Portfolio Manager Insights | Weekly Investor Commentary - 2.2.22

To download the commentary – click here.

At the moment, headlines are focused on the stock market correction, especially among technology stocks, that has been building for weeks. The NASDAQ has declined about 15% this year, the S&P 500 tech sector has fallen by nearly as much, and some individual stocks have performed much worse. The overall S&P 500 is also near an official correction (defined as the index closing 10% below its recent all-time high).

While short-term market pullbacks are normal and inevitable, especially within volatile parts of the market, many investors are naturally concerned about what this means for the year ahead. Now, more than ever, investors ought to stay disciplined and view market moves with the right perspective. Those investors who can do so might even benefit from market opportunities.

The fact of the matter is that 10% corrections occur on a regular basis, even in years with otherwise strong market returns. No matter how bad pullbacks feel, markets typically recover within a few months which can catch investors by surprise. The current correction may be more striking because it is happening at the start of the year even though this timing is purely coincidental.

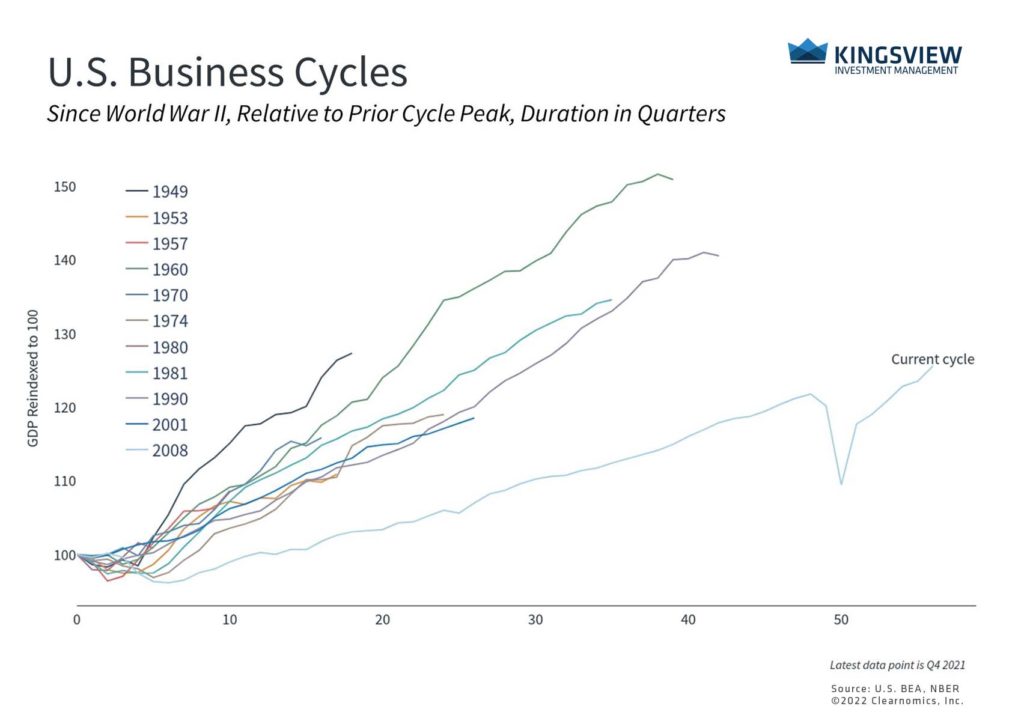

The economy continues to reach new peaks

Key Takeaways:

- The overall economy exceeded its pre-pandemic levels in the middle of 2021.

- As GDP growth continues as a fast clip, the economy is reaching new peaks each quarter. In the long run, this is what matters to investors – not day-to-day headlines.

This is because not all boom-bust cycles are made equal. The root of the global financial crisis was debt, and it is harder for the economy to recover if individuals, businesses and banks are de-leveraging and afraid to expand their spending and investment activities. In contrast, the latest recession was a self-induced shutdown in response to the pandemic. Whether one agrees or disagrees with how this was managed, it’s undeniable that many businesses and factories were able to reopen without losing much know-how or productive capacity. In many ways, this was like turning off and on a light rather than having a bulb burn out.

