Portfolio Manager Insights | Weekly Investor Commentary - 4.20.22

To download the commentary – click here.

For investors, the temptation to focus on short-term trading at the expense of long-term investing is a powerful one. For those investing for retirement and other important goals, this can be especially challenging during periods of market unease. Similarly, for those focused on cryptocurrencies, NFTs, and other new assets, rising prices over the past two years has created a fear of missing out. This is made worse by the proliferation of social media posts touting how easy it is to turn a thousand dollars into a million, among other claims. In this environment, how can all types of investors focus on time-tested investment principles to achieve long-term financial goals?

One of the most important principles of investing is to take advantage of the power of compounding. Albert Einstein is often quoted as saying that compound interest is the eighth wonder of the world. The idea is simple: as your portfolio generates returns, those returns create additional gains, and so on. This eventually leads to not just linear returns but exponential growth. This phenomenon is what creates real wealth for investors so, in a sense, there is some truth to the social media posts.

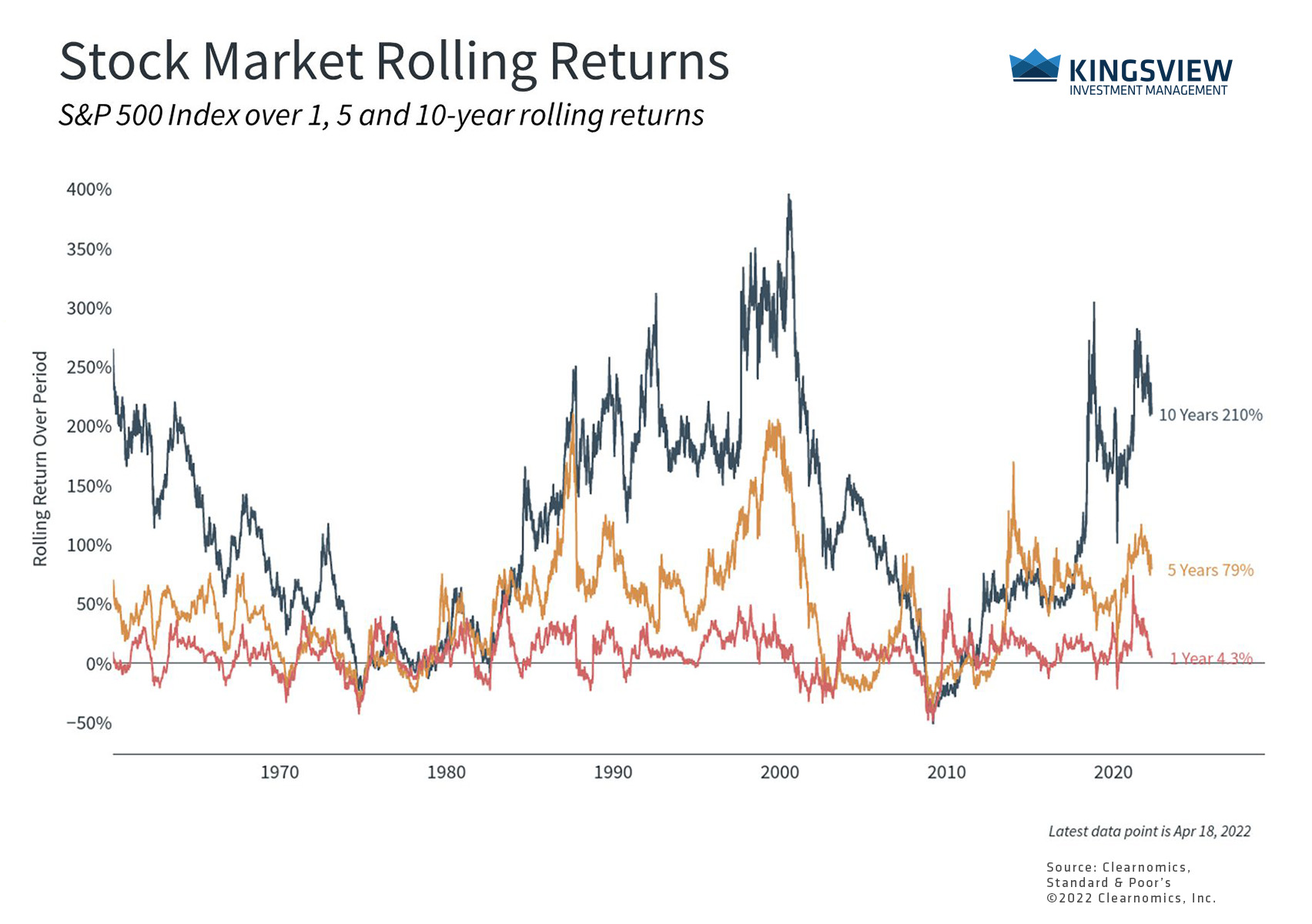

What they neglect to mention is that the key ingredient is time. Financial markets are inherently volatile over days and weeks. On a daily basis, the stock market is almost no better than a coin flip, rising only slightly more than 50% of the time, and down days tend to be much worse than up days. This can be frustrating to investors who expect the stock market to consistently rise and achieve its 30-year average total return of 11.5% in any given year.

Compound interest works over long periods of time

Key Takeaways:

- Compound interest is what creates true wealth for investors over long periods of time. Not only do investment returns add to a portfolio, but those returns generate their own returns, and so on and so forth.

