Portfolio Manager Insights | Weekly Investor Commentary - 8.11.21

Click here for the full commentary.

Anyone with a driving commute knows to expect unforeseen events such as traffic, construction and detours. Even when the destination is certain and you arrive on-time, it’s never clear what may happen along the way. Similarly, most investors know that while markets and the economy tend to rise over long periods of time, they can fluctuate wildly over days, weeks and months. New data and events cause them to zig and zag as they adjust, usually without notice.

However, the sharp economic recovery has defied this rule with the S&P 500 gaining 18% year-to-date and the economy growing at the fastest pace in history. This sudden rebound may create unrealistic expectations as the business cycle reaches a steady expansion, even if markets rise for years to come. How can long-term investors maintain perspective over the coming years?

75% of the jobs lost during the pandemic have been regained

KEY TAKEAWAYS:

KEY TAKEAWAYS:

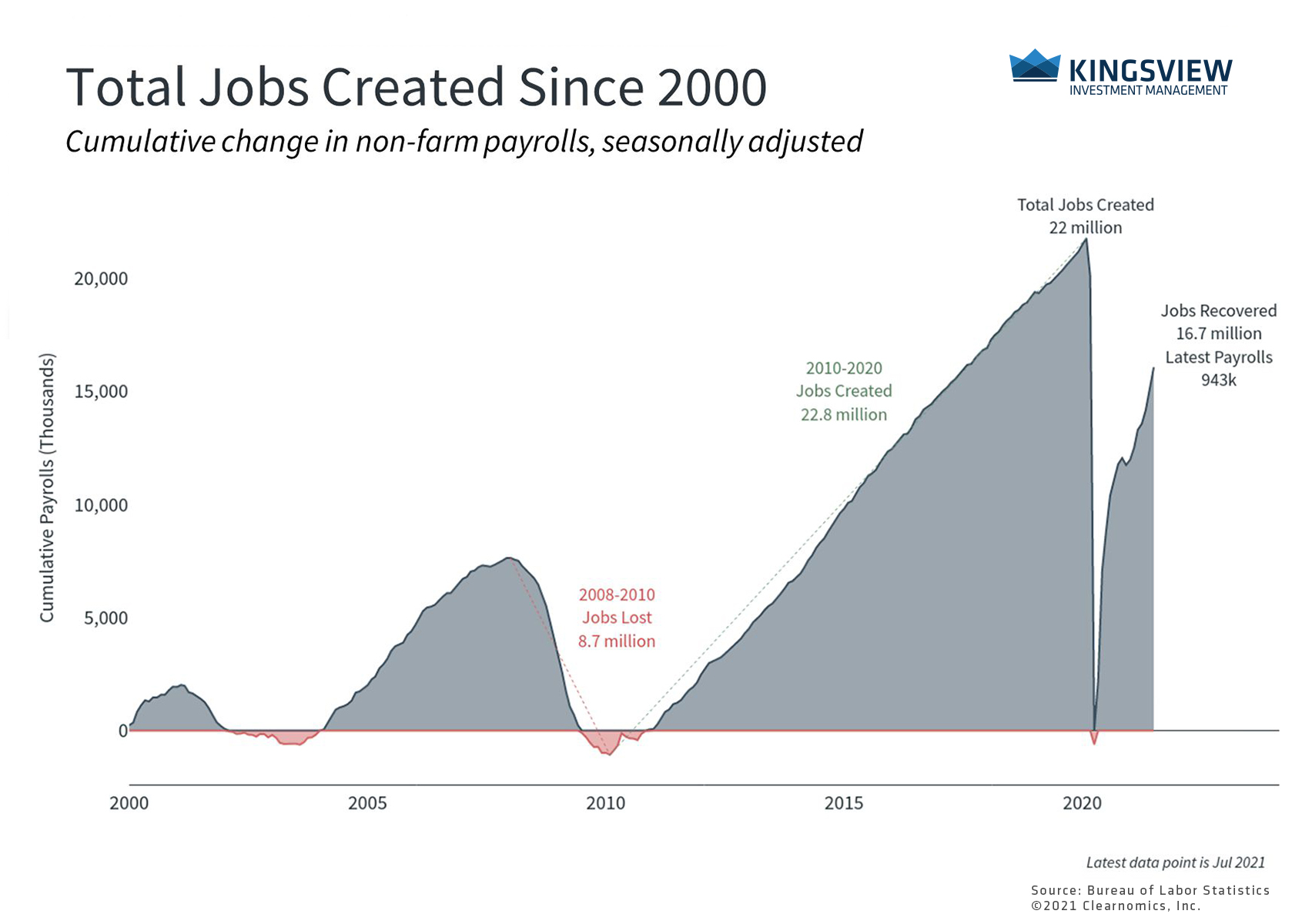

- The July jobs report showed that 943,000 jobs were added during the month, pushing the number of jobs recovered to 16.7 million.

- About 75% of the jobs lost last year have been recovered.

