Portfolio Manager Insights | Why Investors Can Be Thankful After a Volatile Year — 11.22.23

Click here to download this commentary in PDF format.

While it may not feel like it, investors truly do have much to be thankful for this holiday season. Over the past year, investors have navigated both short-term challenges due to interest rate swings, the banking crisis, and political battles in Washington, as well as long-term uncertainty resulting from inflation, the Fed, geopolitical conflicts, and more. And yet, through all of this, major market indices have held onto strong gains, reversing much of last year’s declines. How can investors maintain perspective as they take time to reflect on the past year?

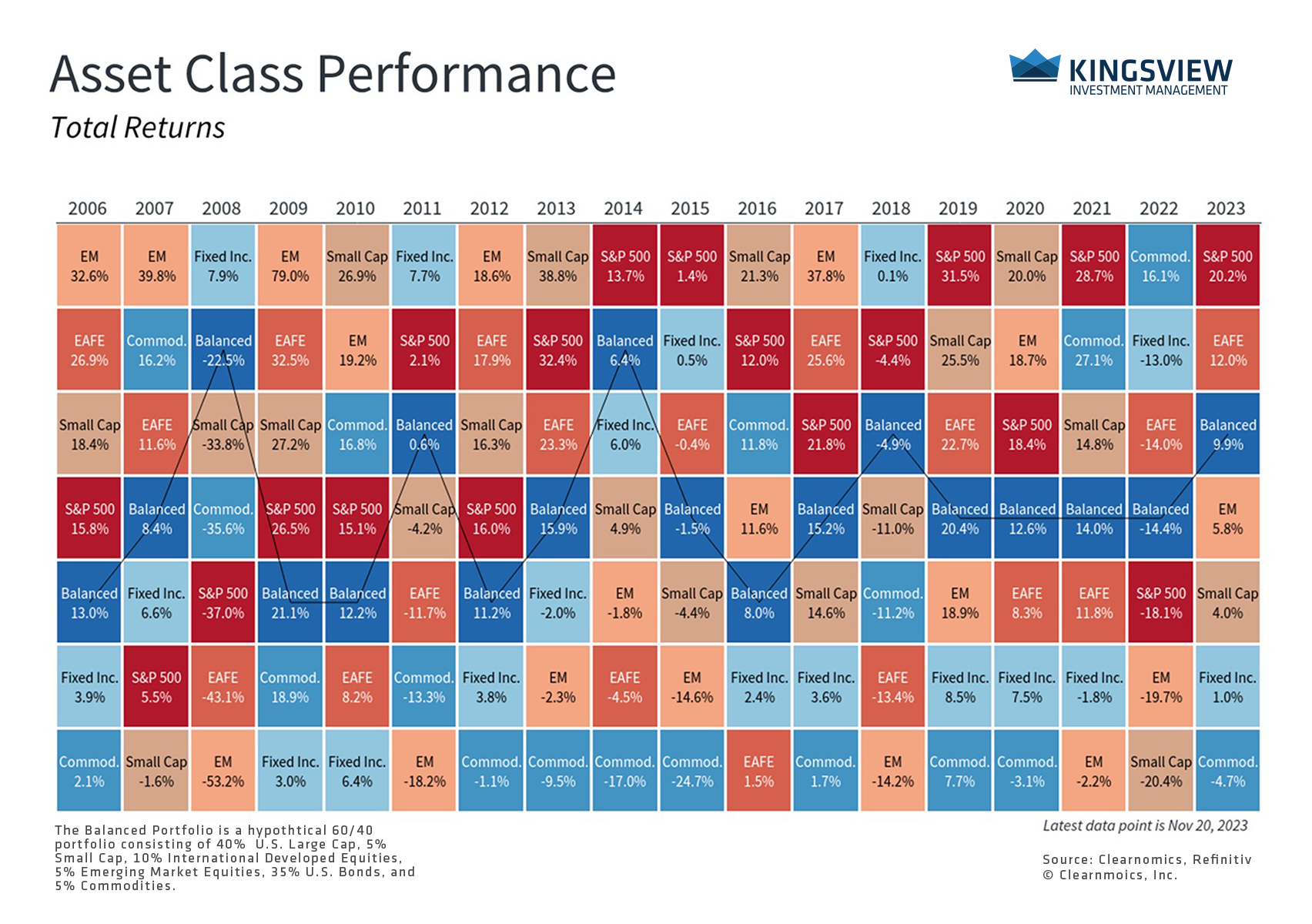

Financial markets and the economy have defied expectations in 2023. In many ways, the current environment represents the best-case scenario for which investors and economists could have hoped just a year ago. With only six weeks left in the year, the S&P 500 has returned 19.3% with dividends, the Nasdaq 36.0%, and the Dow 7.5%. International stocks have also performed well with developed markets gaining 11.5% year-to-date and emerging markets 4.8%. Interest rates climbed throughout the year but have retreated in recent weeks. The 10-year U.S. Treasury yield, for instance, has declined from just above 5% to just under 4.5%. While a diversified bond portfolio has only returned about 1% this year, this is far better than last year’s historic bear market decline.

Many major asset classes have made strong gains this year

An important reason for these gains is the health of the economy. One year ago, economists expected a recession by the second half of the year due to Fed rate hikes and early signs of stalling growth. Not only did this not occur, but the job market is still one of the strongest in history with the national unemployment rate near 3.9%. GDP growth for the third quarter, a 4.9% annualized rate, was one of the fastest in recent decades. The strength of consumer spending, driven by excess savings during the pandemic, has helped to drive the demand side of the economy as the supply side recovers. There are signs that this is gradually filtering through to corporate profits which may have reached an inflection point in the third quarter, after three quarters of falling earnings.

