Portfolio Manager Insights | Weekly Investor Commentary - 11.3.21

To download the commentary – click here.

The business cycle is advancing despite a number of investor concerns, one quarter after the economy returned to pre-pandemic levels. And while the pace has decelerated, this is normal after last year’s extreme rebound. For investors, this is important because an economy that is expanding – even at a slower rate – is what supports a robust bull market. What should those worried about their portfolios expect from the economy going forward?

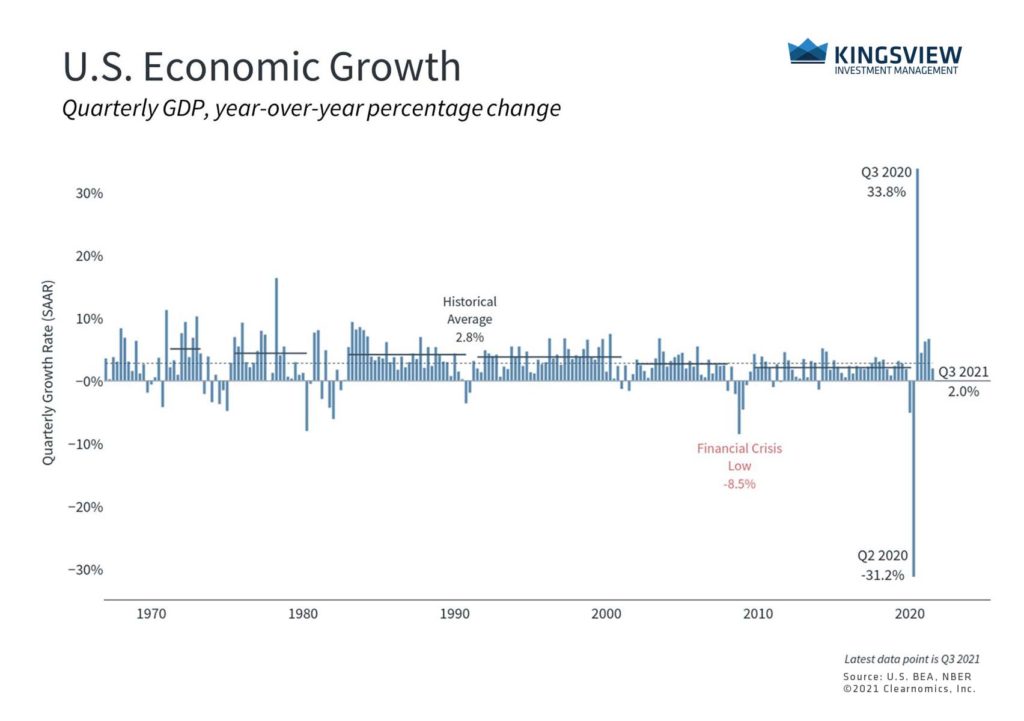

Last week’s data show that U.S. GDP grew by 2% in the third quarter compared to the second. Although this is slower than many had hoped, this was due to factors that were widely anticipated: the delta variant, supply chain bottlenecks and a deceleration in consumer spending. When looking at the bigger picture, not only did the economy grow 4.9% in Q3 from a year ago, but personal consumption expenditures came in better than expected and both investment and government spending flipped from negative to positive.

The economy grew less than expected in the third quarter

Key Takeaway:

- The economy grew at a 2% annualized rate in the third quarter when compared to the second. This is slower than expected but is due to well-understood factors. What matters is that the economy is continuing to grow despite a number of challenges.

When considering economic data such as these, it’s always important to focus on a broader perspective. The glass-half-empty view is that last quarter’s growth rate is the slowest since the recovery began, especially compared to the previous quarter’s 6.7% figure. The reality is that investors should not expect the types of growth that occurred right after businesses reopened last year, regardless of supply constraints and inflation. The 33.8% rebound in Q3 2020 was possibly a once-in-a-lifetime event and only occurred because the economy shrank by 31% at the start of the pandemic. Clearly, the strong growth rates of the past year benefited from the reopening and should taper off over time.

