Volume Analysis | Flash Market Update - 11.7.22

We noted in last week’s commentary that the bulls had driven the market up, closing at the midfield resistance line. Should the bulls convincingly break through this important 3900 resistance, the direction of the intermediate trend would shift to their favor. However, this past week the bears regained their footing, again gaining control of the intermediate trend. Short term, the market is now in another trading range between 3700 and 3900. Having seasonality and the presidential cycle as tailwinds, should the bull’s breakthrough 3900, the intermediate trend would shift to bullish control. Whereas the bears are currently on the right side of the long-term and intermediate trend, they need to crack through 3700 to regain control of the short-term trend.

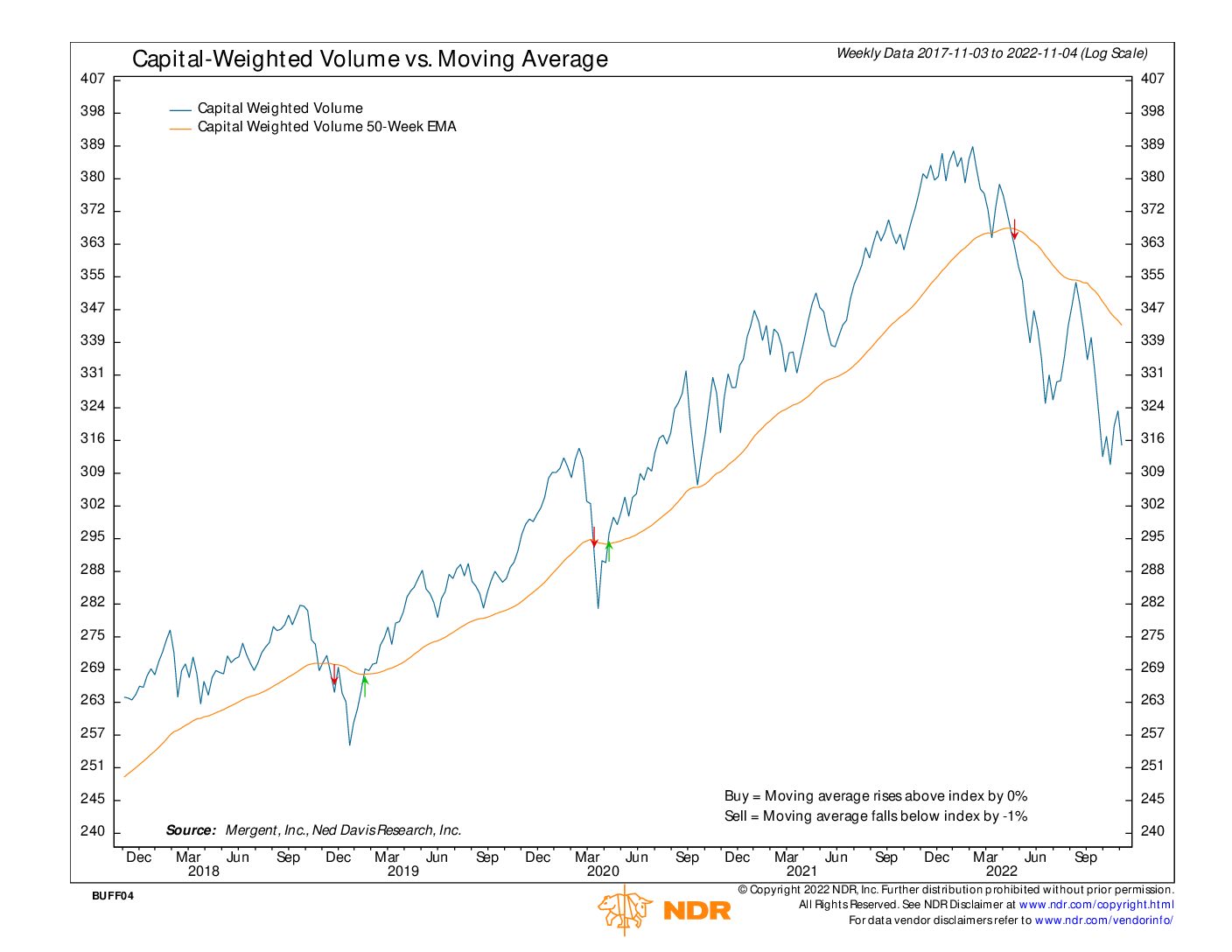

