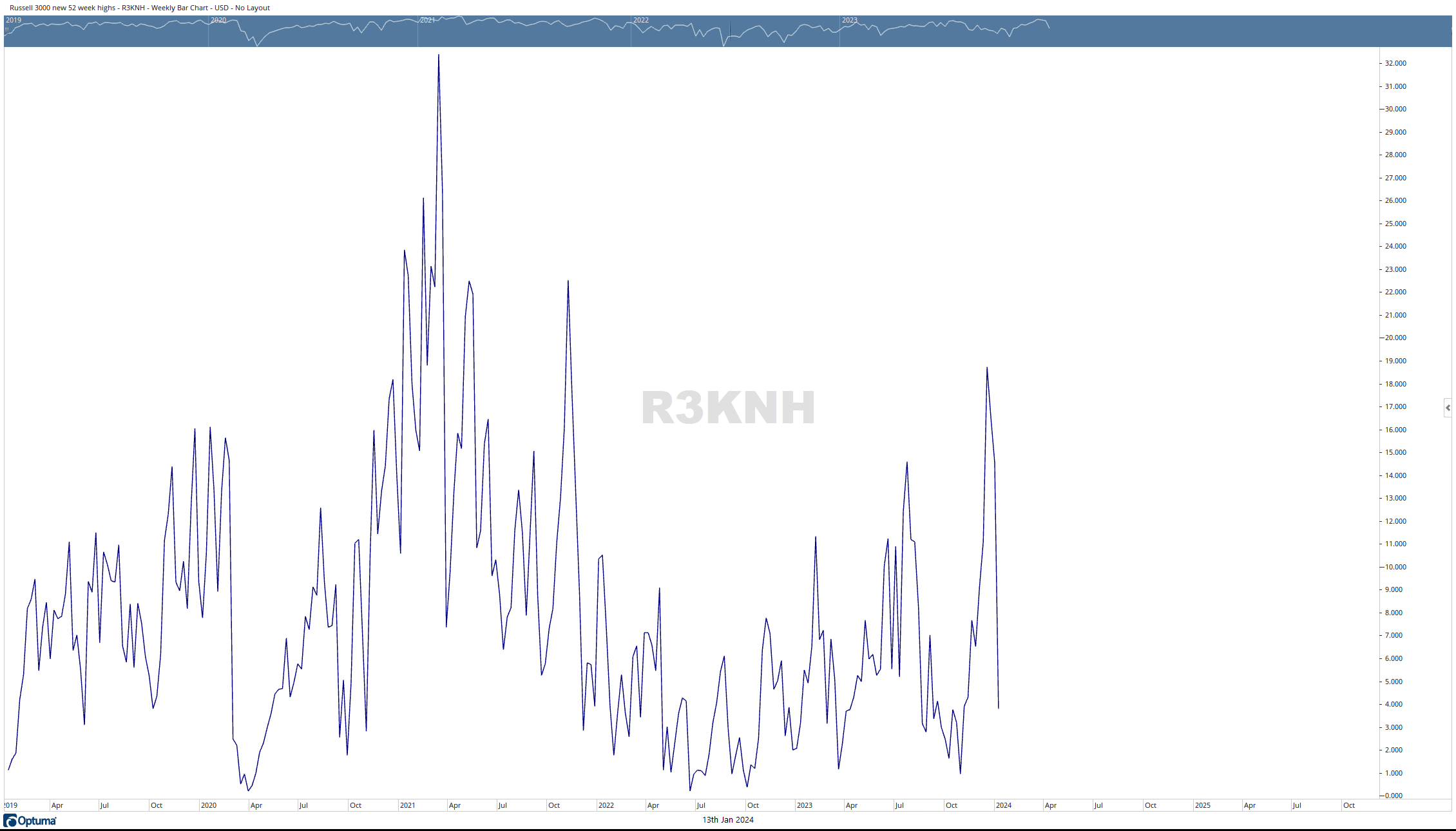

Switching gears to examine market breadth, the NYSE Advance-Decline Line closed the week lower. Additionally, the number of stocks making new 52-week highs in the Russell 3000 saw a significant drop. Taken all together, this data holistically may suggest that the broadening out trends proposed back in October might be suspended temporarily.

Focusing on the troops (the iShares Russell 2000 ETF) in isolation, both IWM’s volume momentum indicators (Volume Momentum Indicator, Volume Momentum Confirmation Indicator) hit 52 week lows during December’s peak. While this indicates positive long-term prospects, in the short term, it suggests that the market’s rapid ascent may have gone too far too fast. Using a health analogy, the broad markets resemble a well-conditioned athlete capable of achieving great heights. However, it may have surged too far ahead over the short term and may benefit from a recovery breather before marching onward.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 1/16/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.