Volume Analysis | Flash Market Update - 7.17.23

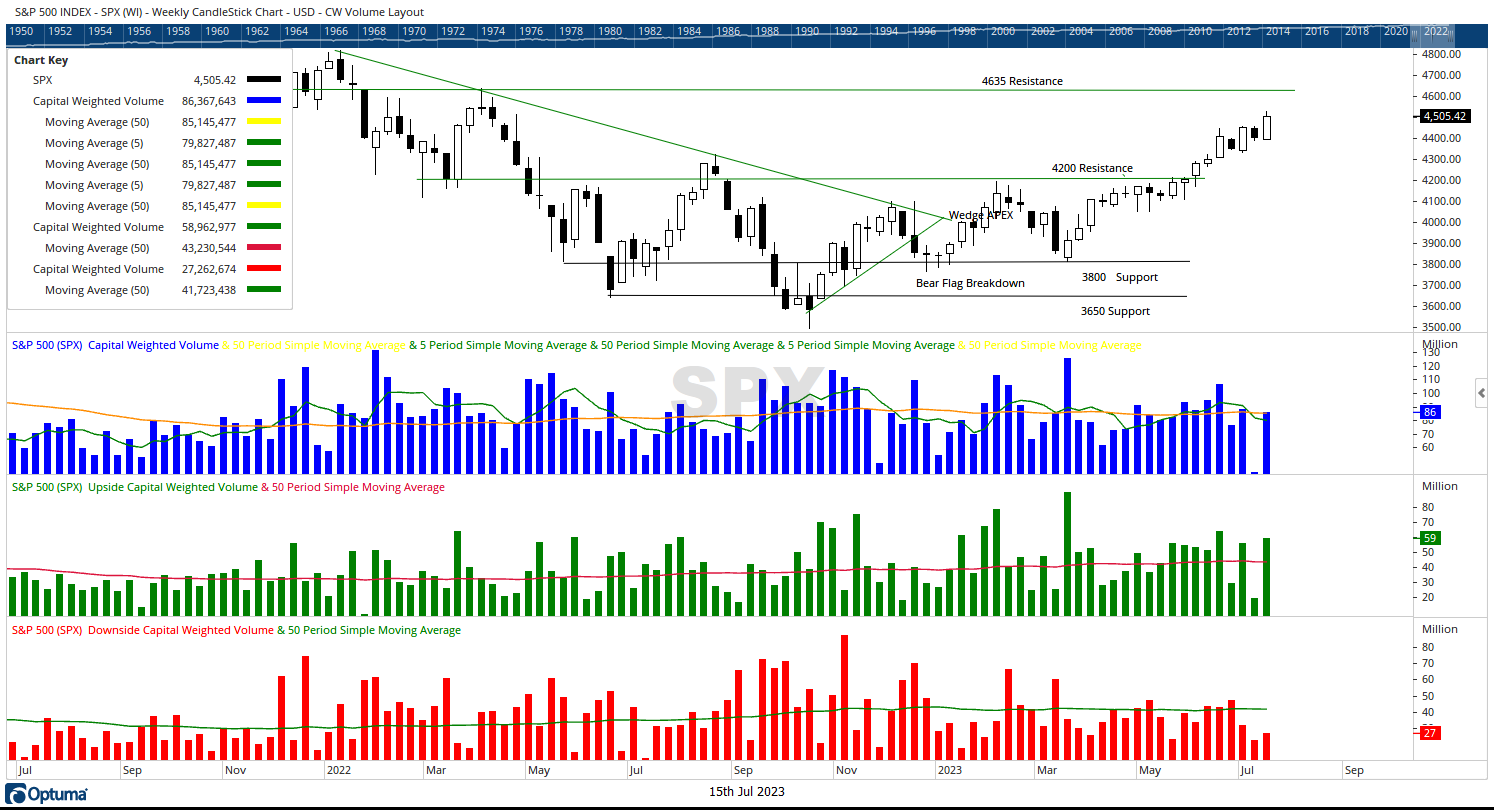

In 2023, the generals (NDX 100) and her troops (Russell 2000) have not been in sync with the rally. However, this past week, both the generals and the troops moved in cohesion against the bears. Capital flows were strong during last week’s rally. The S&P 500 saw $59 Billion in new inflows to only $27 Billion in outflows. Overall, high volume and heavy capital flows are leading the market higher.