It’s important to acknowledge how robust the recovery continues to be despite a variety of concerns. Last week’s strong payrolls report showed that the economy added 943,000 jobs in July and the unemployment rate fell to 5.4%. This is a significant decline from last April when the jobless rate hit 14.8%. With these gains, which are consistent with those seen over the past year, nearly 75% of the jobs lost during the pandemic have been recovered.

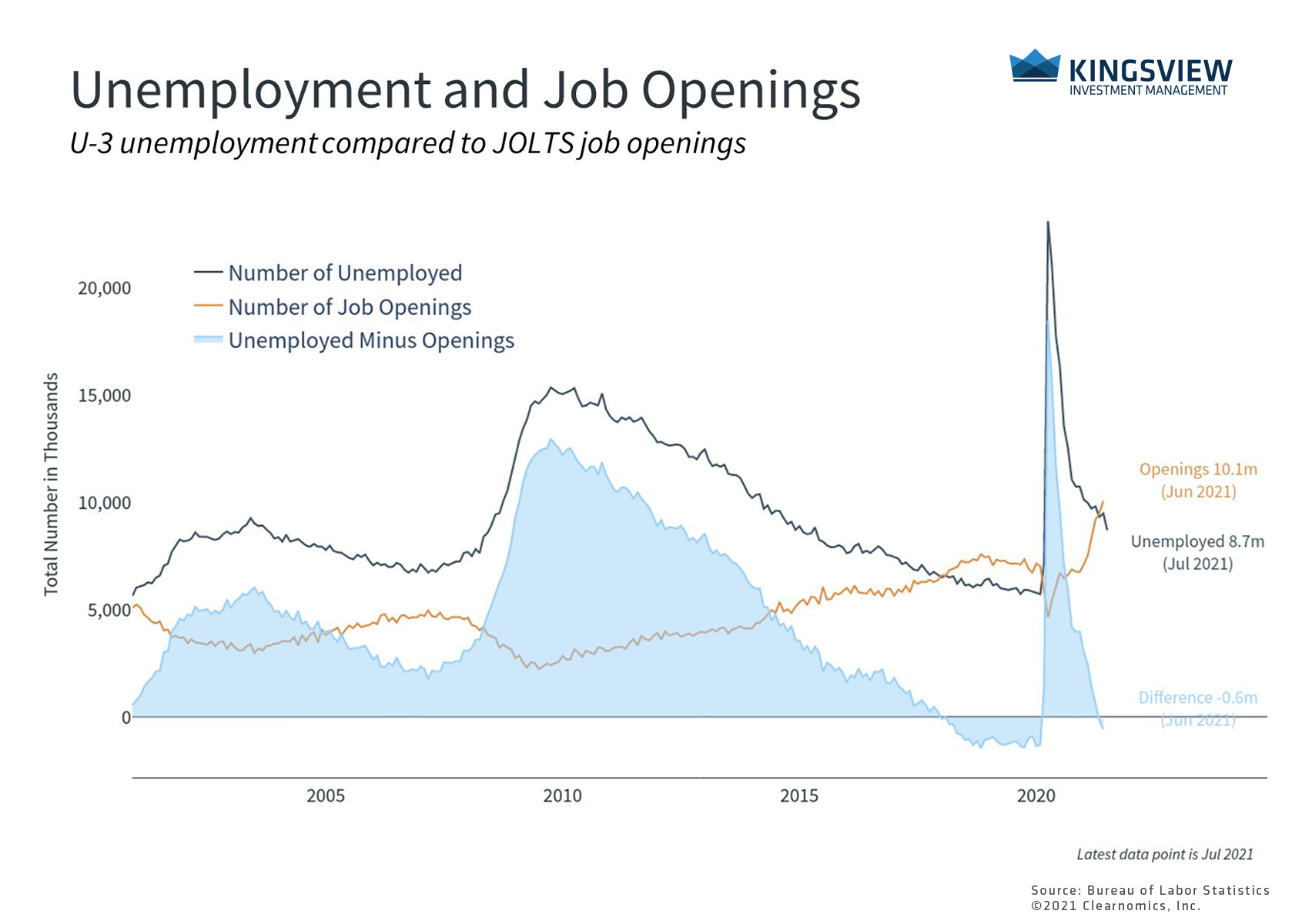

The fine print is that these data are based on surveys taken before rising delta variant concern. However, it’s still the case that there were over 10 million job openings across the country, eclipsing the 8.7 million people counted as unemployed (not including those who have dropped out of the labor force). This may be due to worker skills, geography, and expanded unemployment benefits.

There are many more job openings than unemployed

KEY TAKEAWAYS:

- There are many more job openings today than unemployed individuals. Over time, this gap could shrink as companies find qualified workers, individuals move to new cities for opportunities, and those who had given up re-enter the workforce.

- Expanded unemployment benefits may also be playing a role in keeping jobs vacant.

