Volume Analysis | Flash Market Update - 11.27.23

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

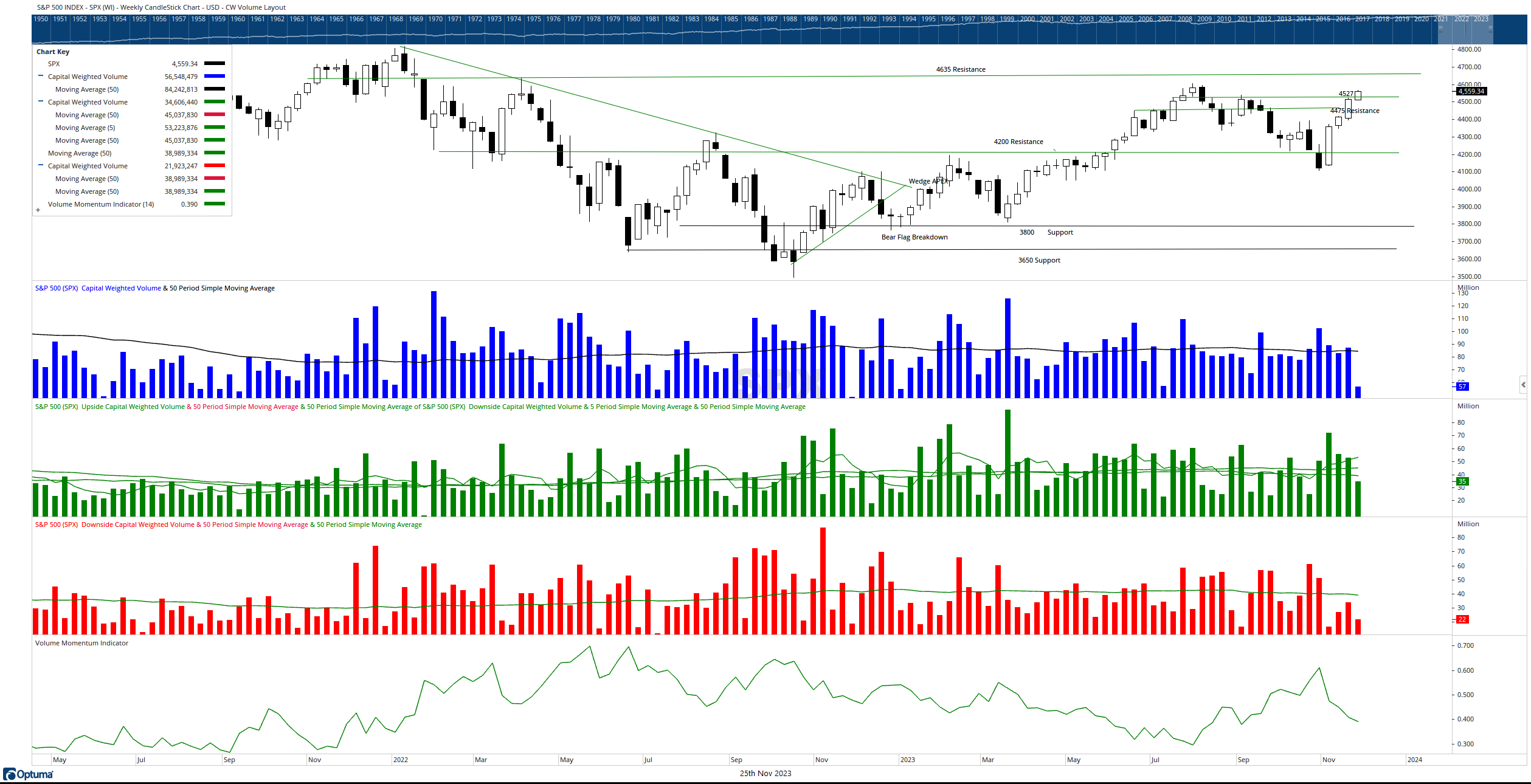

Volume was notably subdued last week, which aligns with expectations of a short trading week. The S&P 500 saw a robust influx of over $34.5 billion, contrasting sharply with just under $22 billion in outflows, culminating in a 1.00% S&P 500 price gain. However, the troops / small-cap stocks (IWM) and the heavy tech sector / mega cap index, the generals,(NDX), experienced more modest upticks of 0.58% and 0.91%, respectively, and emerged as the relative laggards in the week’s performance.

