Volume Analysis | Flash Market Update - 5.2.22

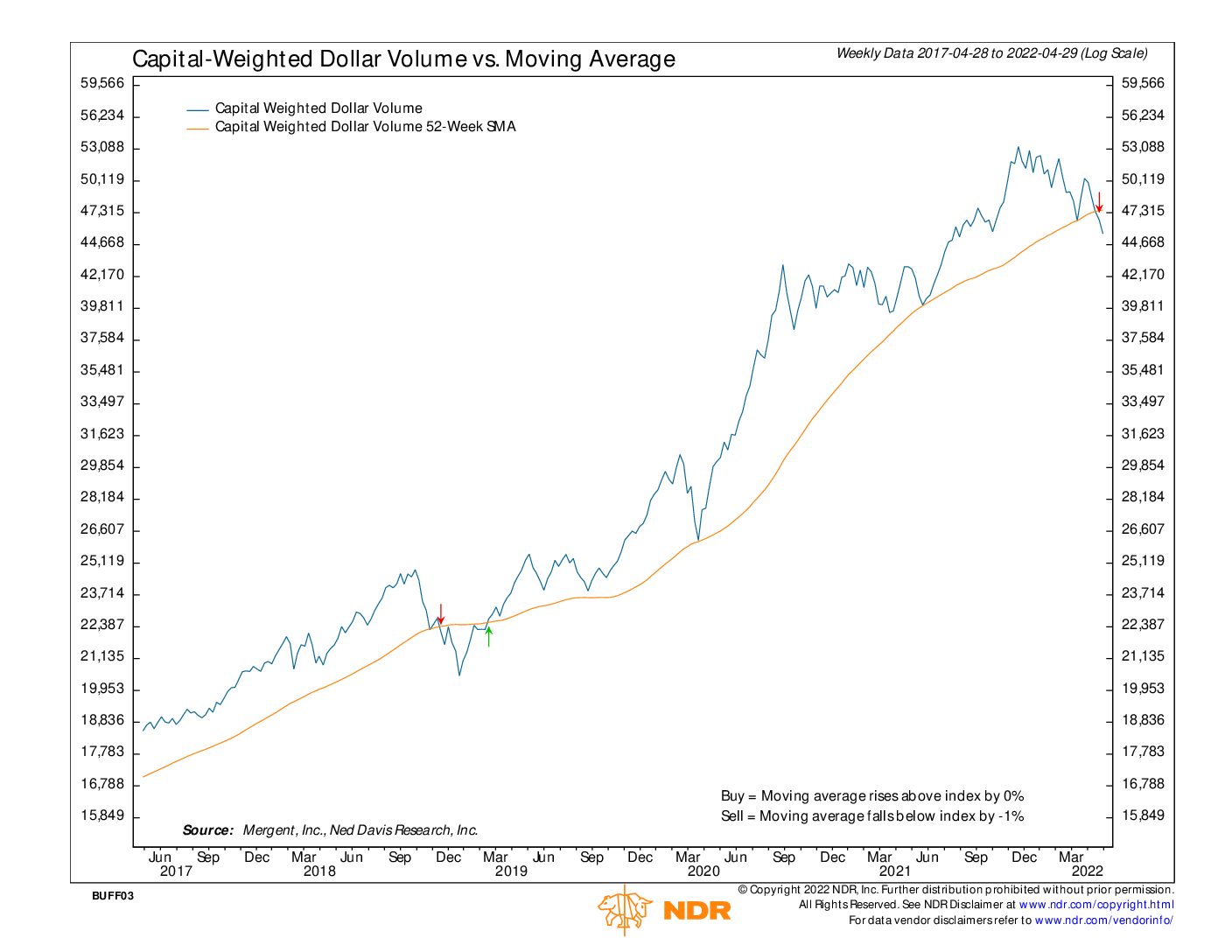

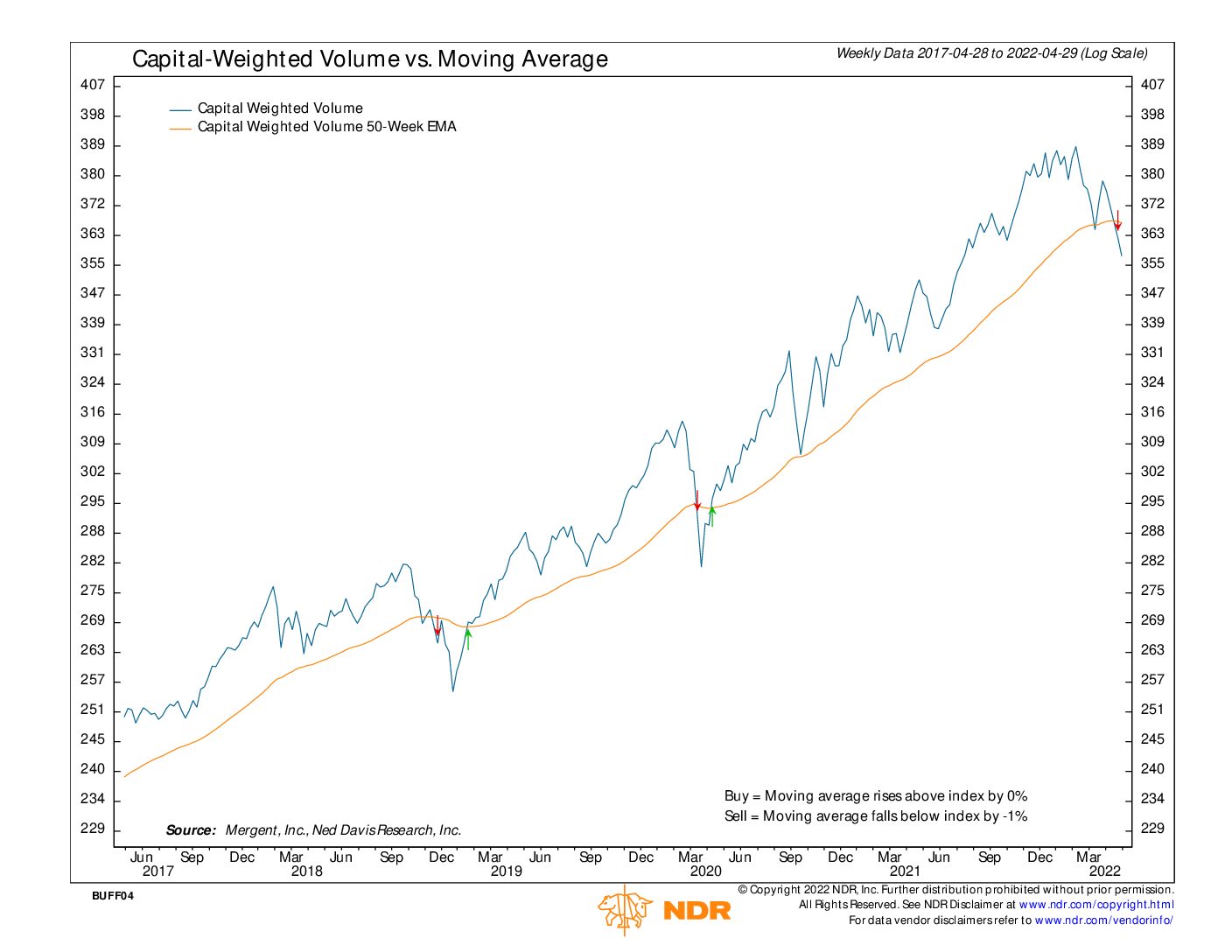

In the pursuit of successful investment outcomes, risk management is often the path less taken. Yet, it is our belief is that great offenses are inspired by strong defensive play. For these reasons, the goal of the volume analysis risk overlay is to run with the bulls and hide from the bear. Presently, both capital weighted volume and dollar volume remain more than 1% below trend. Meanwhile, the advance-decline line also continues to fall. From a volume analysis perspective, the market remains in a bear market. Given these current risk/reward market conditions, we believe temporarily adjusting growth objectives to that of capital preservation may be appropriate.

Updated: 5/2/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.