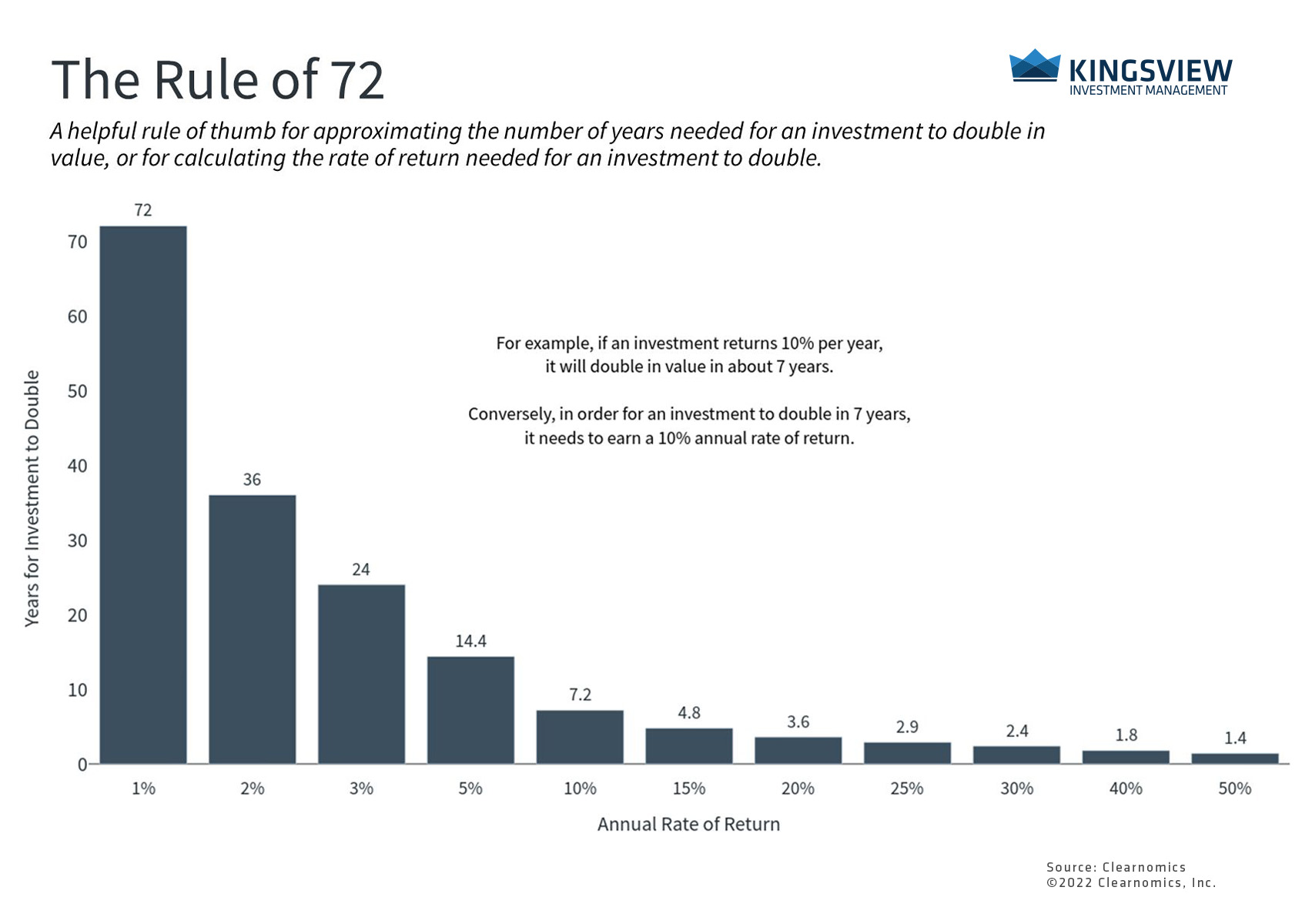

- The rule of 72 is a simple way to understand this compounding effect. It is a rule of thumb that estimates how quickly a rate of return would lead to a doubling of a portfolio, or similarly, what return is needed to double a portfolio in a certain amount of time.

However, even a coin flip that is very slightly in an investor’s favor, when compounded over longer time frames, can generate surprisingly positive results. On a monthly basis, the stock market has risen more than 60% of the time going back three decades. On an annual basis, this percentage jumps to 70%. This does not mean that stretches of poor performance do not occur, but simply that staying invested is often the best approach. Historically, there have been very few instances when investing in the stock market for 10-year periods has resulted in negative performance, and zero instances for 20-year timeframes since the Great Depression. While the past is no guarantee of the future, this underscores the importance of patience when investing toward financial goals.

These investment principles are at odds with how many investors view stock markets, meme stocks, and newer asset classes today. Investing as a way to generate an easy buck, especially via get-rich-quick schemes or hot stock tips, is as old as money itself. It’s for this reason that Benjamin Graham, one of the fathers of value investing, distinguished between investing and speculating. The goal of speculation is to generate short-term gains, often based on limited “research.” Unfortunately, stories of sudden and immediate wealth are what naturally attract attention and interest. This is not to say that speculation has no role in portfolios, but that it should be done in a disciplined way with a long-term investment plan, if it’s done at all.

Stocks perform better over longer time frames

Key Takeaway:

- The stock market can swing wildly over very short time frames. However, over the course of years and decades, stocks have historically trended upward and done quite well based on the business cycle.

Thus, the biggest hurdle to achieving financial goals is not about modeling interest rates, forecasting the Fed, or predicting geopolitical moves – it’s overcoming one’s own biases and inclinations. Although S&P 500 is negative for the year, the reality is that the S&P 500 has gained 96% since the pandemic crash and 30% since the pre-pandemic peak. There is often a disconnect between short-term perception and long-term reality when it comes to market behavior, no doubt amplified by constant headlines.

Investors should focus on their overall portfolios instead of individual assets

Key Takeaway:

