Volume Analysis | Flash Market Update - 5.9.22

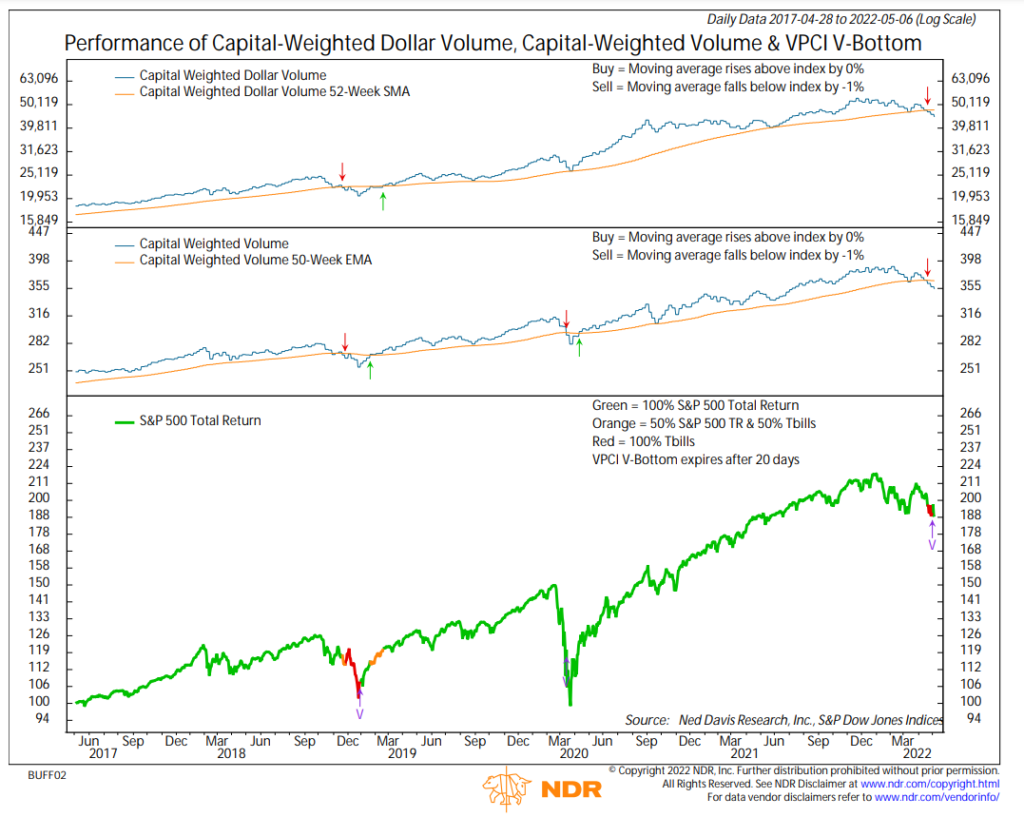

The goal of the volume analysis risk management strategy is to run with the bulls and hide from the bear. Recently, both capital weighted volume and dollar volume fell more than 1% below trend. Meanwhile, the advance-decline line has been trending down for months now. From a volume analysis perspective, the market remains in a bear market, time to hide posture. When positioned defensively, the difficulty is identifying the reentry point where opportunity once again exceeds reward.

In our efforts to identify such transitions, we once again turn to our leading market indicators to identify such opportunities. Markets run on primarily two emotions, fear and greed. Fear drives bear markets. Fear can be easily identifiable through violent market drops on high volume/ heavy participation. Sometime during these violent sell offs, participation begins to wane. In other words, in this phase of falling prices, fewer of the remaining investors are compelled to sell at heavily depressed price levels. When this relatively lighter volume occurs, this may be a sign of a market transitioning from fear to a market driven by apathy. Apathic markets are not driven by greed to buy while prices are lower but rather an unwillingness of new or remaining owners to sell.

Often, bull markets are born on apathy. We attempt to identify these apathic conditions through a proprietary tool known as the VPCI (volume price confirmation indicator) V Bottom. This capitulation indication is designed to identify deeply oversold markets where we believe investors have become overly pessimistic. Last week, we received this indication. The signal is only temporary, and if our leading market internals do not significantly improve over the weeks and months to come, we may revert to our defensive disposition.

Updated: 5/9/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.