Volume Analysis | Flash Market Update - 10.16.23

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

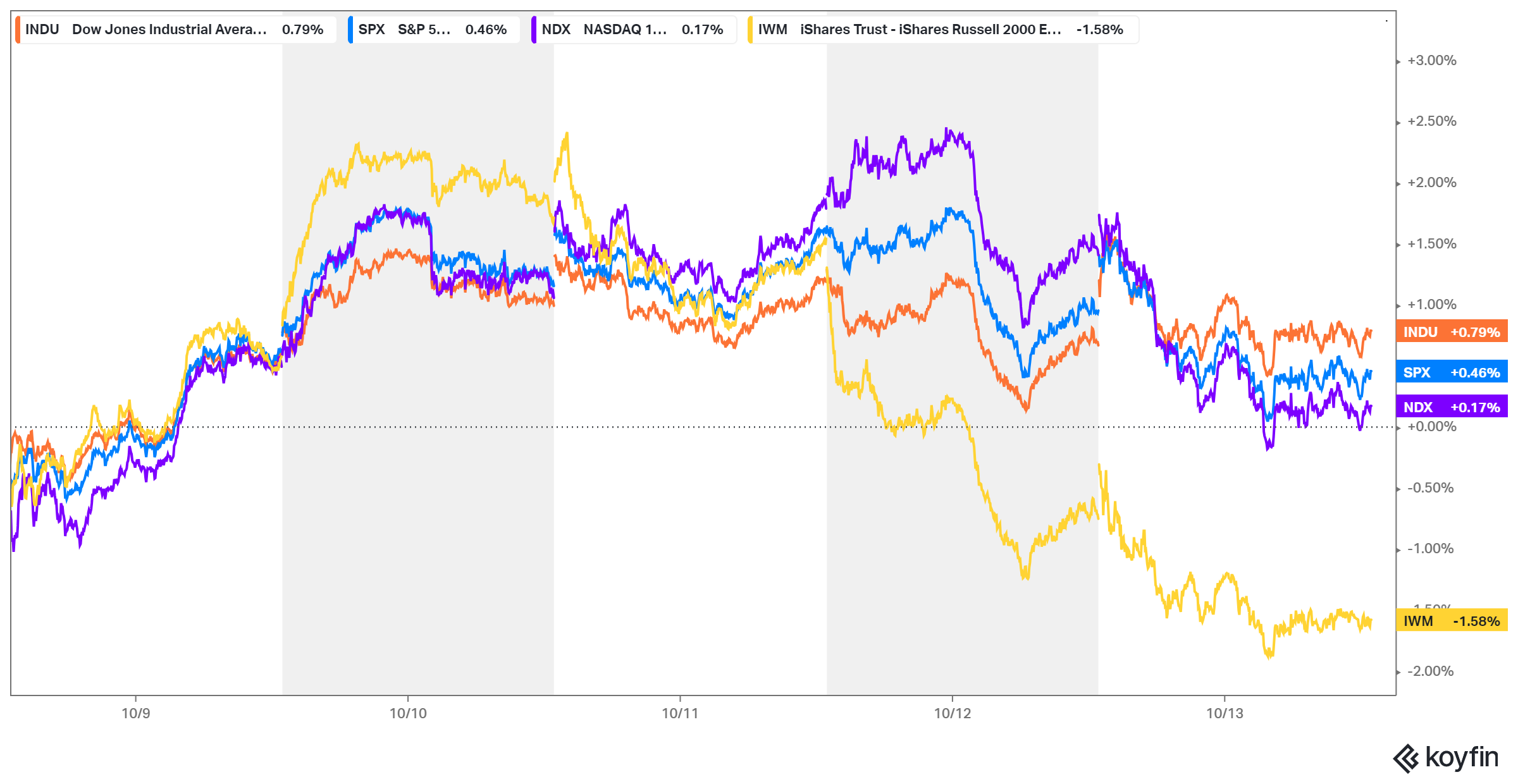

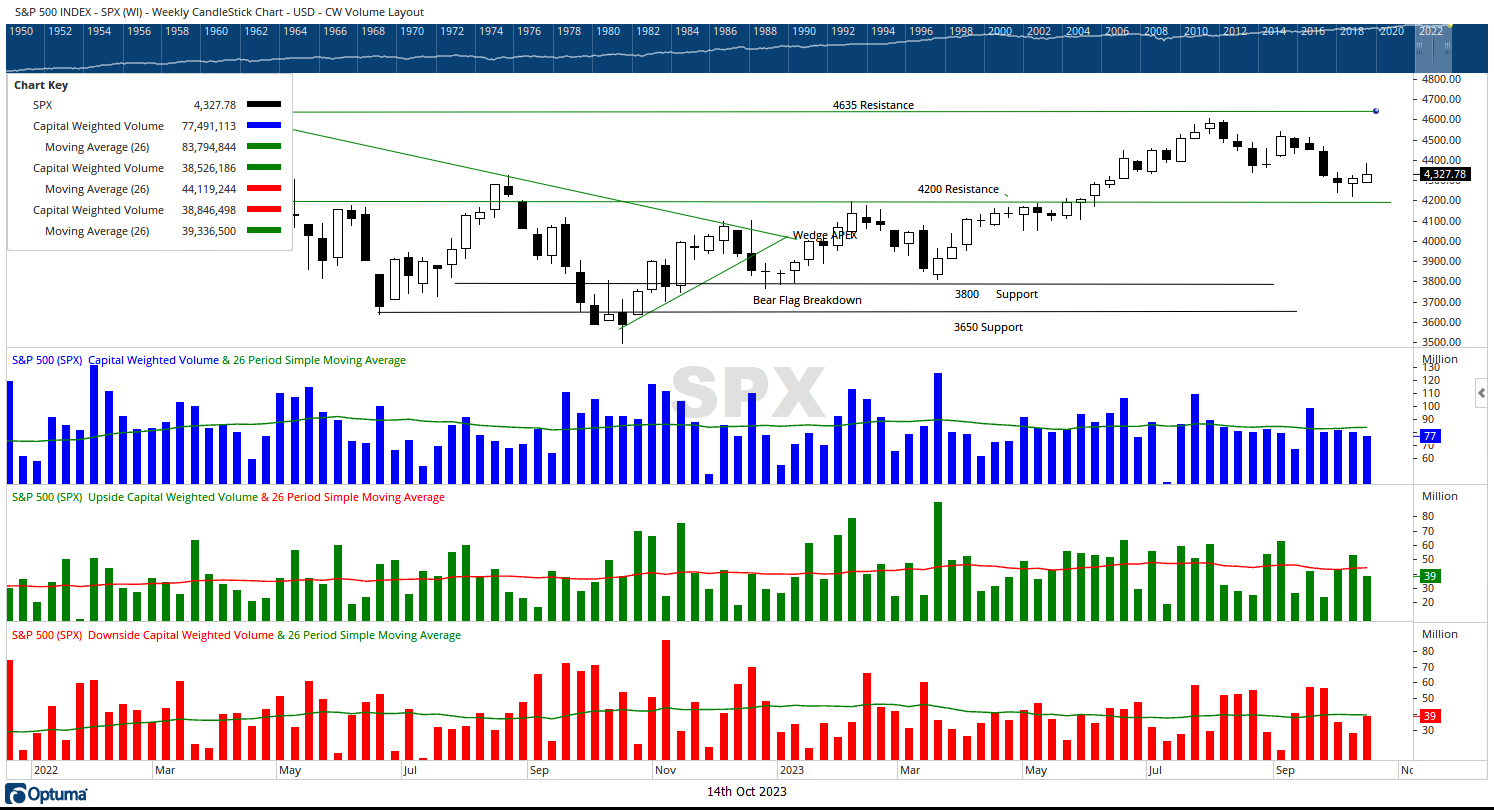