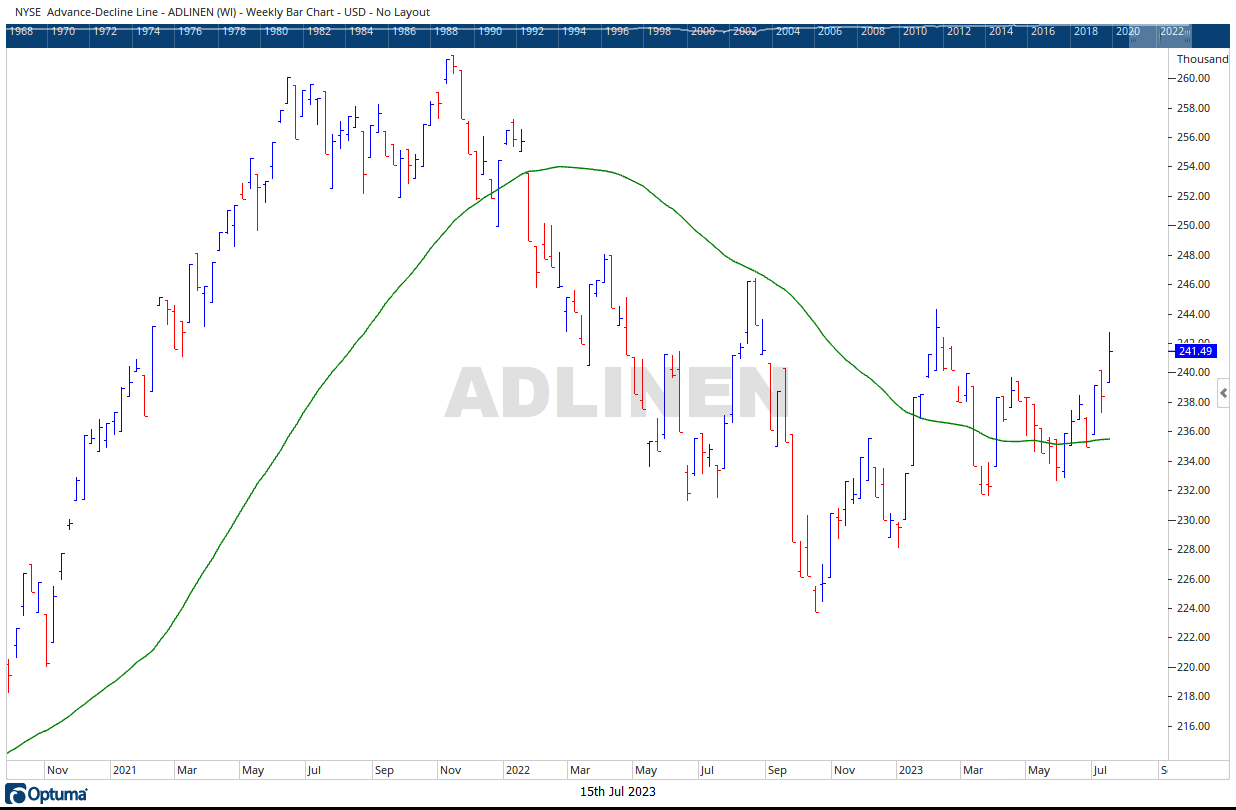

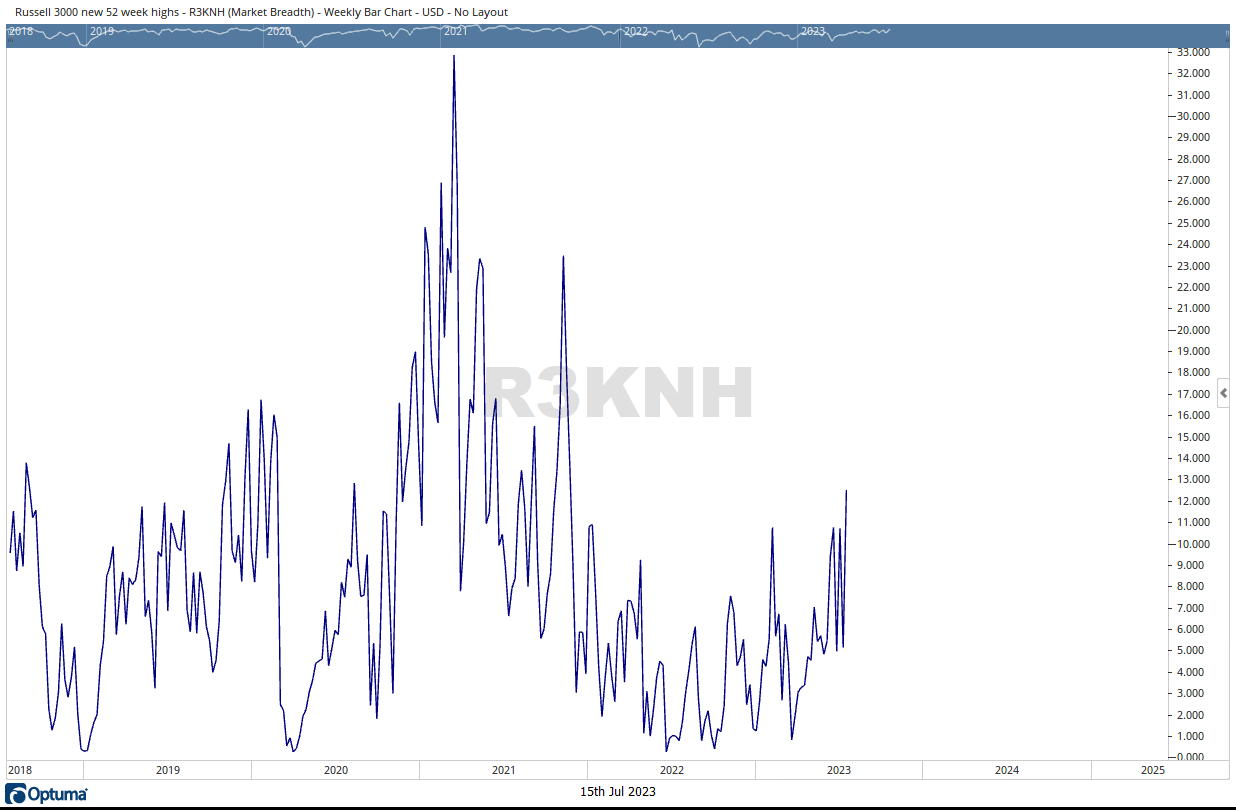

The price and volume action was further supported by a rising Advance-Decline Line, now robustly in a new uptrend. This action suggests market liquidity and breadth. Further bullish confirmation came from the number of stocks in the Russell 3000 making new highs. Our New Highs indicator finished at its highest level of the year, suggesting that resistance is waning on many issues.

