Volume Analysis | Flash Market Update - 11.13.23

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

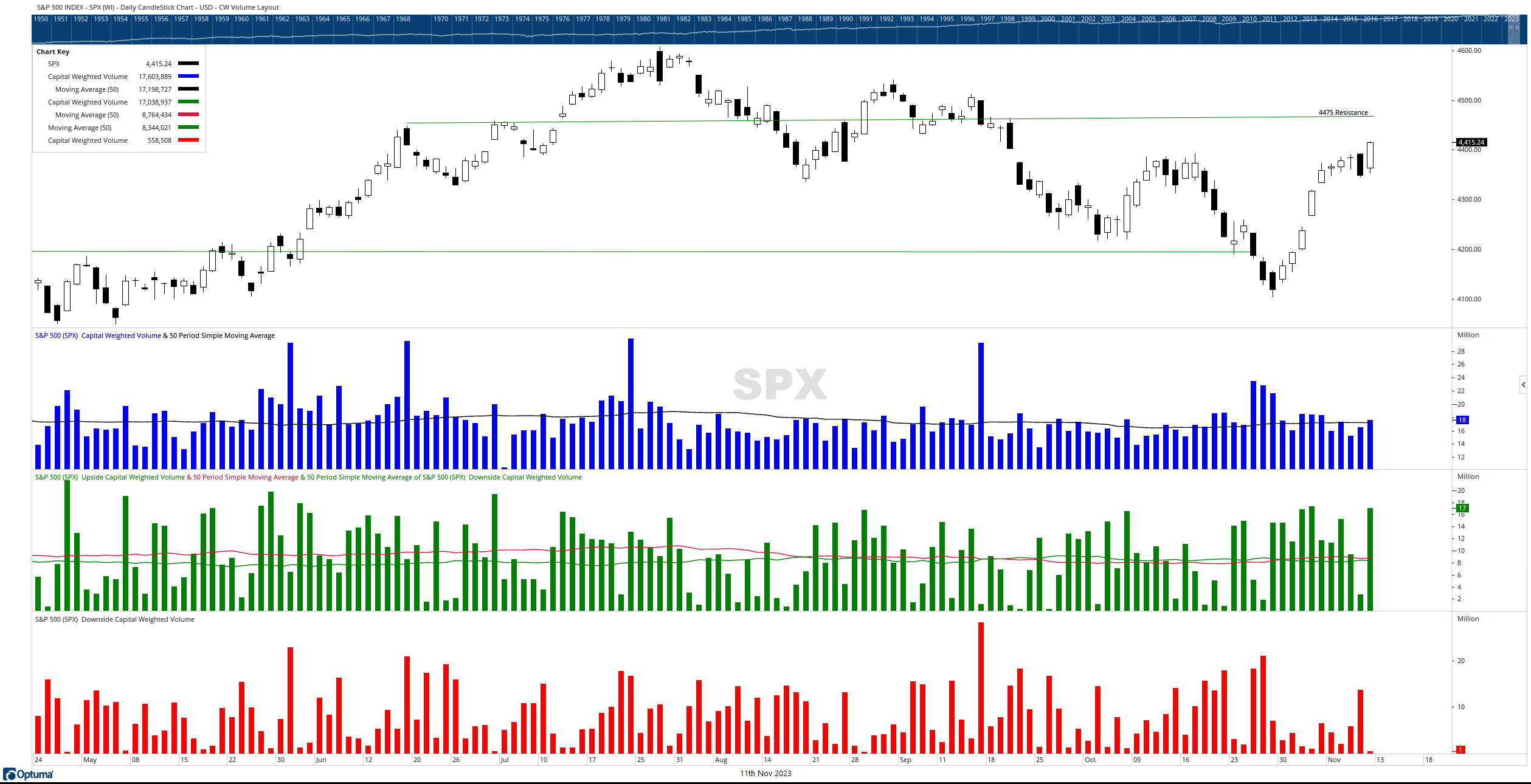

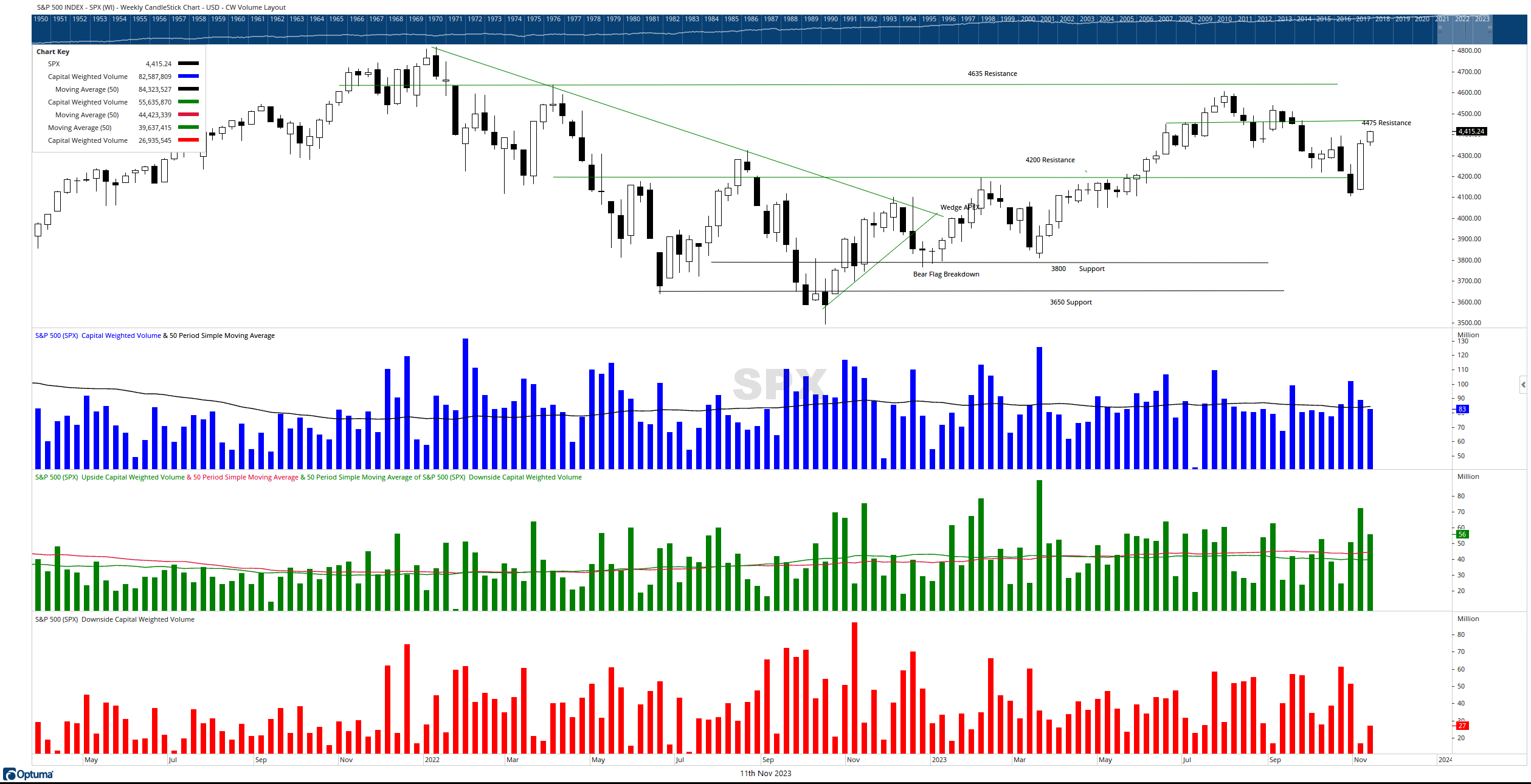

The Generals (NDX 100) once again led the markets, surging 2.85% higher for the week. Unfortunately, the troops (IWM Russell 2000 ETF) retreated by -3.08%, closing near the minor support level of 168. In terms of capital flow, inflows exceeded outflows with $55.6 billion coming in compared to just under $27 billion going out. Consequently, more than twice as much money flowed into the S&P 500 than out, resulting in a 1.31% gain for the week.