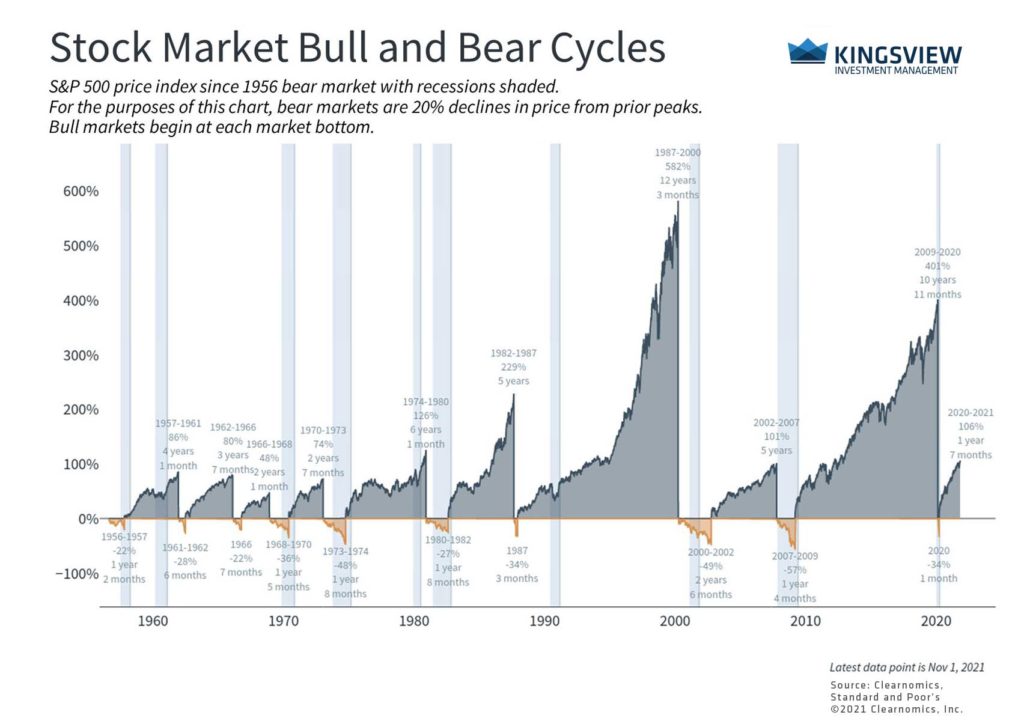

Of course, the situation never seems perfect. During the previous cycle, investors were constantly faced with intractable concerns such as structural debt problems, Fed policy, government spending, the Eurozone crisis and, ironically, the fact that inflation was too low. Despite this, the S&P 500 rose 400% over the course of an 11 year period. Similar patterns can be found across all business cycles through history.

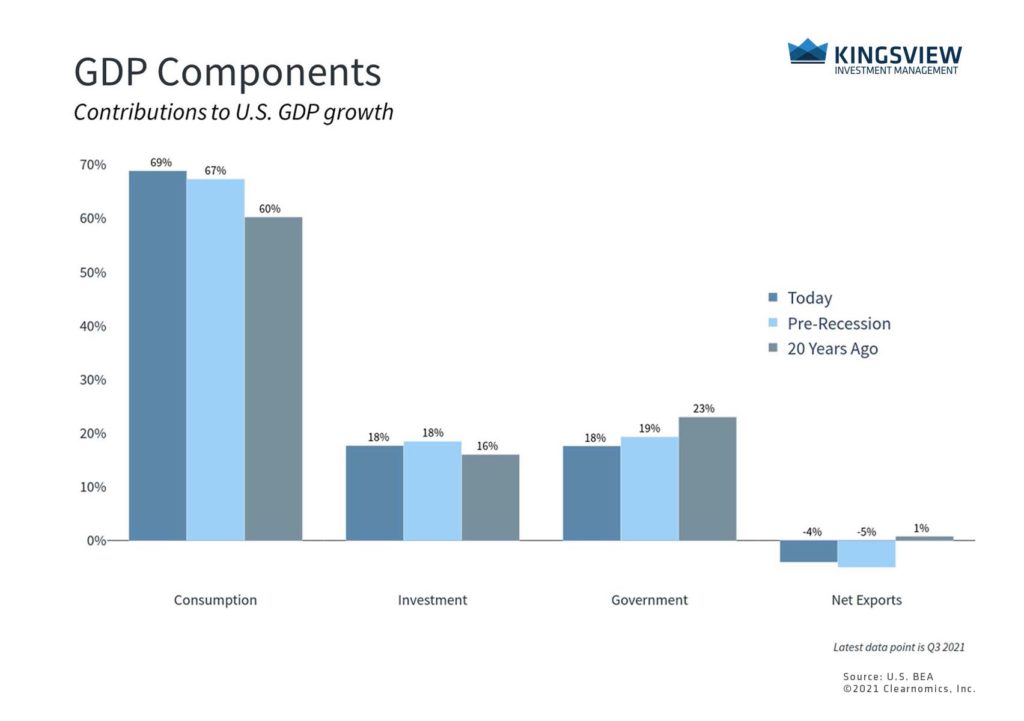

Consumer spending is the largest part of the U.S. economy

Key Takeaway:

- Consumer spending continues to be a major part of the U.S. economy. The fact that consumers are in a strong and stable position is a positive sign.

While pessimism can occasionally pay off in the short run, it almost never helps in the long run. Even when the situation fails to evolve as investors hope, investment portfolios that are properly positioned often find a way to perform well nonetheless.

Thus, the more optimistic perspective for investors is that the economy can continue to grow at a steady pace. The average consumer is in a strong financial position, especially as the unemployment rate continues to fall, and industrial activity continues to expand. Although not all Americans are doing well, they will begin to benefit with cases of the delta variant low and businesses growing.

A strong economy can support long market cycles

Key Takeaway:

- History shows that recessions and market crashes are short while bull market expansions are long – if they are supported by steady economic growth.

For long-term investors, it’s important to keep in mind that recessions and bear markets tend to be sudden and last for months, while bull markets and economic expansions tend to be steady and last for years if not decades. Positioning for the latter, without focusing too much on any individual data point, is the best way to achieve financial goals.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)