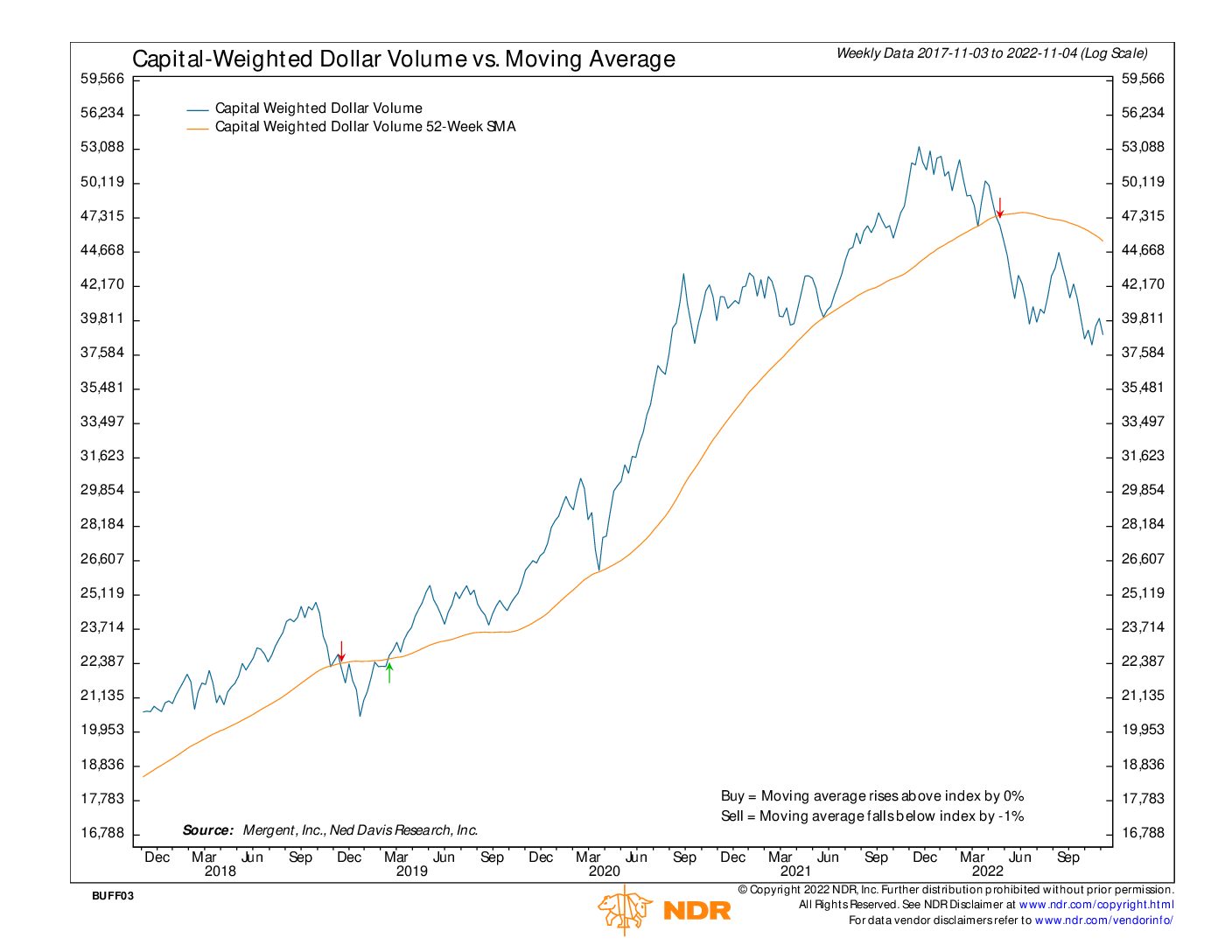

Shifting to our leading indicators, last week witnessed strong outflows of capital from the S&P 500. $87 Billion fled the market last week compared to just $24 Billion in capital inflows. Capital Weighted Dollar Volume bounced off 39,811 resistance and is not far from breaching yearly lows. Similarly, Capital Weighted Volume, ricocheted off 324 resistance and now must hold above 310 to avoid new yearly lows and break major support. Overall, the S&P 500 is in a tighter trading range between 3700 and 3900. The resolution of this range could determine the intermediate and short-term broad market trends. Risk management is often the path less taken but the steady course leading towards successful long-term financial outcomes.

Grace and peace to you my friends,

Buff Dormeier

Updated: 11/7/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.