Volume Analysis | Flash Market Update - 12.18.23

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

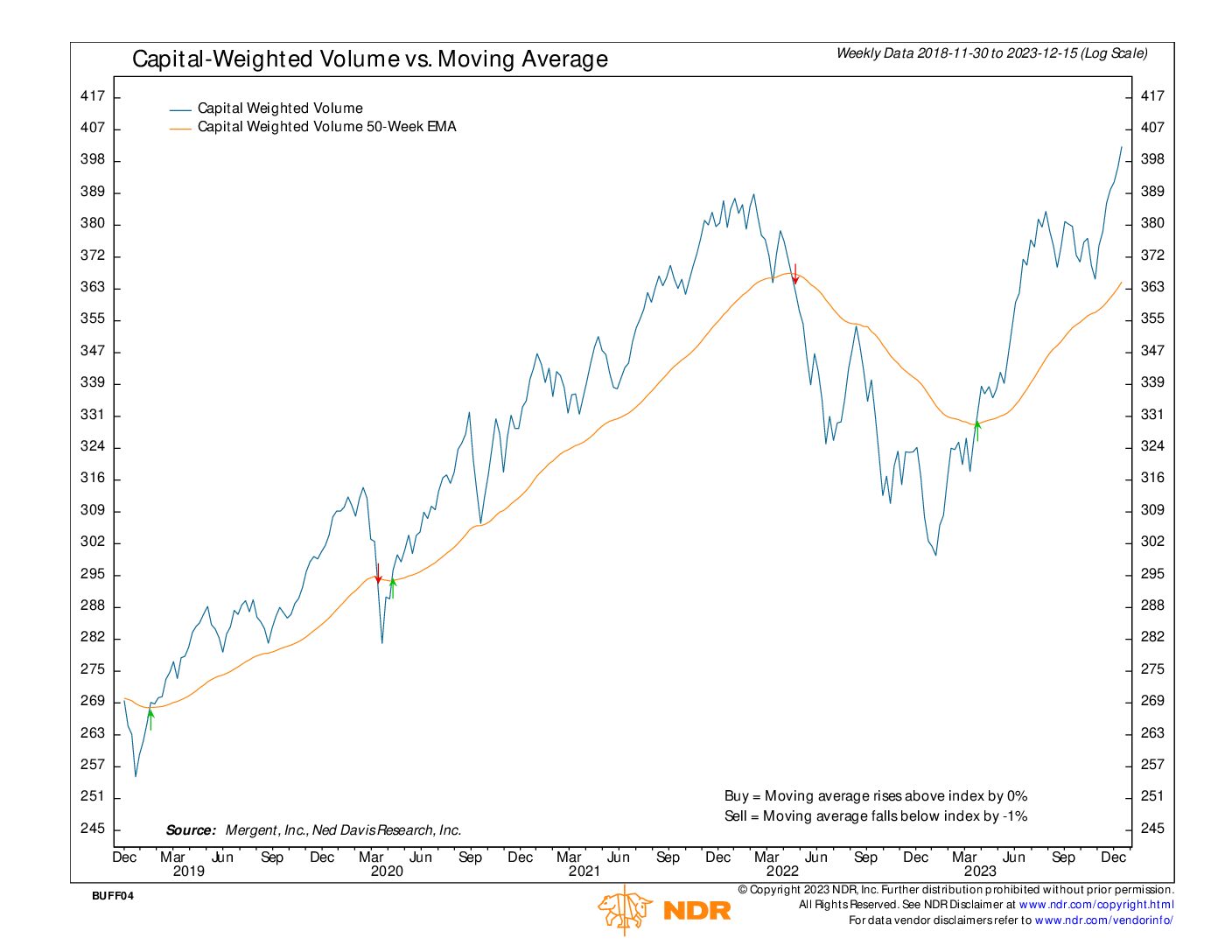

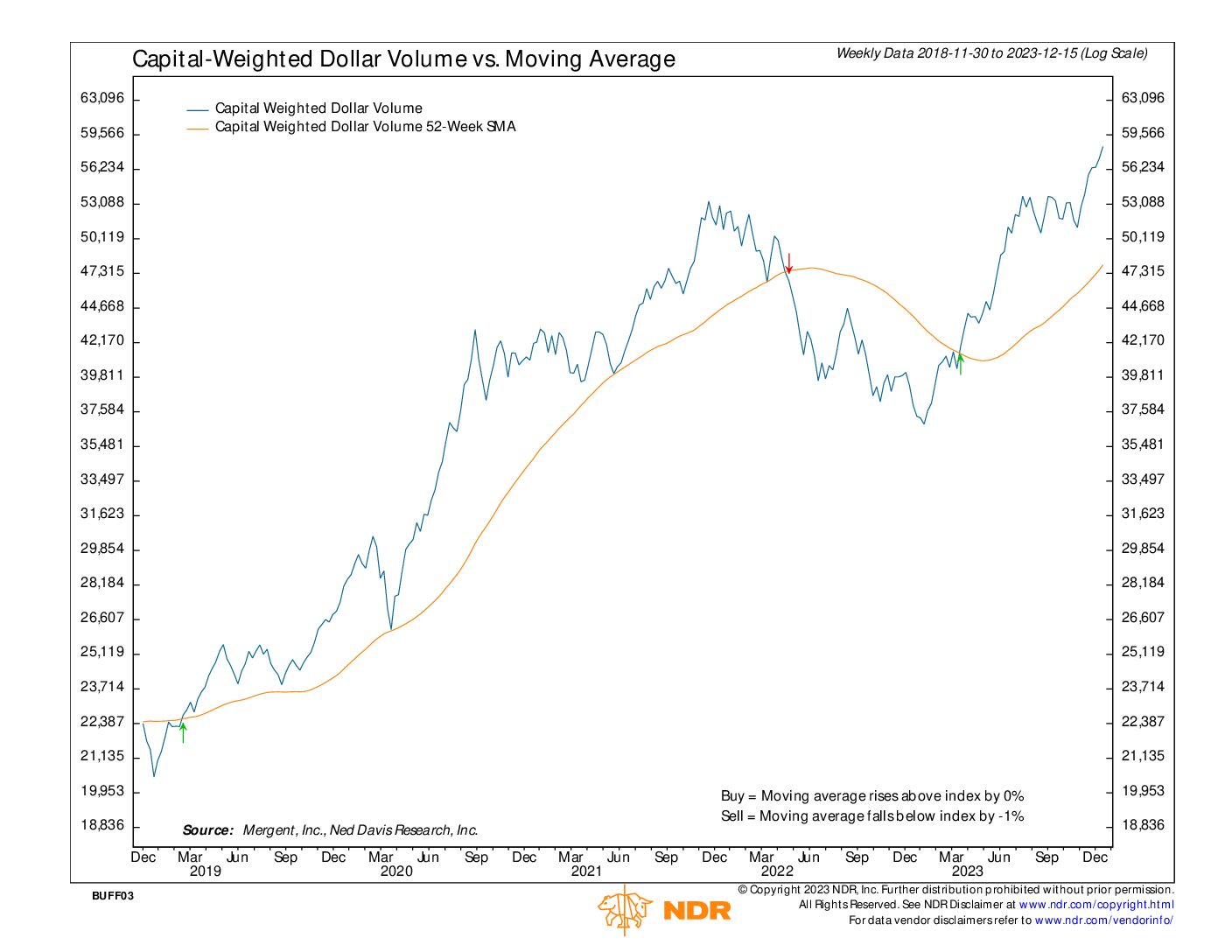

