Volume Analysis | Flash Market Update - 3.27.23

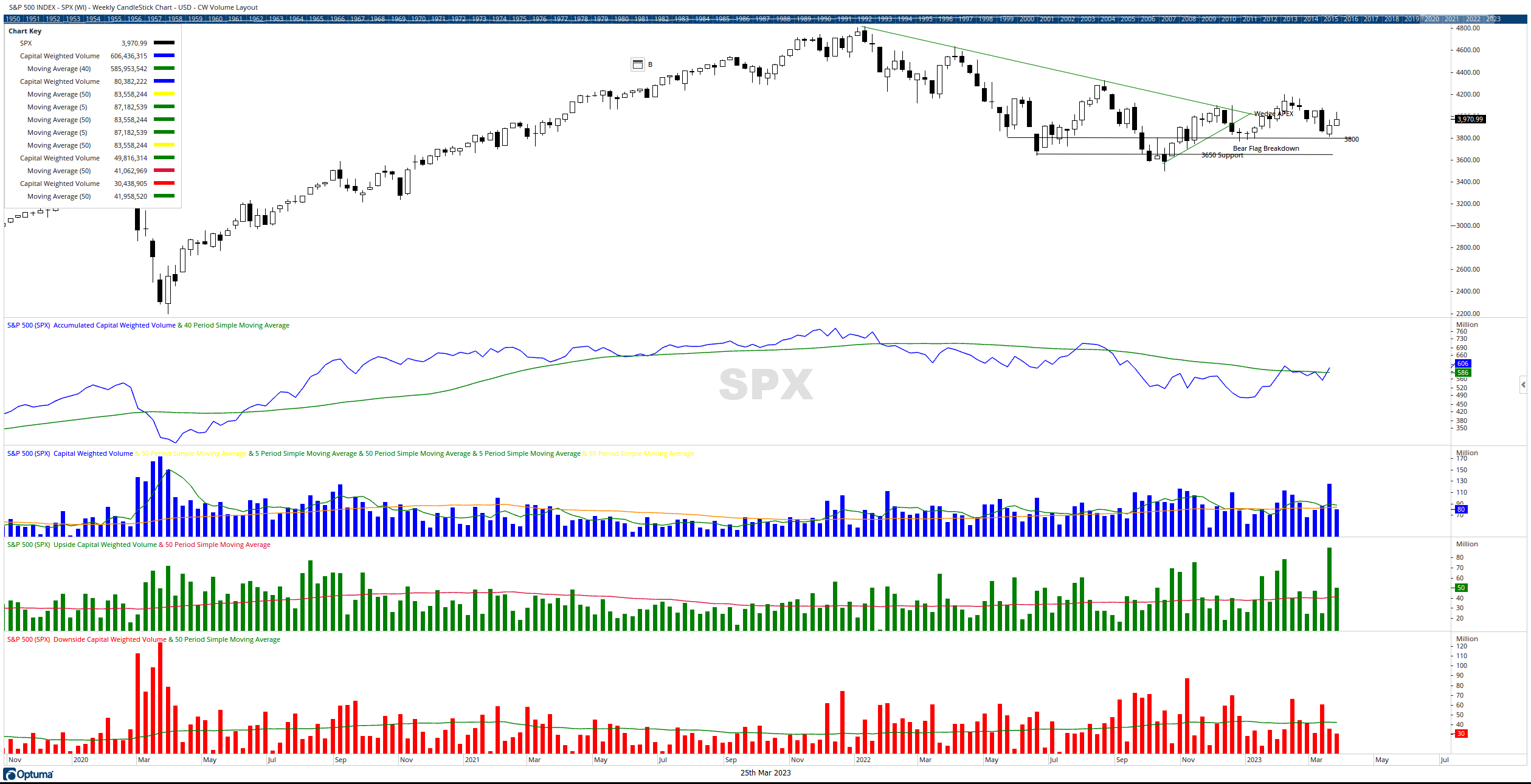

The battle for 4000 is on. The bulls, led by the generals, are gaining steam. Last week’s edition of Volume Analysis weekly stated, “Overall, capital is moving back into the market. However, the inflows are concentrated amongst the large caps and specific sectors, not the broad market. The return of capital to the growth sectors could indicate the market is expecting a return to easy monetary policy whereas the flight of capital and liquidity from the small and mid-sized and value stocks could suggest investors have concerns about the state of the underlying economy. The generals are leading a strong charge.”

