Volume Analysis | Flash Market Update - 11.14.22

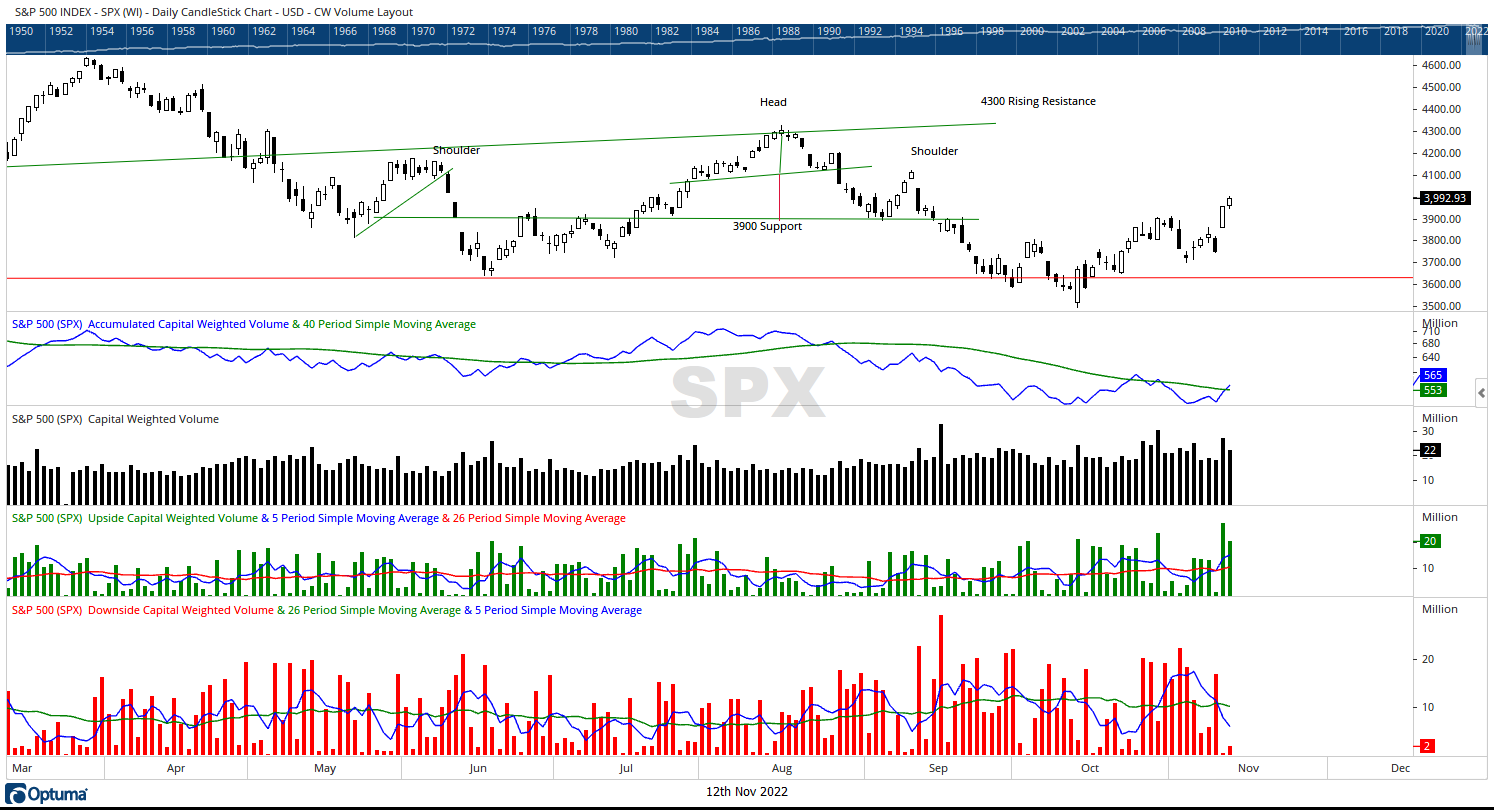

In the October 17th Volume Analysis Flash Update we stated, “The bears were about to put the game away for good, when suddenly the unexpected happened. The bulls intercepted the ball in the endzone reversing the field by taking the ball all the way back to the bears 3669 yard line. The next play, Friday, the bears pushed the bulls back to the 3583 yard line. Although the bears are still winning the game this year, often one dramatic play can change the momentum of the game and the eventual outcome. Could Thursday be that play? For the bulls to neutralize the bears momentum they need to push the bears back to their own 3725. The bulls would then need to advance the ball past SPX 3900 to breakout of bearish territory. A move to 4200 would give the bulls not only control of the ball but momentum to test further levels.”

