Volume Analysis | Flash Market Update - 11.6.23

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

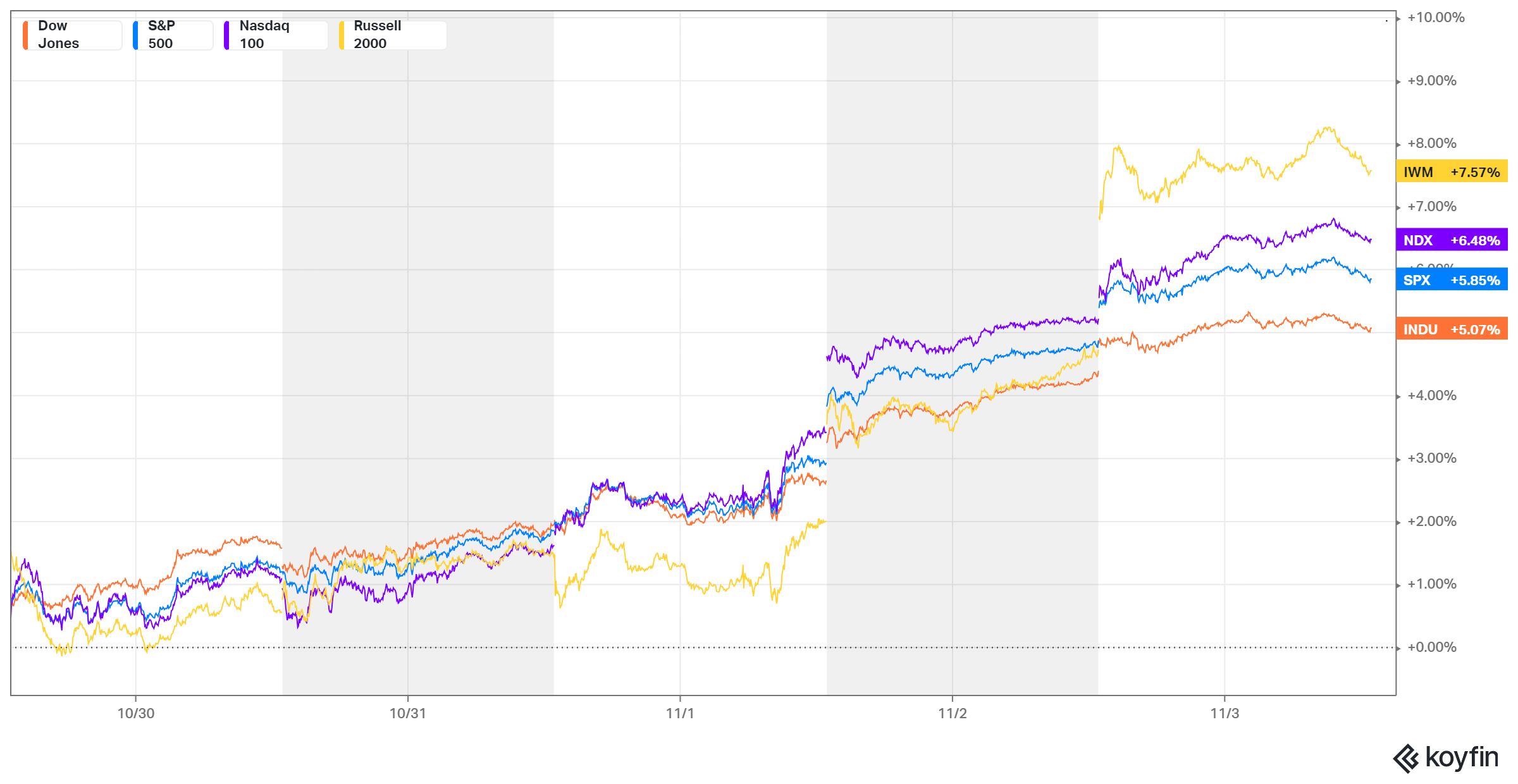

After breaching significant support levels to conclude October, the markets mounted a robust rally, potentially kickstarting the traditionally favorable month of November. The troops (IWM) recorded a weekly gain of 7.57%, surging well beyond the 163 resistance level, which had recently served as the major support just recently breached the prior week. Meanwhile, the Nasdaq Generals (NDX) regained their charge, posting a 6.48% gain in the last week. The S&P 500, which had recently dipped below the crucial 4200 support, rebounded strongly, notching a 5.85% weekly increase, and is currently positioned to retest the minor resistance level at 4400.