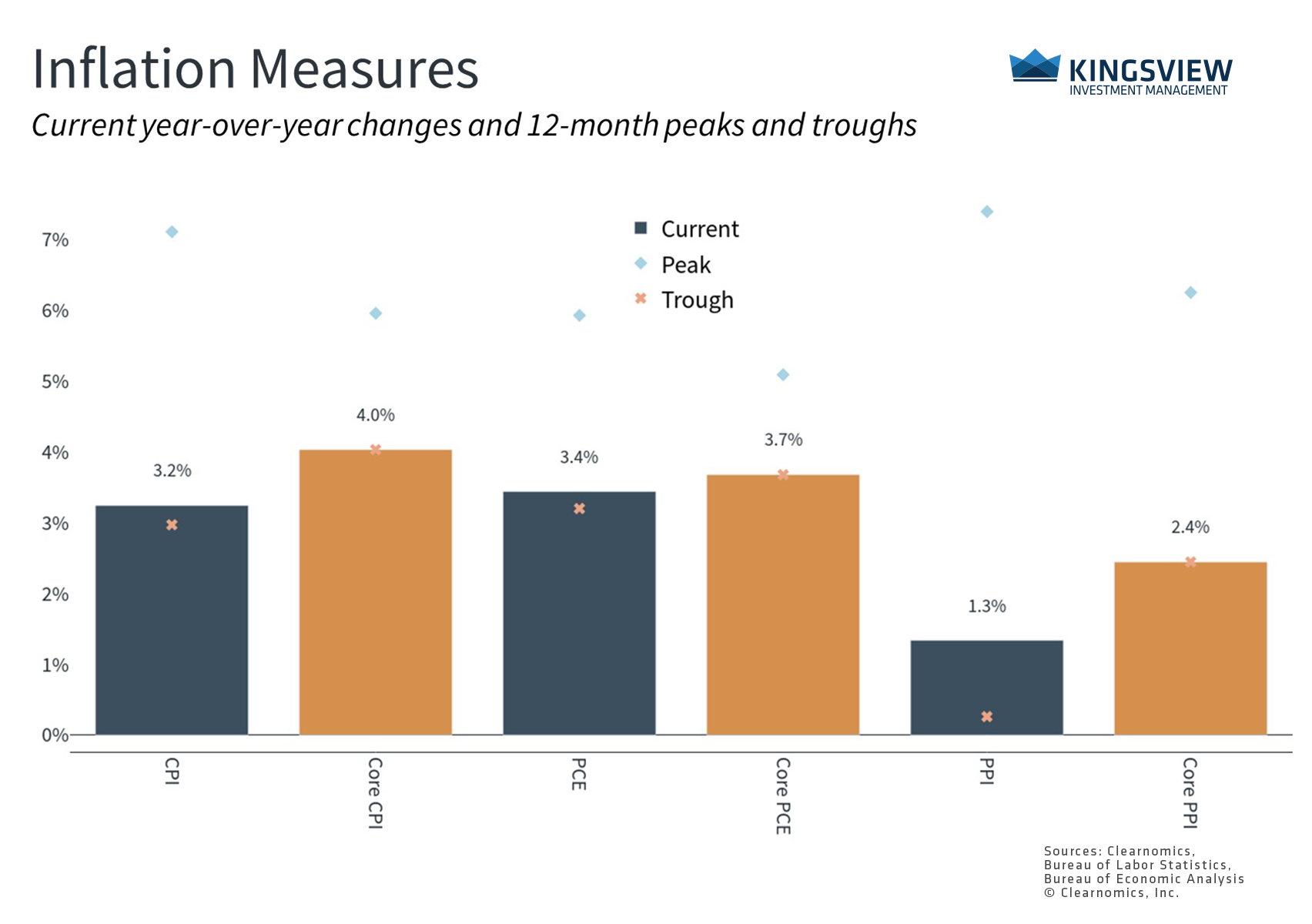

Another reason for these trends is the fact that inflation has improved significantly. Major inflation measures, such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE), are now in the 3% range on a year-over-year basis, down from highs of 9.1% and 7.1%, respectively. On a month-over-month basis, inflation improvements are even more striking with the CPI index flat from September to October. Other measures, such as the Producer Price Index (PPI) which measures inflation for businesses, have improved even more. Once again, these figures represent the rosiest scenario that economists could have predicted at the start of the year.

Inflation has improved significantly

Unfortunately, slowing inflation rates do not mean that prices will decline – only that they will rise at a slower pace. While this provides some relief, many households, especially those in or near retirement, may continue to find higher prices challenging. From an investment standpoint, however, both stocks and bonds have already benefited from greater price stability. The fact that the Fed may be near the end of its rate hike cycle only adds to the tailwinds that have propelled markets this year.

For example, technology-related stocks have been particularly sensitive to inflation and interest rates due to the forward-looking nature of their products and businesses. While they have performed well over the past decade, they also led declines in 2022 when rates rose suddenly. Decelerating inflation and stable interest rates have helped this group drive markets higher this year. Sectors such as Information Technology, Communication Services, and Consumer Discretionary have led major indices. As inflation continues to improve, the hope among many investors is that other sectors will begin to benefit as well.