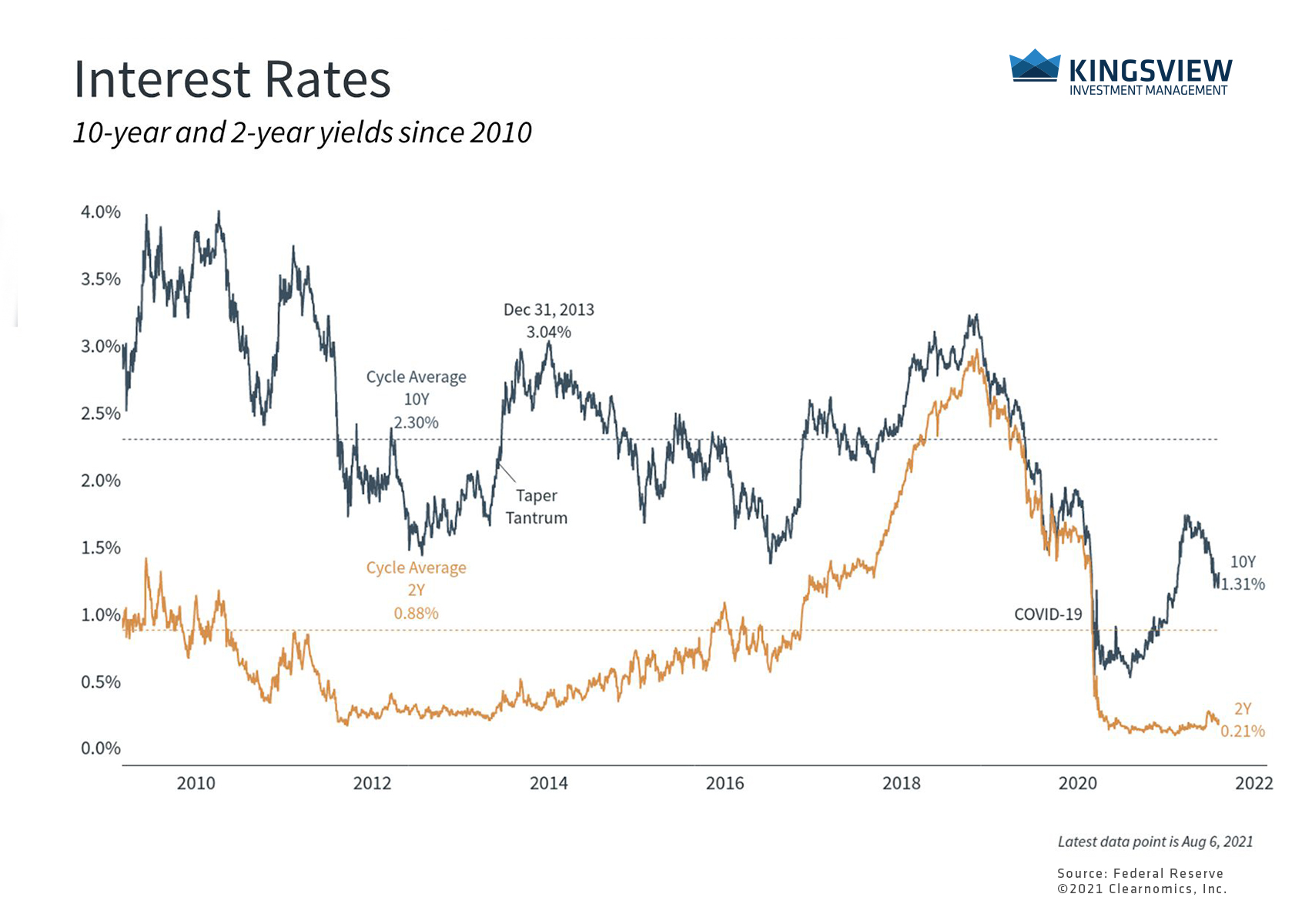

Despite the strong data, some investor expectations have already been called into question. Interest rates, for instance, spiked during the first quarter of the year as many expected interest rates to rise steadily until the 10-year Treasury yield reached 2%. As is usually the case, this straight-line increase failed to materialize and interest rates fell throughout the second quarter. Since then, many rates have stabilized and have resumed rising again following positive economic news.

There are other areas in which investors expect sharp increases month-after-month and quarter-after-quarter, across GDP, inflation, corporate earnings, and market returns. Investors should expect economic data, including monthly payroll numbers, to decelerate over time. Not only is this natural during this phase of the business cycle, but many investor and economist expectations may be too lofty after a string of historic numbers.

Interest rates have stabilized and have begun to rise again

KEY TAKEAWAYS:

- Interest rates, which declined throughout the second quarter, stabilized after last week’s jobs report.

- It’s possible that rates continue to rise over the coming quarters as we enter the later stages of the recovery and the Fed discusses tighter monetary policy.

Similarly, it’s unrealistic to expect market prices to accelerate indefinitely. Markets have been exceptionally calm this year, despite a variety of concerns and the feeling of uncertainty. Investors should always be prepared for volatility, especially when few are anticipating it.

To be clear, this doesn’t mean that investors should be fearful of the market – far from it. Instead, they should continue to hold balanced portfolios that can help steer them through all phases of the cycle. In doing so, investors can increase the likelihood of reaching their destination without worrying about the bumps along the way. While investors should be grateful for the strong economic recovery, they should also maintain reasonable expectations while staying properly diversified.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)