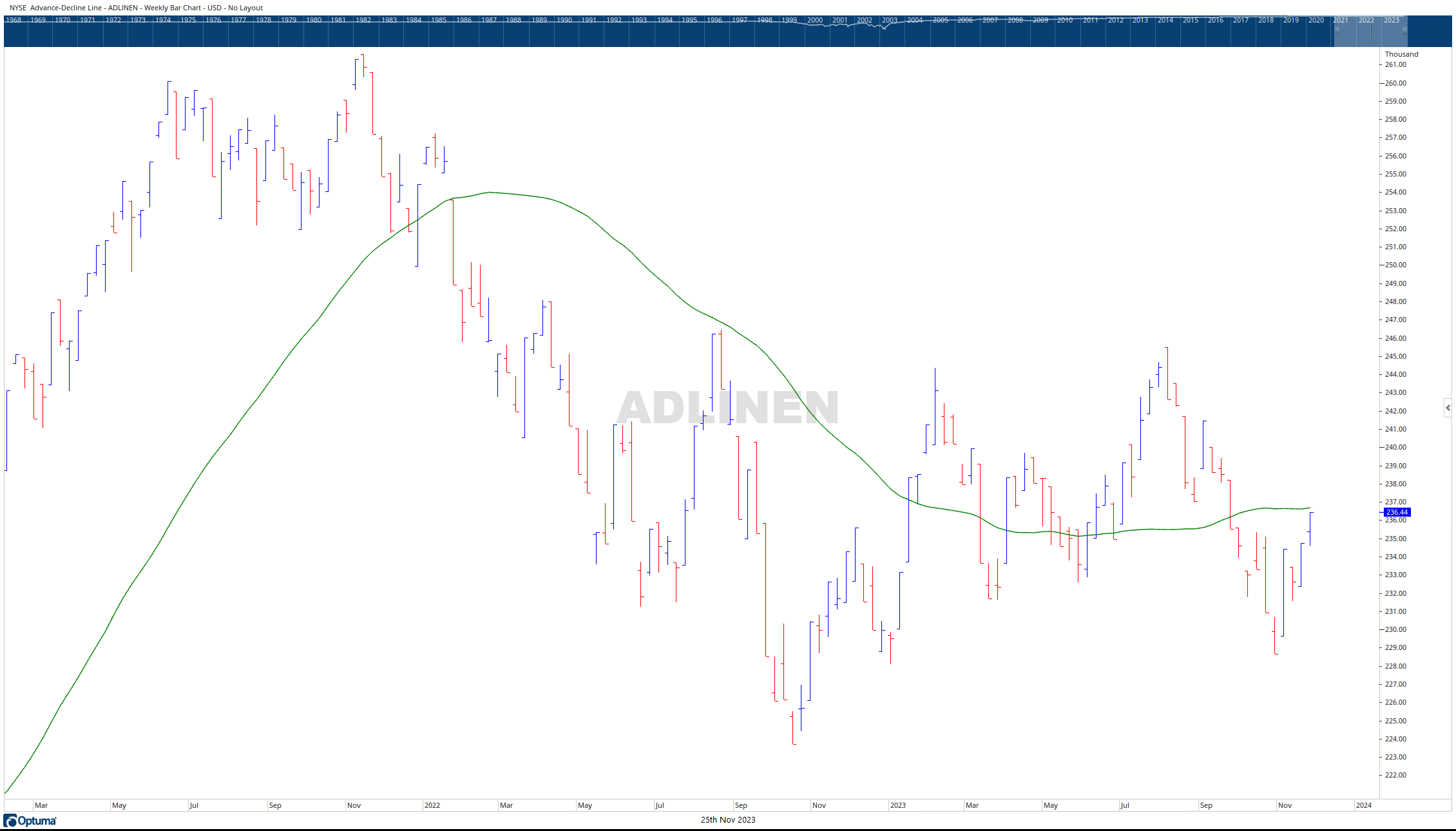

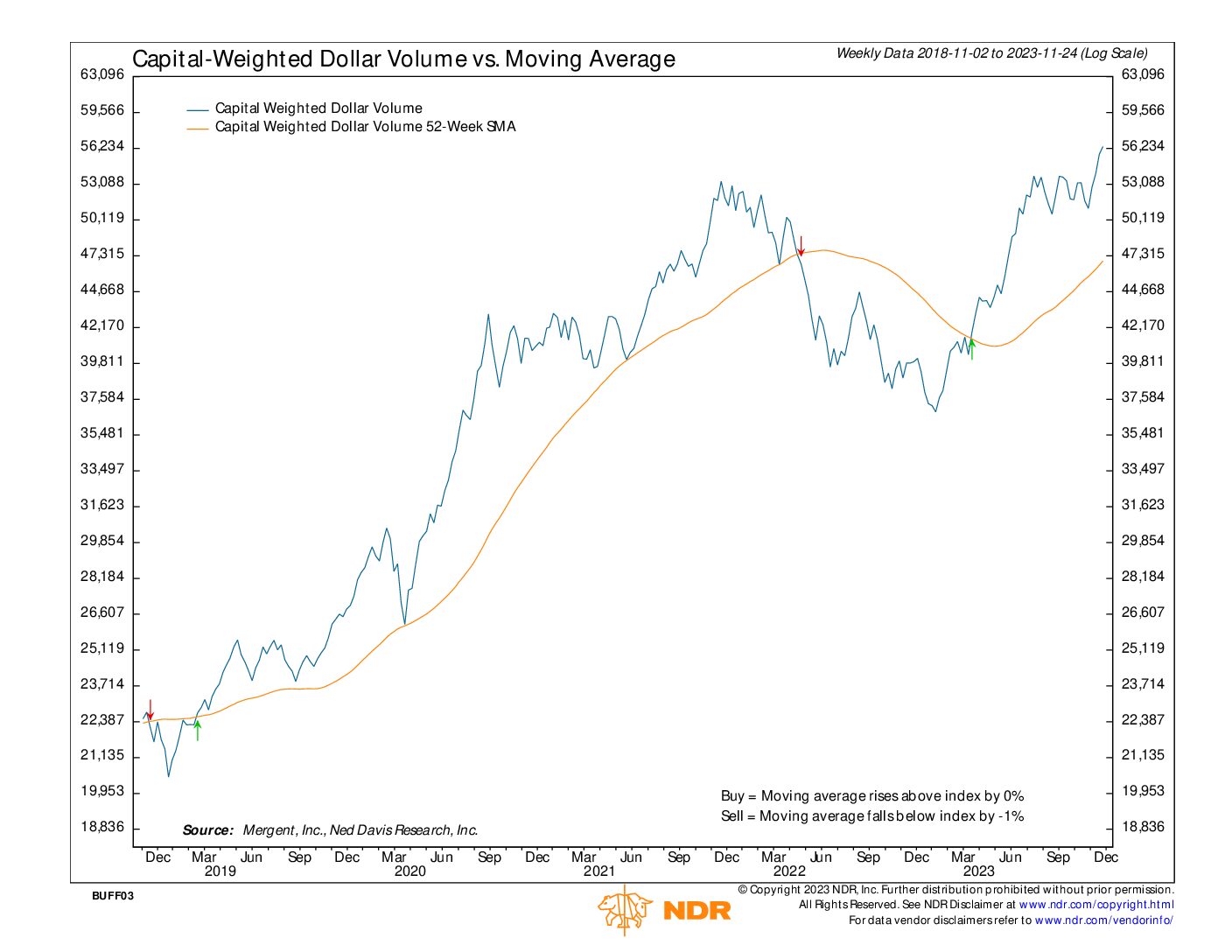

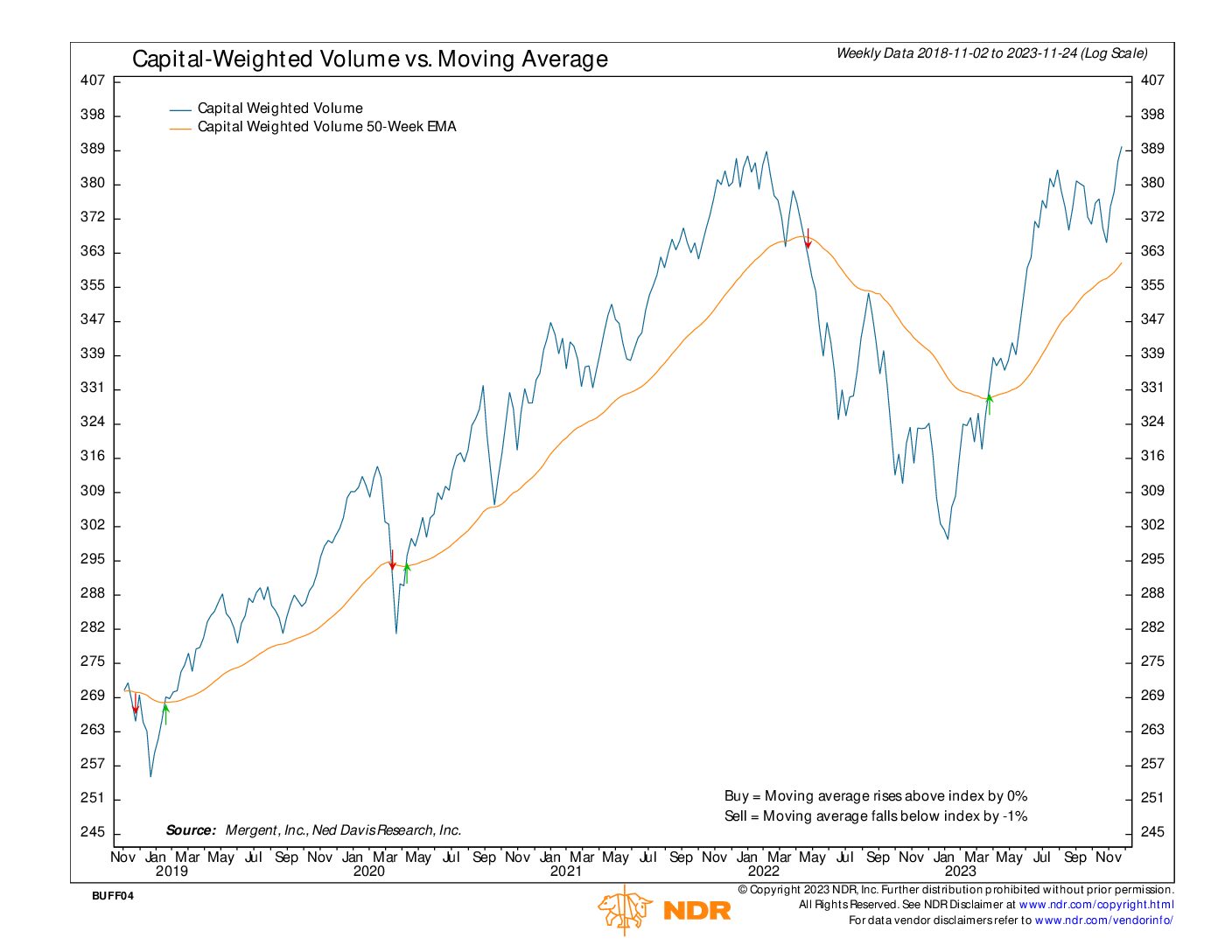

Positive momentum extended to market breadth, evident in the advancing Advance Decline Line, which is steadily approaching trendline resistance. Capital Weighted Dollar Volume achieved new all-time highs, and notably, Capital Weighted Volume is now on the verge of reaching historical peaks as well.

Looking ahead, minor SPX resistance is anticipated at the July highs of 4607, followed by more substantial resistance at 4635. The former S&P 500 resistance level of 4527 now acts as short-term support, while intermediate support is situated at 4475. The ongoing strength in Capital Weighted Volume and Dollar Volume demonstrates capital flows into the equity market appear to remain strong.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/27/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.