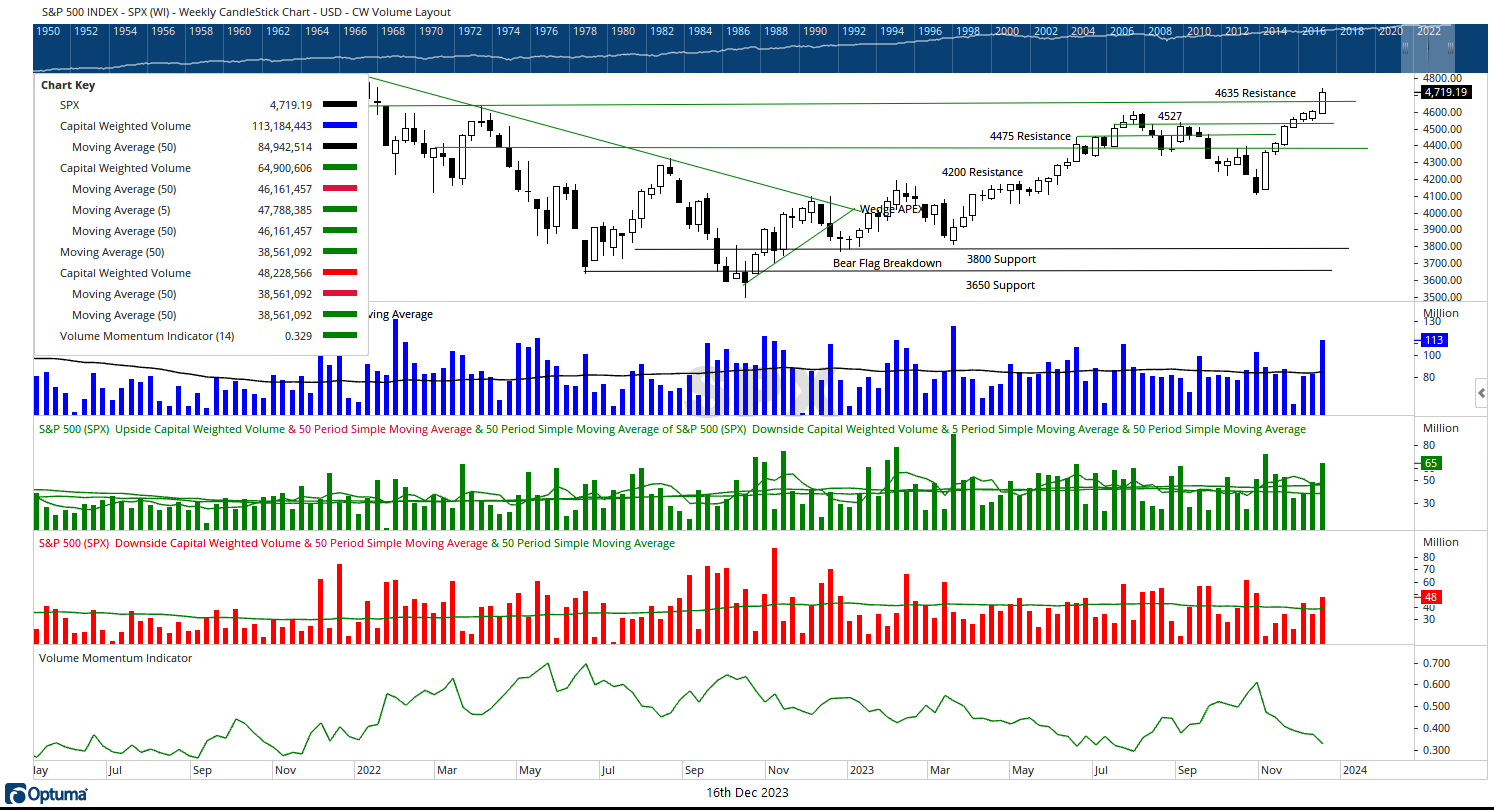

The S&P 500 Capital Weighted Volume experienced a significant surge this past week, witnessing over $113 billion in net flows, marking one of the highest readings of the year. Capital inflows surpassed outflows, registering $65 billion compared to $48 billion. Both upside and downside Capital Weighted Dollar Volumes surpassed their average weekly volumes.