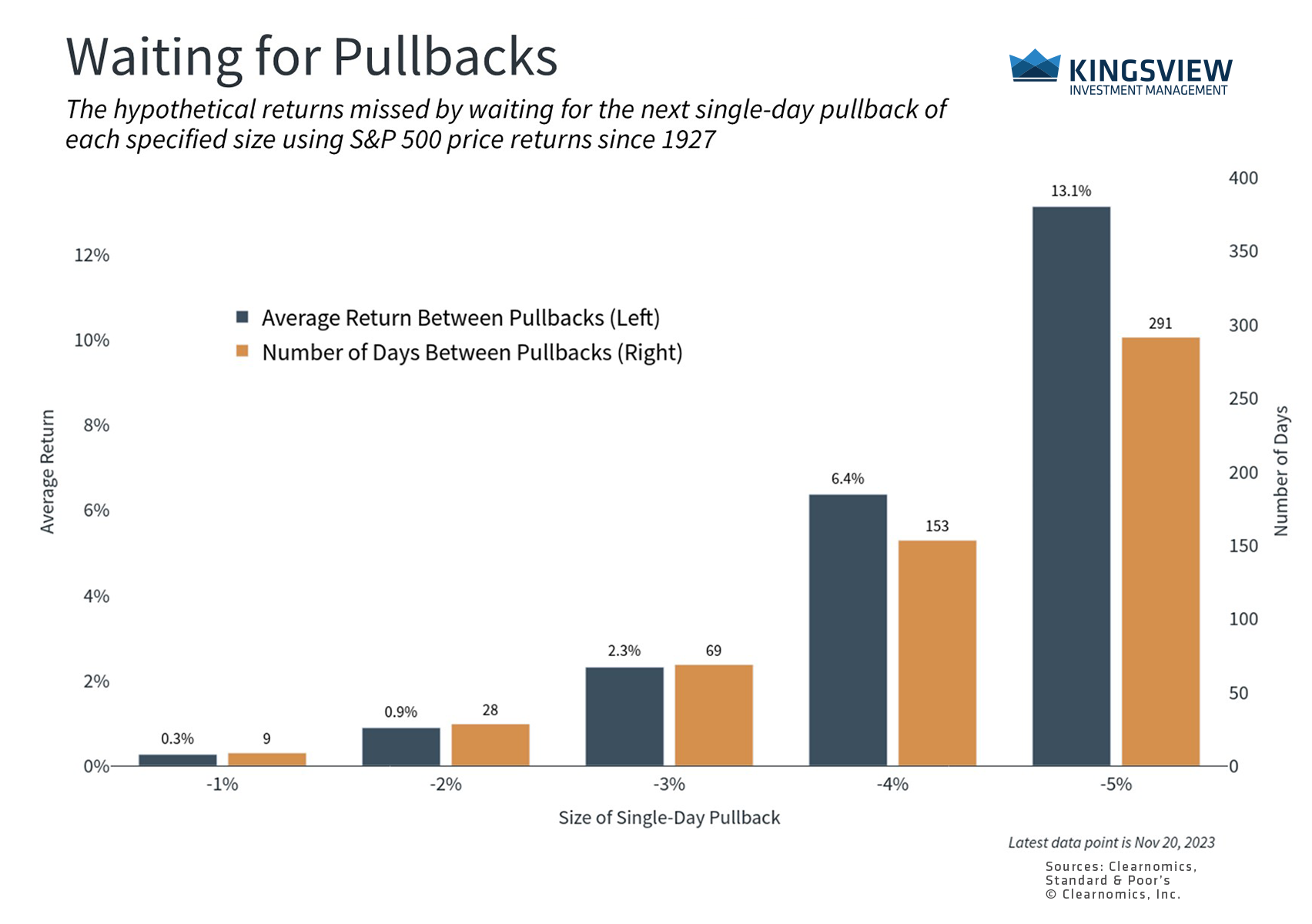

Staying invested is still the best way to achieve financial goals

One lesson that this past year underscores is the importance of sticking to a financial plan. While it’s tempting to wait for the next pullback to re-enter the market and get back on track, history shows that it’s often better to simply be invested. This is because markets tend to rise over long periods of time, making both higher highs and higher lows. The accompanying chart shows that investors often wait long periods before the next pullback and, in doing so, forego periods of healthy returns.

The bottom line? Investors do have much to be thankful for this year. This can be difficult to recognize since it often feels as if markets move from one crisis to another. With the benefit of perspective, it’s easy to see that the economy and financial markets have come a long way this year, hopefully setting the stage for investors to achieve their long-term financial goals.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2023)