Volume Analysis | Flash Market Update - 11.20.23

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

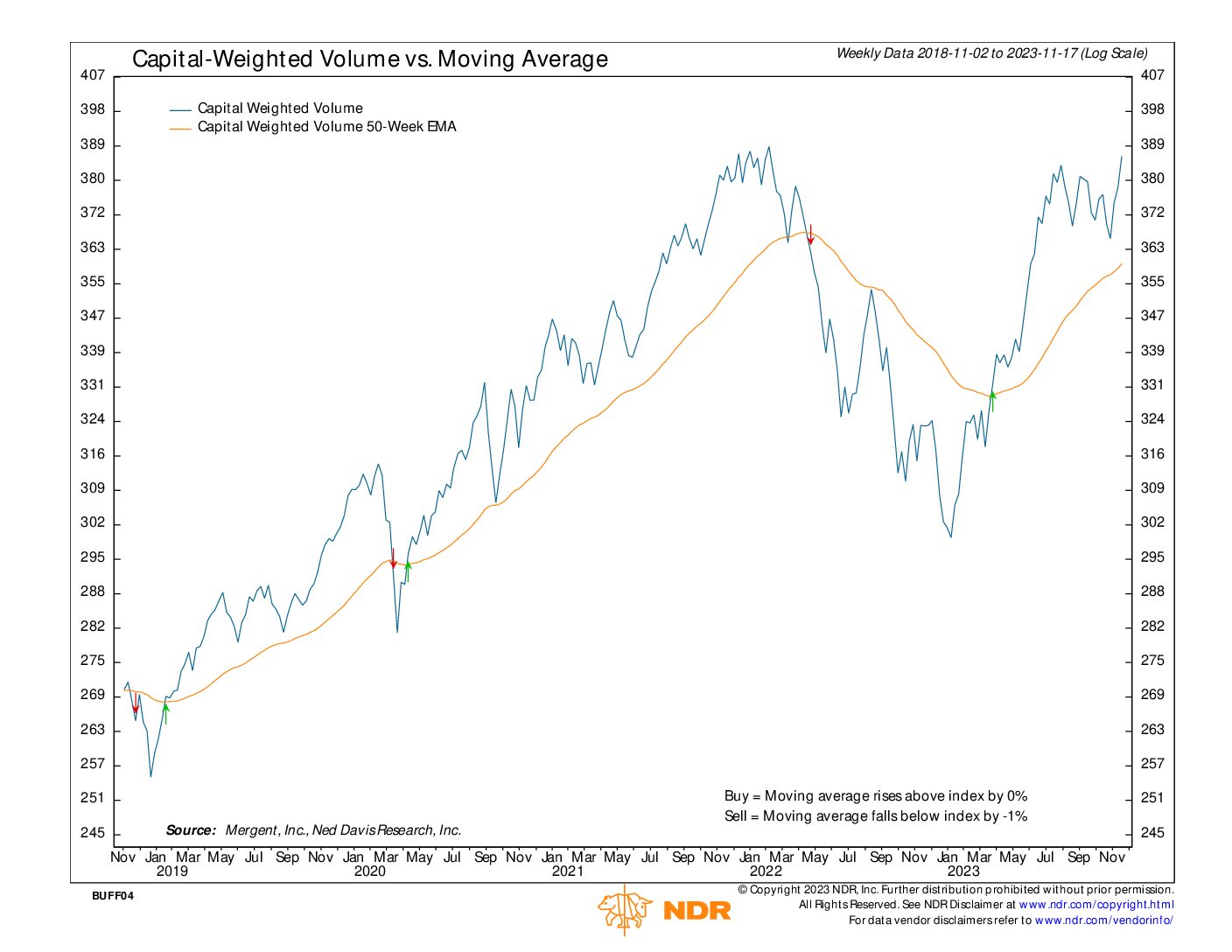

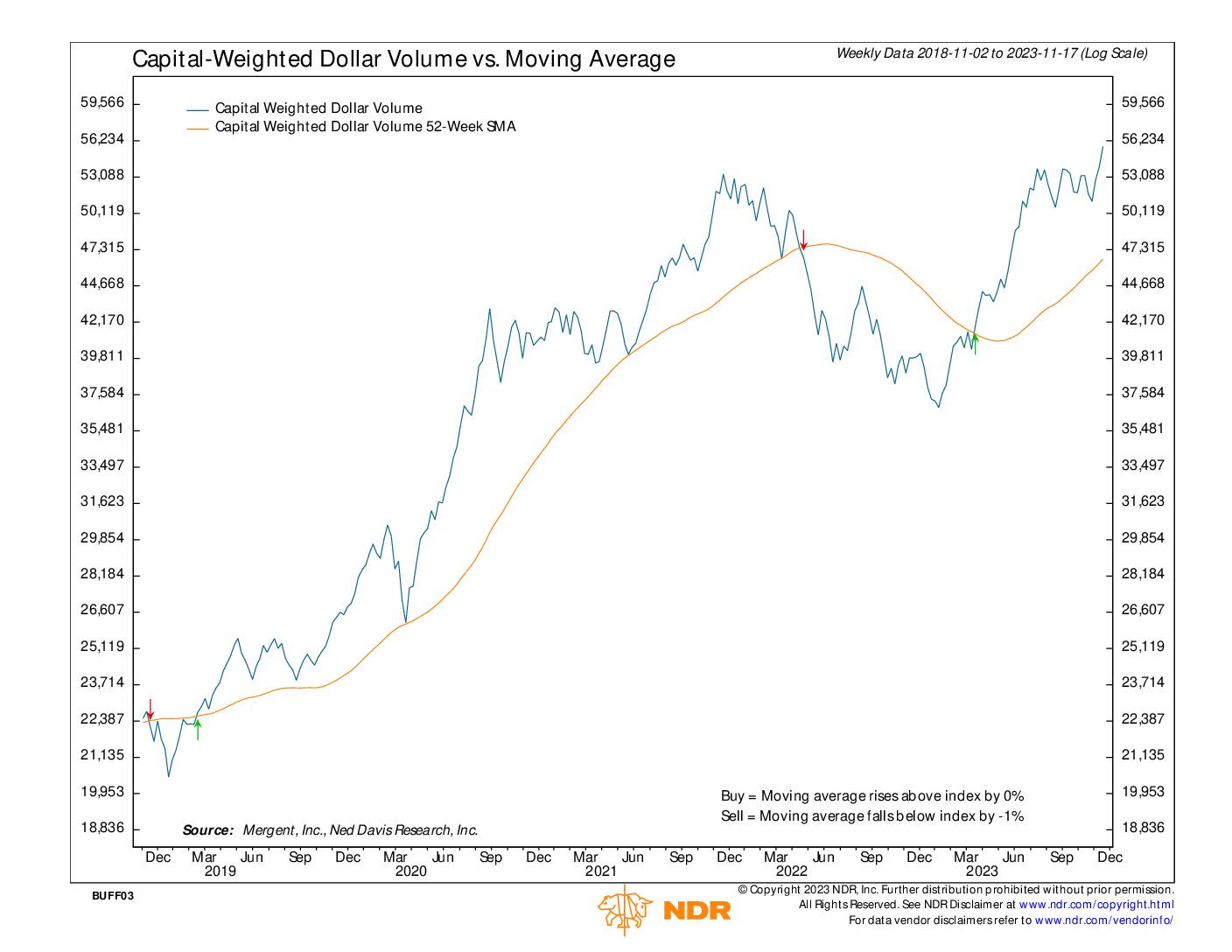

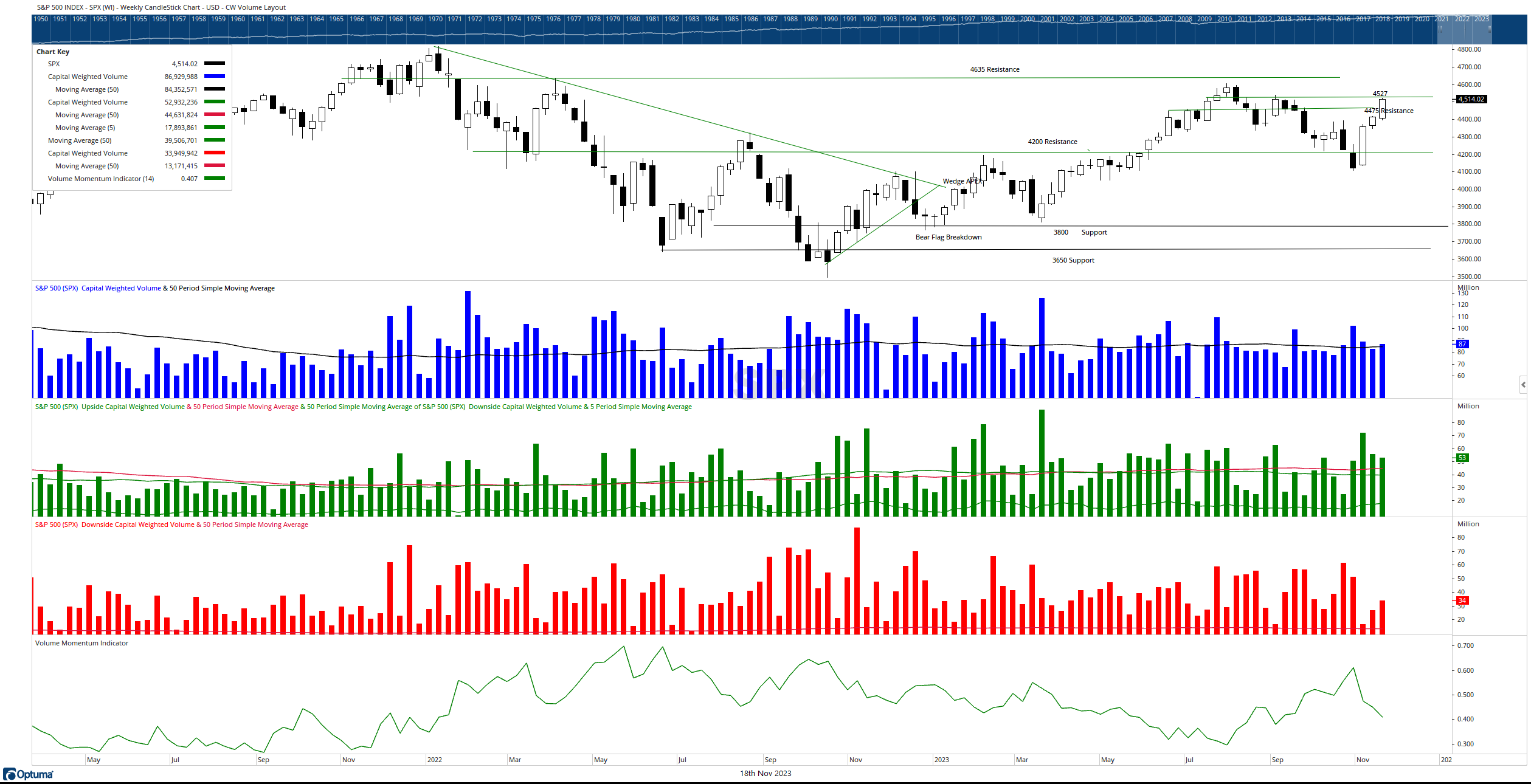

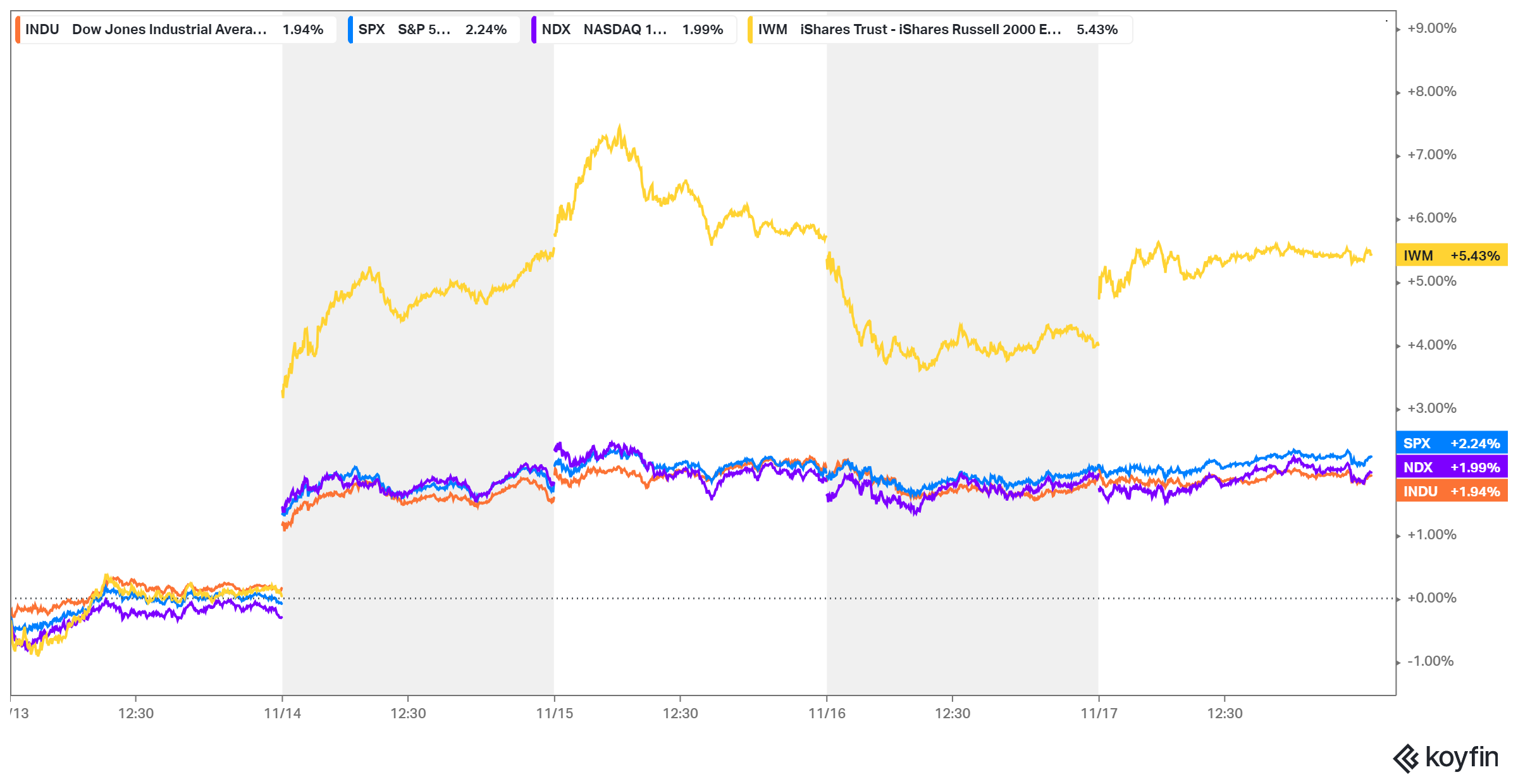

From our perspective, perhaps the prior week’s most significant development was S&P 500’s Capital Weighted Dollar Volume reaching all-time highs, marked by a notable surge in Capital Flows. Conversely, a potentially concerning development was observed as the Russell 2000 (troops) displayed weakness, diverging from the sustained strength observed in the NDX 100 (generals). However, in a turn of events this past week, the previously lagging troops led all indices, experiencing a 5.43% increase.

During this period, Capital Weighted Dollar Volume saw a breakout, attracting nearly $54 billion in Capital Inflows, while Capital Outflows amounted to less than $35 billion. This influx contributed to a 2.24% rise in the S&P 500 and a 1.99% increase in the generals (NDX 100).

