CIO Scott Martin Interviewed on Fox Business News 7.28.21 Pt. 1

Program: Cavuto Coast to Coast

Date: 7/28/2021

Station: Fox News Channel

Time: 12:00PM

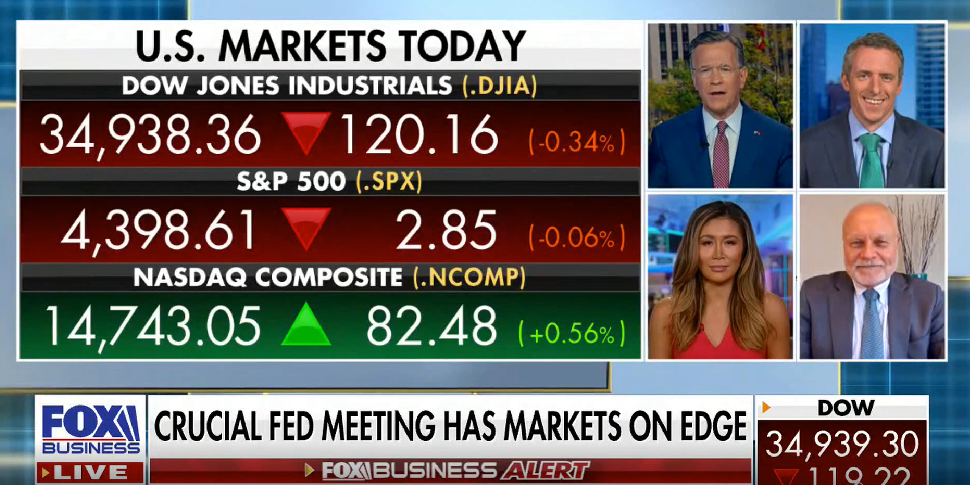

DAVID ASMAN: But first, inflation and inflation, is it permanent or transitory? That is the question the Fed is debating as we speak right now. We’ll hear about their decisions coming up. But markets are on edge, waiting to hear whether the central bank will pull back on its money printing sprint. Our all star panel is here, Kingsview Asset Management CIO Scott Martin, Fox Business correspondent Susan Li, and Through the Cycle, president and founder John Lonski. A great panel. Thank you all for being here. So, Susan, what are the markets expecting? They seem not to not to be too certain about what’s going to come up.

SUSAN LI: Yeah, well, what does transitory mean? Because before you’ve heard the Federal Reserve say maybe two to three months and now is it for the rest of this year? We know that inflation has run hot now for the past three months. You have a five percent increase in prices, consumer prices, the fastest, two thousand eight. So I guess the discussion is when do they take away the punch? Bowl is a twenty, twenty two. And then do you get the first interest rate increase in twenty, twenty three? I think the markets are passing and looking for some sort of wording from Jay Powell later on today.

ASMAN: Scott, which way. You bet.

SCOTT MARTIN: Expecting not much, David, actually, I think the real news is going to come out in the Jackson Hole meeting in a few weeks here, but I’ll tell you what else is going on here, David, is you talk about this transitory notion of inflation. Susan’s right. The setup is exactly correct. It was a couple of months and now it’s several months. And as long as they keep using that word along the line, I guess it’s still transitory. And I’ll tell you, interest rate projections are hard to handicap right now because we’ve got softening economic growth coming down the pike here in Q4 and Q1 of next year, which probably puts off the rate hike at least another six months into two thousand twenty two.

ASMAN: Well, John, earnings, of course, are looking in the rearview mirror, but we have these spectacular earnings yesterday, almost 60 billion dollars between three companies, Microsoft, Apple and Google or Alphabet, as it’s now called. So you had these spectacular earnings from the high tech companies. You still have a lot of demand out there. There’s this pent up demand. People with a lot of cash, they want to spend it. But you have a labor shortage. You have you have inflation. You have certain pushbacks on supply, supply chain, mess ups and and strangulations going on. So. So what’s your bet on what the economy is going to be doing in the months to come?

JOHN LONSKI: I think the economy’s going to slow down. We have had a number of downward revisions for predictions of economic growth during the second half of this year. You know, we had, for instance, GDP now by the Atlanta Fed earlier. They thought that the second quarter and we’re going to get a report tomorrow on second quarter GDP, the second quarter GDP growing by something faster than 10 percent. Since then, that forecast has been lowered to seven point four percent. Basically, David, what is happening is that price inflation, higher prices are beginning to take their toll of household expenditures. The best example, housing. New home sales in June were a disaster, down nearly seven percent monthly, down 19 percent from a year ago, despite still very low interest rates. I think the Fed is quickly finding that it’s going to be between a rock and a hard place. If it hikes rates to try to cool inflation, it will hurt the economy. If it does nothing faster, price inflation will lead to pullbacks by consumer spending.

ASMAN: But, Susan, they’re going to have to rewrite their mandates, if that’s true, because they have two major mandates. One is for price stability. As we talked about, there isn’t much price stability right now. Inflation is going up. There are even signs that it could be double digit next year if if that’s conceivable that we could go back to the late 70s. And the second mandate is on unemployment. Well, we have nine point three million unfilled jobs. Yes. They might not be paying as much as the government is for unemployment benefits. But the point is we don’t have an unemployment problem right now. So is the government just getting in the way

LI: And finding the workers to fill those jobs? And they also say that there’s a Fed put out there being that there’s a third mandate, which is to protect the stock markets, because a lot of people on Wall Street says that if we see the stock market fall 10 percent, you bet the Fed will step in at some point, as we saw in the depths of March last year, which they should have done. But, yeah, there are concerns that right now maybe the economy is running too hot. There are a lot of jobs out there, not the right people to fill it. And maybe it is time to take away the punchbowl. Now, if you take away stimulus, it doesn’t mean you can’t be reinstated once you see some sort of slowdown or some sort of hiccups in the economy.

ASMAN: But but but right now and again, Scott, it has to be the last word. I’m sorry, John. We’ll get back to you. We’ll start with you the next round. But but the fact is, is that we have the government just getting in the way of this amazing emergence from from all of the lockdown’s, which was creating all this spectacular growth. I’m wondering if the government is causing more problems than they’re solving right now

MARTIN: For sure, David. And creating new problems every day. It’s the classic case of government knows best. Government knows how to do best with your money, not you, yourself, the business owner or the spender. And that’s really where I think we’re at this crossroads here, because the Fed has done what they needed to do. The government has gotten in the way and created more inflationary pressure. And they seem to keep doing that with some of these crazy spending packages that have yet to be passed through Congress.

ASMAN: A panel this good should not be missed in their second round, which is coming up later in the hour. Good to see you guys.