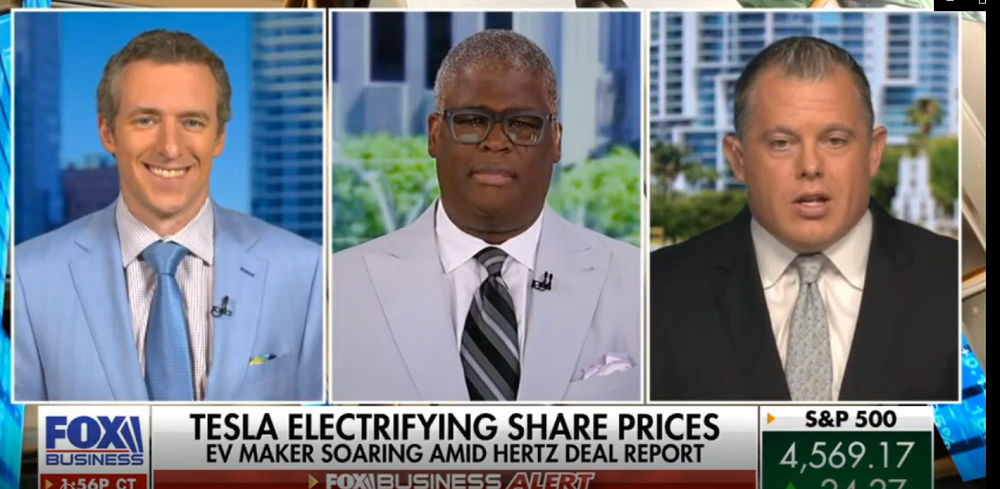

CIO Scott Martin Interviewed on Fox News 10.25.21

Program: Making Money with Charles Payne

Date: 10/25/2021

Station: Fox Business News

Time: 2:00PM

CHARLES PAYNE: All right, stop me if you heard this before, but Tesla is a stock of the day. I mean, it’s a top performer in the S&P 500, bringing a consumer discretionary to the top of the pack. Morgan Stanley up their target to twelve hundred. This after their hurts, they’ll want to bring in Scott Martin and Michael Lee to discuss Mike, you buying here in this on Tesla?

MICHAEL LEE: Well, look, it depends what your thoughts are on Tesla. Or if you’re a trader, I think you buy here and play the momentum. But you got to have an exit price mapped out because Tesla for years has had no correlation to any reasonable valuation. In my mind, it’s the original meme stock. And today there was a gamma squeeze combined with some fantastic news for them and the stock just exploded. If you’re a longer term investor. I’ll wait for some bad news to come out, which kind of invariably happens with kind of the National Transportation Board investigations of the company, the Elon’s propensity to over promise and under deliver. So I think if you want to be a long term investor, you wait to get in. I think if you were a trader, you could probably make some fast money on the back of this momentum

PAYNE: And so interesting with all of that. And then that’s sort of been the backdrop for the last half dozen years. It’s a trillion dollar stock, and Elon Musk is by far now the richest person on the planet. You know, Scott, when reminds me of is, I think about all the people who stopped out of this stock over the years. And I think there stocks that you have, regardless of how volatile they are, no matter what you plan to hold, you’re going to hold and you’re not going to let volatility get you out of this stock because I’m pretty sure I’ve been stopped at a Tesla in the past.

SCOTT MARTIN: Yeah, for sure, and I think like like Mike said, you know, it’s stuff that kind of has become meme ish. I guess if that’s a word, you know, stocks that have gotten this fanfare and then just been pushed down because of of things surrounding the company, I mean, Facebook, certainly one of them over the years, things like AMD to, you know, where have they just been slammed because of supply issues and other things a couple of years ago with respect to product development or product completion? So I think the intersting thing on Tesla for me, Charles, just quickly is that for me, it’s actually not really a trade right here. I think it is a good long term investment. I think the stock’s pretty much overdone considerably here to the upside, at least short term. But gosh, this is still to your point, a story of Tesla that’s maybe, you know, rags to riches or Ali to the highway with respect to how the stock has done. And I think it’s a great company owned for the future, but for many, many years in the future as well.

PAYNE: I think if you think of it that way, then you won’t get shaken out. You won’t get spooked out on those periodic air pockets that it does it. Let’s talk about Facebook, guys, they report after the close. It’s just simple, Mike. Buy, sell or hold? I mean, where are you on this stock right now?

LEE: Yeah, I buy this into into the close, and then if if for whatever reason, it sells off more tomorrow, I buy more. I think a lot of these names tend to go into going to earnings calls with enormous expectations. I don’t think that’s the case for Facebook. I think there’s a cloud over it. I think they’re going to blow through it. But on the odd chance, something on the call spooks investors, I’d be adding more.

PAYNE: Scott?

MARTIN: Yeah, I think Mike’s right expectations have come down a bit, which is good. You’re going to get a great opportunity to pick up some of these names in tech land this week, and I do believe that the one thing that could surprise investors and analysts if they do start talking about maybe ameliorating some of those security issues are some of the content issues that have been plaguing them for the last few months. So that was what I’d be kind of concerned about. If you’re not in the stock here and looking to buy it after earnings, because you may get some of that news.

PAYNE: In your mind, what would it be better to do? Buy it now before the close or wait until after the numbers come out and then look at it in the morning?

MARTIN: I’d buy it before the close

PAYNE: And real quick got, let’s say, a minute ago, is there something that might that people should be in this week before they report?

LEE: Besides Facebook, I don’t think so, a lot of these big fake names have a tendency to sell off fast and hard after their earnings, basically something on the call spooks investors. And that’s the time you want to add them because by the next call, they’ve almost completely recovered.

PAYNE: And to that point, you could have bought Netflix on temporary weakness last week and Tesla on a little bit of weakness for a brief moment. Last week, Scott Michael, thank you both very, very much.