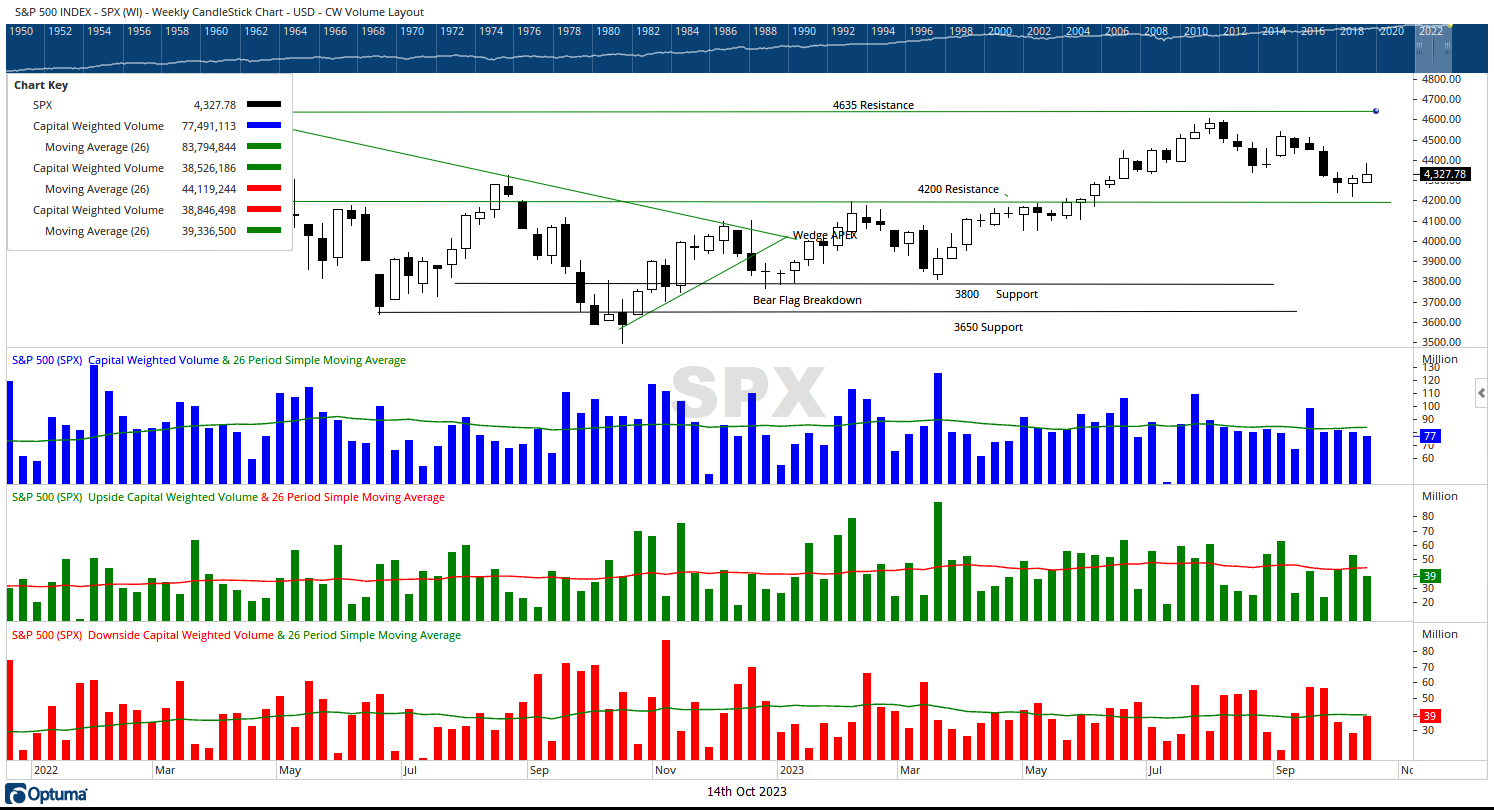

This past week, the generals (NDX) made a modest advance of 0.17%, while the troops (IWM) retreated by -1.58%. The S&P 500, on the other hand, saw a 0.46% increase for the week. Despite the price advance, capital inflows and outflows remained balanced, with both totaling approximately $38 billion for the week.