This past week the bulls flipped the field on a short-term basis, breaking through the aforementioned 3900 resistance. This was on the back of another stellar game changing day by the bulls. On Thursday, November 10th, the S&P 500 rose over 5% in one day on the news that CPI was lower than expected. Such a one-day move is surely impressive, but what is even more impressive was the capital weighted volume. Thursday, November 10th marked the biggest spread between bulls and bears that I can recall. The S&P 500 had $27 Billion in inflows versus only $138 million in net outflows. One of the signs I look for in detecting a market bottom is a 90% upside day. A 90% upside day is where over 90% of the volume is inflows. Historically, 90% moves have led to a continuation of the rally. Thursday’s rally was a 99% day!

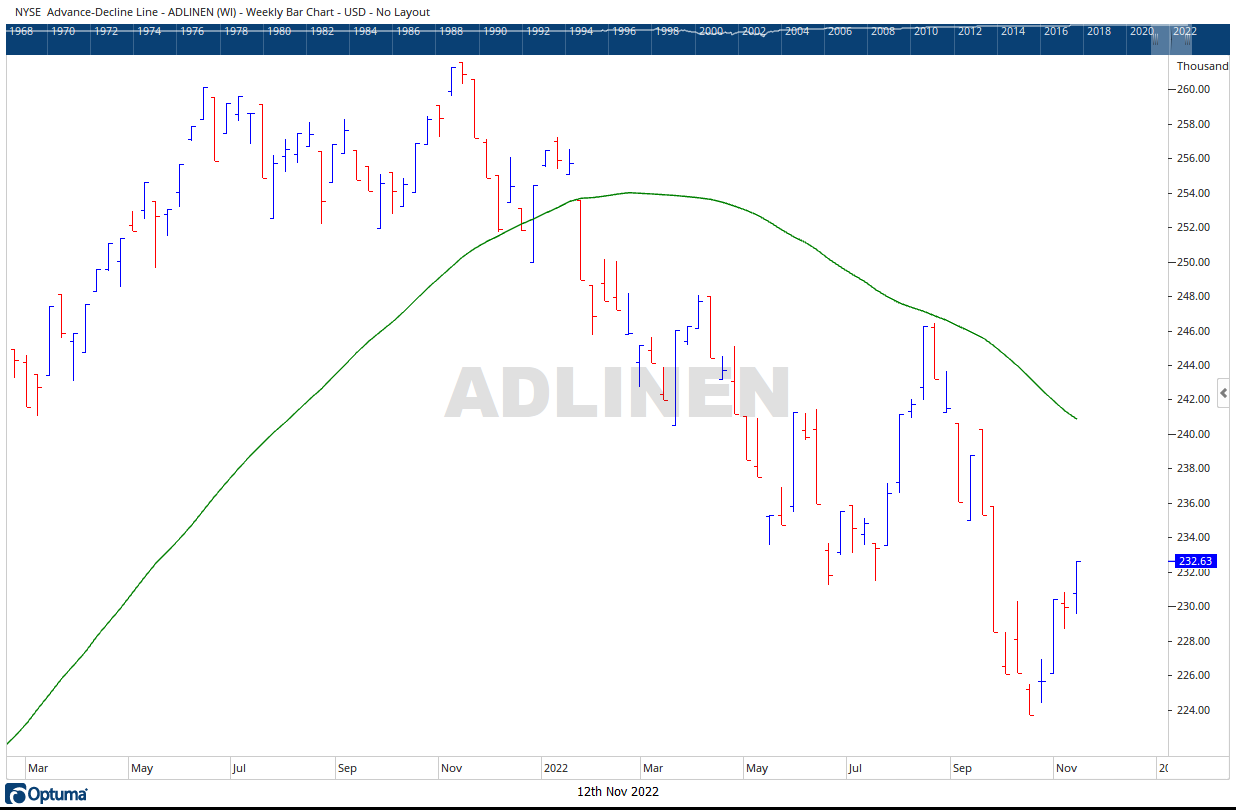

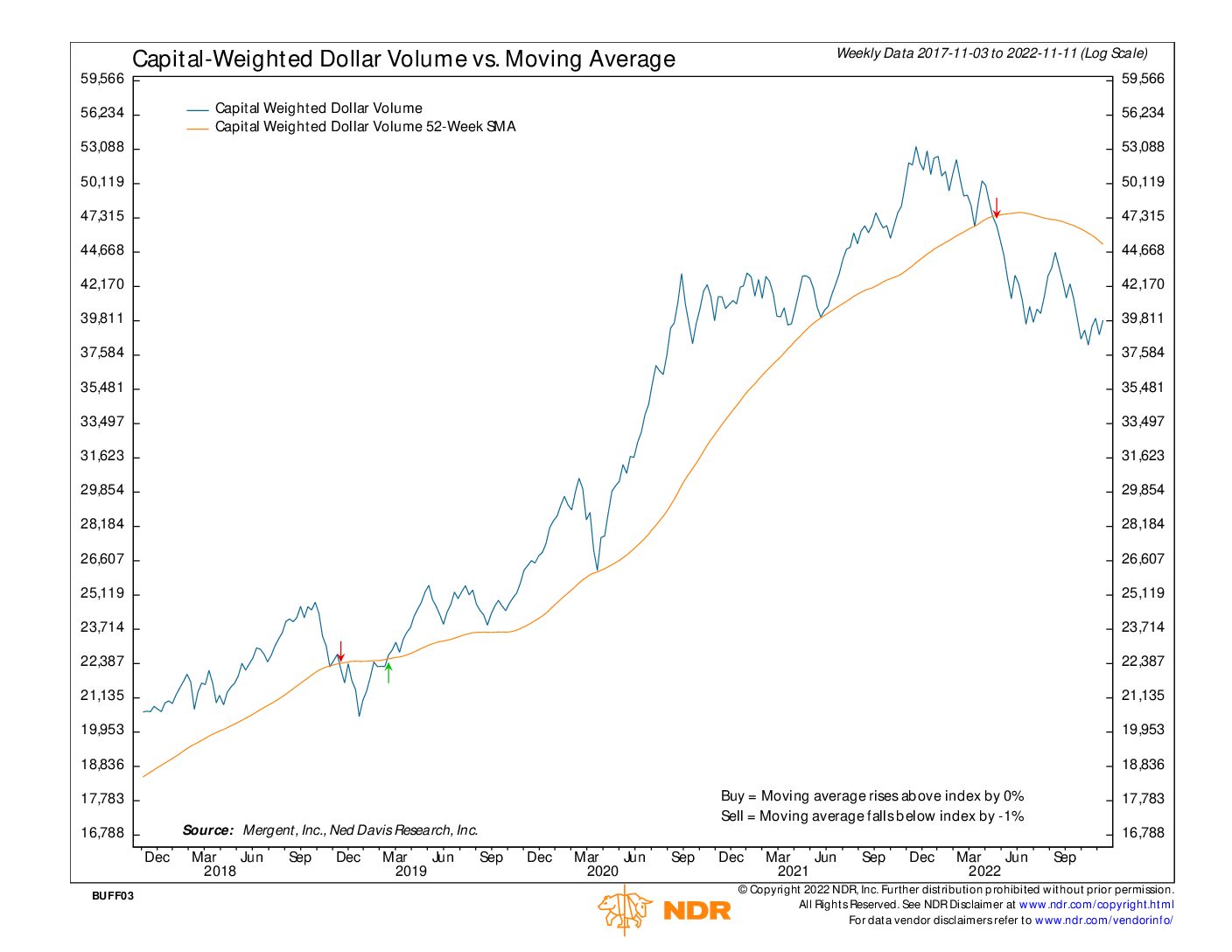

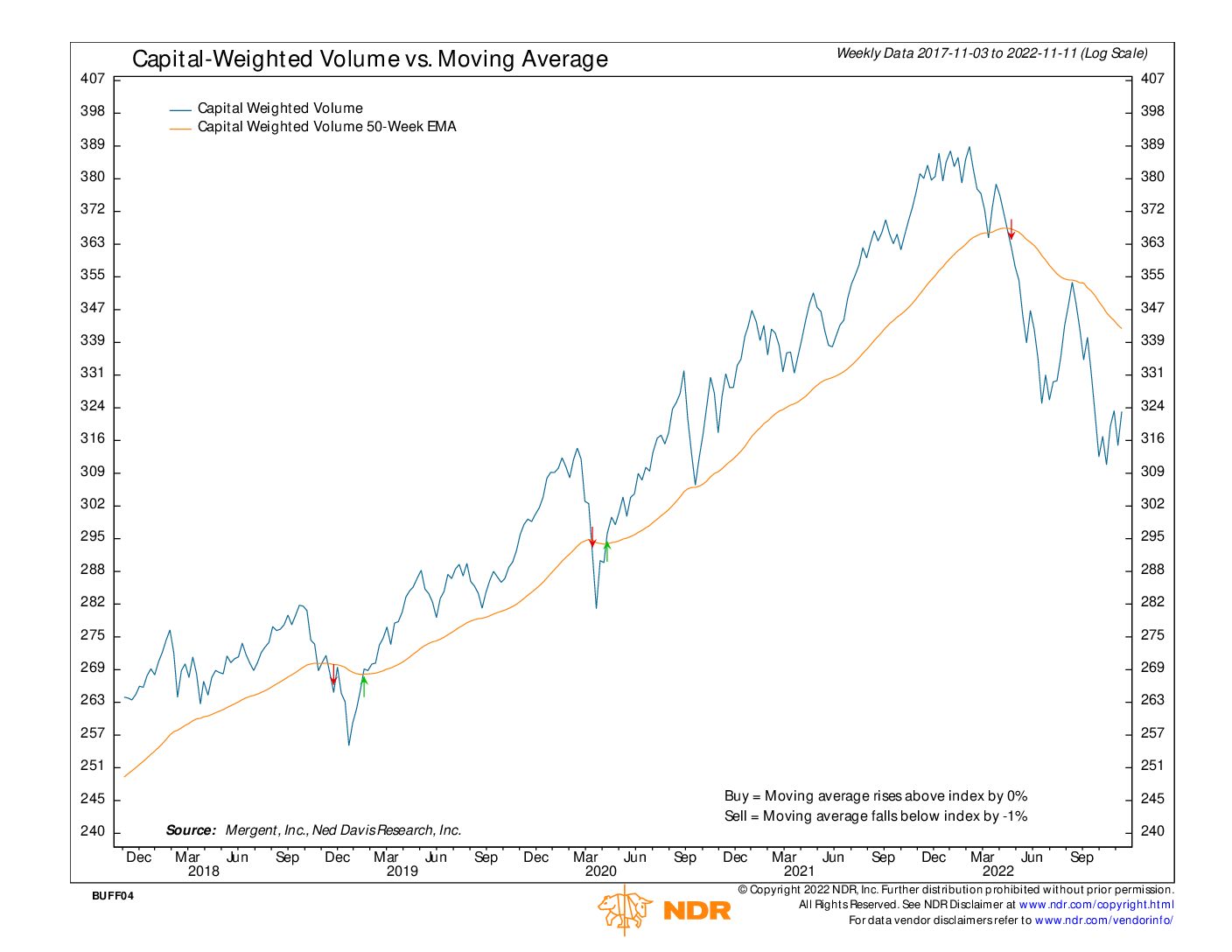

Despite Thursday’s incredible move breaking 3900 resistance, neither capital weighted volume nor capital weighted have broken above corresponding resistance. Capital weighted volume needs to break above 324 and Capital Weighted Dollar Volume needs to break through 40,000 to clear resistance. The Advance – Decline is performing much better than volume the last few weeks but is still lagging on the intermediate term.

Overall, on a short-term basis, the bulls are firmly in control. The unofficial VPCI V Bottom on September 30th, the game changing play on the 17th of October, the 5% rally on 99% Upside Capital Weighted Volume, seasonality and the presidential cycle lead me to believe there may be more upside to this market short-term. Yet, on an intermediate and long-term basis, this market has yet to break the down trend. Moreover, our leading indicators are still lagging price. Overall, my conclusion is that this is a speculators market where traders are trying to catch the bottom. Traders are postulating that this past CPI print is the catalyst for a Fed pause which will mark the bottom of the cycle. However, the smart money is not yet convinced enough to buy in but is also not selling into the strength…. at least not yet. With the bulls taking control of the short-term trend, I am look at a new trading range of 3900 on the downside to 4100/4200 on the upside.

Grace and peace to you my friends,

Buff Dormeier

Updated: 11/14/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.