Volume Analysis | 1.24.22

In our 2022 Volume Analysis Outlook, the S&P 500 was fresh off new highs exceeding 4800. We suggested that while it is rarely a good idea to fight the trend, there were many signs of caution developing. As such we discouraged the temptation of purchasing additional equities on potential forthcoming equity market pullbacks. We also identified two potentially key areas of market support to watch as key decision points. Now that the market (S&P 500) has achieved the first of our two downside targets of 4410 (4315 being the second), in this issue of Volume Analysis we will once again review those criteria which earlier gave us pause. Further we will update you on what those same leading indicators may be suggesting now.

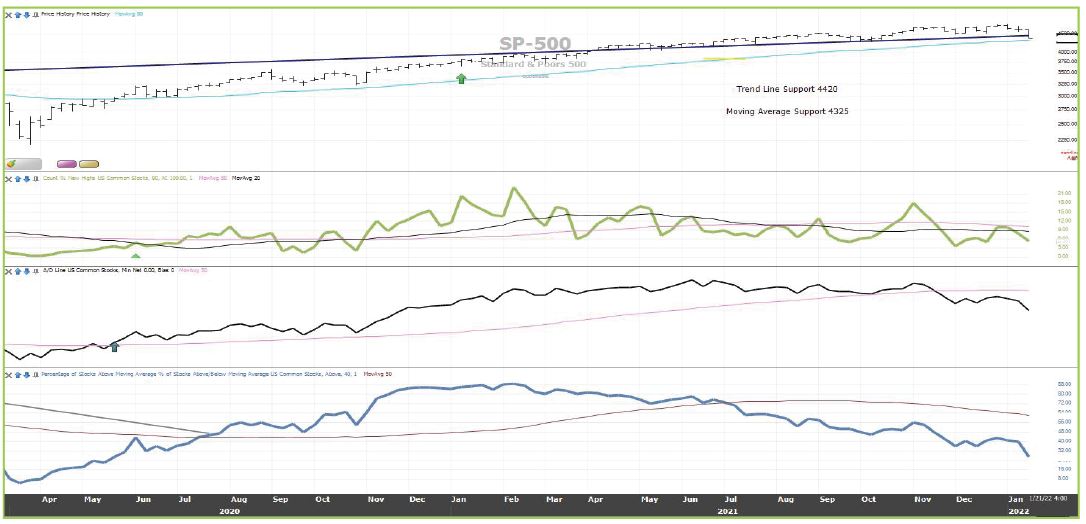

Let’s begin with the chart below illustrating those breadth indicators that were strongly diverging from the broad market’s up trend.

Source: StockFinder, Worden Brothers

Previously we pointed out all three of these breadth indicators were bearish, diverging against the primary uptrend of the market raising the yellow precautionary flags. As of the date of this writing, all three indicators are still headed south. When New Highs are falling, it may mean the market has stronger overhead resistance. When the Advance Decline is declining, this suggests liquidity is failing. And when Percentage of Stocks Above Trend is decreasing, it indicates many stocks are finding it more difficult to move up than down. A few weeks ago, all of these leading indicators were negative, and they remain so today.

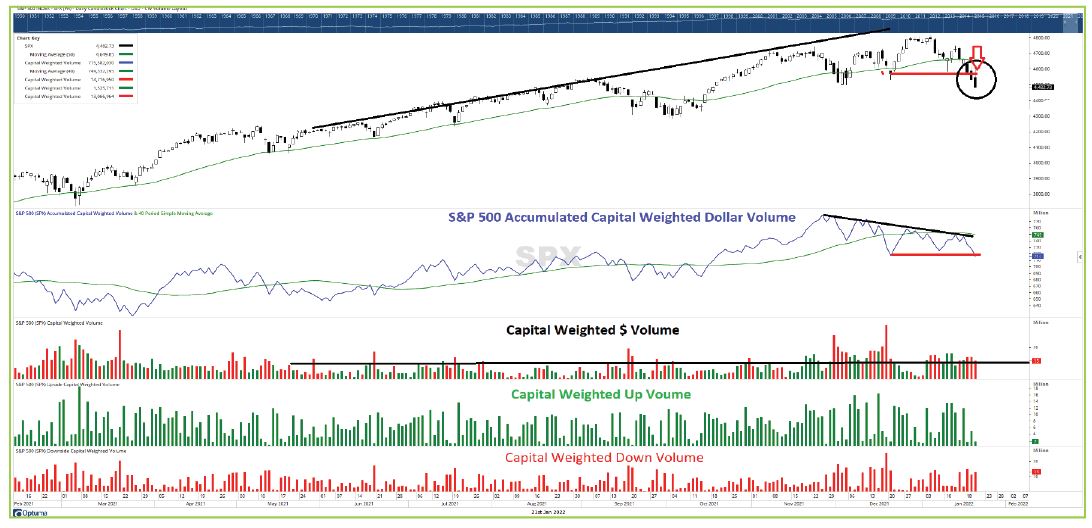

Additionally, in our 2022 Volume Analysis Outlook we also discussed how daily capital weighted volume was also diverging from the broad market’s strong up trend. In the chart below, you can once again see this observation by reviewing the black trend lines. At the time we viewed the price moving higher with less money participating as a warning sign.

