Volume Analysis | Flash Market Update - 8.28.23

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

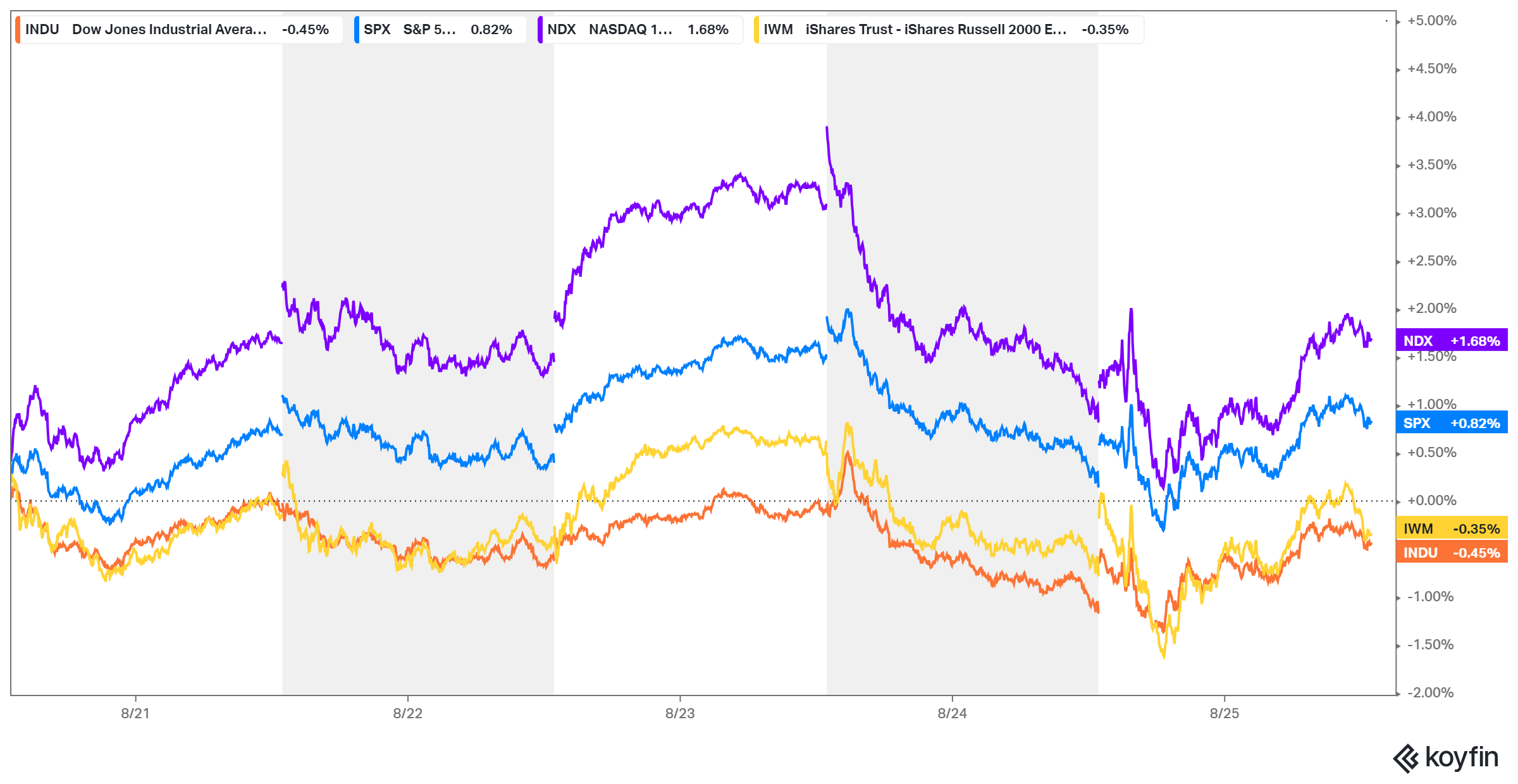

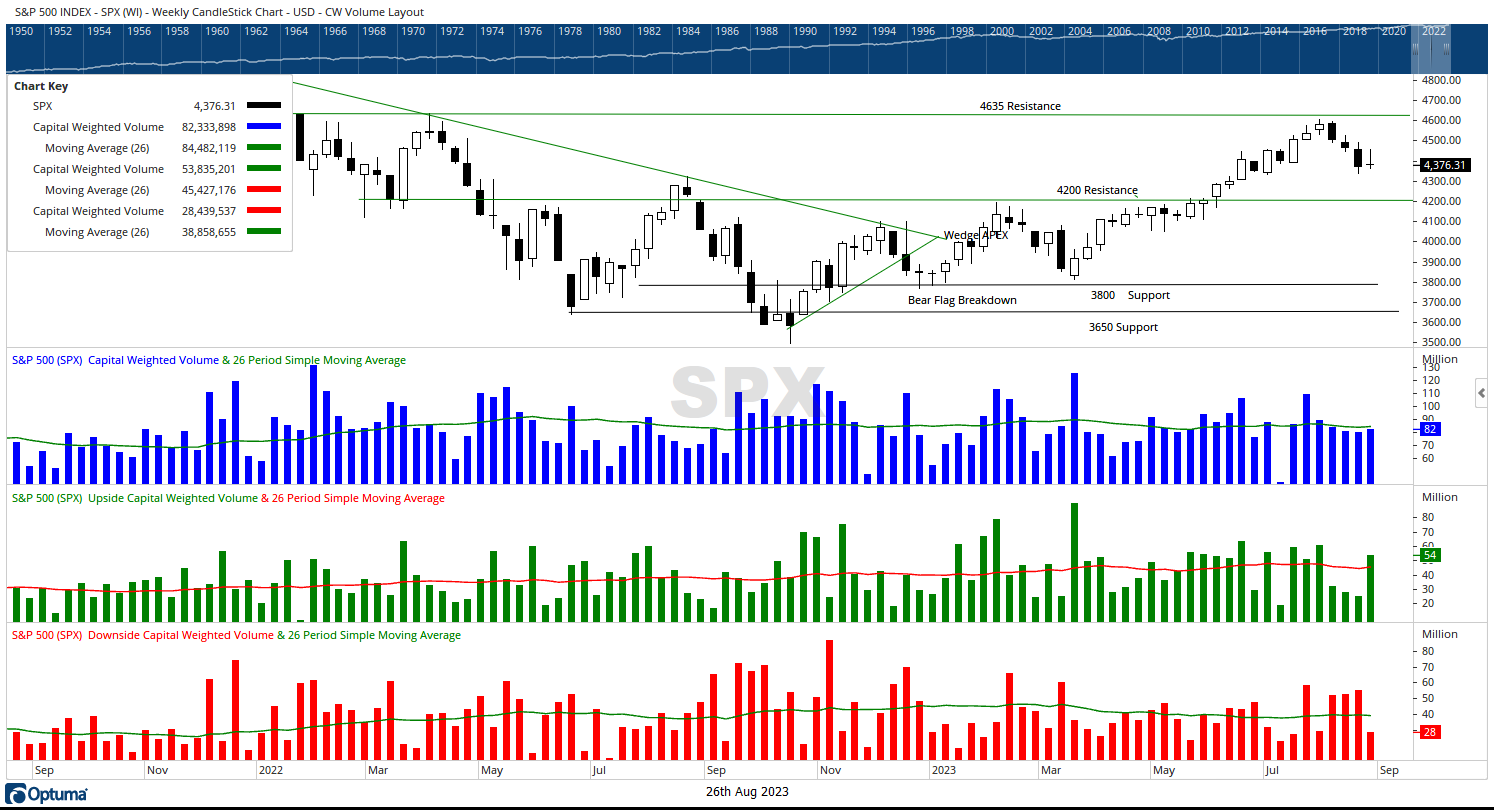

Despite ultimately closing below its mid-week peak, the S&P 500 experienced a modest uptick during the week, guided by the troops (NDX 100 index). The NDX 100 exhibited strength, concluding the week with a gain of 1.68%. In contrast, the Dow Jones Industrials saw a decrease of 0.45% while the iShares Russell 2000 ETF (the “troops”) faced a slight decline of -0.35%. The S&P 500 commenced the week with an opening value of 4380 and concluded slightly higher at 4406 by the close on Friday, marking a 0.82% increase for the week.

