Volume Analysis | Flash Market Update - 10.30.23

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

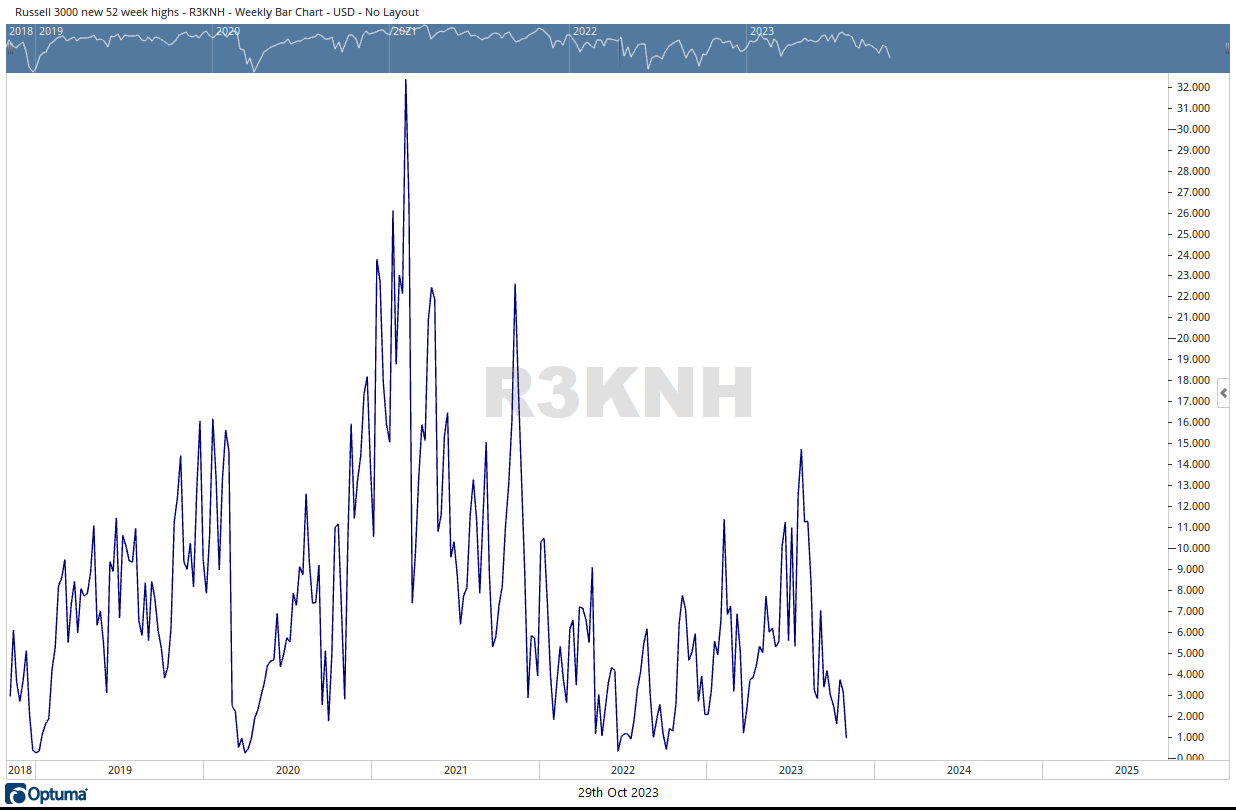

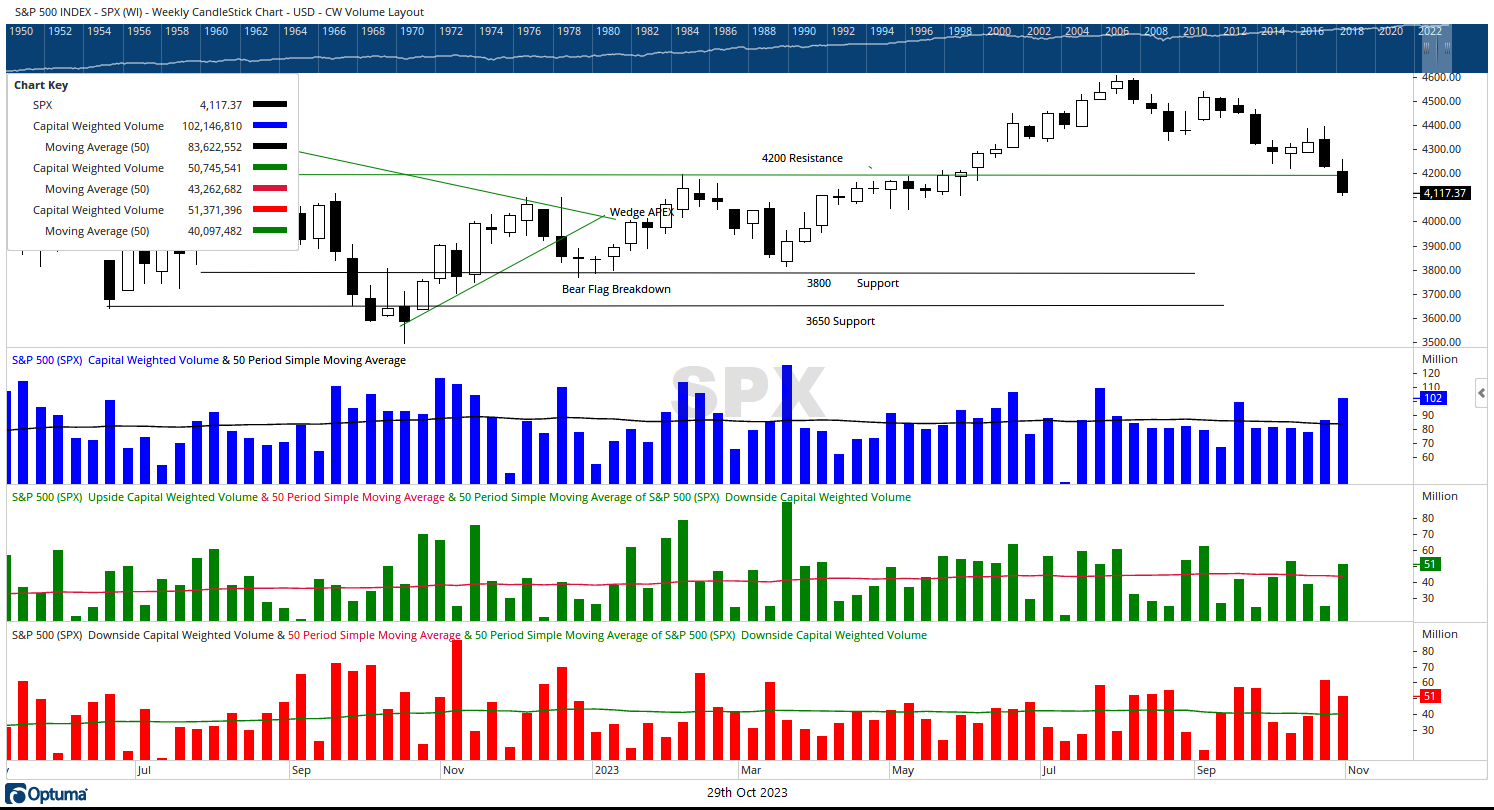

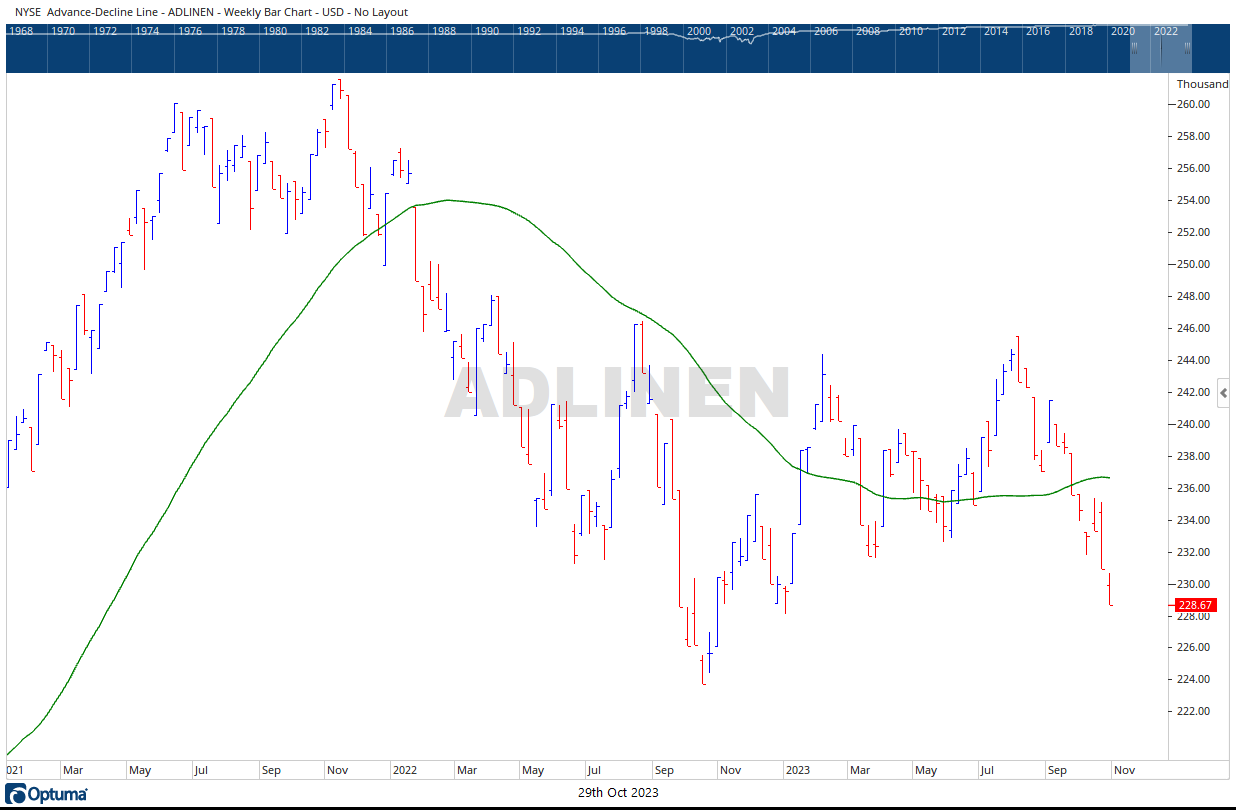

The S&P 500 broke underlying support @ 4200 and the troops (IWM) also broke critical support @ 163. The break of S&P 500 below 4200 knocks the S&P 500 from a bull market to neutral. IWM breaking through 163 throws the troops squarely back into bear market territory. Further market damage may have occurred in the breadth statistics with the NYSE Advance-Decline Line and Stocks @ New Highs both making new lows on the year. And, as the cherry on top for the bears, S&P 500 Capital Weighted Volume also dipped beneath corresponding support.

