Volume Analysis | Flash Market Update - 6.12.23

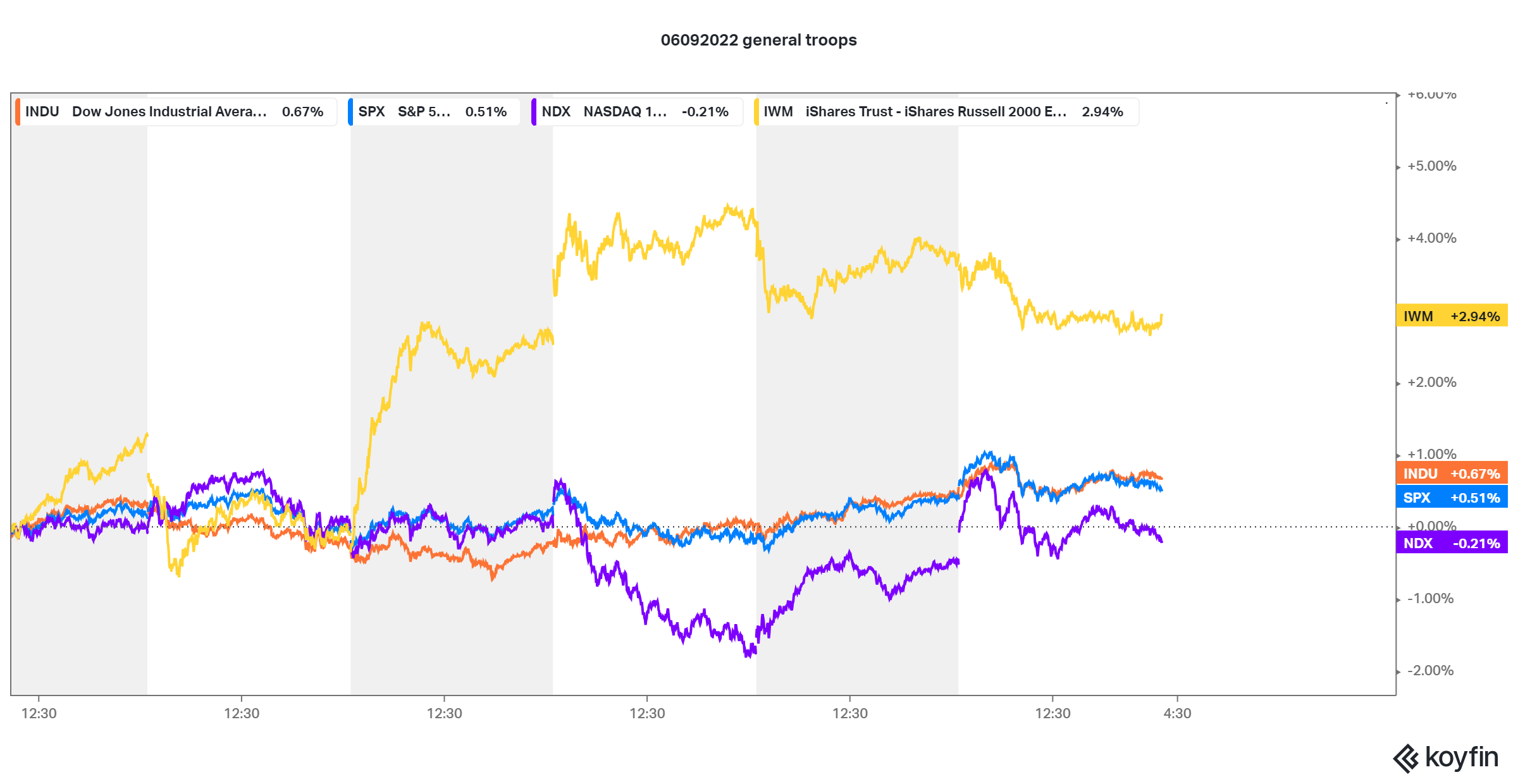

Last week’s Volume Analysis Flash Update concluded, “capital continues to flow positively into stocks. Perhaps the concentration of capital into the big names has become overly ripe, and it may be time for a more inclusive market to take hold.” This past week that theme played out with the generals taking a bit of a breather (Nasdaq 100, -0.21%) and the troops (IWM, +2.94%) joining in on the battle against the bears. Overall, capital continued to flow into the markets for the week, with $51.4 billion flowing into the markets compared to $42.6 billion coming out. Capital Weighted Dollar Volume was high for the week, with both inflows and outflows above average for the week.

