Portfolio Manager Insights | Weekly Investor Commentary - 7.14.21

Click here for the full commentary.

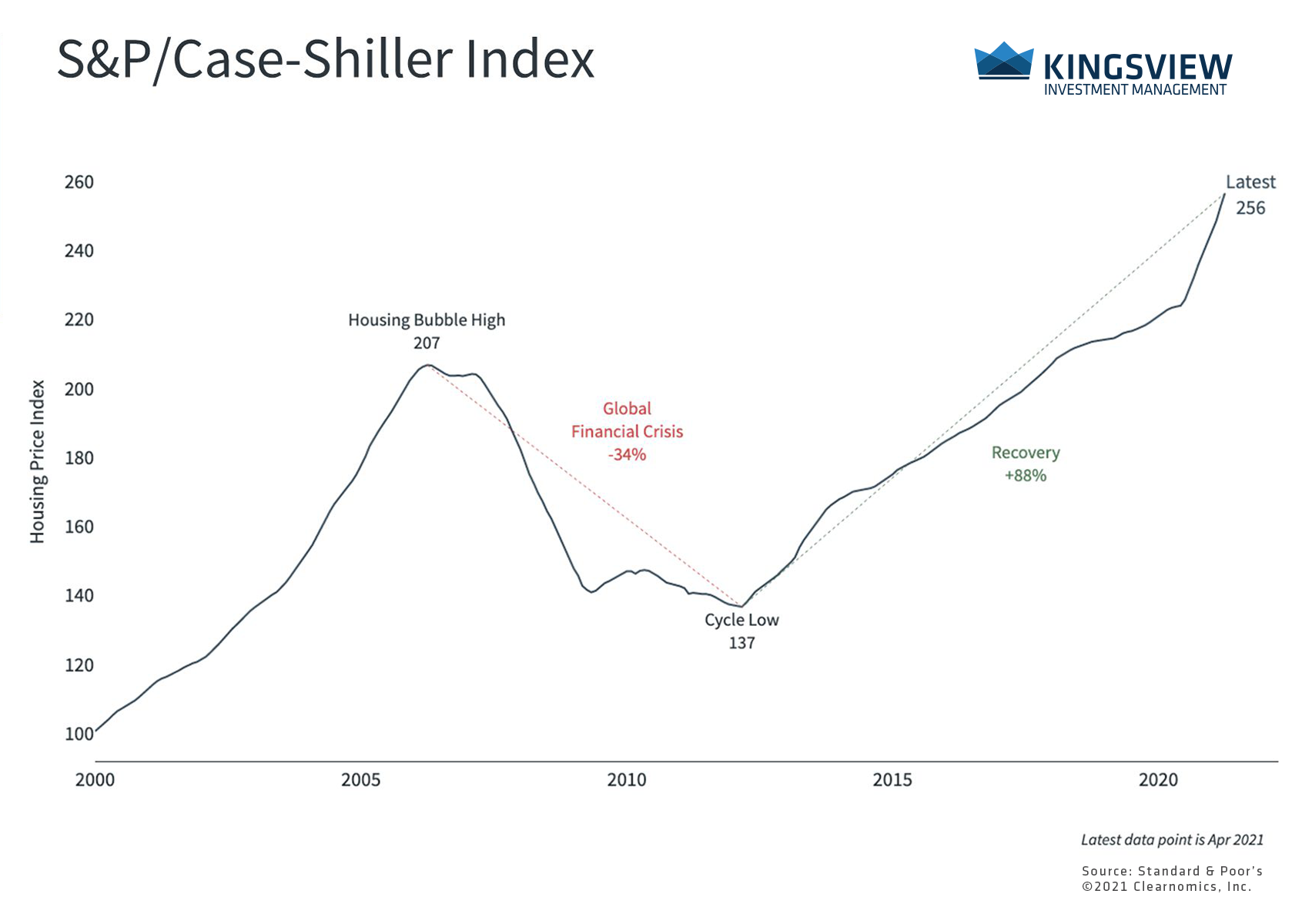

The housing market continues to heat up alongside the post-pandemic boom. The limited supply of homes, historically low interest rates, rising financial asset prices and other factors have created a sense of urgency among many to buy new homes and list their existing ones. As the market further eclipses pre-2008 levels, how does this affect investors?

The housing market is both an income-generating asset class as well as a macro-economic indicator. Housing prices at all-time highs can bolster financial confidence and spur consumer spending in other areas, a fact often referred to as the “wealth effect.” That this is occurring while all financial assets are rising should not be a surprise, since the housing market is highly correlated with the stock market and other liquid sources of wealth.

Housing prices continue to break records

KEY TAKEAWAYS:

- Housing prices, as measured by broad indices such as the Case-Shiller index, continue to reach new all-time highs.

- This should be no surprise as financial liquidity searches for income-generating and inflation-protected returns. However, rising home prices can also feed back into financial markets due to the wealth effect.