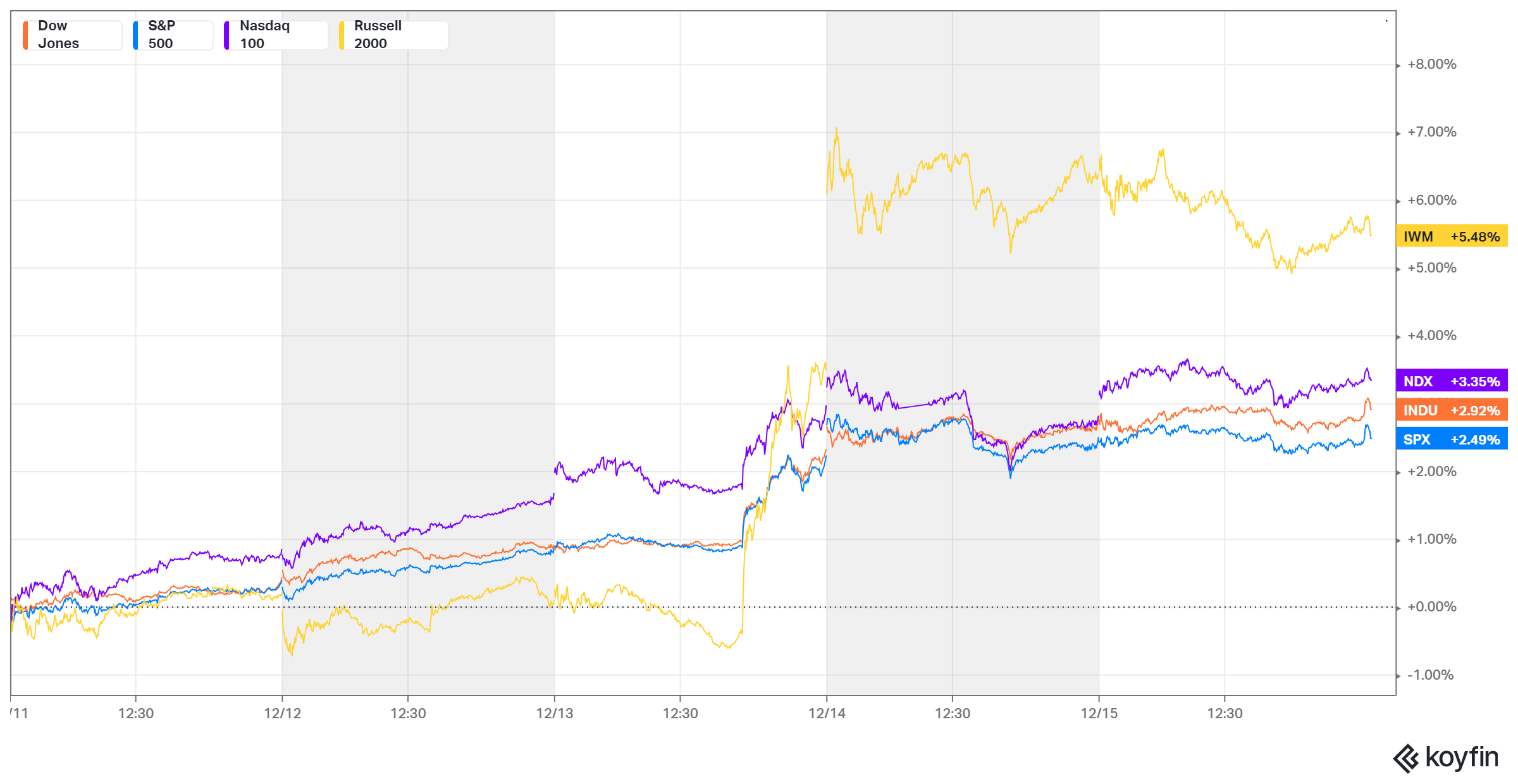

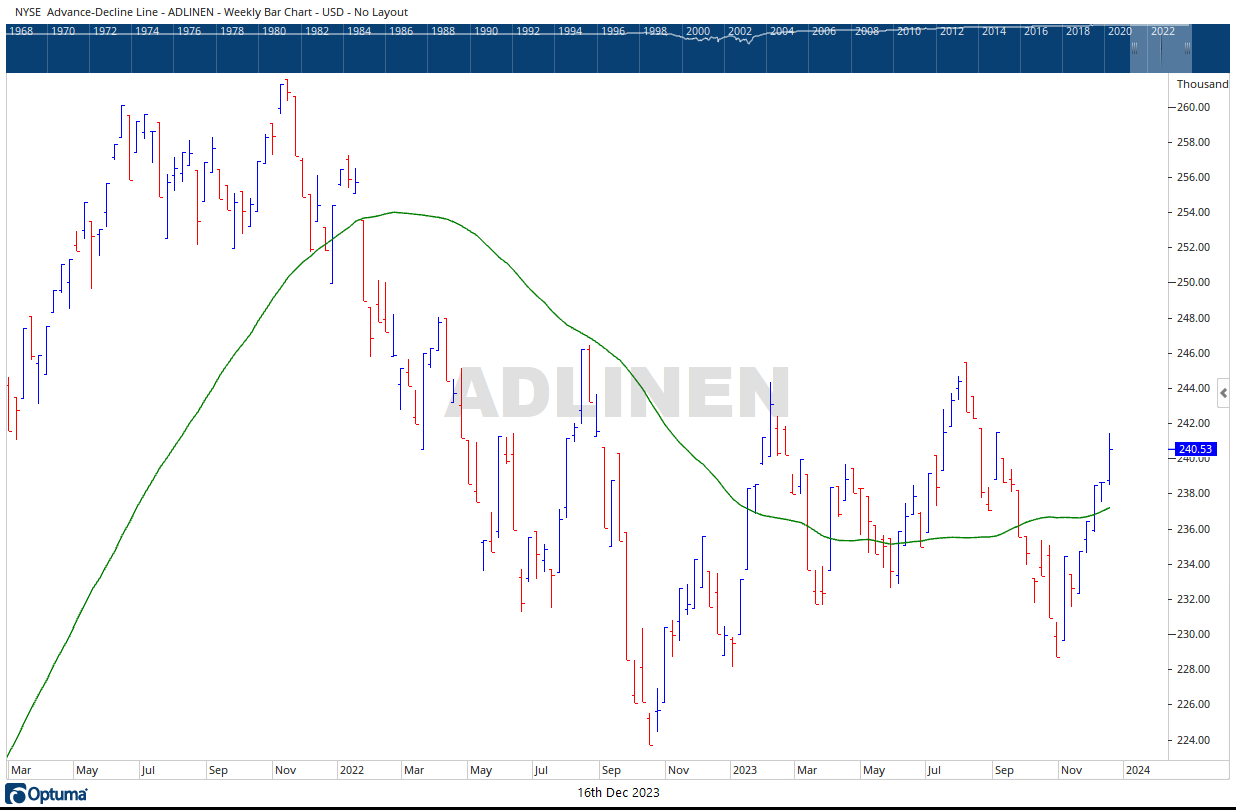

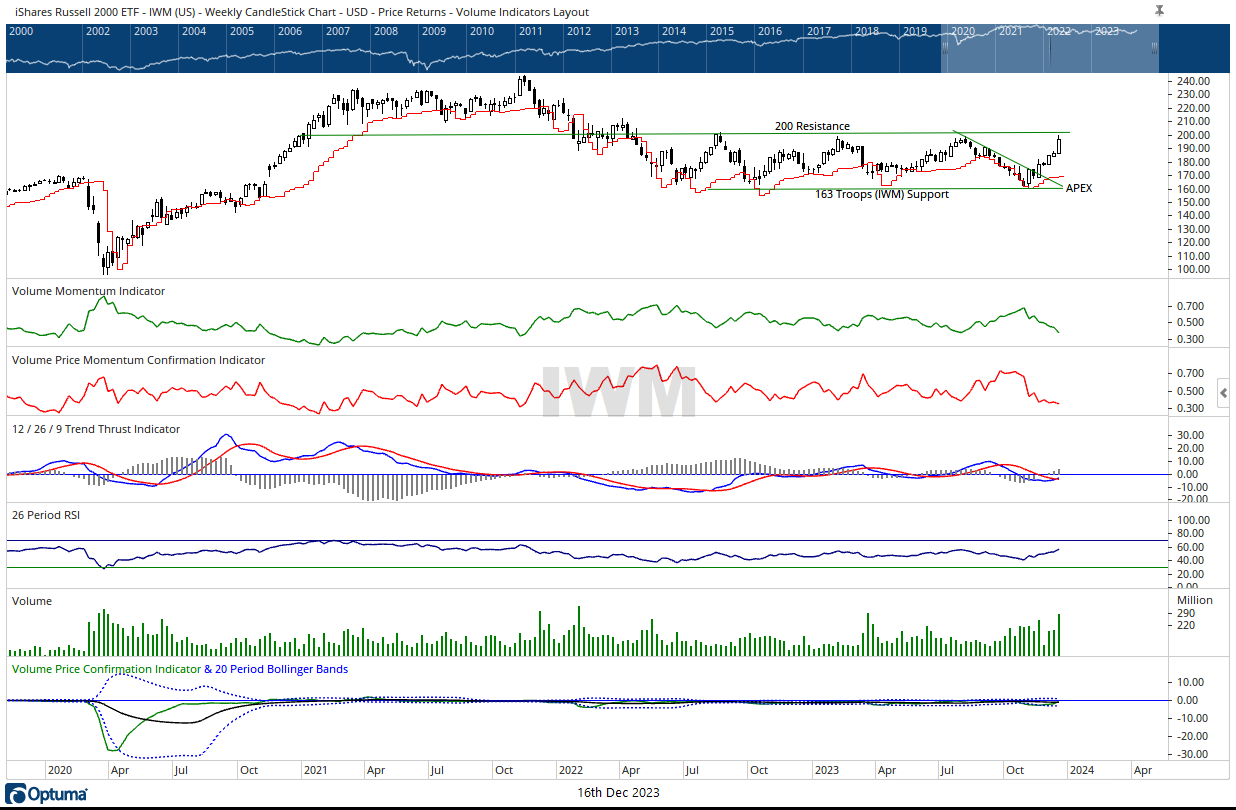

Furthermore, both S&P 500 Weighted Volume and Capital Weighted Volume achieved weekly all-time highs once again. Market breadth demonstrated strength, with the NYSE Advance-Decline line surging, albeit still below its July highs. Overall, the S&P 500 closed the week with a 2.49% gain, trailing behind the NDX 100 (generals) which recorded a 3.35% increase, and the formerly struggling IWM (troops), which saw a notable 5.48% gain.

While the surge in the troops is viewed as constructive for the long term, IWM faces formidable resistance at 200 once again. Over the past two years, each time IWM approached this level, it has retraced, including instances in July 2022, January 2023 and July 2023. Given the rapid magnitude of the recent surge, a period of consolidation may be necessary before attempting to overcome this resistance level.

The S&P 500 encounters resistance only about 2% away from its all-time highs in the 4800s, while support rests at 4600. Both Capital Weighted Volume and Capital Weighted Dollar Volume lead the price indexes higher, indicating a potentially healthy market. However, the earlier theme of broadening out in the market, predicted at the quarter’s beginning, may have largely played out. Nonetheless, if IWM successfully breaks through 200 resistance, it could signal a unification of the troops with the generals, fostering a bullish market sentiment.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 12/18/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.