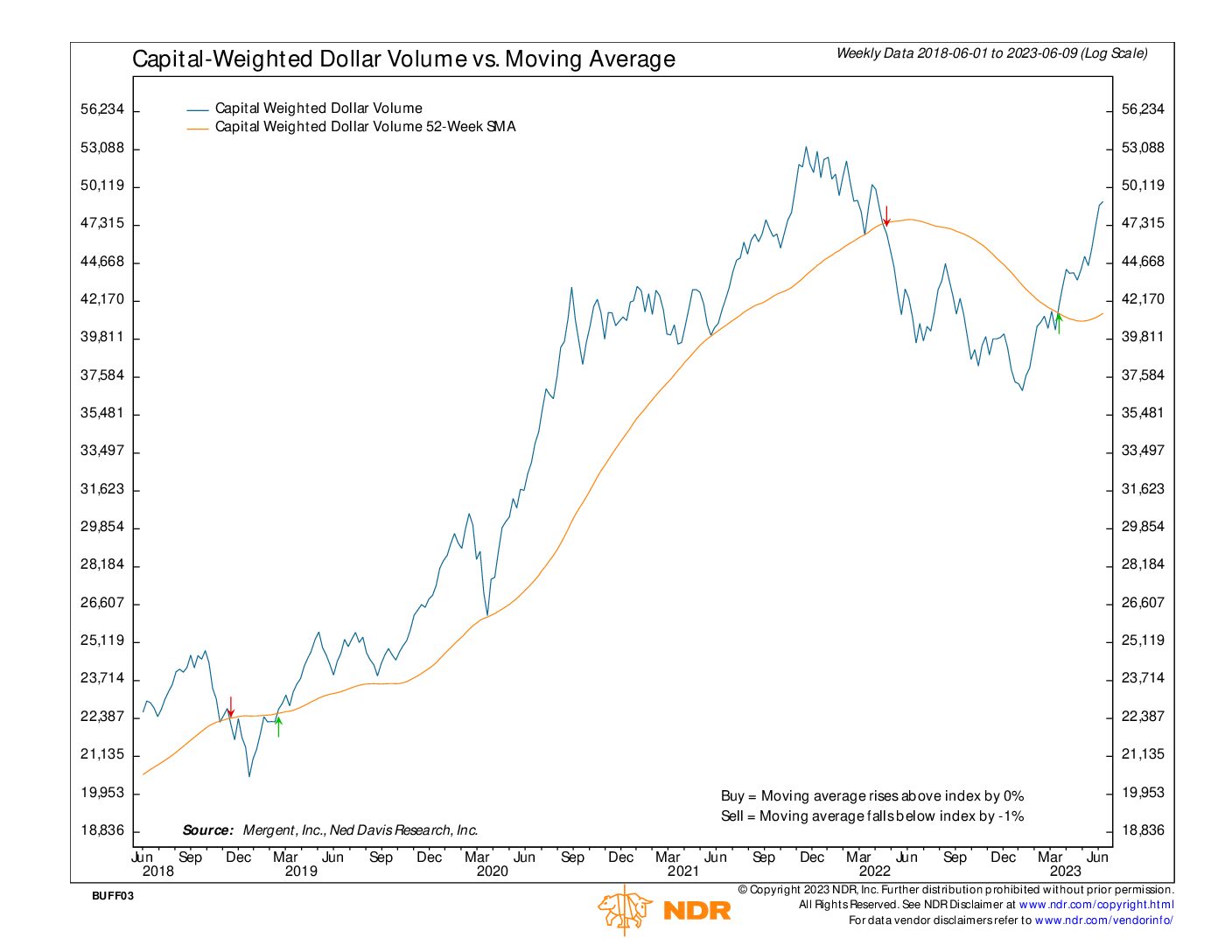

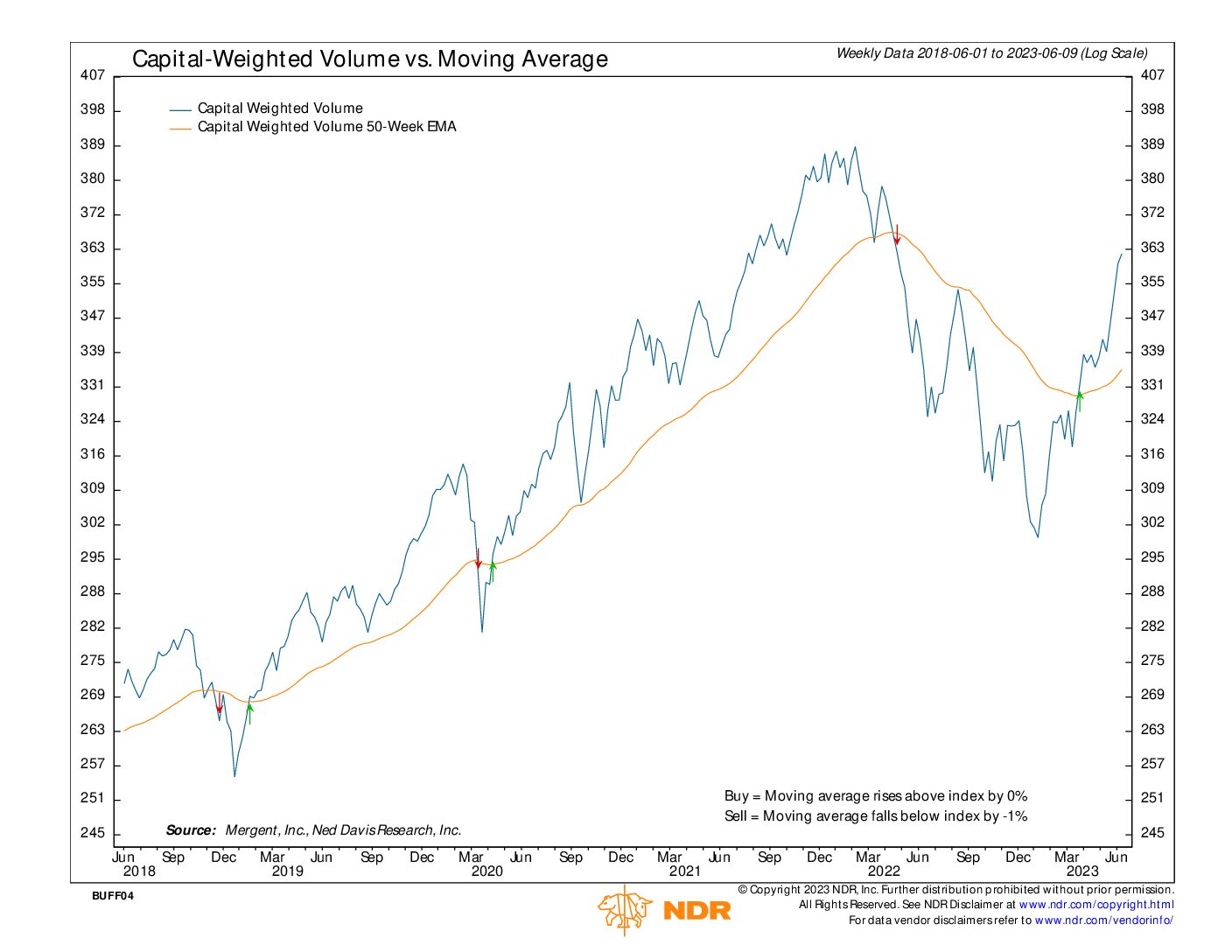

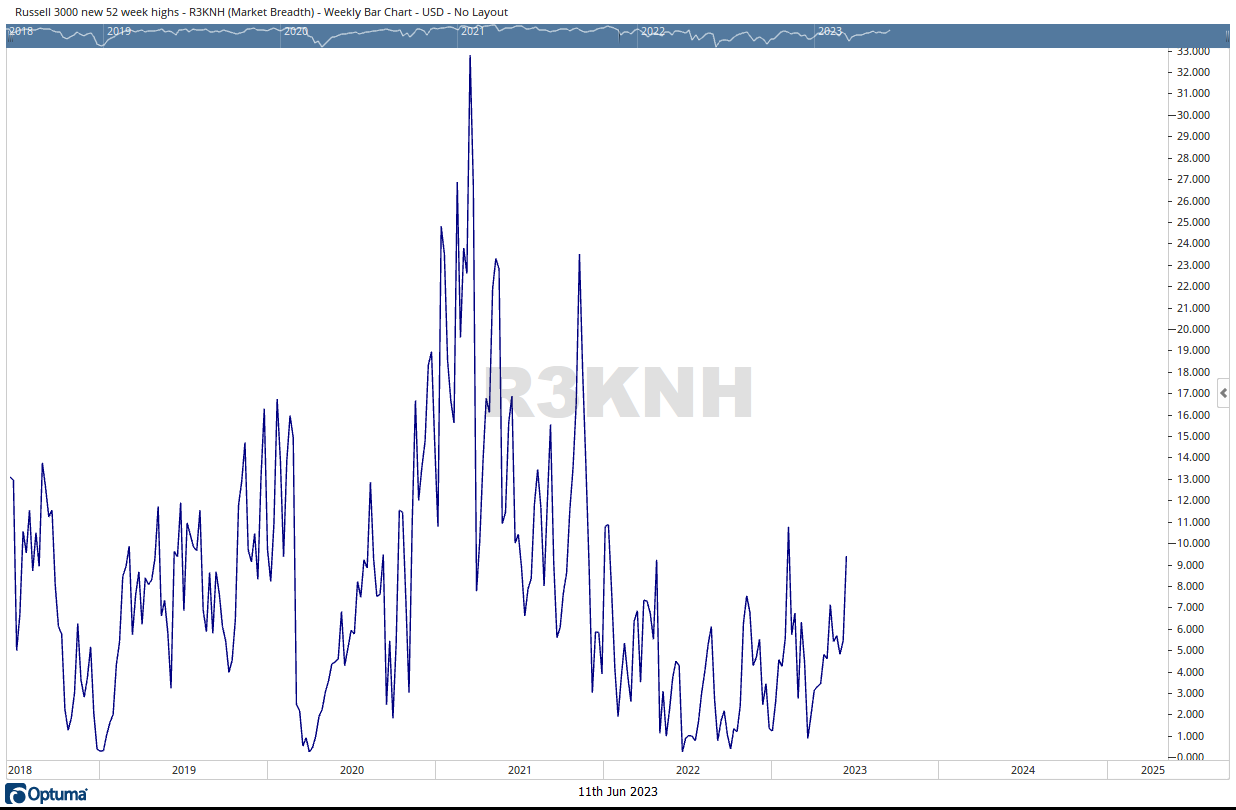

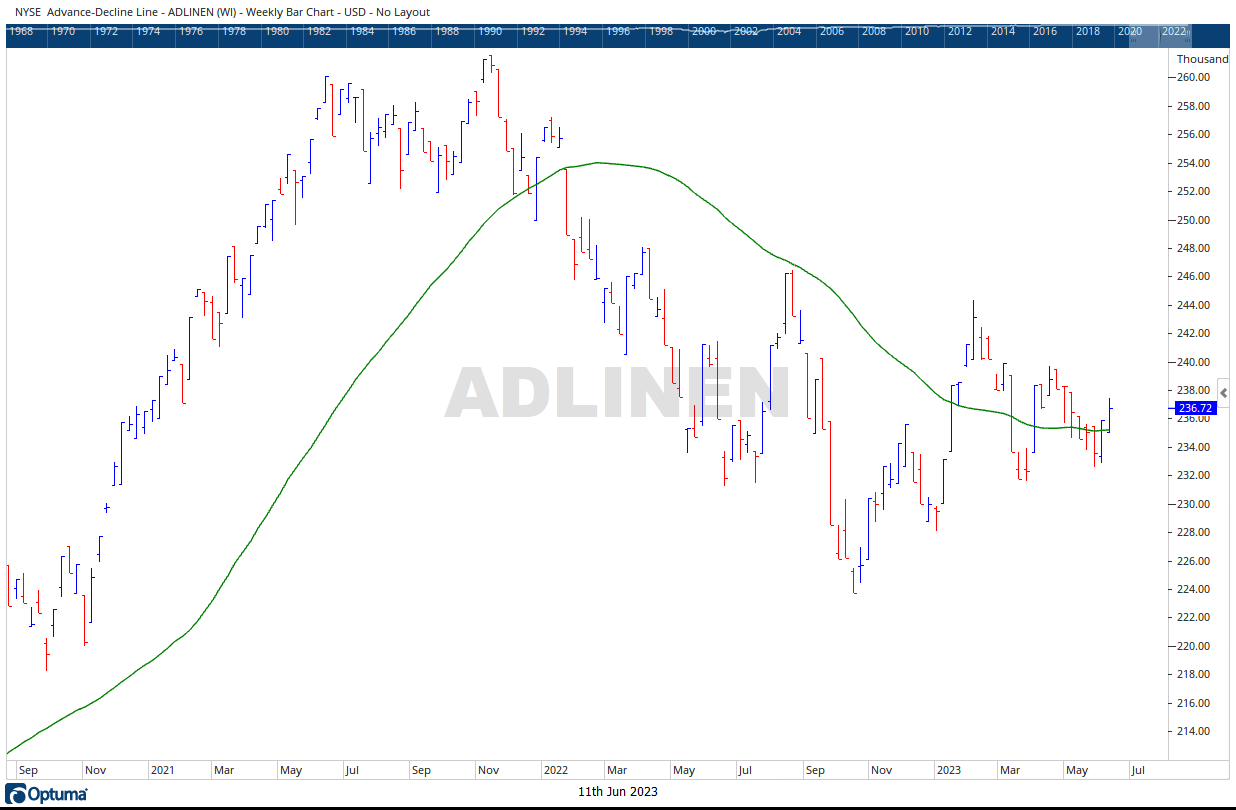

The internals also showed improvement with the Advance-Decline Line continuing higher and the number of stocks making new highs also improving. Both Capital Weighted Volume and Capital Weighted Dollar Volume continue to advance higher. Capital Weighted Dollar Volume is now approaching new all-time highs. Meanwhile, Capital Weighted Volume is nearing 365 resistance, its former breakdown level. Perhaps a short-term pause may be in order as S&P 500 resistance is near at 4325 (August highs) as is the aforementioned Capital Weighted Volume also nearing its resistance. Should the Bulls break through and close above 4325, the next S&P 500 resistance resides @ 4400 (January 2022 lows). S&P 500 support is at 4200 (former long-standing resistance).

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 6/12/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.