Portfolio Manager Insights | Weekly Investor Commentary - 9.29.21

Click here for the full commentary.

Partisan drama is once again center stage as the debt ceiling deadline approaches. Although this has become a regular occurrence in Washington, many investors are still understandably nervous. While it’s unclear how this will play out over the coming weeks, especially as ongoing debates over $4.5 trillion in new spending proposals continue, the fortunate news is that financial markets are taking these events in stride. History shows that investors who are able to stay focused through periods of political and fiscal uncertainty are better positioned to achieve their financial goals.

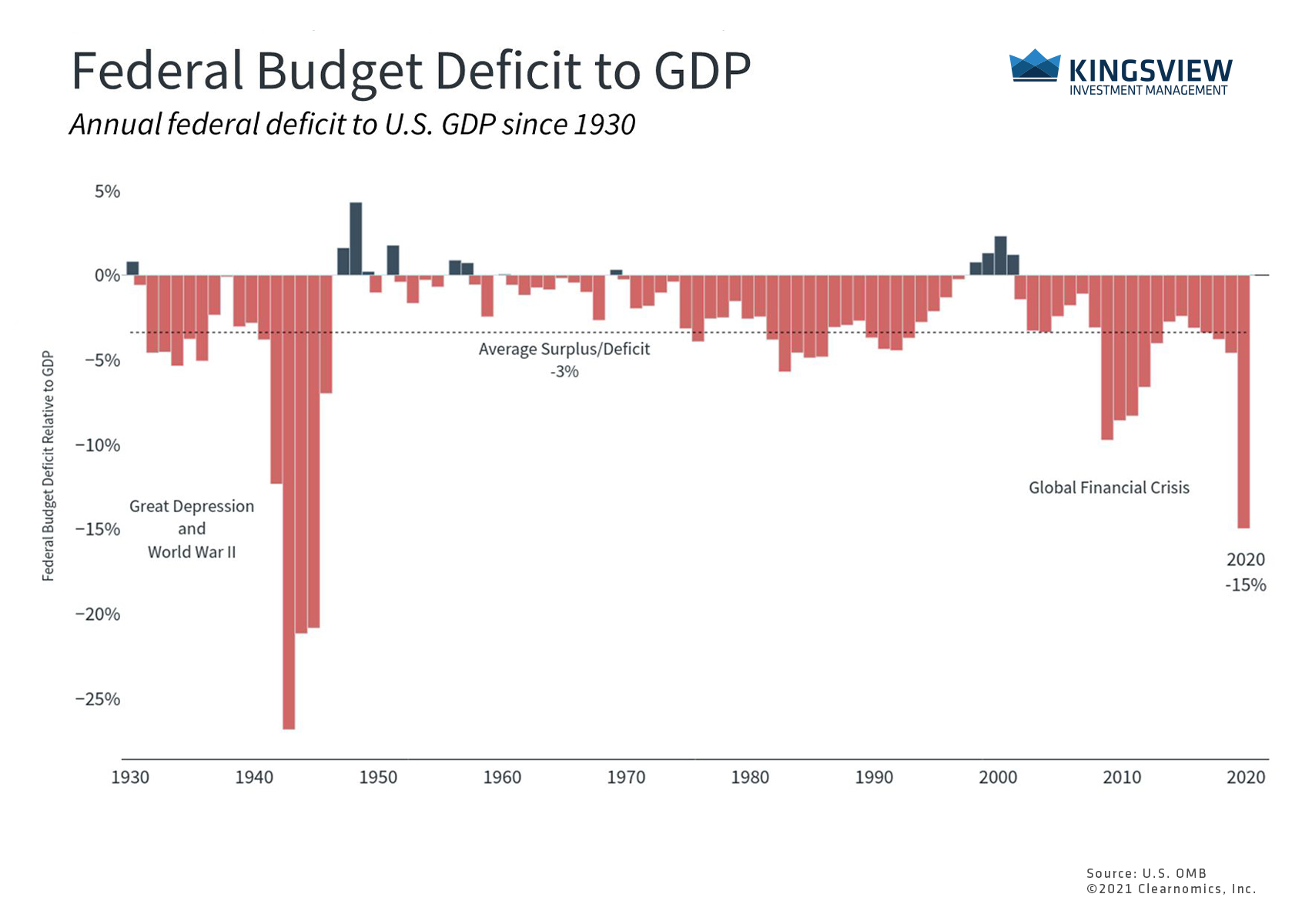

Regardless of how the current episode is resolved, this is unlikely to be the last debt ceiling debate. The debt ceiling was intended to be a way for Congress to revisit the size of the national debt periodically. By limiting the ability of the Treasury to borrow new funds, politicians are forced to acknowledge and address the level of the federal deficit by voting to raise it.

The federal debt is approaching the debt ceiling

KEY TAKEAWAYS:

KEY TAKEAWAYS:

- Congress will need to approve an increase to the debt ceiling soon. This has accelerated in importance due to emergency pandemic spending and increases to the federal budget.