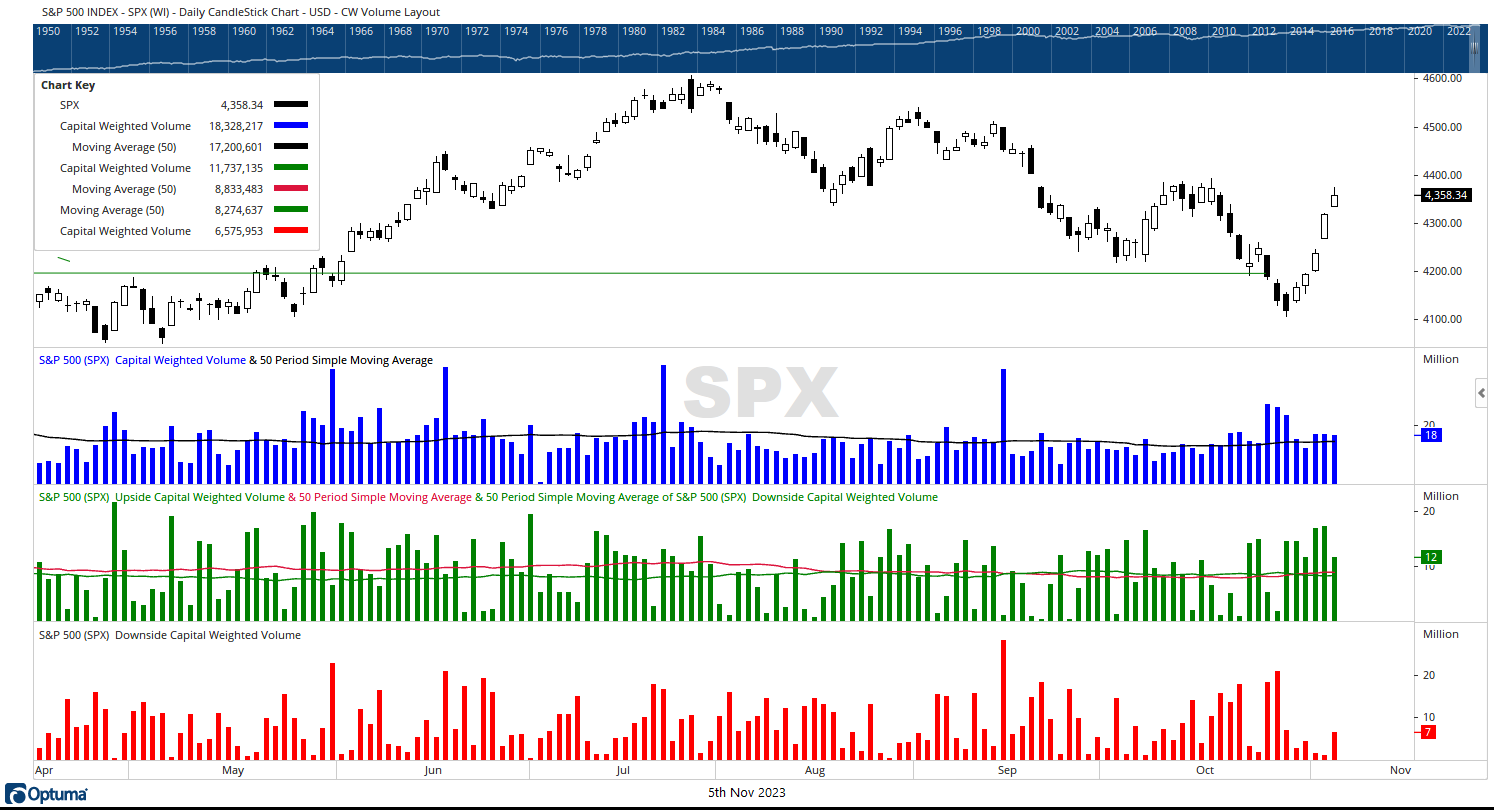

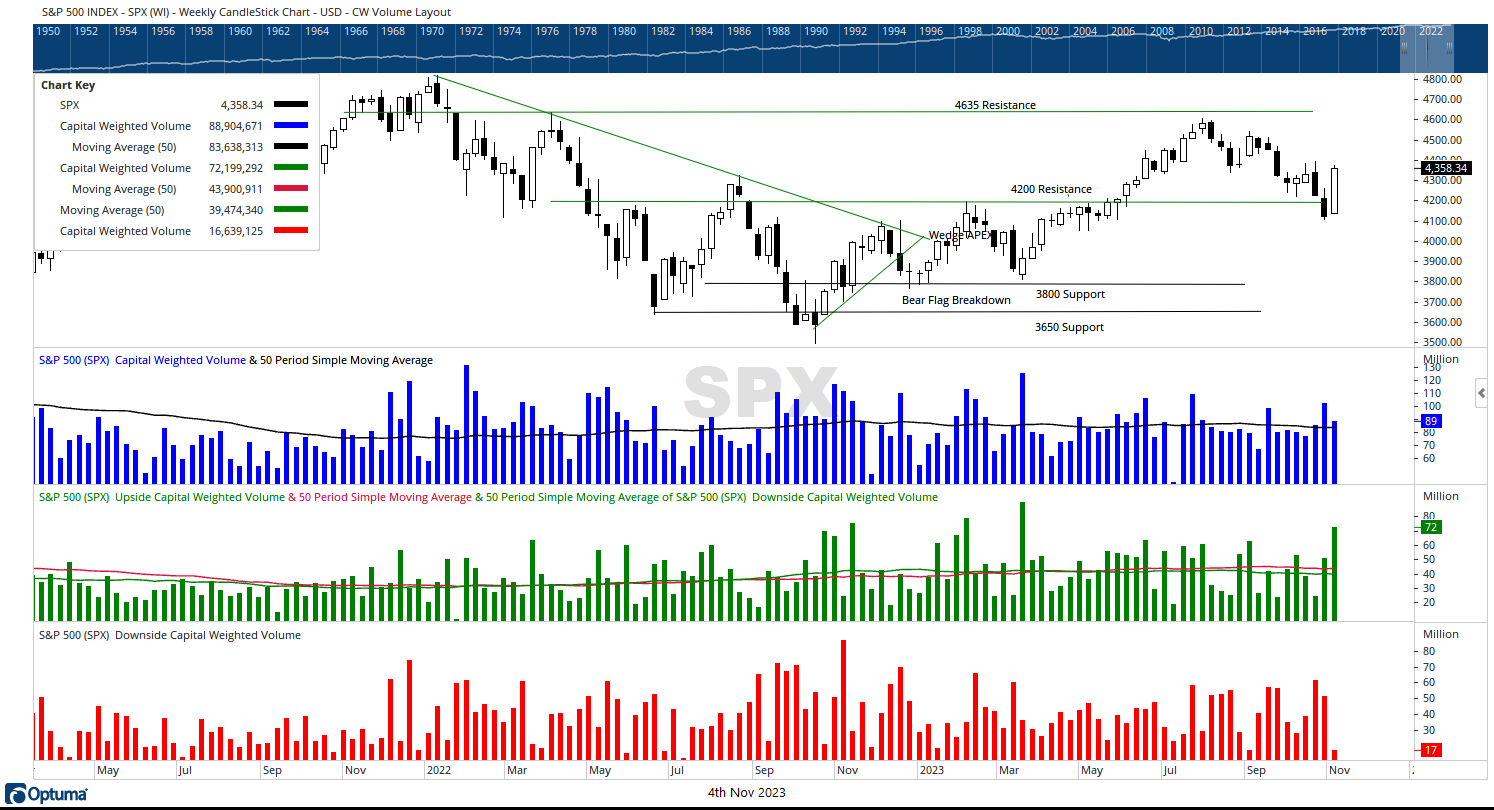

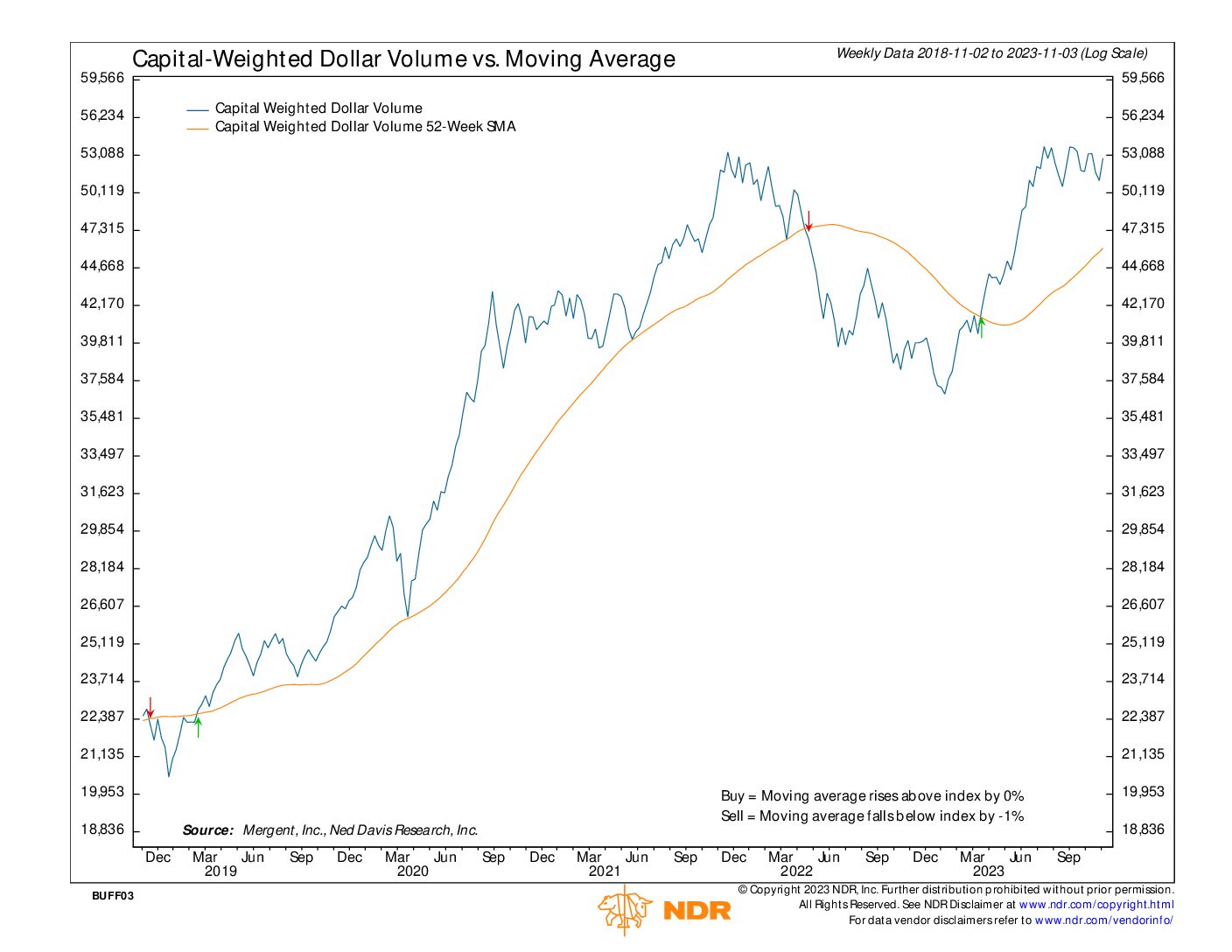

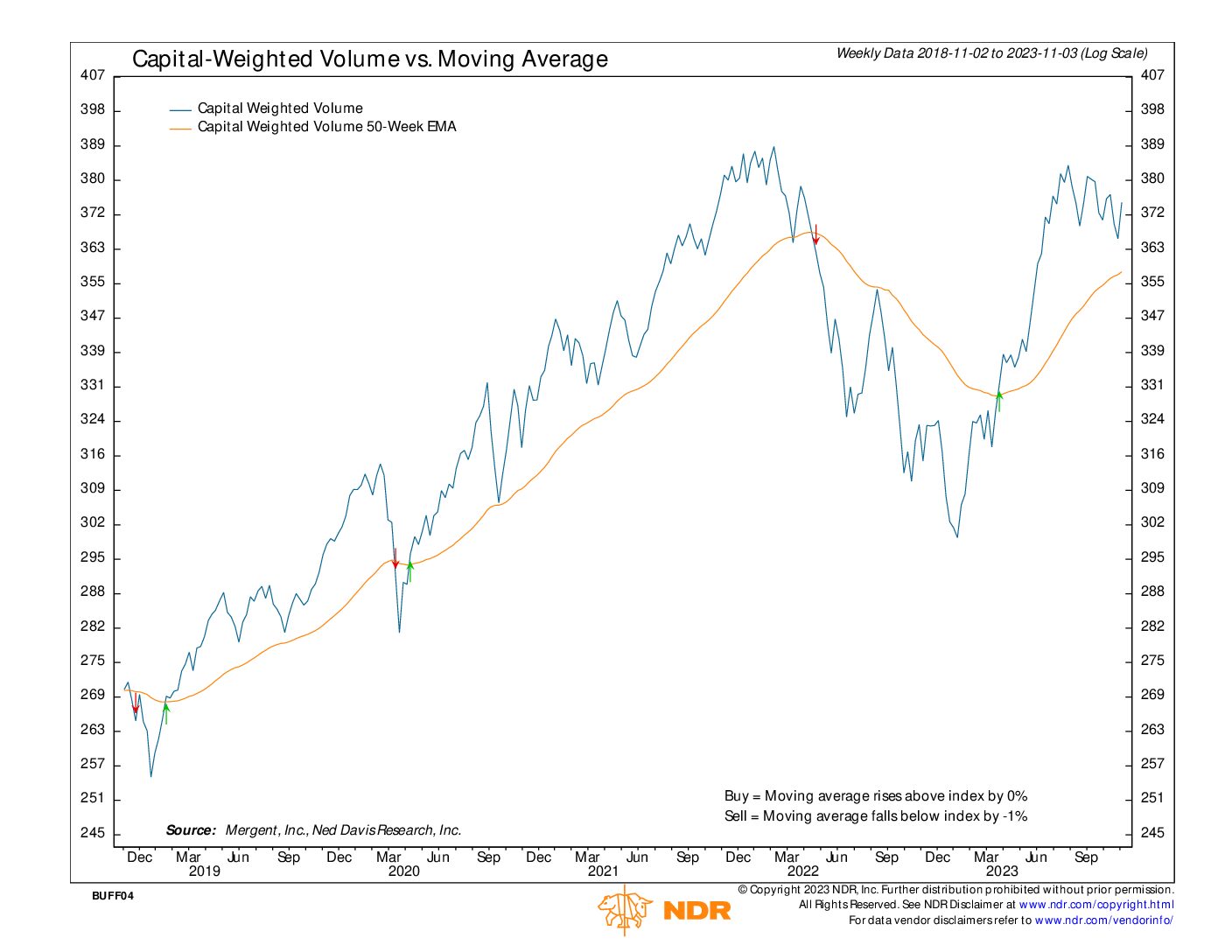

While price movements grab headlines, the driving force behind these market shifts is trading volume and capital flows. In this context, S&P 500 Capital Inflows surged dramatically, with a massive influx thrust of $88.9 billion pouring into the S&P 500 index. This represents the most robust weekly inflow since the market bottom in March, following the S&P’s testing of the 3800 support level. On the flip side, S&P 