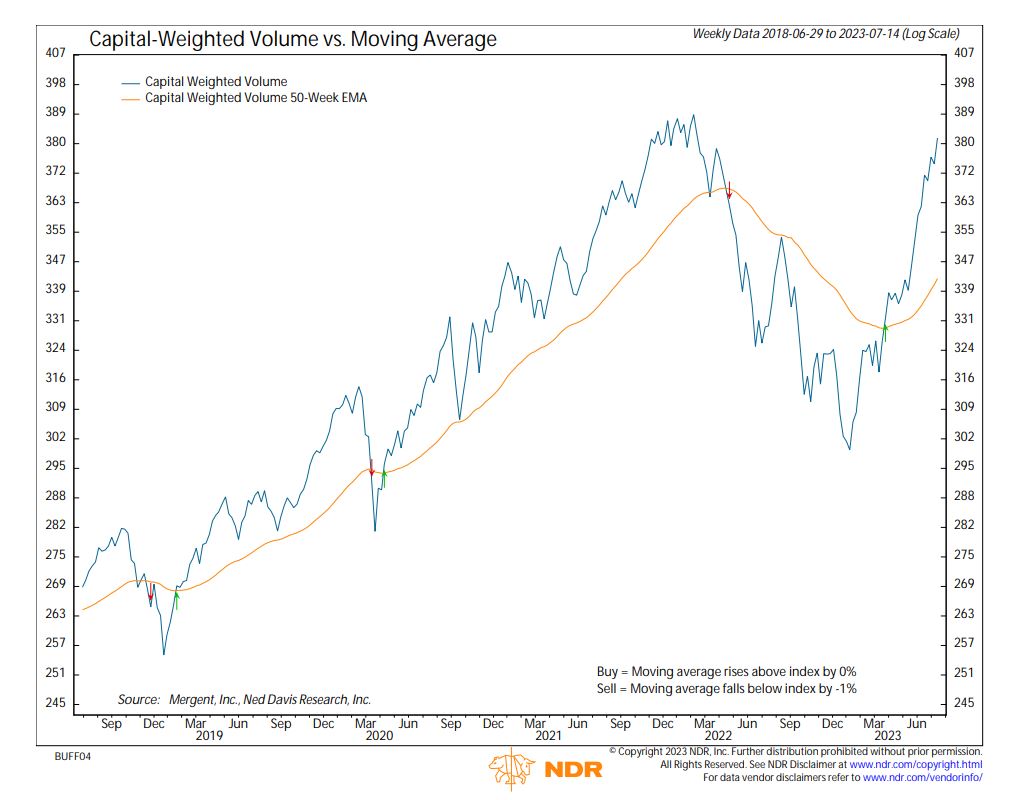

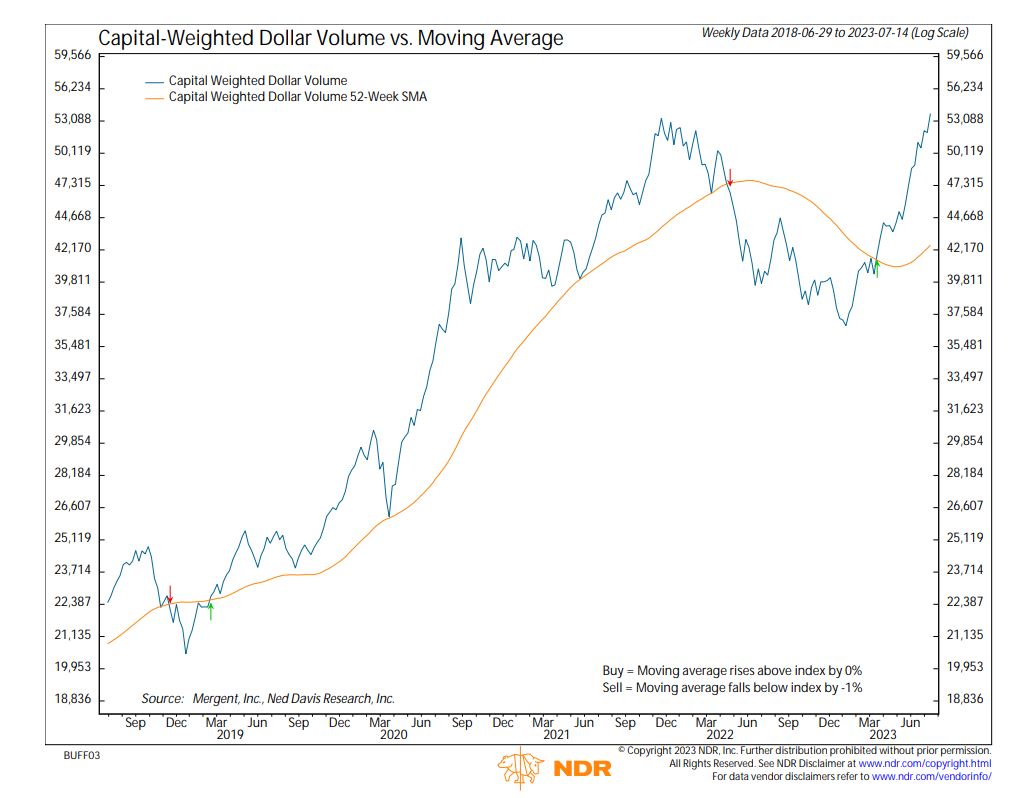

While the S&P 500 is over 100 points from its next major resistance at 4635, S&P 500 Capital-Weighted Dollar Volume is on the verge of breaking out to new All-Time highs. Capital-Weighted Volume is also showing strength. And like Capital-Weighted Dollar Volume, Capital Weighted Volume is also approaching its all-time high set in January of 2022.

Major S&P 500 resistance resides at 4635, whereas minor support rests at 4390. Overall, volume and capital flows continue to lead the broad market higher. While our intermediate-term indicators signal green lights, please be aware that this is also the time of year (seasonality) when countertrends may develop.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 7/17/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.