Portfolio Manager Insights | Weekly Investor Commentary - 12.1.21

To download the commentary – click here.

In less than a week, the COVID-19 variant known as omicron has renewed public health concerns around the world. While the World Health Organization has stated that it could have “severe consequences,” reports from South Africa where the “variant of concern” was first identified suggest that symptoms have been mild. Only time will tell how severe – or not – the public health implications may be, especially as vaccination rates rise and other safety measures become commonplace.

Through all this, it’s more important than ever for investors to distinguish between public health issues – which can be fraught with politics and strong personal beliefs – and what’s best for their portfolios. If the pandemic has taught us anything, it’s that staying focused on the long run is the best approach.

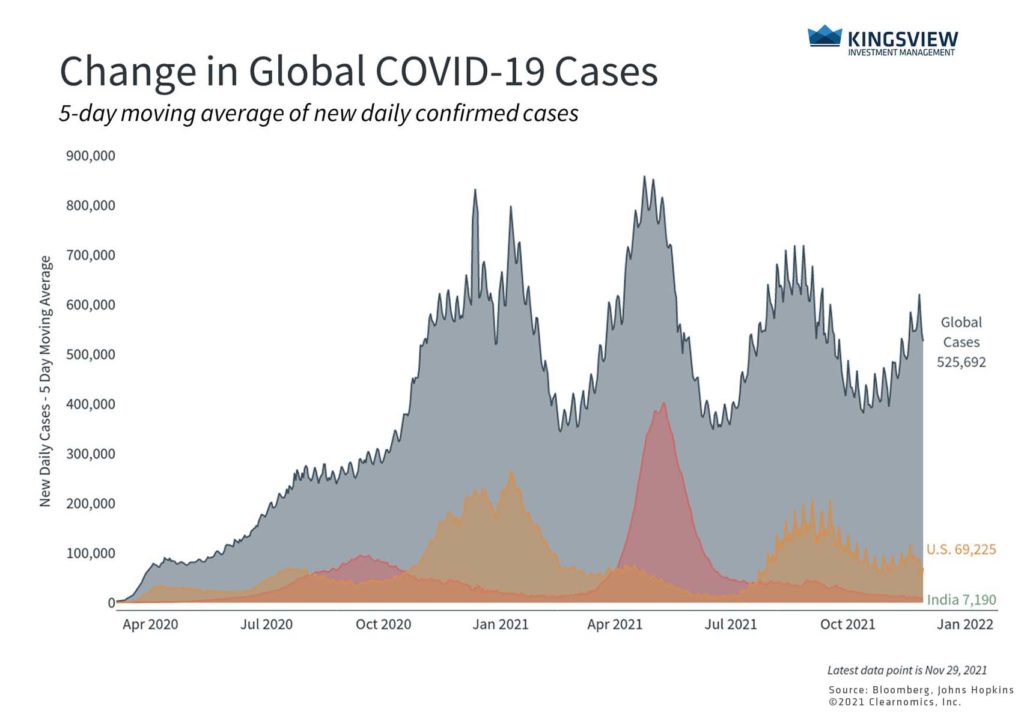

There are growing public health concerns over the new COVID-19 variant

Key Takeaways:

- Investors have experienced multiple waves of COVID-19 during the pandemic. Still, the most impactful was the first wave when the economy was shut down.

- Subsequent spikes, including due to the delta variant, have not even come close in terms of their economic and market impacts.

It’s generally accepted that COVID-19 is now “endemic” – i.e., like the flu or common cold, it’s here to stay. Unfortunately, this means that whether due to omicron or another strain, it is only a matter of time before new variants create public health concerns. Like the original COVID-19 strains and later the delta variant, these worries can escalate quickly due to the pace of infection. It’s possible for these variants to spread to multiple continents by the time they are identified, named, and appear in the news.

At the onset of the pandemic, this exponential pace created significant challenges for everyone, not least of which was the emotional toll of isolation and social distancing. Fortunately, the situation today is quite different. Individuals and businesses alike have fresh experience and playbooks for dealing with the pandemic and there is a much better understanding of the risks. Without diminishing the public health challenges ahead, this means that there is a stark distinction between how officials should respond to the ongoing crisis and how investors should respond in their portfolios.