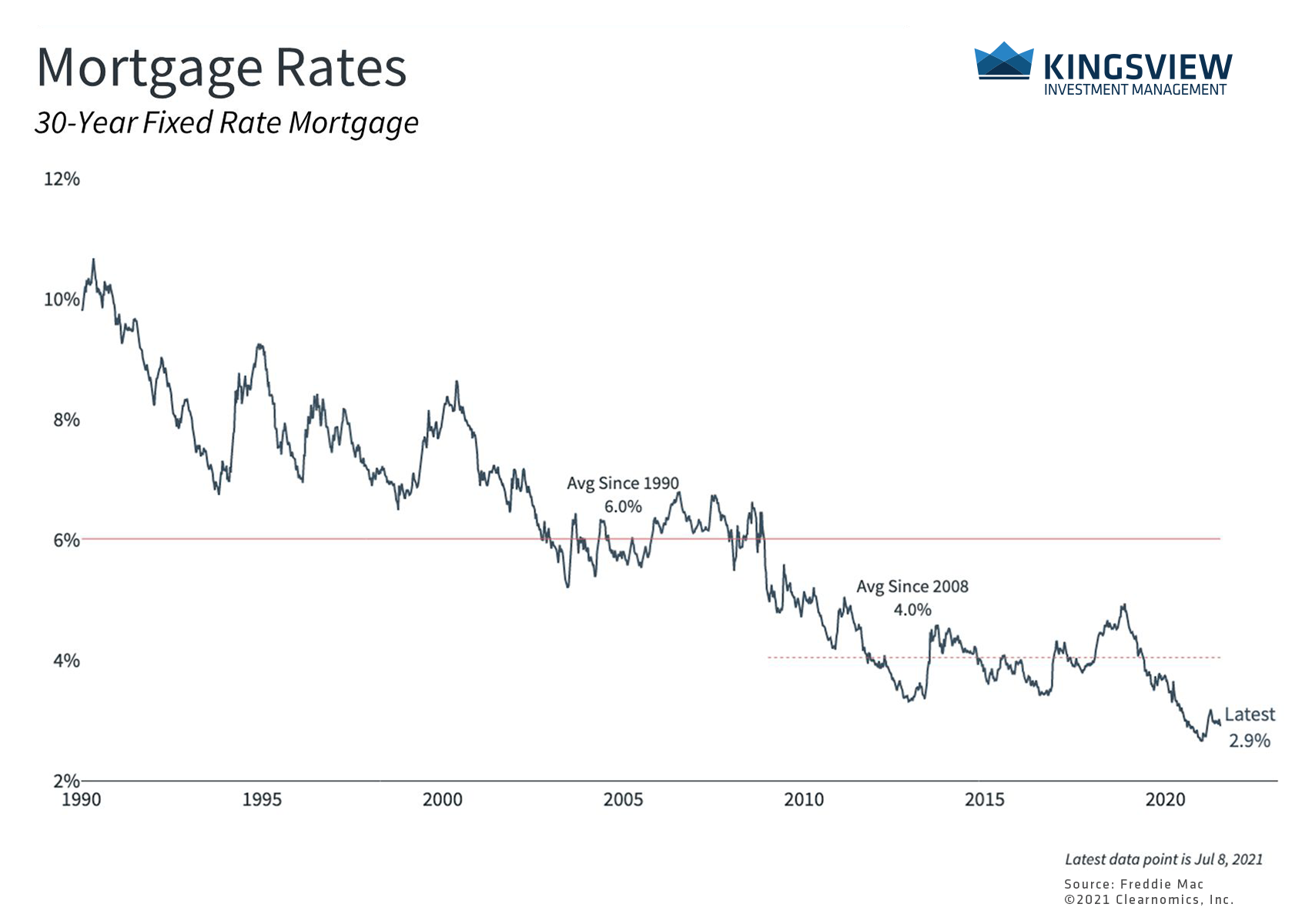

The fact that interest rates have fallen in recent weeks may continue to support prices too, whether or not the market needs the support. The 30-year Treasury yield, which peaked at nearly 2.45% in March, is now under 2%. The average 30-year fixed rate mortgage is still below 3% as a result. While both rates are well above their 2020 levels, they are still extremely low by historical standards. The Fed’s guidance that it may keep its policy rate at zero percent until 2023 only supports housing affordability further.