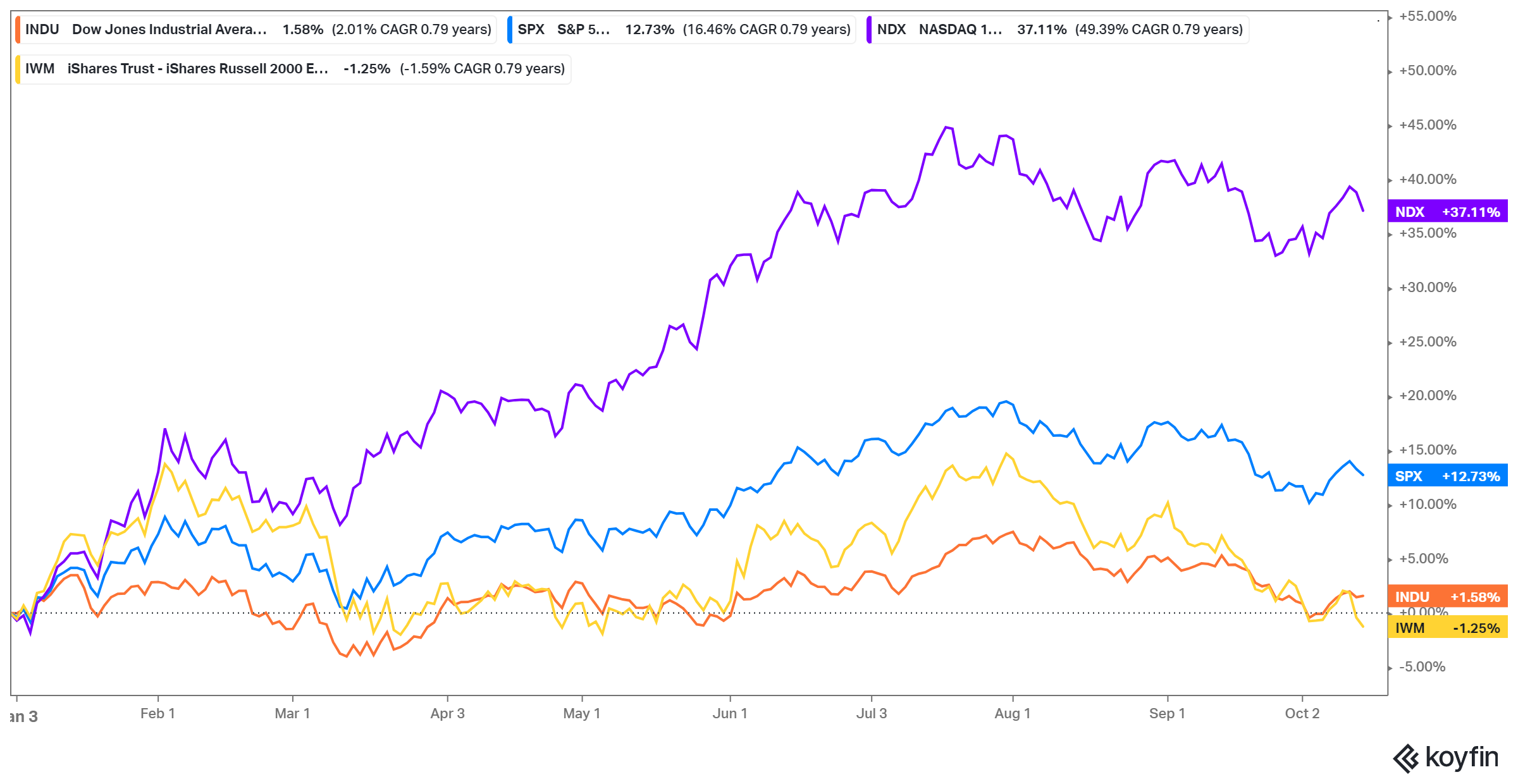

Year-to-date, the generals have performed impressively, showing a gain of 37.11%, whereas the troops have experienced a decline of -1.25%. Earlier in the year, when a similar discrepancy between the generals and troops was observed, we noted that it was customary for the generals to lead and uplift the troops. This observance came to pass from June to August when the IWM rallied by approximately 15%. However, the troops have now relinquished all of those gains and are near their yearly lows.

