CIO Scott Martin Interviewed on Fox News 12.21.21 Pt. 1

Program: Cavuto Coast to Coast

Date: 12/21/2021

Station: Fox Business News

Time: 12:00PM

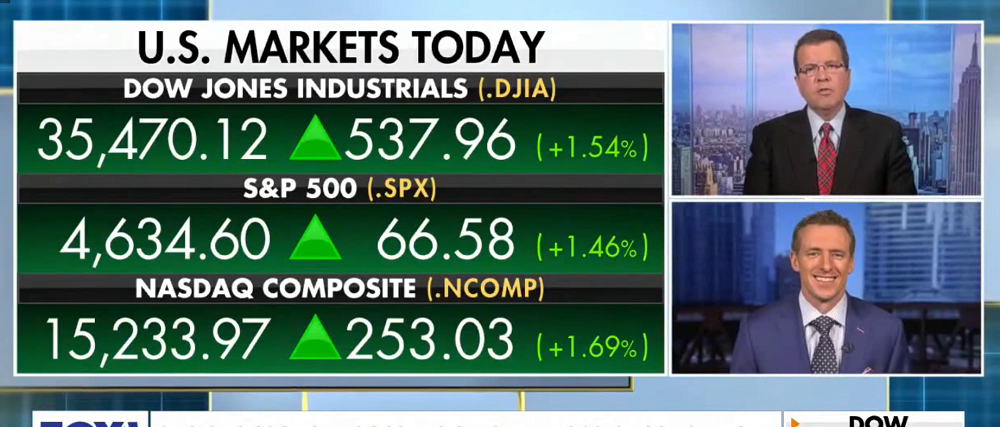

NEIL CAVUTO: In a corner of your screen there, you’re noticing that stocks are spreading ahead, and it’s a reminder that every time the market gets shellacked, even though in this case it was a significant shellacking over three days. You are richly rewarded if you just stay patient and you’re buying the dips. In fact, history suggests that you’re a dip. If you don’t do that, eventually, that won’t always pan out, but it is today. Scott Martin with us. Scott, what do you think of that strategy? It’s richly rewarded investors, if they just hang tight, can’t always be that way, but it seems to be again not making a big deal out of one day. But what do you think?

SCOTT MARTIN: The riches do come, Neil, and the riches come to those who are patient in those who stay on the path, I mean, as an investment adviser. Every day it’s like you’re either looking at stocks to buy or you’re you’re psychologically counseling clients to just hang in there. In fact, NeIl, to your point about, you know, don’t be a dip and buy the dip, find that cash or find the wherewithal to maybe rebalance some of the names that are doing better or worse, depending on the day, and start allocating to names that look really bad. You know a couple of things in the last couple of days in the energy space. The materials space. Some things we talked about last week on the show are names that are just way down and completely indiscriminately sold, and ones that they feel terrible when you put the buy order in on them. But they’re ones that really start to bounce on days like today because they get so hated on those down days like we saw earlier this week and late last week.

CAVUTO: How are you playing next year, Scott? Normally, after three years of double digit, heady double digit advances over 20 percent year in and year out, at the very least, I’m on the fourth year you’d see things dramatically slow down, I think the Wall Street Journal had said last week maybe no more than two or three percent next year. Where are you on this?

MARTIN: Yeah, and 2020 was supposed to be the Great Depression, and twenty twenty one was going to be bad. Well, because, you know, it’s like the more I hear those predictions, Neil, the more I’m like, OK, here we go to all time highs. How I’m playing it next year, I’m probably sucking my thumb a lot, hiding under my desk, forwarding my calls just because sometimes I mean, we’ve talked about this to me in the last few weeks. Sometimes it’s best to just kind of turn away a little bit and think about how stocks are positively sloped over time. Think about some of the earnings reports that we’re seeing from the Apples and the Adobe’s and the visas and all those companies out there that are so part of our daily lives and there are so great product developers and their parts of our future that we know we’re going to have in our lives. And you just have to be confident that these companies are going to figure out they’re going to figure out profit margins, they’re going to figure out hiring, they’re going to figure out R&D. And those are the companies we want to own in our stock portfolios. And those are the companies. Frankly, man, as we’ve heard those dire predictions. Those are the ones that always beat out those predictions and return well to our investors.

CAVUTO: Now, would they include the big well-known names that have run up far and fast anyway, the Amazons, the Apples and Microsofts disproportionately weighted in technology? I know. But how do you how do you pick your winners that have a winning record when it comes to earnings and even company forecasts that right now are holding up pretty strongly?

CAVUTO: We call this a pregnant pause. I apology for that. Just to let you know, here one of the things they do look for technology stocks. Part of this report was because they were disproportionately running up, returning about 40 percent last year, 35 percent the year before that 36 percent, I think the year before that, that they’re due for a slowdown, no matter how spectacular their earnings and their guidance looks. There is no way of knowing that, but that is just one of the things that’s out there and one of the points that I had wanted to raise with Scott. But I apologize for those technical difficulties. They are not micron related.

***