Portfolio Manager Insights | Weekly Investor Commentary - 11.17.21

To download the commentary – click here.

Perhaps the biggest side effect of the rapid economic recovery is the historic number of job openings across the country. This has led to a wave of individuals quitting their jobs in search of greener pastures, a phenomenon that has been dubbed the “Great Resignation.” Historically, this is often what happens after economic shocks as many find new work that best utilize their skills. While this is great news for many, especially those who can command higher pay or benefits, it also highlights challenges for businesses and the economy. What does the Great Resignation mean for economic growth and investment portfolios in the years ahead?

The labor market affects all investors in many ways. The most obvious manner is that it directly impacts our personal lives, in addition to those of our families, friends and neighbors. For instance, whether or not inflation-adjusted wages have kept pace is a core issue in the wealth inequality debate. It’s no secret that both the 2008 global financial crisis and the pandemic worsened these effects.

Job openings and turnover are near record highs

Key Takeaway:

- Job openings are near historic levels. This has prompted many to quit their jobs in search of better opportunities.

In addition, work is more than a paycheck. Right or wrong, it often defines who we are and can be an important part of achieving personal fulfillment. While this effect is not directly financial in nature, it does affect societal and economic trends.

Thus, one of the most difficult challenges for the economy over the past two decades has been the decline in the “labor force participation rate.” This occurred as large numbers of working-age people gave up on finding jobs. The participation rate peaked in 2000 and has been falling due to a number of factors including an aging population, globalization and technology. These latter factors have allowed for goods and services to be produced elsewhere and with fewer workers. Especially when the job market is otherwise stagnant, it is easy to become discouraged and then give up altogether.

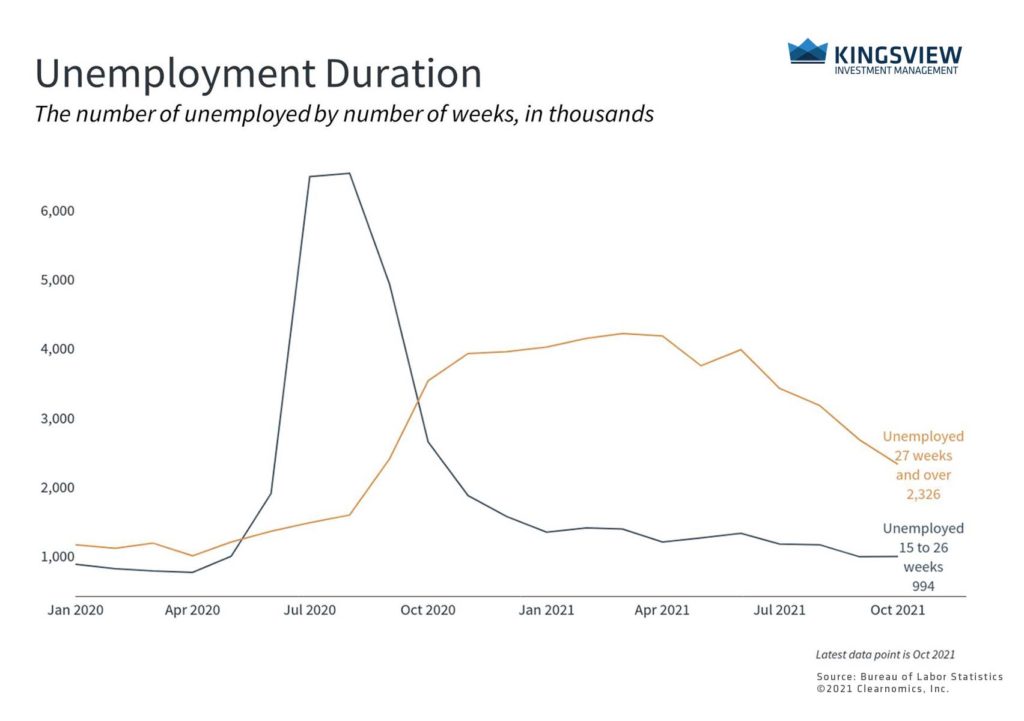

Long-term unemployment is falling

Key Takeaway:

- One group that has benefited from these trends is those who have been unemployed for half a year or longer. These long-term unemployed are fewer today due to the economic expansion and the sheer amount of hiring activity across industries.

In the long run, this can create labor shortages in certain industries. In the short-term, however, job openings being near record levels – 10.4 million across the country in September – is positive news. This means that positions are available and businesses would like to hire at the fastest rate in history. That the quits rate has accelerated alongside openings to 4.4 million per month means that many are successfully finding attractive jobs or are confident they can find them quickly.

The caveat is that not all jobs are created equal. The fact that these positions are open means that businesses are having trouble finding enough qualified candidates in their industries. This may mean they don’t have the right skills, especially in high-tech sectors, aren’t in the right geographic location, or that there are other mismatches. Like other supply chain bottlenecks plaguing all businesses, a shortage of qualified workers can harm growth and expansion plans.

Participation rates have stabilized

Key Takeaways:

- Unfortunately, the labor force participation rate, which measures the number of people who want to work, is still very low. This measure has been declining for decades due to a variety of factors which were worsened by the pandemic.

- Many hope that the level of job openings can help to get workers off the sidelines and back into great roles.

The hope is that, over time, job openings entice working-age people to come back into the labor force and the participation rate rises. Workers might re-train to match high-growth areas and wages might adjust based on hiring demand. This could help to accelerate economic growth in addition to improving personal financial situations.

From the perspective of long-term investors, the labor market is a broad signal of economic health. It’s for this reason that investors watch the monthly jobs report so closely. The fact that unemployment has fallen significantly, job openings are at records, wages are picking up, individuals are finding better opportunities, and labor force participation has stabilized are all positive signs.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)