Portfolio Manager Insights | Weekly Investor Commentary - 3.16.22

To download the commentary – click here.

The U.S. dollar has had a tumultuous few years due to the pandemic, the global recovery, and now the conflict between Russia and Ukraine. The U.S. government, similar to other countries, is also exploring the possibility of a “digital dollar.” The dollar is an important economic indicator that, like interest rates, reflects a wide array of global trends. As the world’s reserve currency and most reliable medium of exchange, its value affects every part of the economy and everyday life. What does the strengthening dollar mean for investors and consumers in the months ahead?

Like many financial assets, the dollar serves many purposes. For individuals, the value of the dollar is important when traveling abroad, exchanging currencies and purchasing foreign-made goods. However, most also see the dollar as a barometer of the country’s importance on the global stage. Unfortunately, this latter factor doesn’t tell the whole story since a currency that is too strong can make U.S.-made goods less competitive in the global market. Thus, for long-term investors and economists, the dollar is an important gauge in at least three ways.

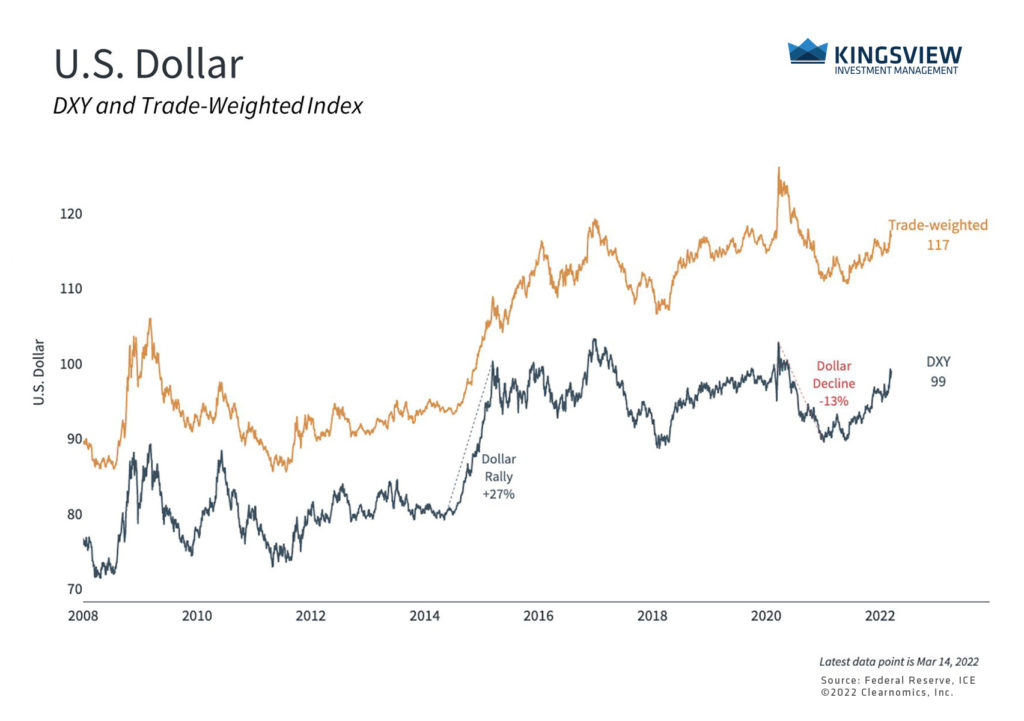

First, the dollar serves as a financial “safe haven” since it is backed by the full faith and credit of the U.S. government, making it attractive in uncertain times. This has been the case recently amid the “flight to safety” spurred by the Fed and geopolitical risk. Not surprisingly, this also occurred during the initial stages of the pandemic when the S&P 500 was near its lows. At the moment, the dollar index (DXY) has risen to 99 from a low of 89 a year ago, its highest level since mid-2020.

The dollar has strengthened due to the Fed and geopolitical risk

Key Takeaway:

- The dollar has been strengthening as the Fed normalizes monetary policy and the conflict in Ukraine worsens.

Second, the U.S. dollar is an important indicator that reflects economic and policy expectations for the U.S. relative to the rest of the world. The dollar has been rising since May 2021 due to the strength of the U.S. economy and the prospect of higher interest rates. The Fed’s plans to tighten monetary policy, both by raising rates and reducing its balance sheet, could further strengthen the dollar. Investors naturally prefer currencies that pay higher interest rates and whose governments and central banks have more prudent policies.