500 outflows only amounted to $16.6 billion, marking the lowest Capital-Weighted Downside Volume of the year, even when accounting for holiday-shortened weeks. Remarkably, more than 80% of the Capital-Weighted Dollar Volume occurred on the upside, a remarkably rare occurrence launched by the Bulls.

In his research paper, Trains, Planes and Automobiles, Wayne Whaley writes, “Market rallies have been appropriately compared to the launch of a rocket. In order for a rocket to have enough momentum to exit the earth’s atmosphere, the ship must be launched with enough initial force to defy the earth’s gravity and penetrate the earth‘s atmosphere. The theory is the market has an atmosphere of boundaries as well, made up of old trading ranges, resistance lines, and the tendencies of investors to pocket short term profits. If the market is to have a chance of overcoming its own atmospheric constraints, the initial rally must be propelled with a thrust adequate in force to send the market through the levels of resistance that thwarted previous such launches. Studies have shown that the vast majority of Bull Markets in the last 50 years have been launched with an initial surge that is of the 4 standard deviation (or once every 4 years) from the norm variety.”

One potentially strong indicator of market thrust is a 90% Upside Capital-Weighted Volume day, signifying that over 90% of capital flows are directed to the upside. An example of a “4 standard deviation” move is two consecutive 90% days. Last Wednesday, the Bull’s scored a 90% day with 92% of the capital flows being to the upside. This was followed by an even more remarkable performance on Thursday, November 2nd, with over 95% of the trading volume notched in favor of the upside.

