Volume Analysis | Flash Market Update - 5.16.22

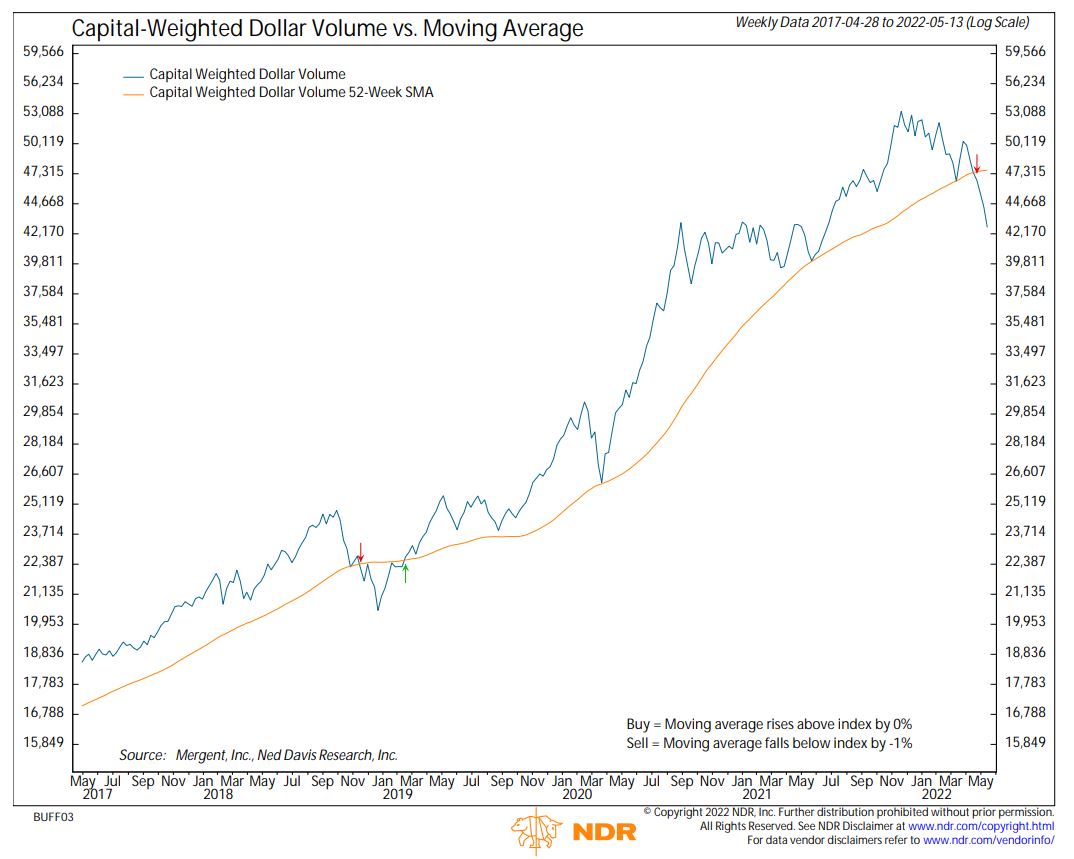

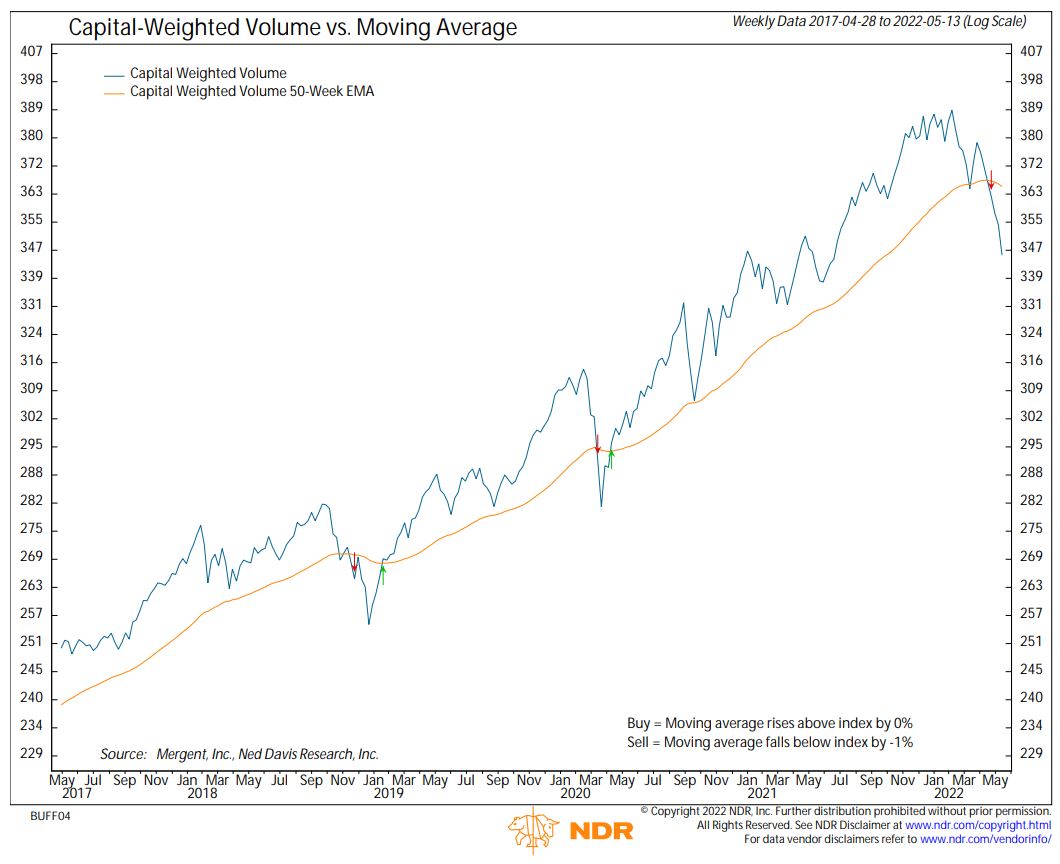

For many months now we have been discussing the gradual deterioration of our leading market indicators. By April warning signs culminated with both the volume and capital flows finally breaking down. These actions place us now squarely in a volume analysis bear market. The question is what kind of bear market? A cyclical bear market lasting months or a secular bear market lasting years? A good case can be made for both for scenarios.

But there is hope at least short term for bulls. Every oversold indicator and capitulation signal we follow is flashing strong indications that the sell-off may be overdone. That includes sentiment indicators such as the VIX is high. Generally that means it could be time to buy. The bears have overtaken the bulls in both individual and institutional sentiment surveys, a rare occurrence known for topping environments. Additionally, the put-call ratio is highly elevated, meaning the speculative market is also upside down. Moreover, the ratio between new highs and new lows is bottoming. And perhaps most importantly, we received a VPCI V bottom signal last week which indicates to us there are ever fewer investors willing to sell at these depressed levels. Given the breadth of topping signs, I believe a relief rally may happen soon. Should that occur, we will watch to see if the leading indicators such as CW Volume and the AD line improve enough to break the back of the bear market.

Updated: 5/16/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.