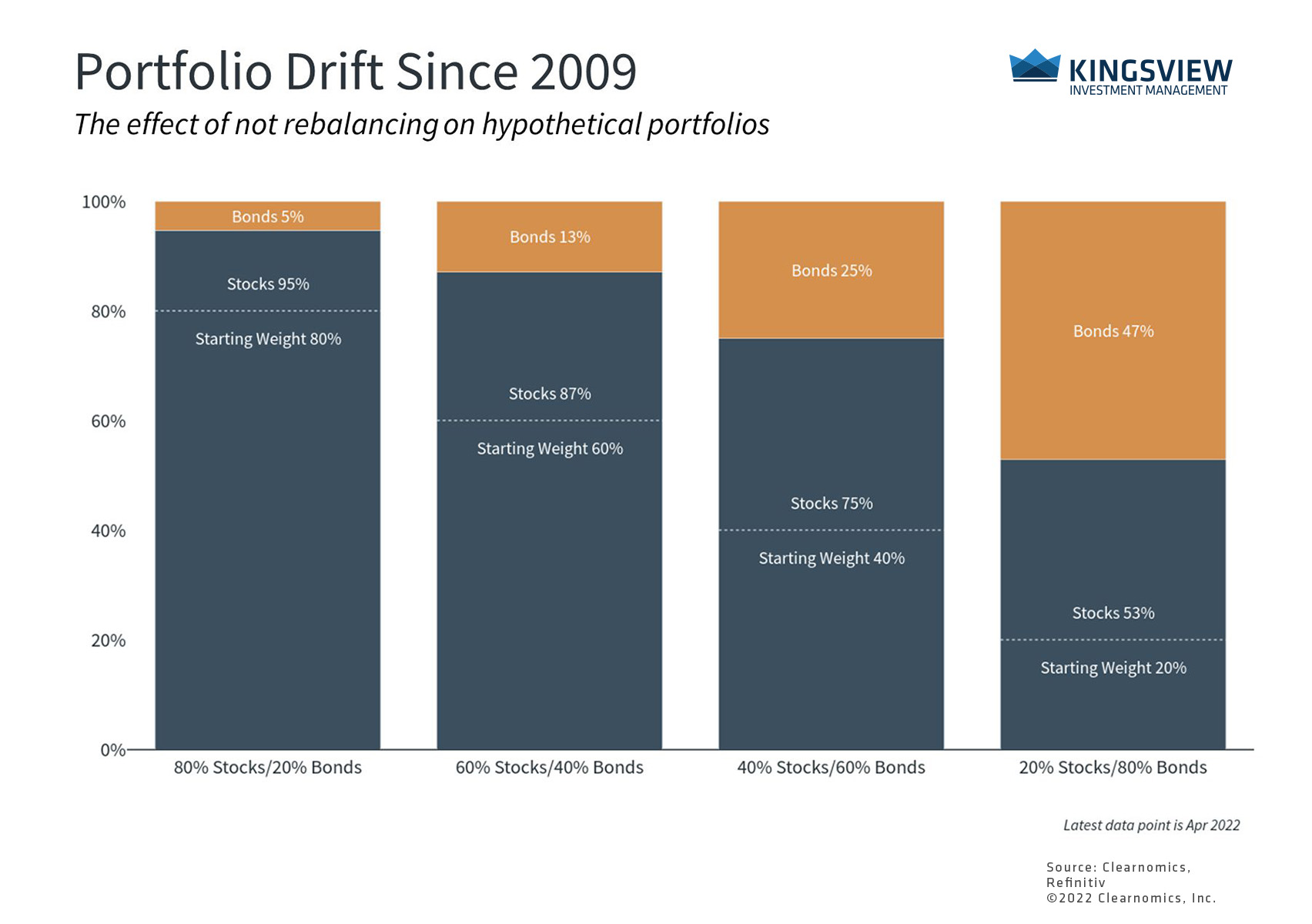

- While speculation is a natural inclination for investors, it should be done so on a foundation of a portfolio built to achieve long-term goals. This chart shows the importance of focusing on this portfolio first by rebalancing and maintaining an appropriate asset allocation mix.

Like many things, the power of compounding works slowly and positive returns over any individual day, week or month are never guaranteed. Market pullbacks and corrections may grab attention and headlines, but it is the slow building of wealth in the face of never-ending market fear that works in investors’ favor over the course of years and decades. While there are valid market concerns around the business cycle, inflation, interest rates, the Fed, and more, the bottom line is that economic growth is still robust. Patience, discipline and perspective are needed as this business cycle matures.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2022)