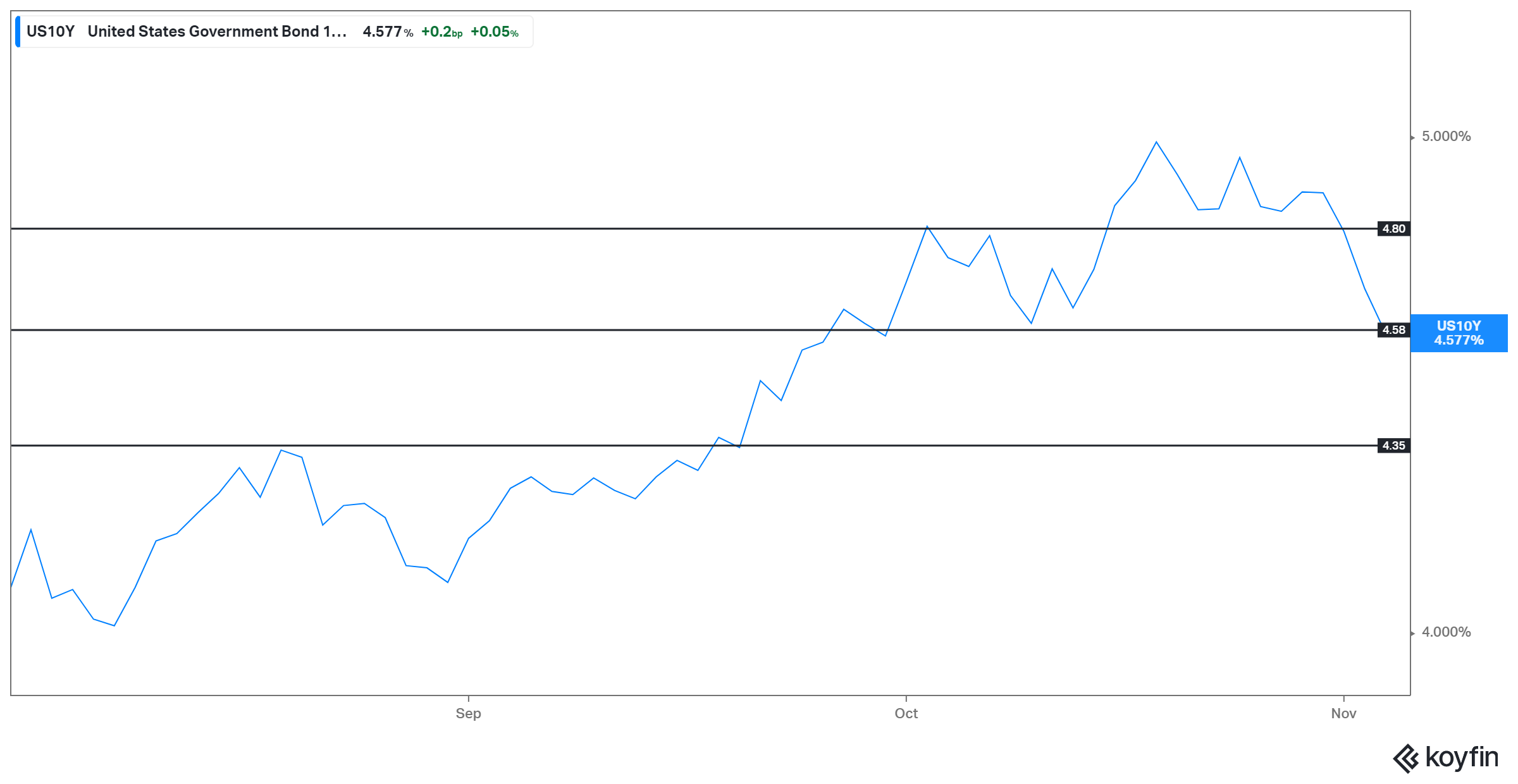

Looking forward, can the Bulls rescript the bottoming action formed in March or will the Bears regroup? The action of the 10-year treasury yield may continue to drive this action. S&P 500 support is once again found at 4200, with resistance looming at 4400. The small-cap index (IWM) support, AKA the troops, again lies at 163, with resistance resting at 180.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/6/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.