Source: OPTUMA (www.optuma.com/volumeanalysis)

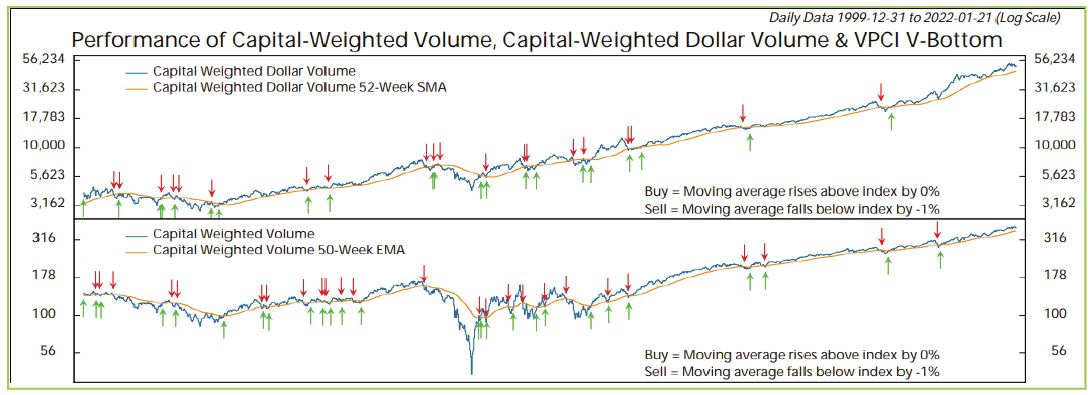

Now, the S&P 500 is down about 8.5% from its former highs just a few weeks ago. When the S&P was making these new highs, we were pointing out that capital flows, measured by capital weighted volume and capital weighted dollar volume were not making new highs. This was a secondary reason not to be fond of buying dips at the time. Now, let’s shift to today by examining the chart below. Now that the market is strongly moving downward, the capital outflows are not nearly as strong as the price direction. Thus, capital flows has now flipped to a positive sign for the bulls.

The top panel in the chart above is capital weighted dollar volume. The blue line is how much money is flowing into or out of the S&P 500. The orange line below is the trend of those capital flows (capital weighted dollar volume). Likewise, the middle panel shows capital weighted volume, which is how many shares are trading up or down within the S&P 500. Notice how both capital weighted volume and dollar volume still remain above their orange trend lines despite the strong pullback in the price index. These two leading indicators confirm that we remain in a volume analysis bull market. In the aggregate, lack of strong capital flows out of the market suggests the “big money” apparently is not yet heavily participating in the market selloff.

Circling back to our opening comments, the S&P is at the critical support level identified a few weeks ago. Support levels represent decision points to either bail or recommit. The market internals we covered in this issue may be useful in forming market strategy. Correct interpretation of these leading indicators may allow us to distinguish between a correction and what may potentially become a bear market. While breadth remains bearish and the recent price action has been destructive, I am encouraged by the apparent lack of capital participating in the recent decline. Mirroring the tracks of institutional capital is what we strive to do. Presently, our indicators do not suggest institutions are caving during this decline. Thus, the return to support (4325) could potentially be an attractive entry point. That stated, risk management is always our number one priority especially when market breadth appears to be so poor. Overall, despite the recent pullback, the intermediate broad market trend remains up. In the coming weeks, while the market weighs events and new data coming, we will continue to watch support at 4325 as the next critical decision point.

Wishing you the very best my friends.

DISCLOSURES

Kingsview Wealth Management (“KWM”) is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that KWM has attained a particular level of skill or ability. Kingsview Investment Management (“KIM”) is the internal portfolio management group of KWM. KIM asset management services are offered to KWM clients through KWM IARs. KIM asset management services are also offered to non KWM clients and unaffiliated advisors through model leases, solicitor agreements and model trading agreements. KWM clients utilizing asset management services provided by KIM will incur charges in addition to the KWM advisory fee.

Information presented is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. This information does not address individual situations and should not be construed or viewed as any typed of individual or group recommendation. Be sure to first consult with a qualified financial adviser, tax professional, and/or legal counsel before implementing any securities, investments, or investment strategies discussed.

Past performance is no guarantee of future results. There are risks associated with any investment strategy, including the possible loss of principal. There is no guarantee that any investment strategy will achieve its objectives.