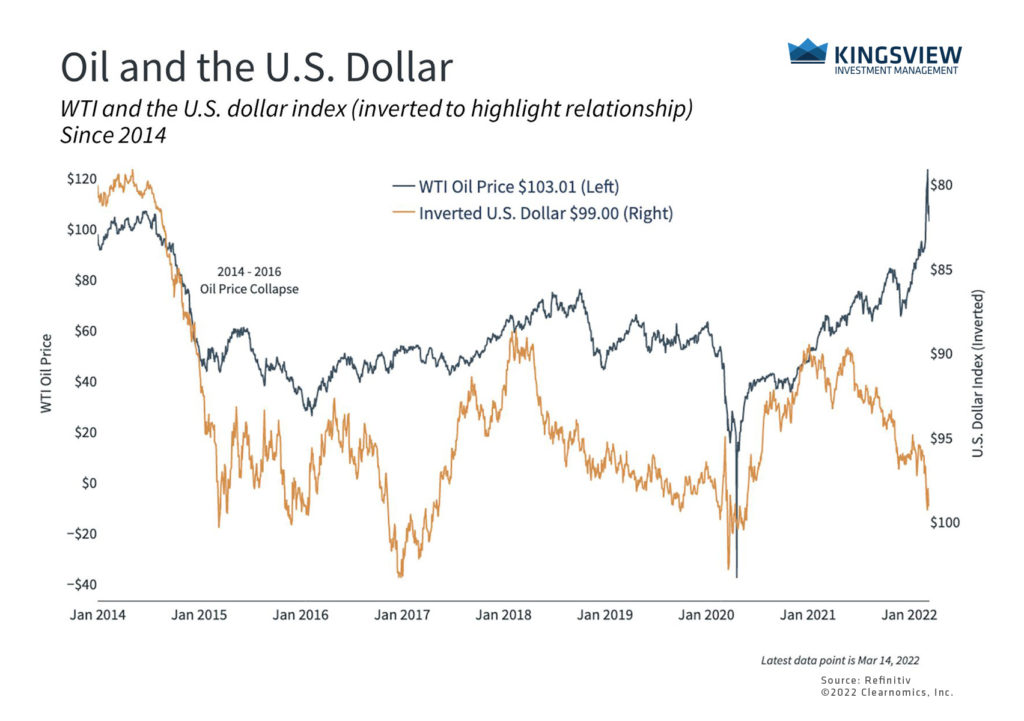

Perhaps the most unusual fact about the current value of the dollar is that it has strengthened alongside rising oil prices. This relationship is typically the opposite – since oil is mostly denominated in dollars, a stronger dollar lowers the listed price of oil (i.e., you need fewer dollars to buy the same amount). So, while the war in Ukraine has caused oil prices to jump, the dollar has risen due to the Fed and its safe haven status. While the situation is still evolving, it’s likely that the historical relationship between the dollar and oil will eventually be restored. Oil prices have already pulled back from their highest levels over the past few weeks.

The dollar has risen despite a spike in oil prices

Key Takeaways:

- The dollar has strengthened even though oil prices have also jumped. This is the reverse of the typical pattern in which the dollar and oil move opposite one another, since oil is denominated in dollars.

- The chart above shows the dollar inverted against oil, highlighting the divergence in the historical relationship.

Third, while the dollar is often strong because of its global importance, this is not necessarily positive for all parts of the economy. A stronger dollar often makes it more difficult for U.S. companies to compete abroad since goods and services priced in U.S. dollars become more expensive to foreign buyers. Around 2015, this resulted in an “earnings recession” due to its drag on corporate profits since international revenue has increased in importance for U.S. companies. Thus, having the dollar at a sensible level is often better than a dollar that is too strong.

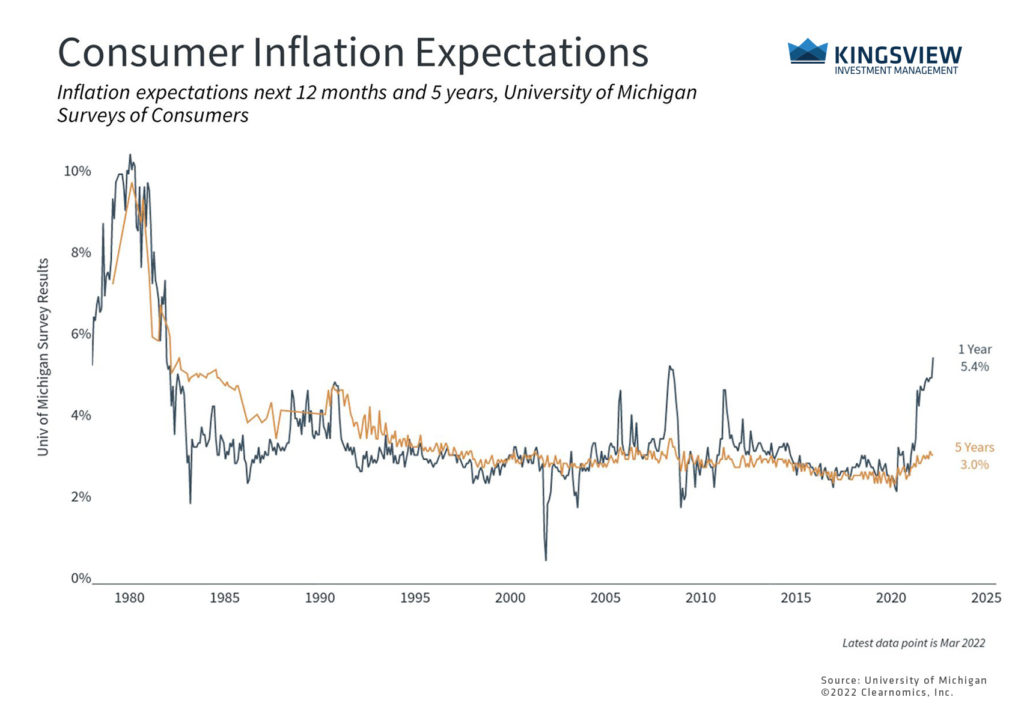

At the moment, since inflation is the central concern for investors and consumers, a stronger dollar can be beneficial. This is because foreign-made goods can be purchased more cheaply when the dollar is stronger, and these are exactly the goods that have propelled inflation rates higher (namely computer chips, commodities, etc.). As long as this does not boost demand and thereby worsen supply chain disruptions, a stronger dollar could help to reduce the impact to consumer pocketbooks.

A stronger dollar could help to combat inflation

Key Takeaway:

- While this may take time, a stronger dollar makes it cheaper for those holding dollars to purchase foreign goods. This could help to ease some measures of inflation in the coming months.

Thus, the way the U.S. dollar has moved recently has reflected the uncertainty faced in global markets. This could continue to be the case as the conflict in Ukraine continues.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)