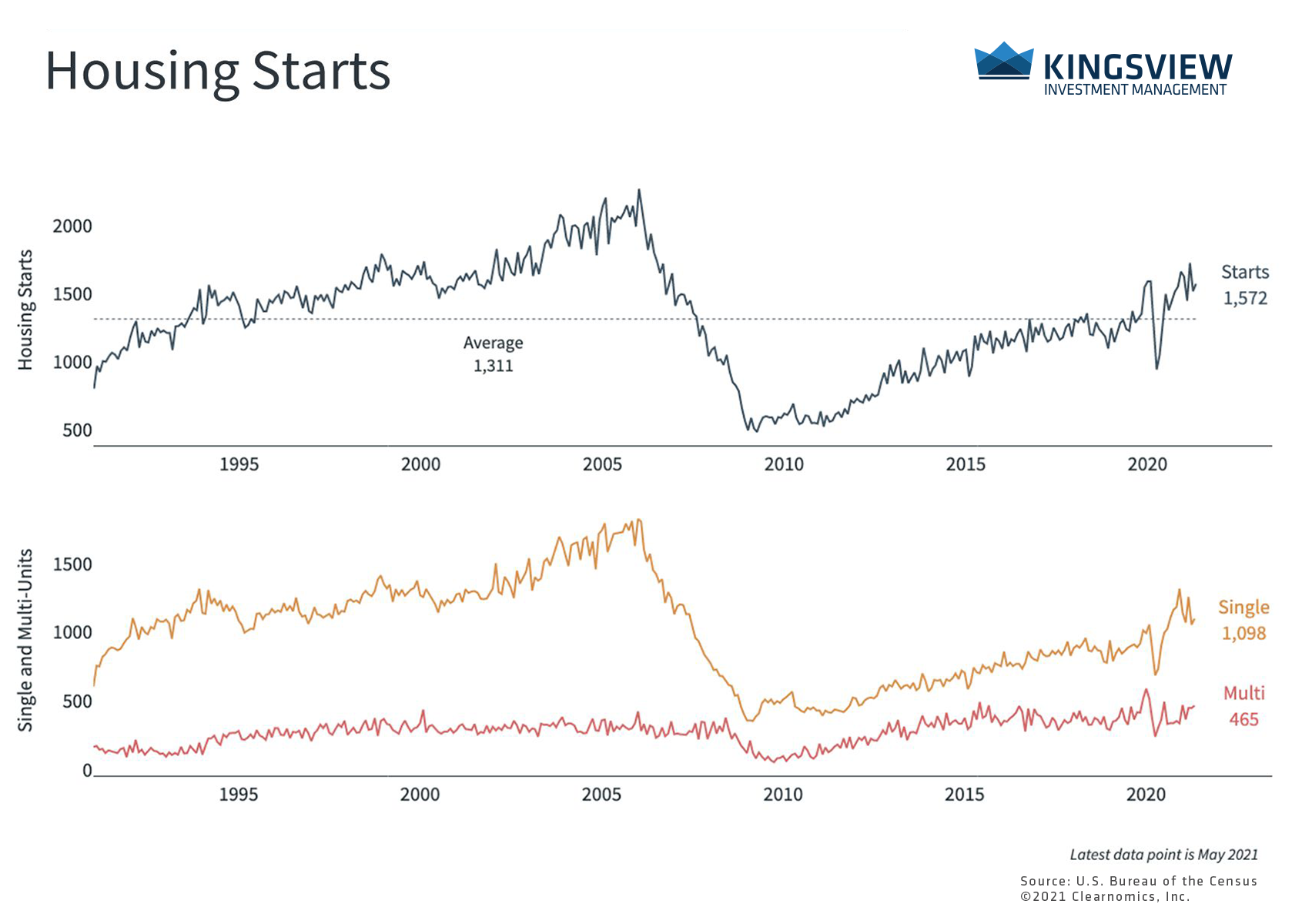

Homebuilding activity is attempting to keep up

KEY TAKEAWAY:

- With a limited supply of available homes for purchase, housing starts and new building permits have jumped. Over time, supply and demand may reach a better balance.

The risk of inflation may also be bolstering the market. As a traditional inflation hedge, real estate investment prices have soared this year. The S&P 500 Real Estate sector has generated a total return of 28%, beating the overall market during the recovery and ongoing rotation in sector leadership. It is currently the second-best performing sector year-to-date behind energy.

Mortgage rates are still near historic lows

KEY TAKEAWAYS:

- Despite higher interest rates this year, mortgage rates are still near historic lows.

- This increases the affordability of housing and can motivate buyers to jump into the market. The Fed’s guidance that it will seek to keep rates low until at least 2023 only fuels the market further.

Of course, where real estate and related stock prices go from here will depend on several factors including the supply/demand of homes, interest rates, stock market valuations and more. To date, not all assets related to real estate have benefitted equally. Lumber prices for instance, jumped to historic highs earlier this year but have since plummeted. And while the market is still hot in most parts of the country, this could also cool a bit after this initial phase of the recovery.

As always, this is a key reason investors should stay diversified and take a holistic view of their portfolios. The housing market has been a positive sign for the economic recovery and has likely increased the wealth of many on paper. The housing market is running hot due to a variety of factors. While this is a positive sign for the recovery and economic expansion, investors should continue to stay diversified.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)