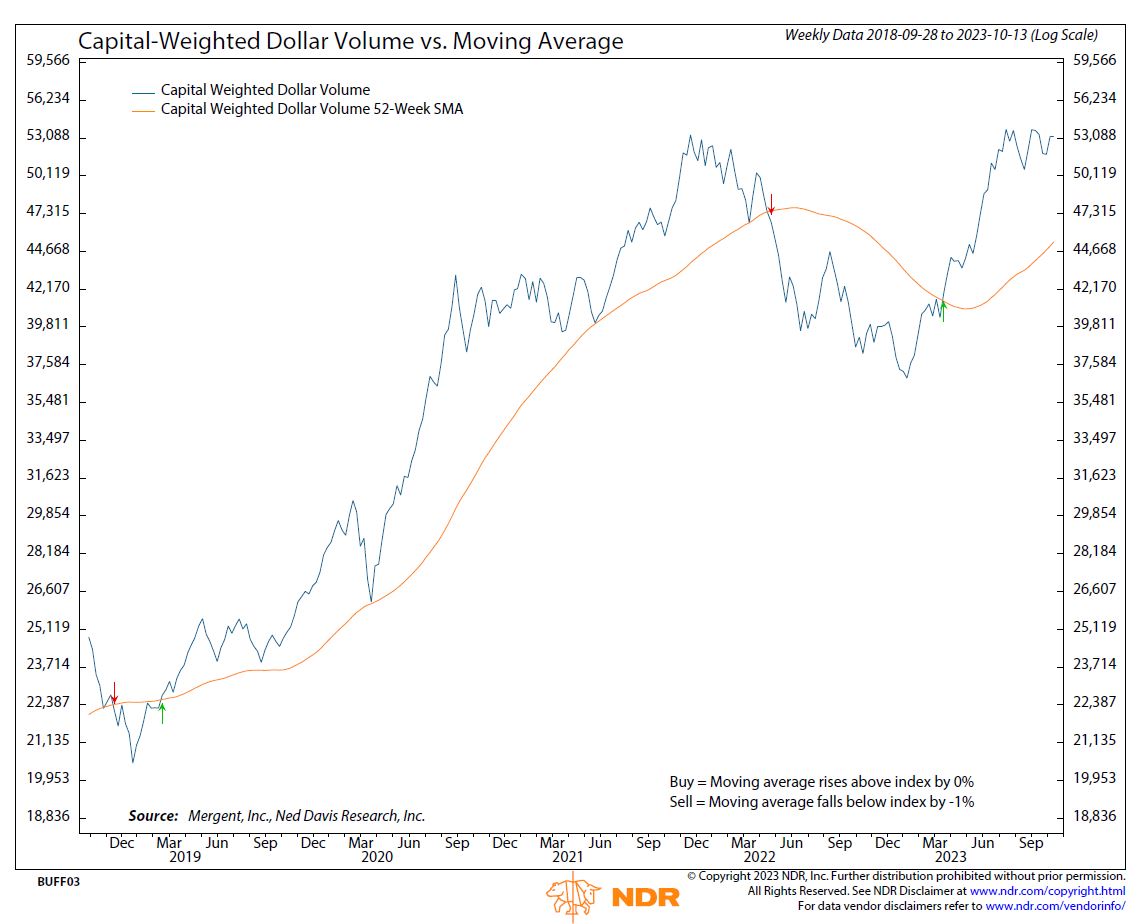

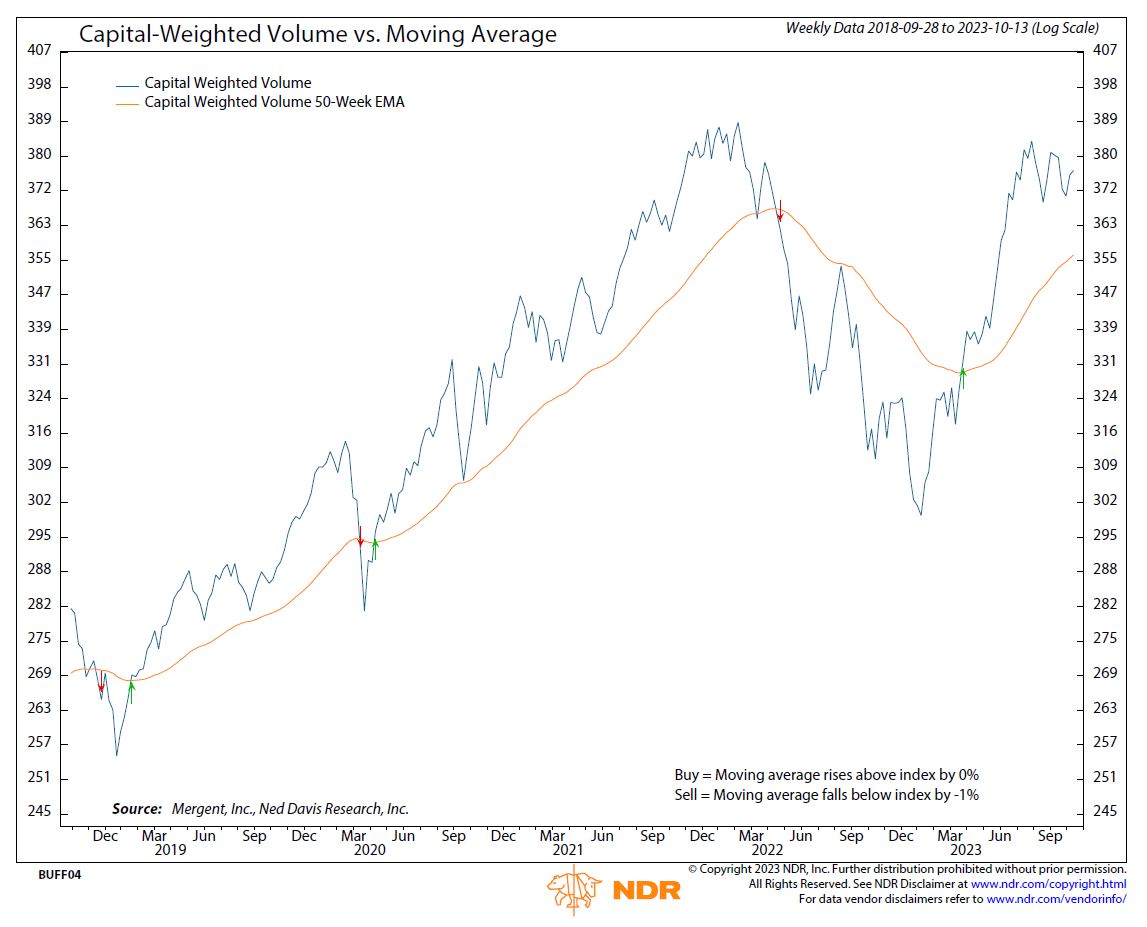

Overall, Capital Weighted Volume is displaying an upward trend, with higher lows consistently being established. A significant development would be a break above the 380 mark, signifying a potential robust bullish trend. Capital Weighted Dollar Volume is already in a full-on bullish trend and is on the verge of achieving all-time highs.

In the upcoming weeks, my focus will be on the troops as they find themselves in a pivotal position. A healthy market necessitates that the troops (IWM) maintain support above 167 and stay above their yearly low at 162. Should the troops shift into a downtrend, it could serve as a catalyst to weaken the bull market. However, if the troops finally join the rally, their participation could bolster the ongoing bullish action. As for the broad market, the S&P 500 faces critical support at 4200, with notable resistance levels residing at 4450.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 10/16/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.