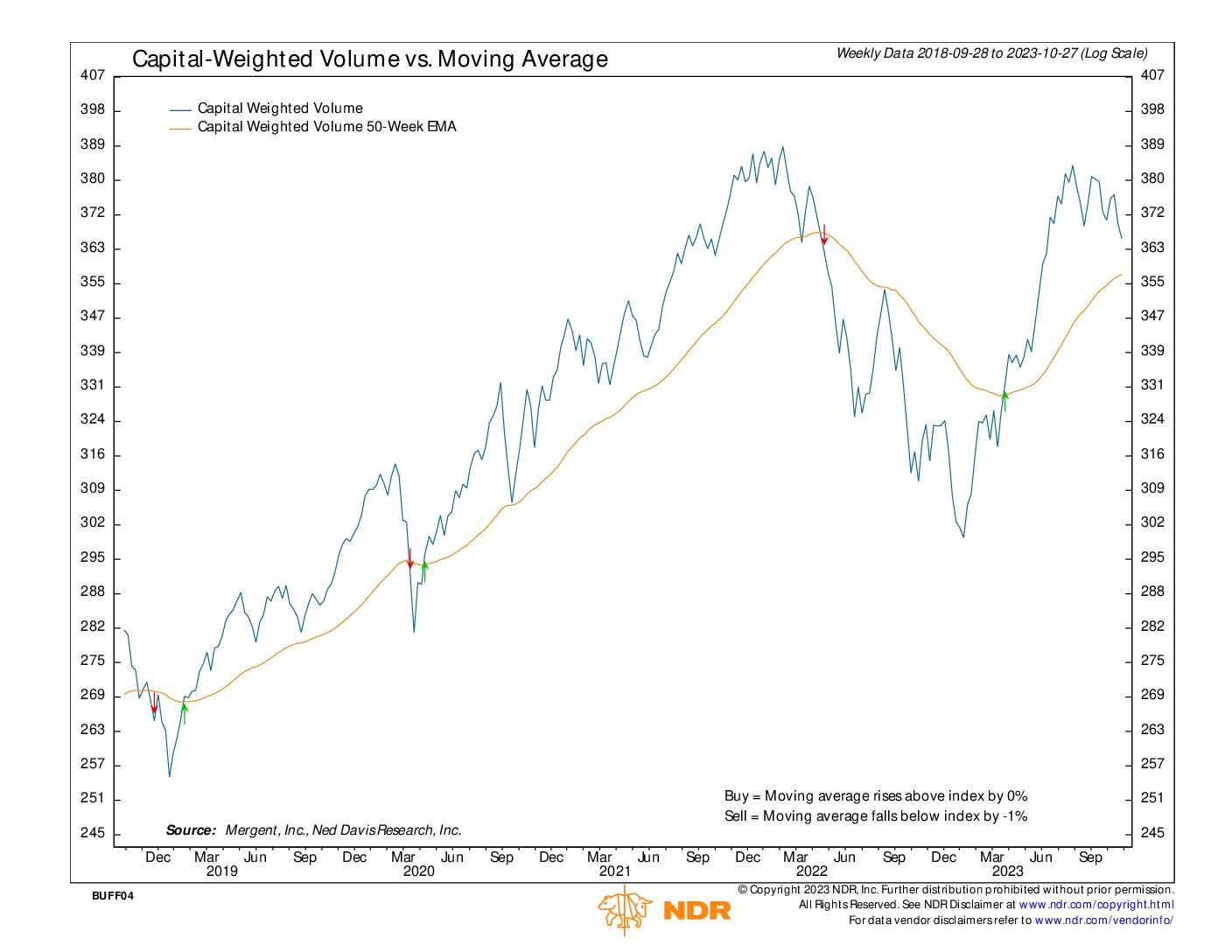

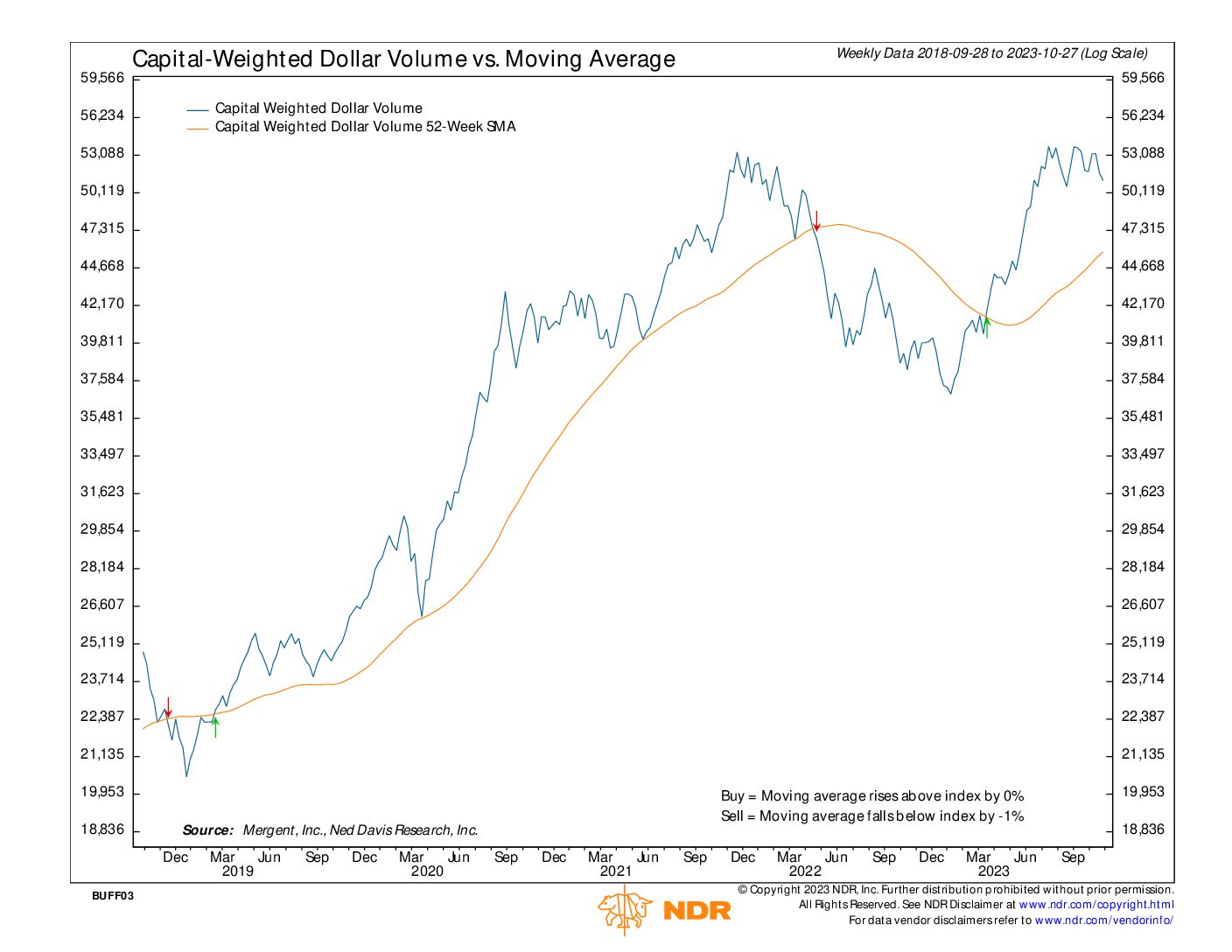

In a ray of hope, an S&P 500 bright spot was Capital Weighted Dollar Volume still holding its uptrend. S&P 500 Capital Weighted outflows were well above average at approximately $51 Billion. However, Capital Weighted inflows were also strong, almost matching outflows with $50.75 Billion. In isolation, this may be a bullish indication considering the decline of the S&P 500 price index.

With S&P 500 4200 support now breached, our next price support is at 4000. S&P 4000 is the apex of two major trendlines, the same apex theming our analysis in 2022 and the beginning of 2023. Resistance on the S&P 500 is now 4200 and support resides at the aforementioned 4000. A price break below 4000 throws the S&P 500 into bear market territory on a price basis. However, a volume analysis bear market only occurs when the weekly intermediate trend of capital flows turns negative. My research shows this is the critical element in capital preservation. Though it may still be a ways off, capital volume deterioration is rapidly gaining traction while capital flows are still holding strong.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 10/30/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.