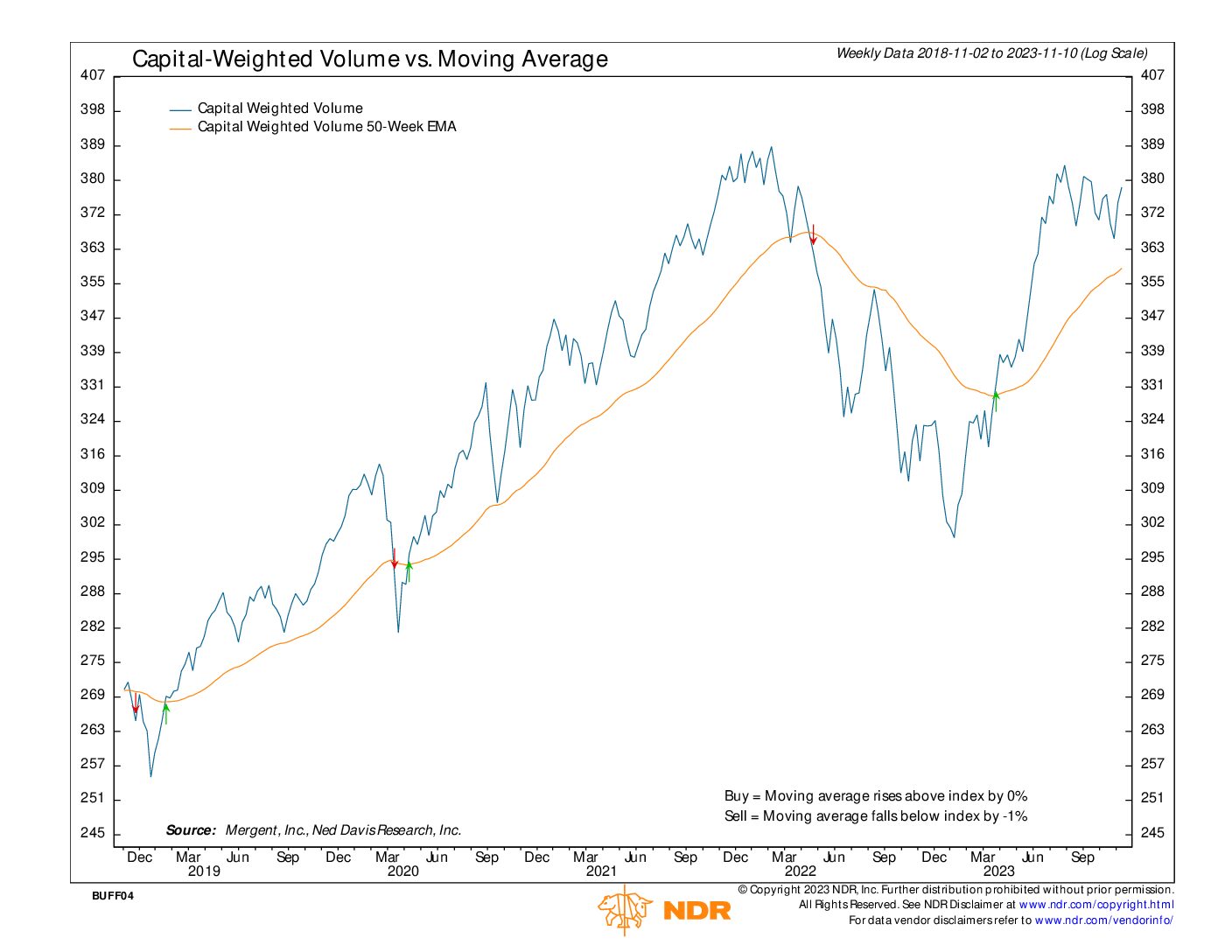

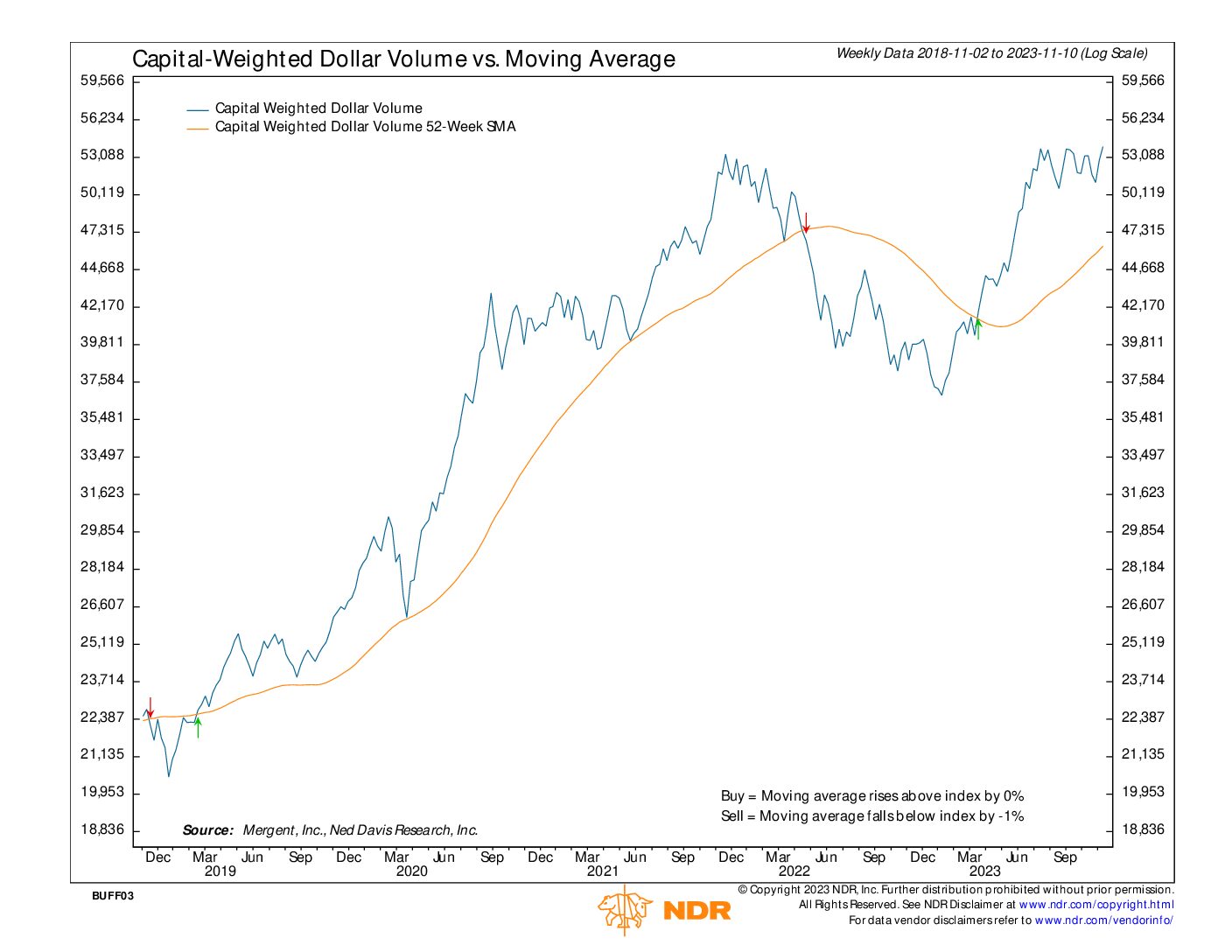

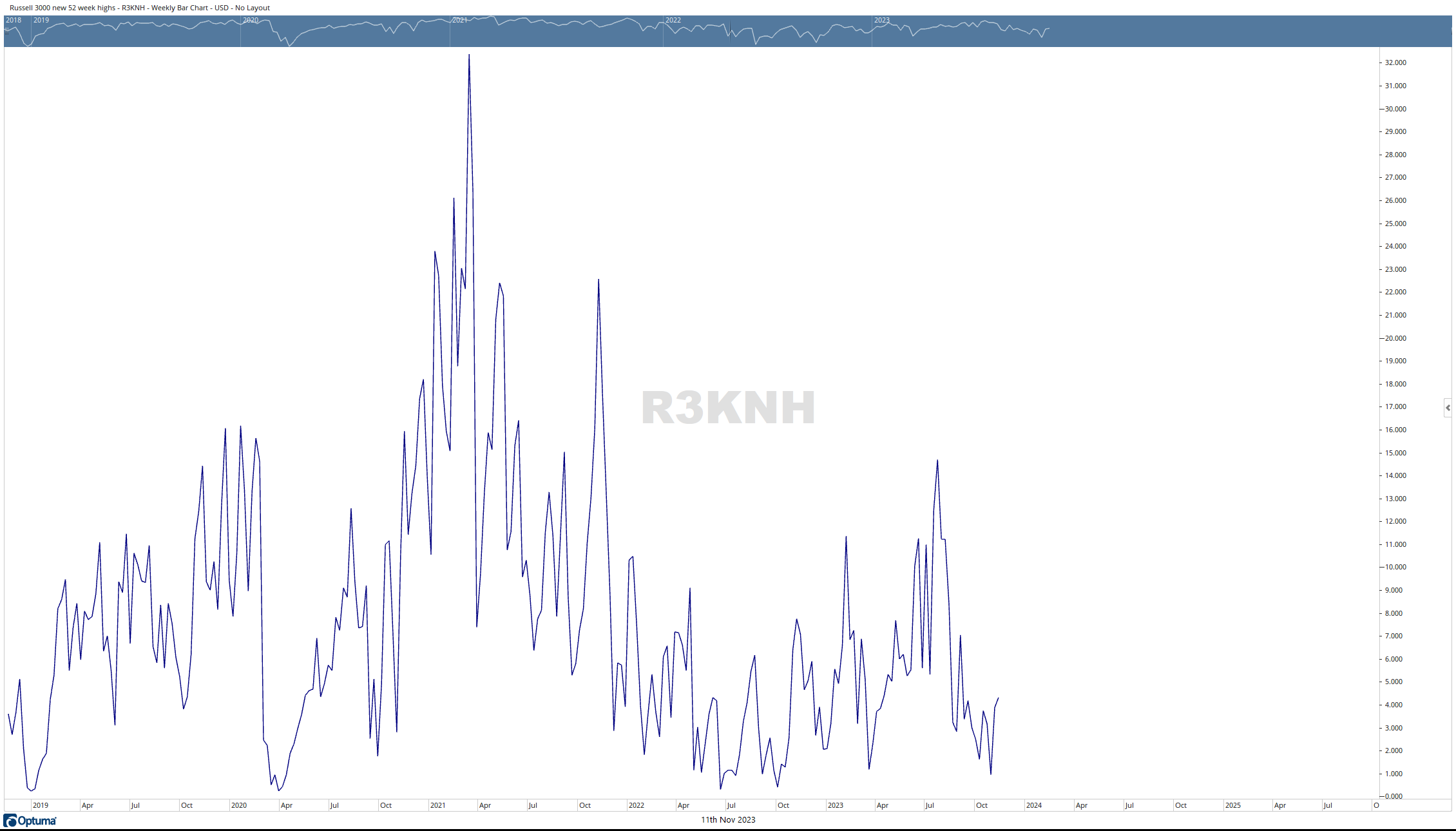

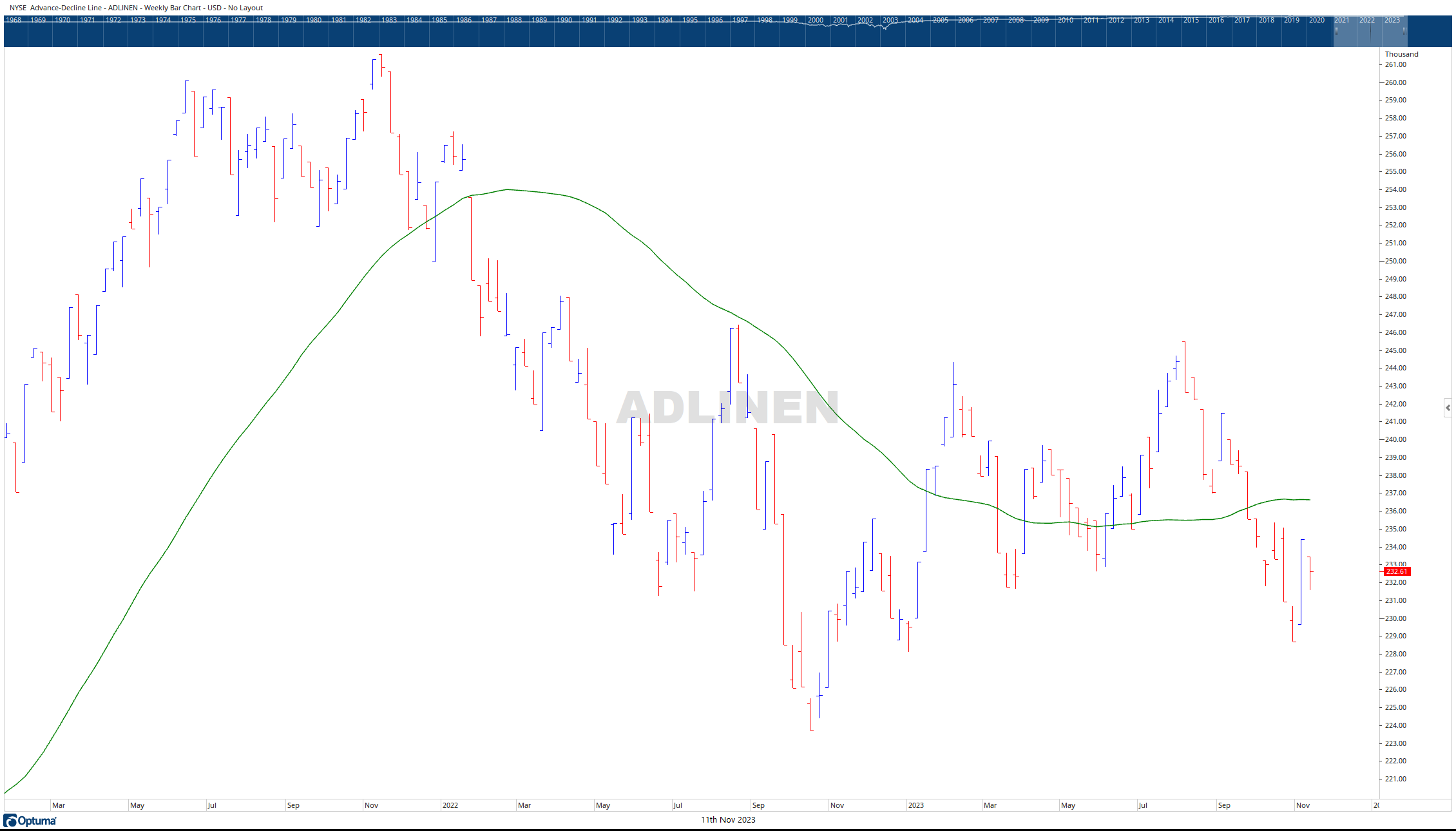

Perhaps the most significant development this week was Capital Weighted Dollar Volume reaching a new all-time high. Although just inching slightly above, this achievement is noteworthy, especially considering that the S&P 500 is still below its June and July yearly highs and well off its all-time highs. From a market breadth perspective, the number of stocks making new 52-week highs increased. However, the NYSE Advance-Decline Line closed the week lower but remained engulfed within the range established the previous week.

In summary, the strong volume thrust previously noted on 11/6 propelled the Generals (NDX) to higher levels, although the troops still lost momentum. The S&P 500 now has minor support at 4300 and major support at 4200. To regain a bullish outlook, the troops (IWM) must maintain levels above 163 neutral levels and break above 200 to join in on the general’s party. A healthy market demands broader participation beyond just the major leaders, yet the new all-time highs in Capital Weighted Dollar Volume may be a positive sign.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/13/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.