Of course, this overlooks many challenges across the economy. Not all industries have recovered fully, even as the overall economy reaches new peaks and unemployment hovers around 3.9%. Many individuals have struggled and have yet to get back on their feet. Inflation is also a significant concern, even if it could begin to stabilize in the coming months. The Fed would be in a real conundrum if a wage-price spiral ensues where inflation is baked into expectations in an uncontrolled way.

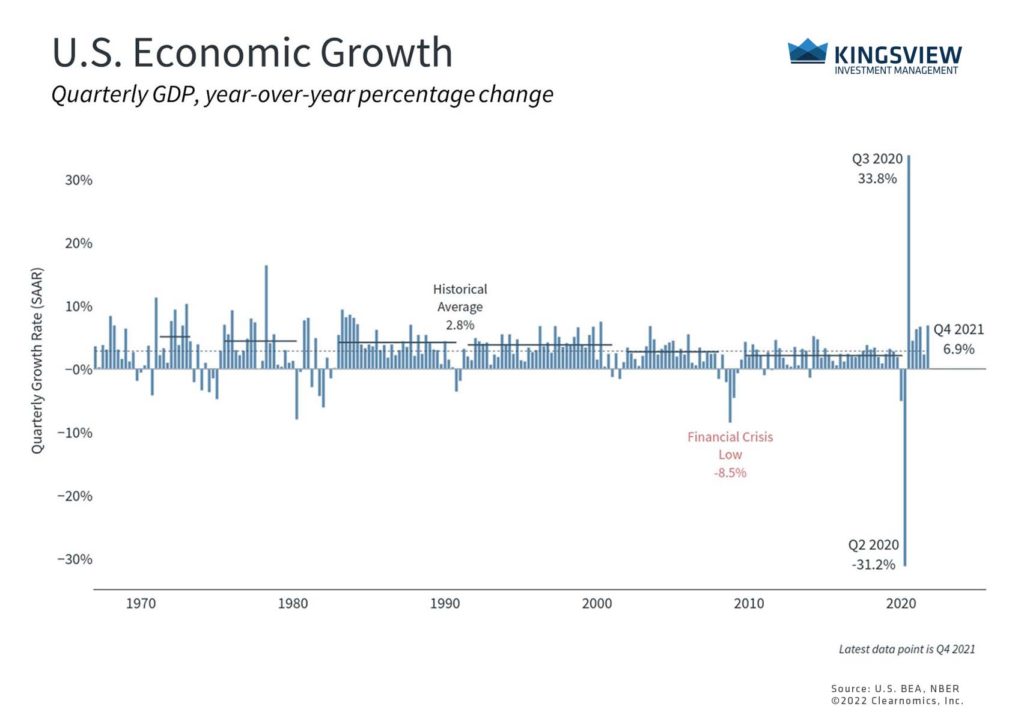

In 2021, the economy grew at its fastest pace in decades

Key Takeaways:

- The 6.9% quarter-over-quarter growth rate in Q4 is the fastest since Q2 2000, not counting the initial post-pandemic rebound in 2020.

- While GDP growth should be above average in 2022, investors should expect growth to return to more average levels in the coming years as the effects of the pandemic lockdowns fade.

While this is not what most economists expect, it’s clear that investors ought to have more tempered expectations for growth in the years ahead. The lights are back on but we shouldn’t expect it to keep getting brighter at the same pace. For instance, the Fed’s latest forecast for 2022 GDP growth is 4% before settling down to 2.2% each of the next two years. This is slower, yes, but this level of growth would still be one of the fastest in decades (since the year 2000).

Corporate profitability is strong

Key Takeaway:

- Ultimately, investors care about economic growth because it is what drives spending, investment and profits. Zooming out over decades, history shows us that markets do well when corporate profitability is high. This depends on business cycles and long-run trends.

Investors will have to adjust to these trends. However, what matters is not that the economy is perfect – it’s that overall growth will support corporate earnings and thus market returns. At the moment, companies are doing extremely well across the board with an S&P 500 earnings-per-share estimate of $223 in twelve months, despite other sources of market uncertainty. Over the course of full business cycles, it is profitability that propels stocks and portfolios ahead, allowing investors to achieve their financial goals.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)