Volume Analysis | Flash Market Update - 8.8.22

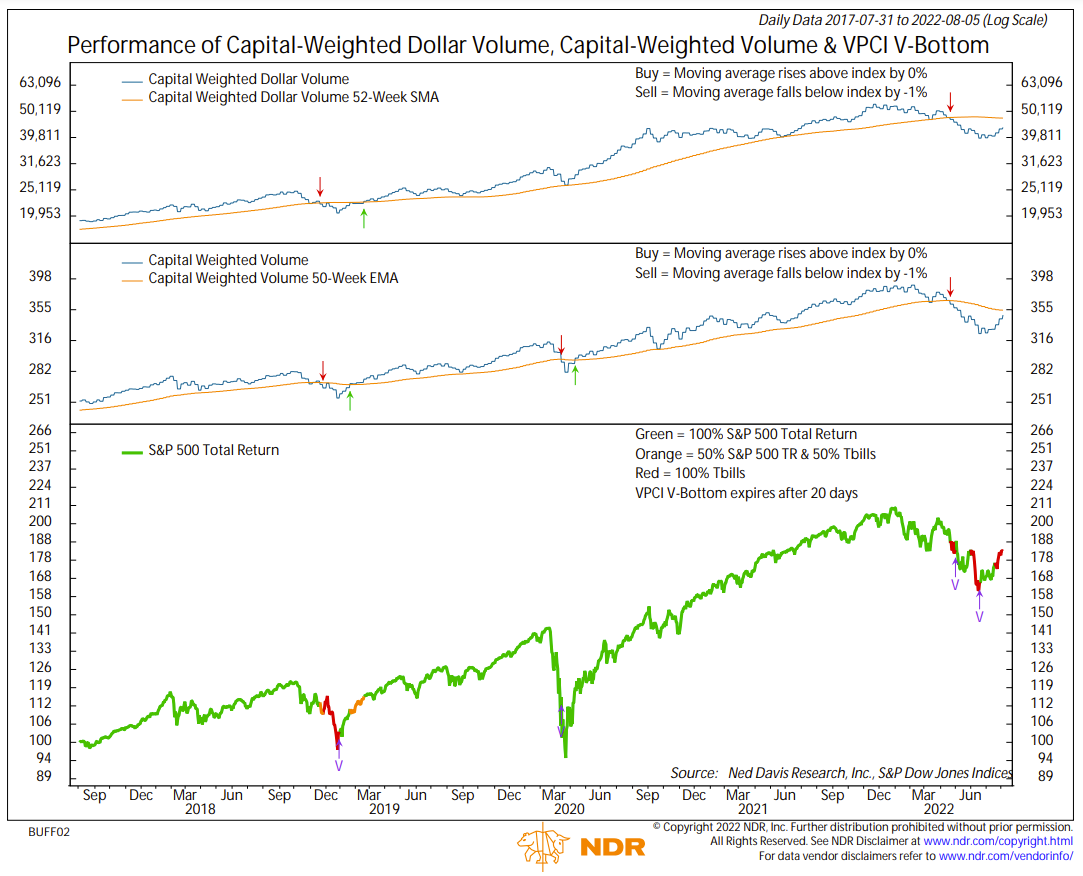

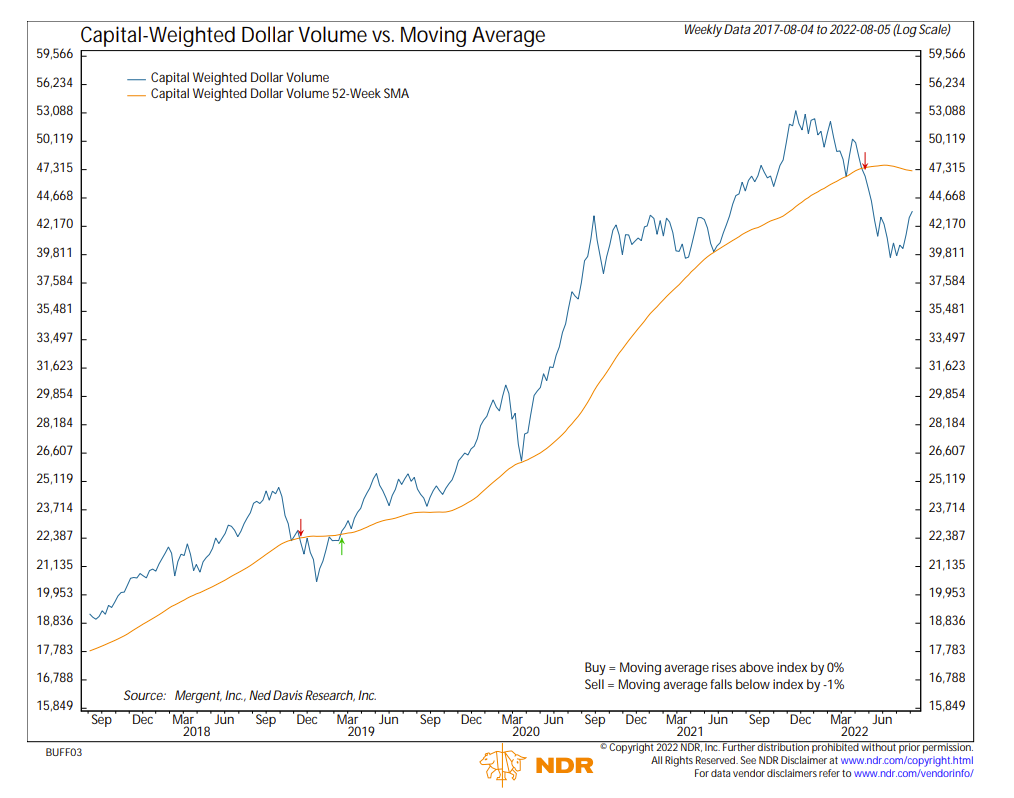

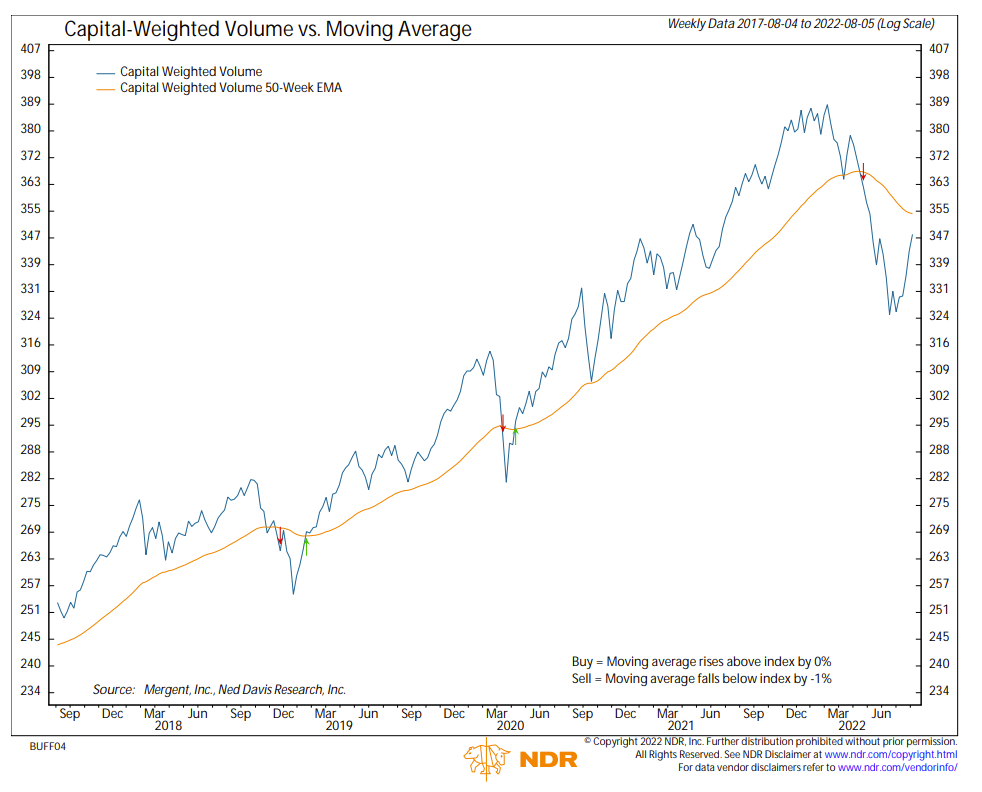

The broad markets have continued to rapidly improve since the VPCI V capitulation bottom June 21st. Capital flows have lagged in the recovery, but the volume has been decent.

Capital Weighted volume is now itching close to becoming an uptrend. However, capital weighed dollar volume (capital flows) continues to lag. Overall, the market is nearing 4200 resistance.

The outcome at this battle line could be an indication of the current health and future direction of the broad markets.

Wishing you my very best my friends.

Updated: 8/8/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.