- Without a raise to borrowing limits, the Treasury will need to enact “extraordinary measures,” including a government shutdown, in order to keep paying the bills.

However, this also prevents the government from paying its bills. Thus, the real problem is simple: the spending that causes the government to reach the debt limit has already been approved via the budget. This is akin to signing the papers for a new luxury car then requesting an increase to your credit card limit when you receive the bill. For most of us, the decision to buy something can’t be separated from whether and how we will pay for it.

It’s important for investors to distinguish between their political feelings on government spending and how they manage their portfolios. Given that this is how the system works, what matters to long-term investors is whether a game of fiscal chicken will spill over into financial markets – even if the government does not default on its debt.

Even in 2011, markets recovered quickly

KEY TAKEAWAYS:

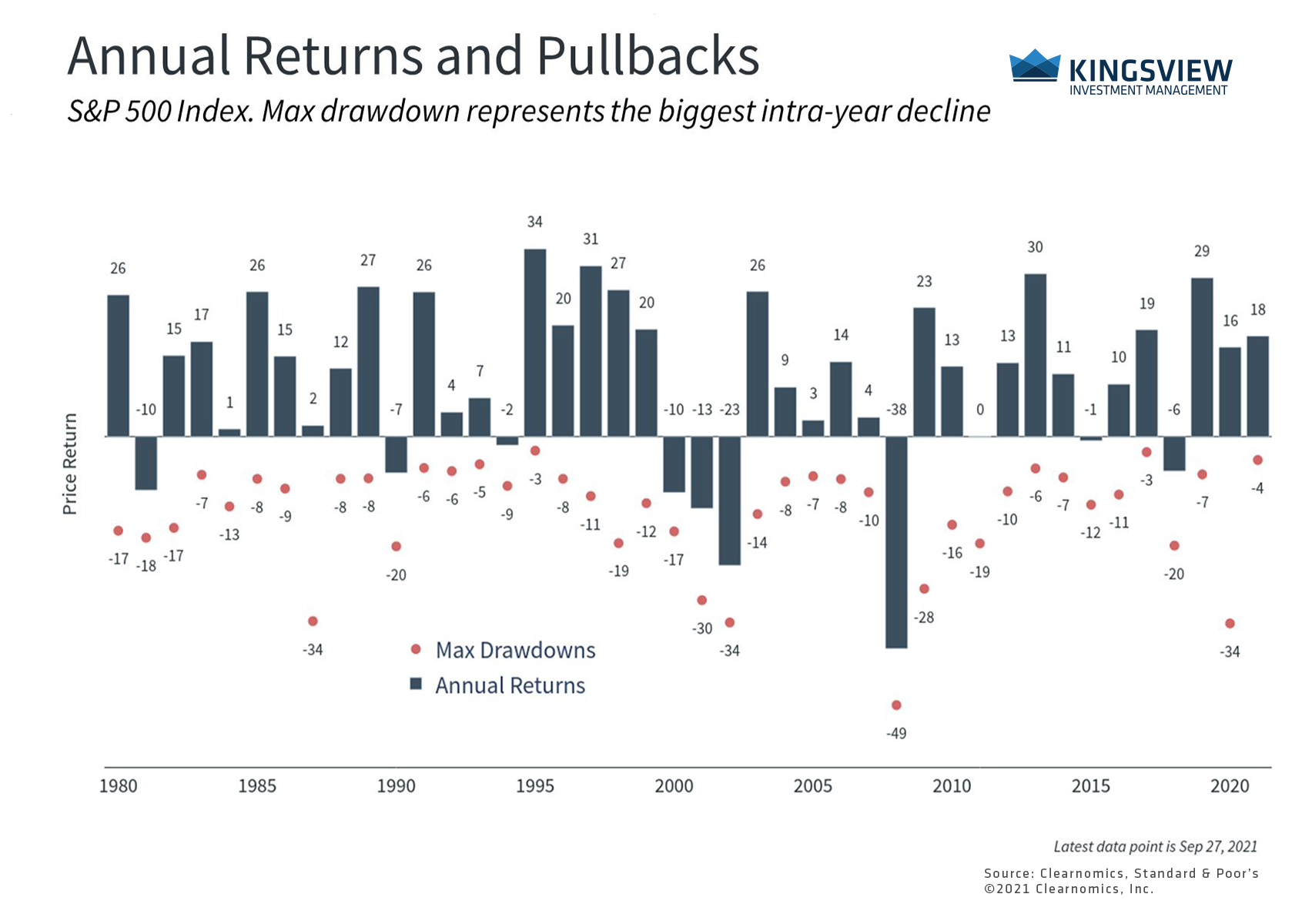

- This last affected markets in 2011 when the debt ceiling debate resulted in the downgrade of the U.S. debt.

- This rattled markets and led to a 19% decline in the S&P 500. Although the index was flat for the year, markets recovered within months and generated a strong return the following year.