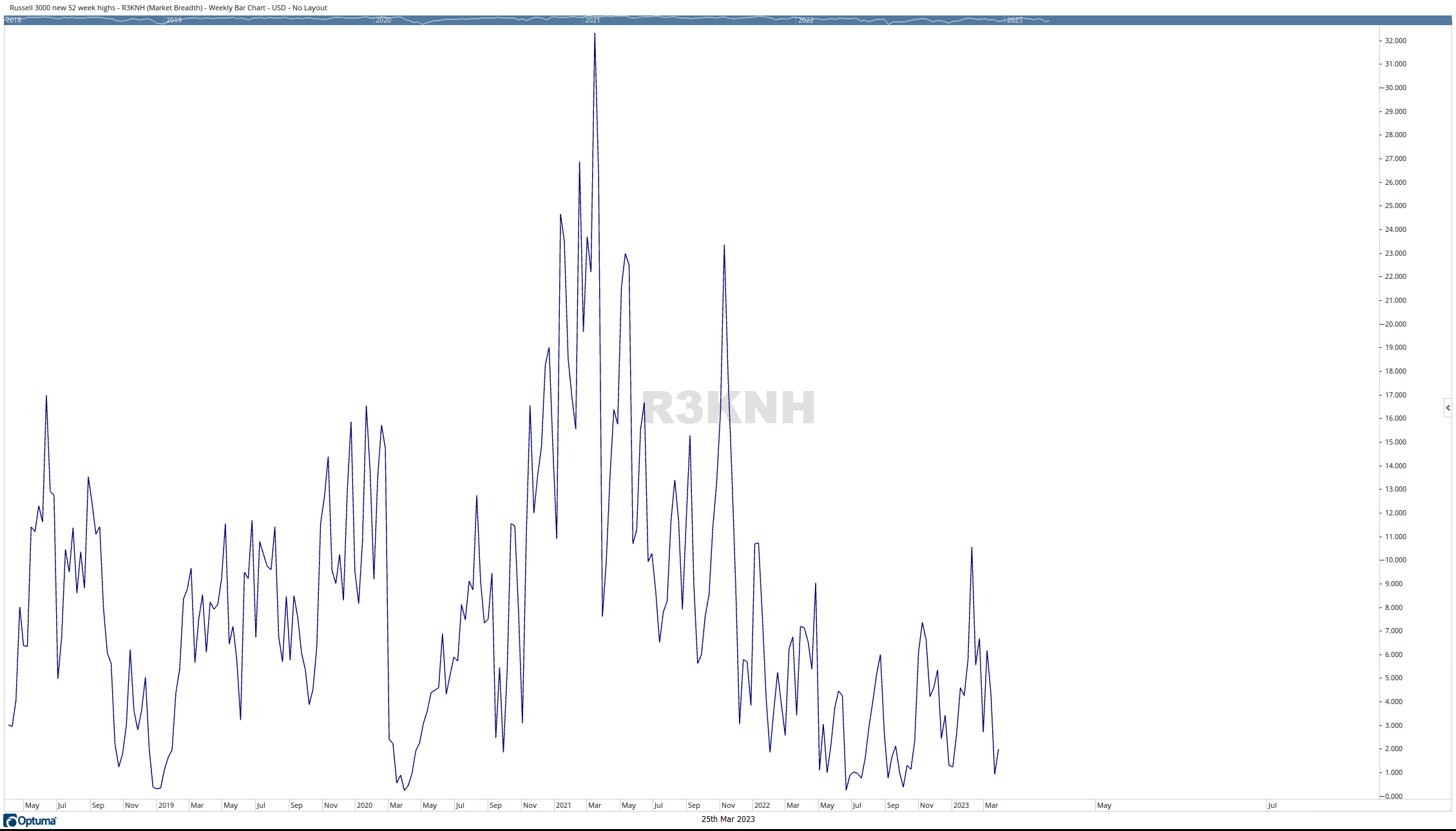

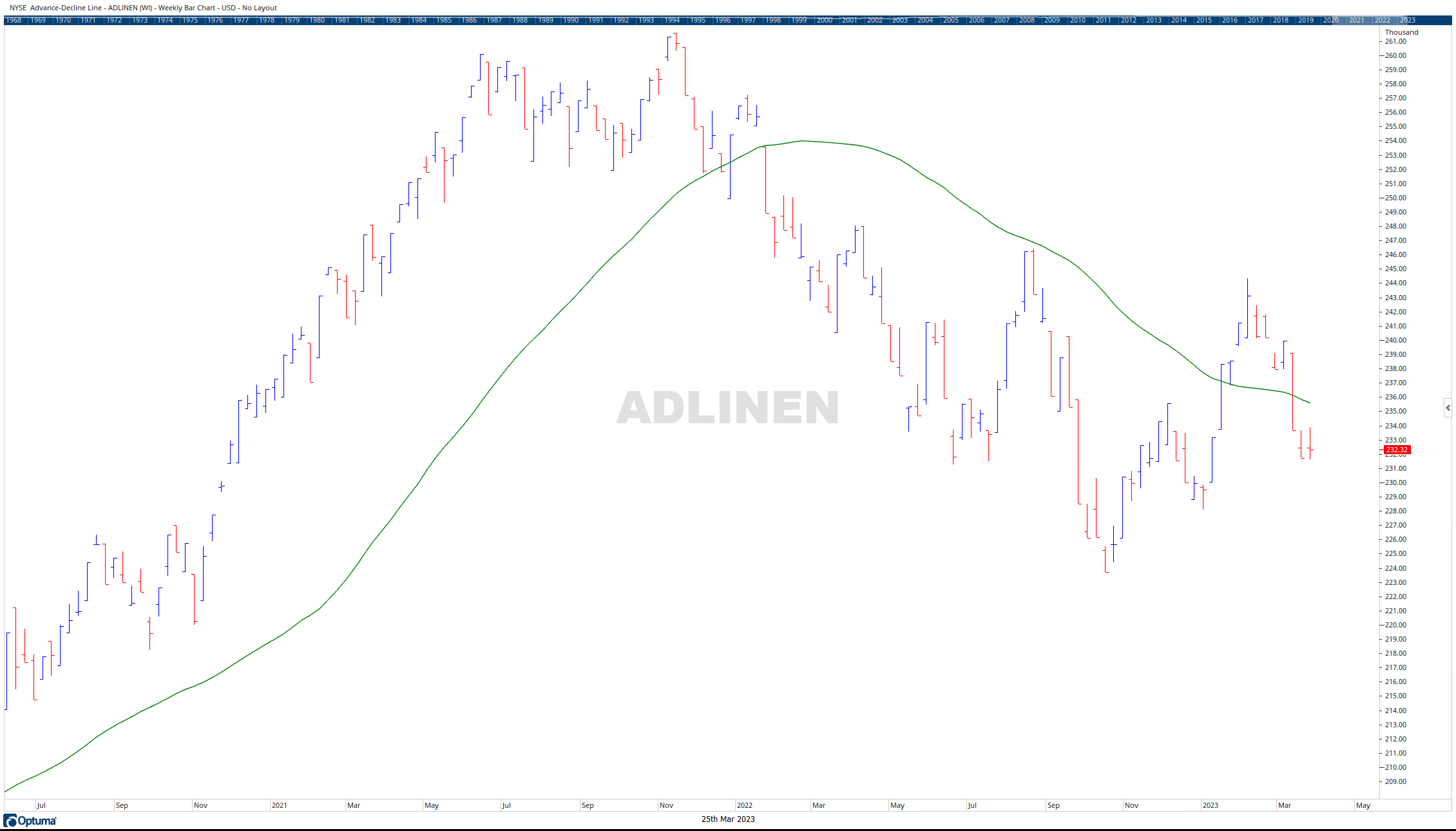

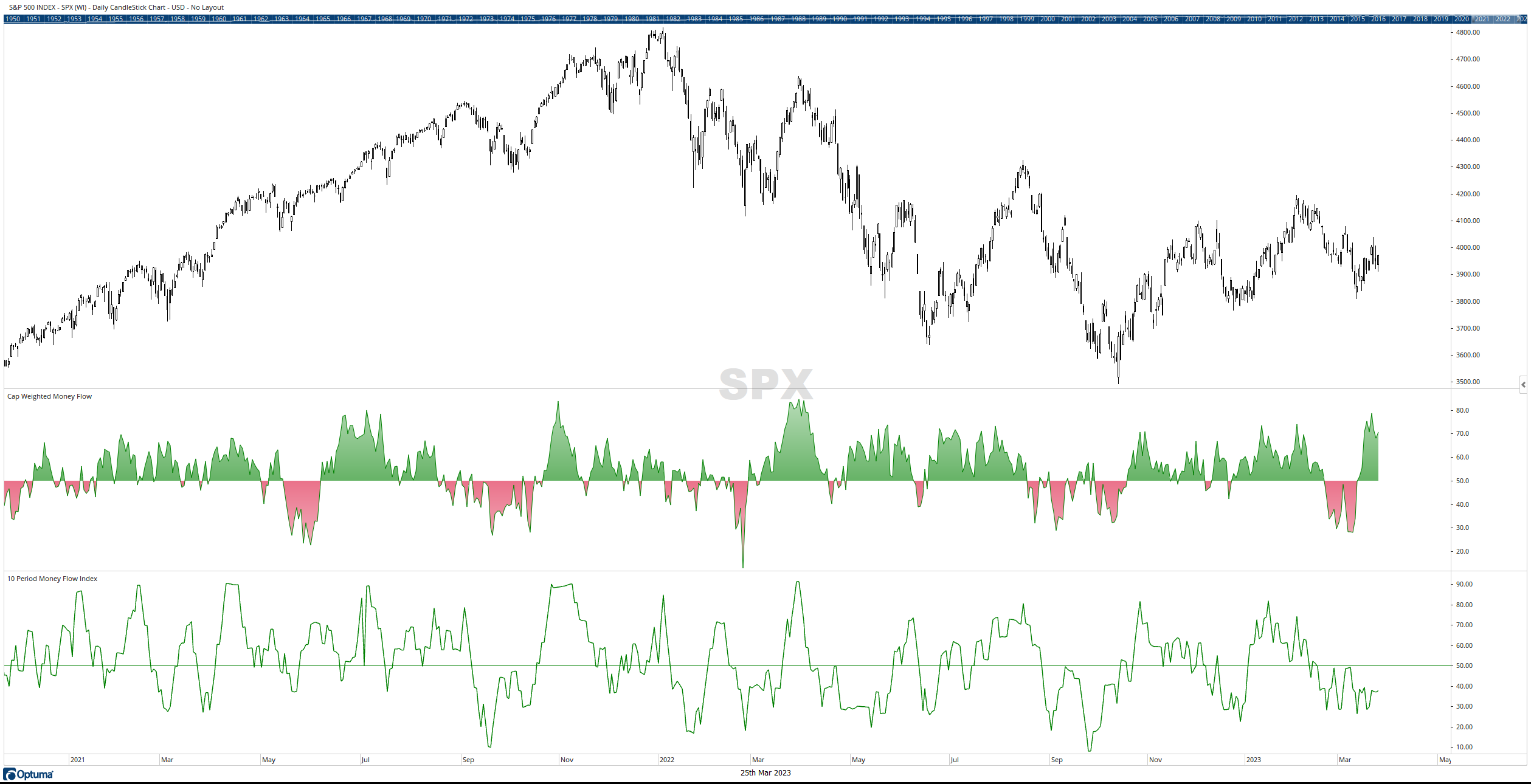

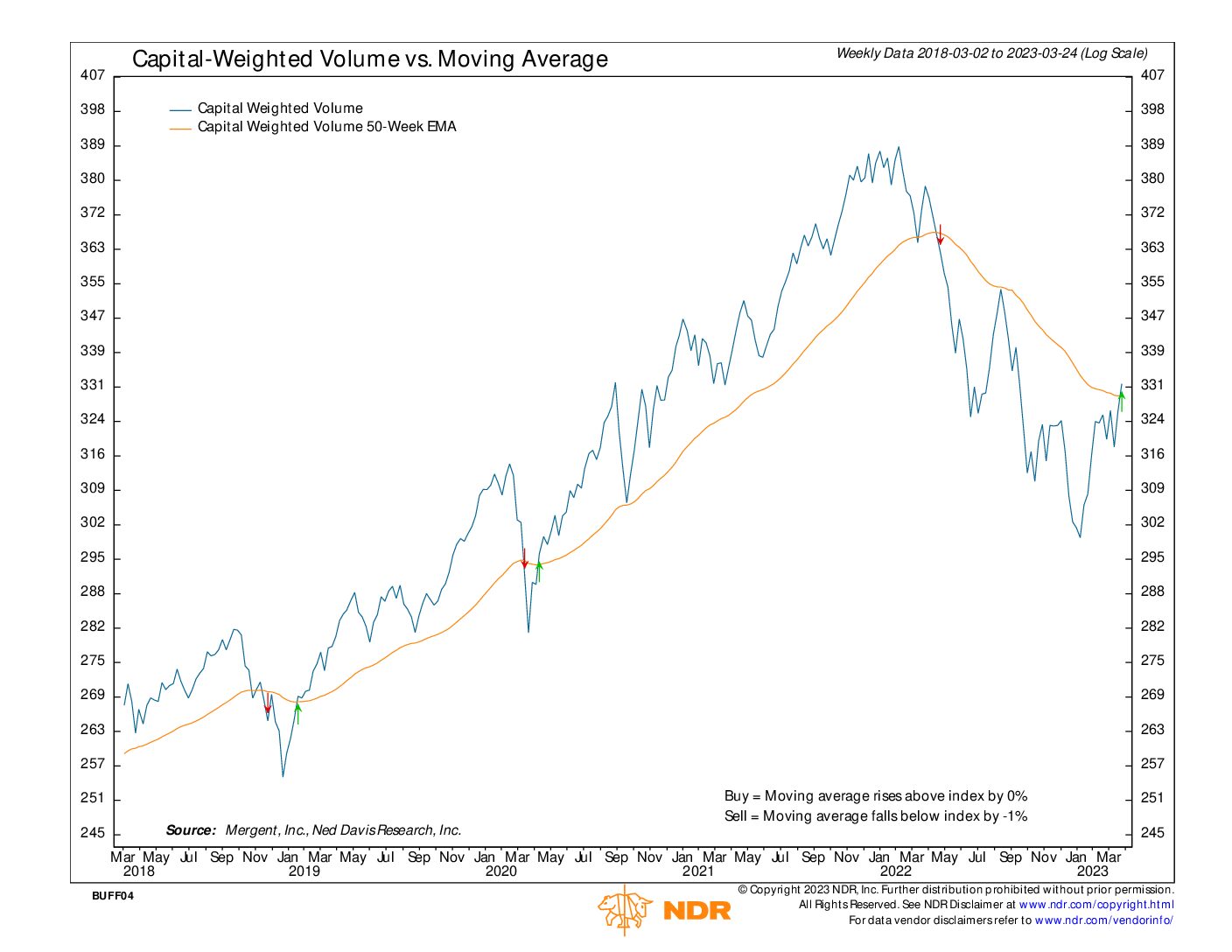

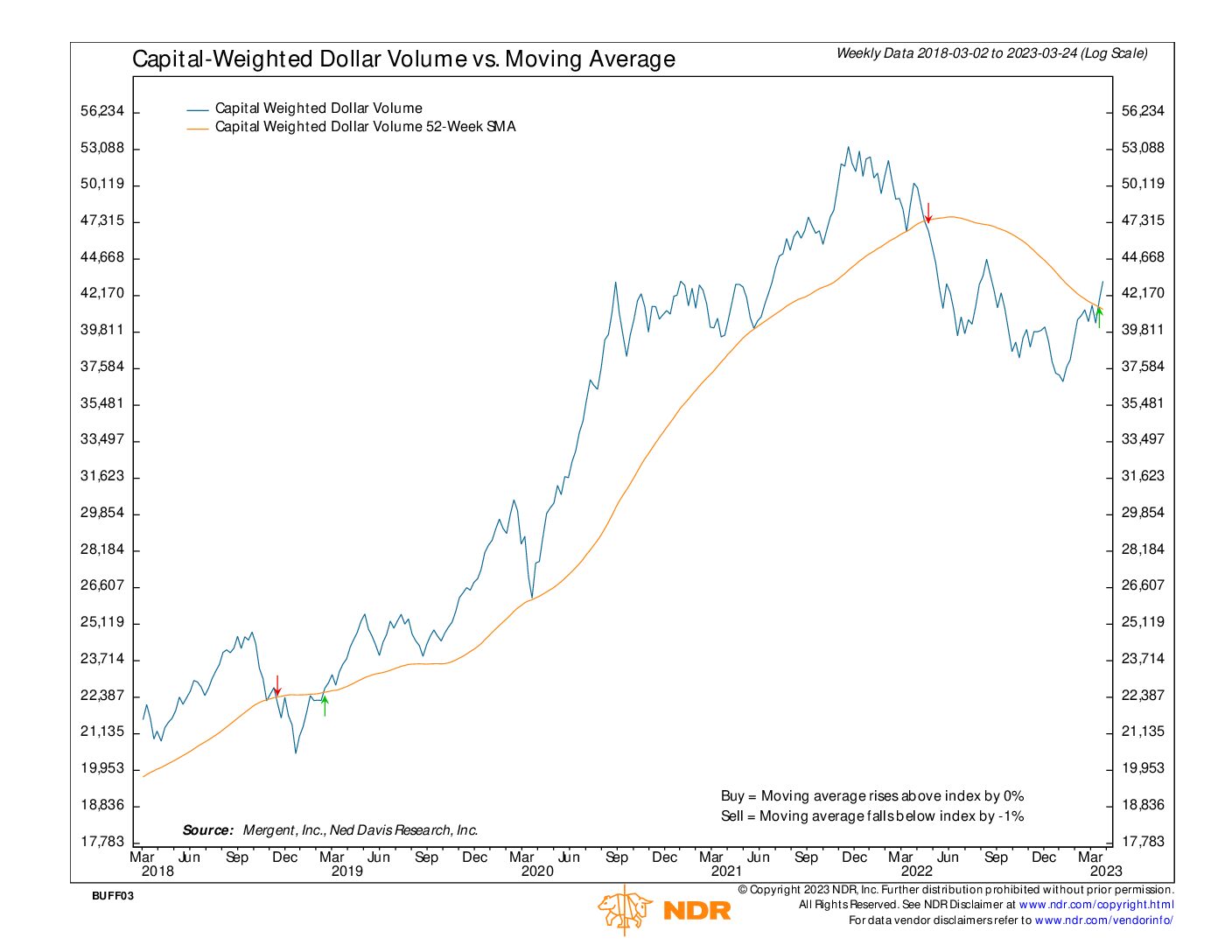

This week the general’s charge continued. All the major indexes, the S&P 500, Nasdaq 100, and the Dow, were all up with even the Russell 2000 managing to squeak out a small gain. Capital-weighted inflows surpassed outflows with $30.5 billion out to $50 Billion flowing in. By far the biggest development was Capital-weighted volume breaking above its trend. Last week we noted that Capital-weighted dollar volume (capital flows), on the heels of a near-record $90 billion of inflows, broke above its trend constituting a capital flows bull market. Capital-Weighted Money Flow (CW-MFI) is also surging indicating momentum is building. Evidence of bifurcation is moderating with the Advance-Decline Line closing approximately where it left off last week and the number of stocks making new highs slightly up. With both capital flows and Capital-weighted volume now above trend, a volume analysis bull market may be on again.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 3/27/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.