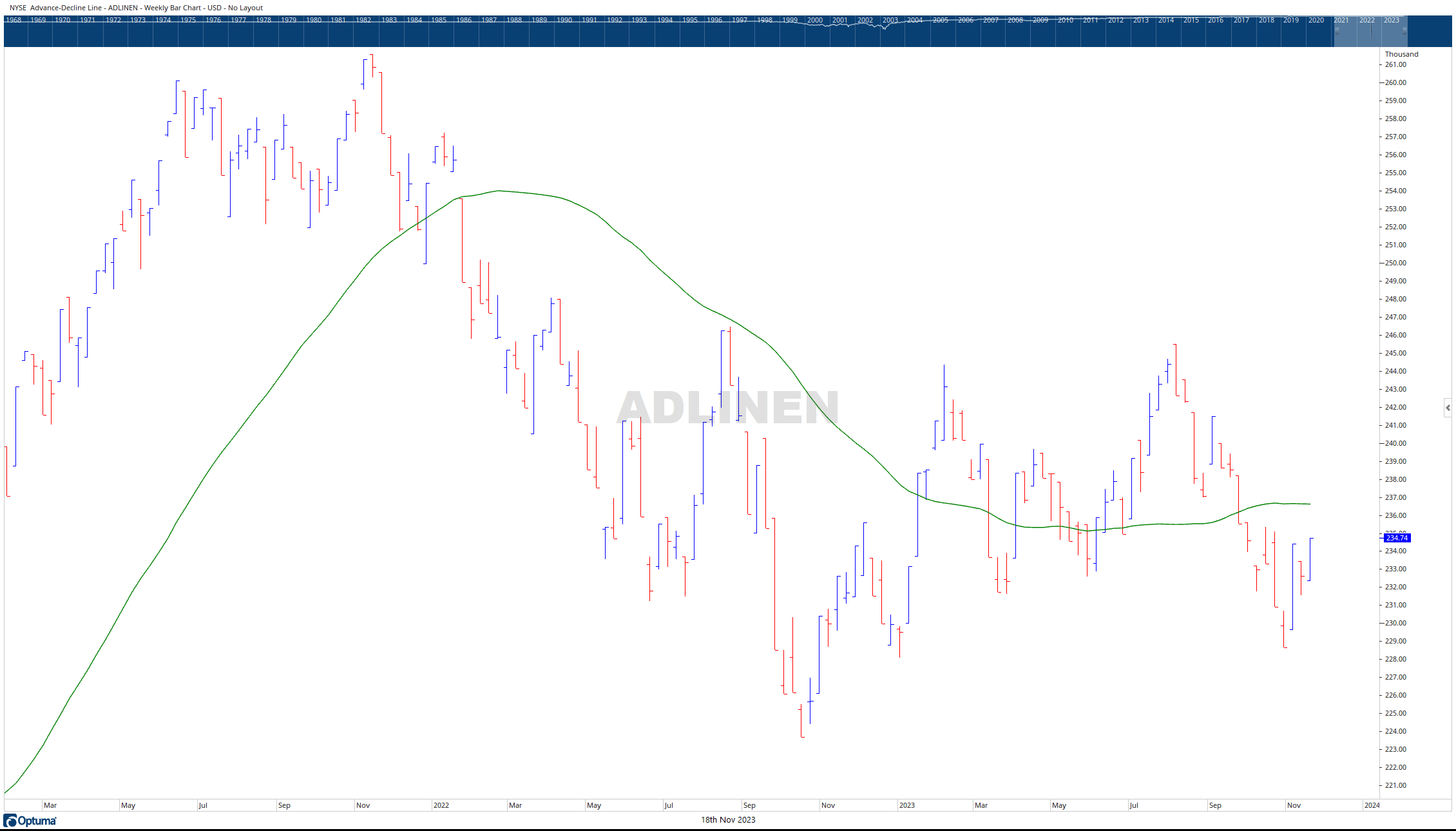

Despite recent fluctuations in the troop’s performance, there may be a positive development on the horizon. The breakout (IWM) bounce against long-term support observed last week may signify the formation of a rare bullish descending triangle. Typically considered a bearish formation, the crucial factor lies in the direction of the move at the apex, whether it’s a breakout or breakdown with high-volume conviction. In the case of IWM, it broke above its downtrend on significant volume. Moreover, this move was substantiated by positive breadth, with the Advance-Decline Line surpassing its previous near-term range.

Looking ahead, S&P 500 resistance resides at 4527 and support rests at 4475. Perhaps more importantly, IWM resistance dwells @ 190 with critical support found at 160.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/20/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.