This is what occurred in 2011 when a political standoff around the debt limit led Standard & Poor’s, a credit rating agency, to issue a warning and then to subsequently downgrade the U.S. debt. Over this period, the stock market fell into correction territory with the S&P 500 declining 19%. Ironically, the prices of Treasury securities increased during this period. Even though these were the exact securities being downgraded, investors still believed they were the safest in the world at a time of heightened uncertainty. Thus, they helped to balance portfolios even in extraordinary times.

Ten years later, this is still held as the worst-case scenario for problems in Washington affecting markets. As unfortunate as this period of brinksmanship was, markets eventually recovered, as they tend to do. The S&P 500 returned to its all-time high about four months later, despite on-going challenges related to the global financial crisis and eurozone debt crisis. Debt ceiling debates since then have resulted in much less market volatility despite anxiety and headlines.

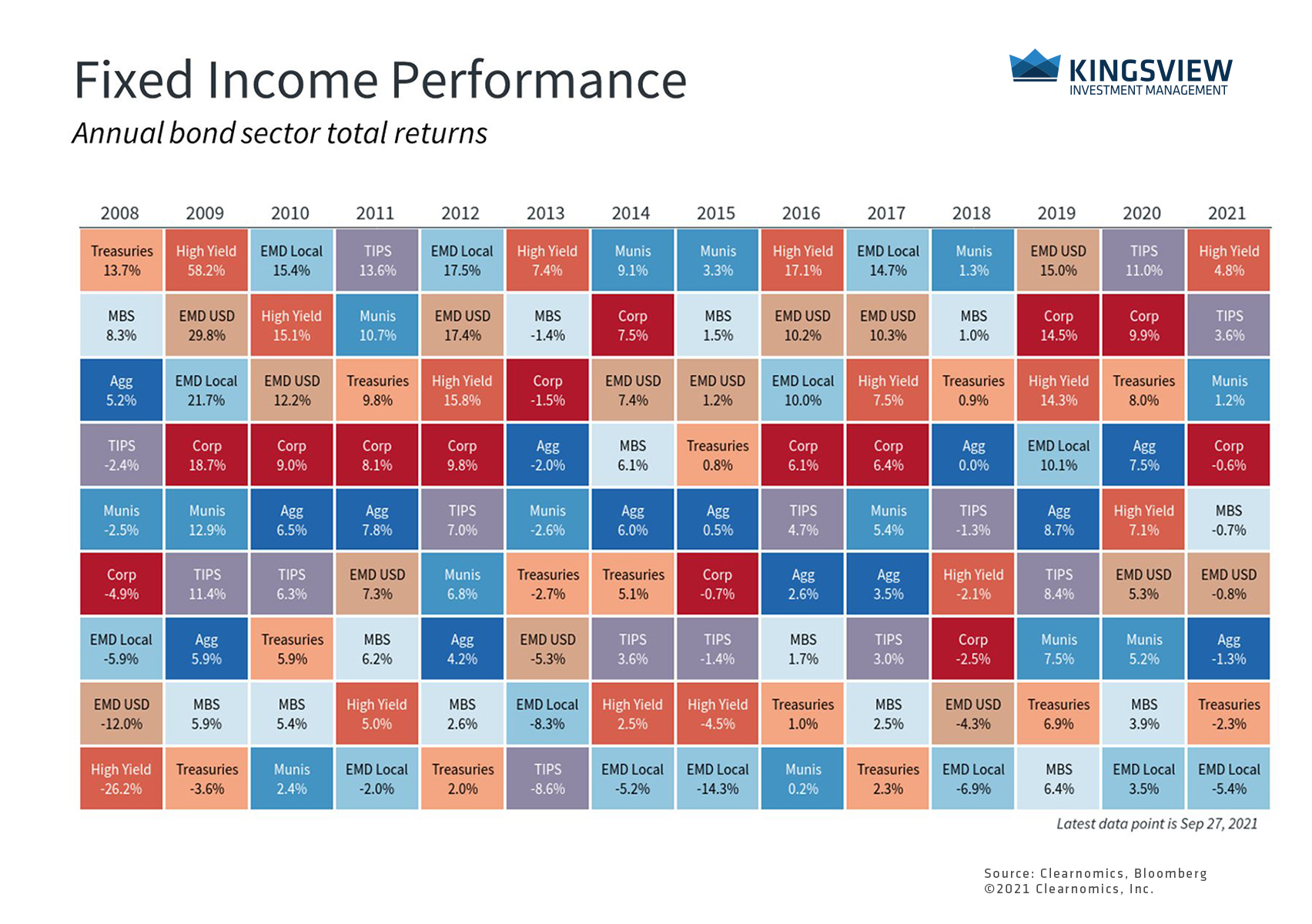

Fixed income fared well during the 2011 debt ceiling crisis

KEY TAKEAWAYS:

- Fixed income securities also helped to balance portfolios in 2011, as they often do during times of market stress.

- This has been true even when interest rates have been low, such as during the COVID-19 pandemic.

Thus, while investors can’t control what happens in Washington, they can control how they react to headlines as they manage their portfolios. Political events, more often than not, serve only as distractions when managing toward financial goals. Even when they do result in market volatility, stocks have tended to recover quickly.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)