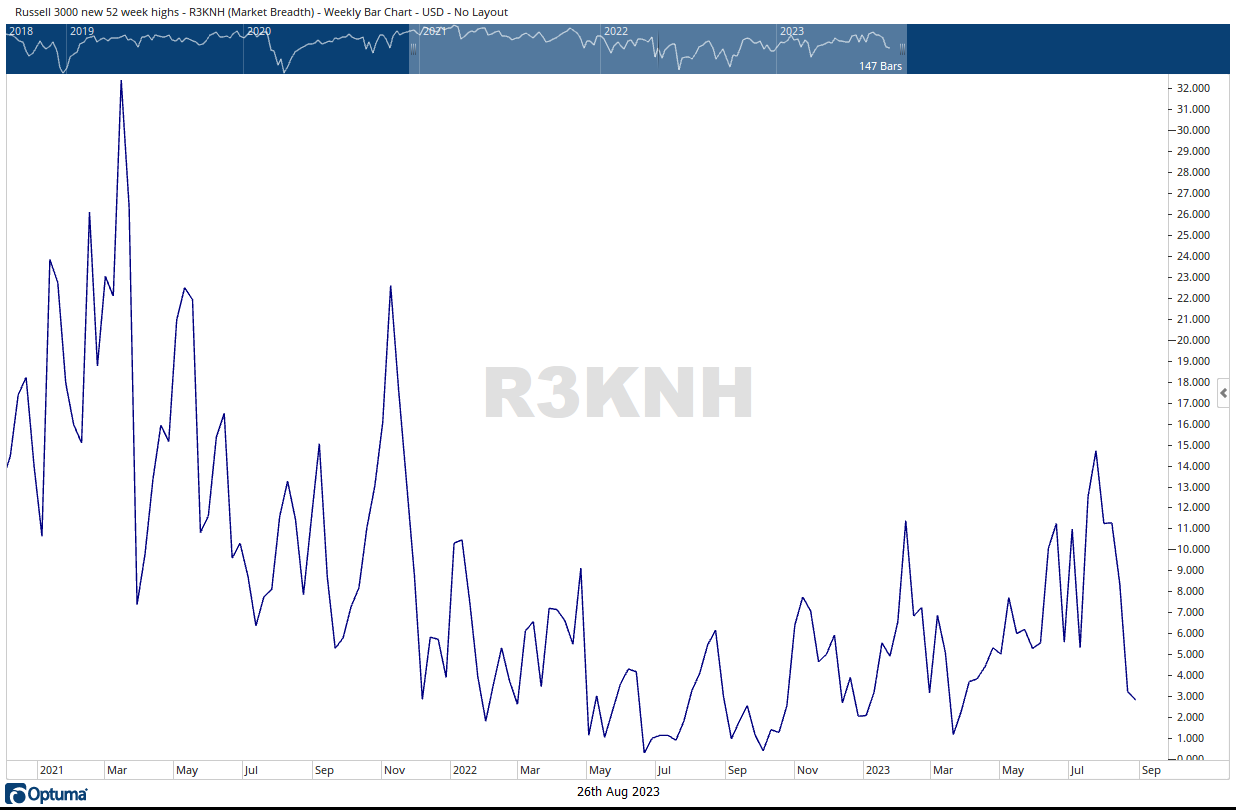

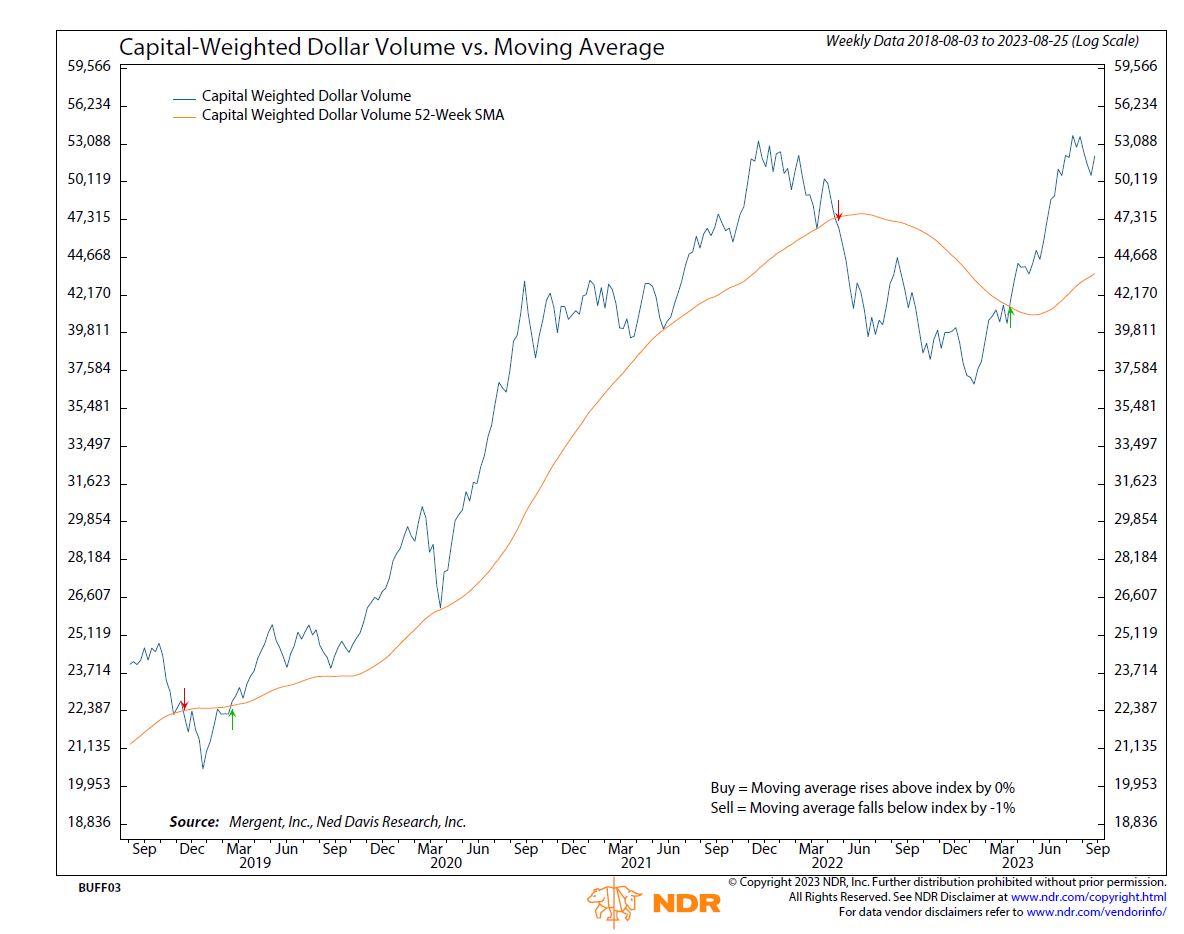

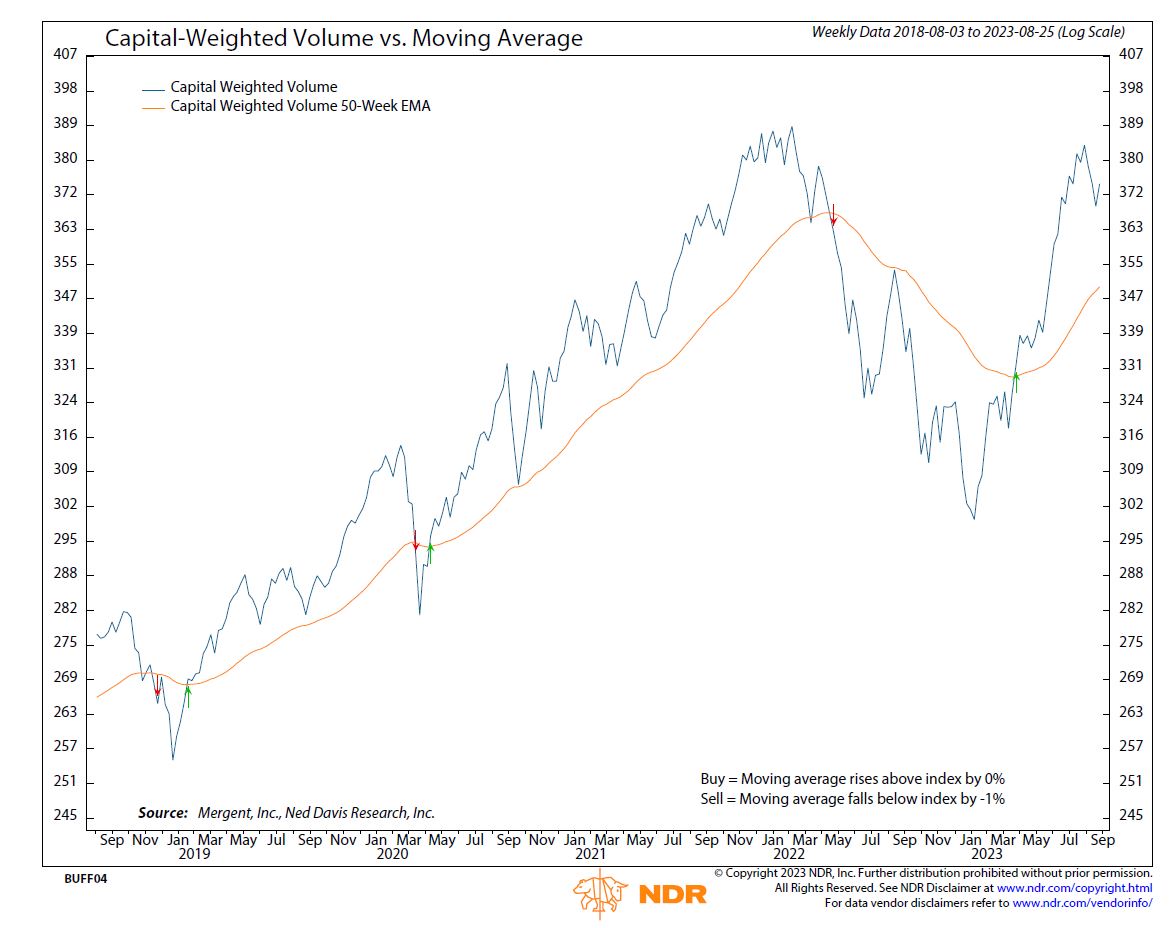

Although the S&P 500 saw overall growth, the market breadth painted a different picture. The number of stocks reaching new 52-week highs shrank, mirroring a similar decline in the NYSE Advance-Decline Line. Notably, for the first time in 3 weeks, a shift occurred in S&P 500 capital flows. Last week showcased robust inflows of $53.8 billion in stark contrast to the $28.4 billion in capital outflows.

Presently, the S&P 500 is trading inside its August 14th weekly range. The upside of that range, 4490, represents resistance, whereas the downside serves as support @ 4435. A daily close above either of these points could suggest the next short-term direction of the S&P 500. Monitoring a daily close beyond either of these points could offer insights into the potential short-term trajectory of the S&P 500.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 8/28/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.