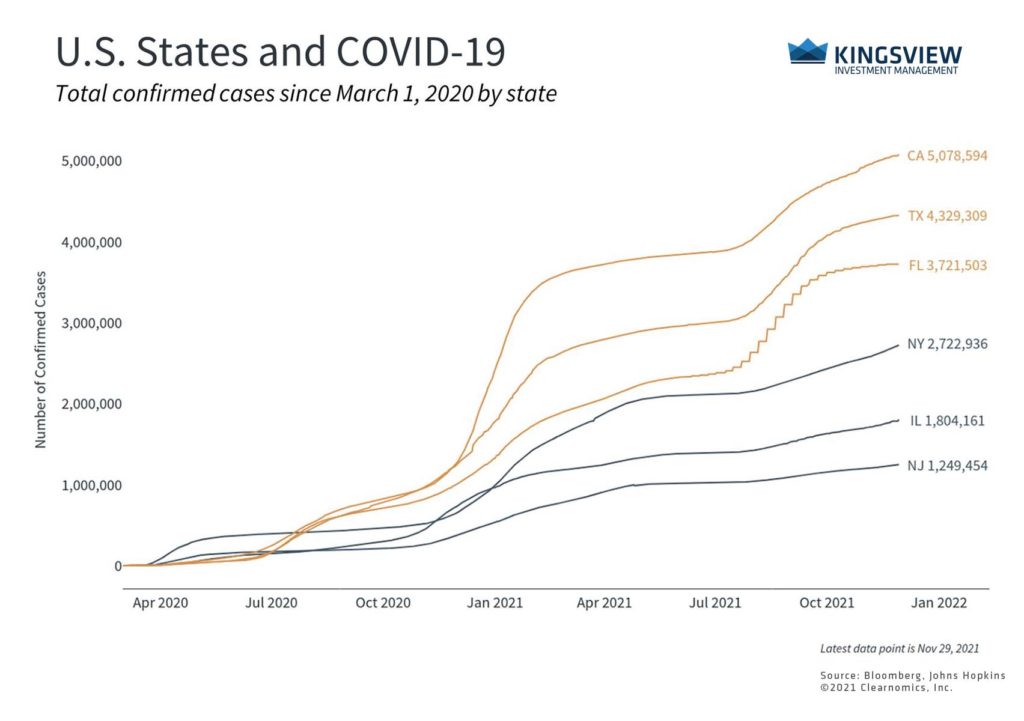

Even before this, cases were rising as winter nears

Key Takeaway:

- Cases have been rising even before omicron due to the colder fall and winter months. Despite this, economic activity has remained solid and job gains have accelerated somewhat.

The delta wave that began in the summer showed that this is the case. Although infections spread rapidly, the death rate remained relatively low. Most importantly for investors, the economic and market impacts were minimal, especially when compared to the initial shutdown measures in 2020. Through that wave and the more recent uptick in cases, economic growth has been strong, hiring activity has accelerated, profits have reached record levels, and markets have continued to achieve new all-time highs. All this despite concerns around inflation, supply chains, politics, the Fed and more.

Of course, investors should always expect periods of market volatility. This is true even in the best of times, let alone when markets are at new highs and valuations are still above average. It is still true that the market has been quite calm by historical standards this year, despite occasional shallow pullbacks. What has made this possible is the strength of the economic expansion which is now over a year and a half in age. While there may be periods of short-term turbulence ahead, business cycles tend to last for many years if not decades.

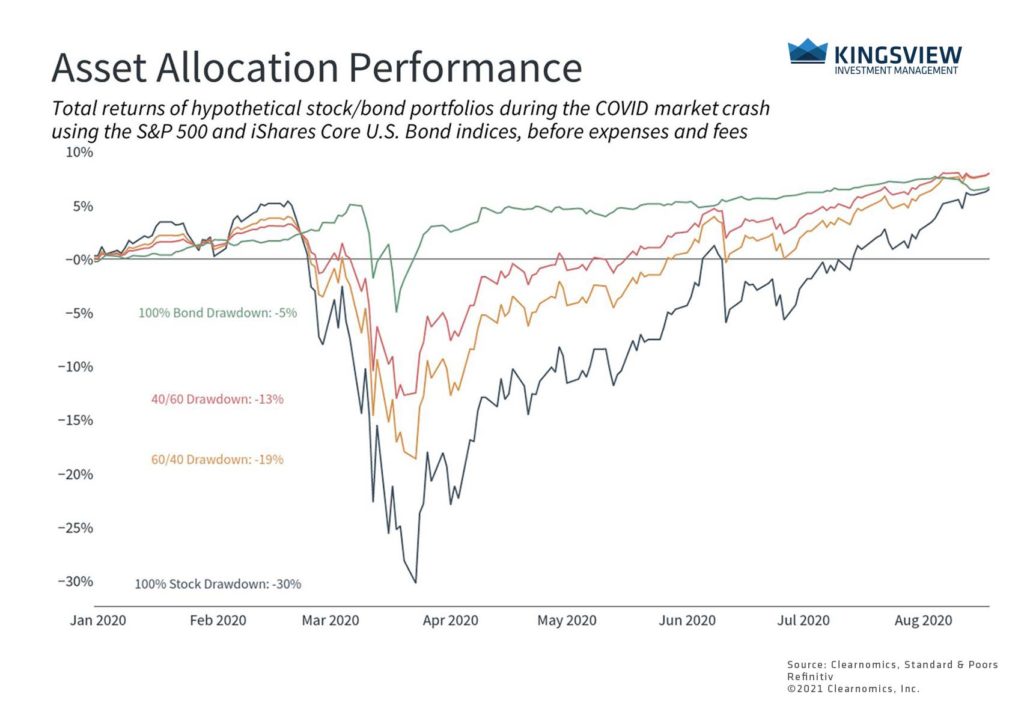

Diversification is still the best approach for navigating the years ahead

Key Takeaways:

- Whether or not the latest variant of concern becomes a serious public health and economic issue, diversification and staying invested are the best ways to invest through the next period.

- This was true during the initial market pullback last year. While the past is never a guarantee of the future, those investors who stayed focused were rewarded within a matter of months.

In the end, portfolio diversification is still the primary tool for investors to achieve their financial goals while protecting from downside risk. The market crash that began in February 2020 emphasized that while trying to sell holdings and moving to cash are tempting, a rebound can occur when investors least expect it. Holding fast with an appropriate portfolio was the best approach throughout these periods.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)