Portfolio Manager Insights | Weekly Investor Commentary - 6.16.21

Click here for the full commentary.

PORTFOLIO MANAGER INSIGHTS

WEEKLY INVESTOR COMMENTARY | 6.16.21

Investment Committee

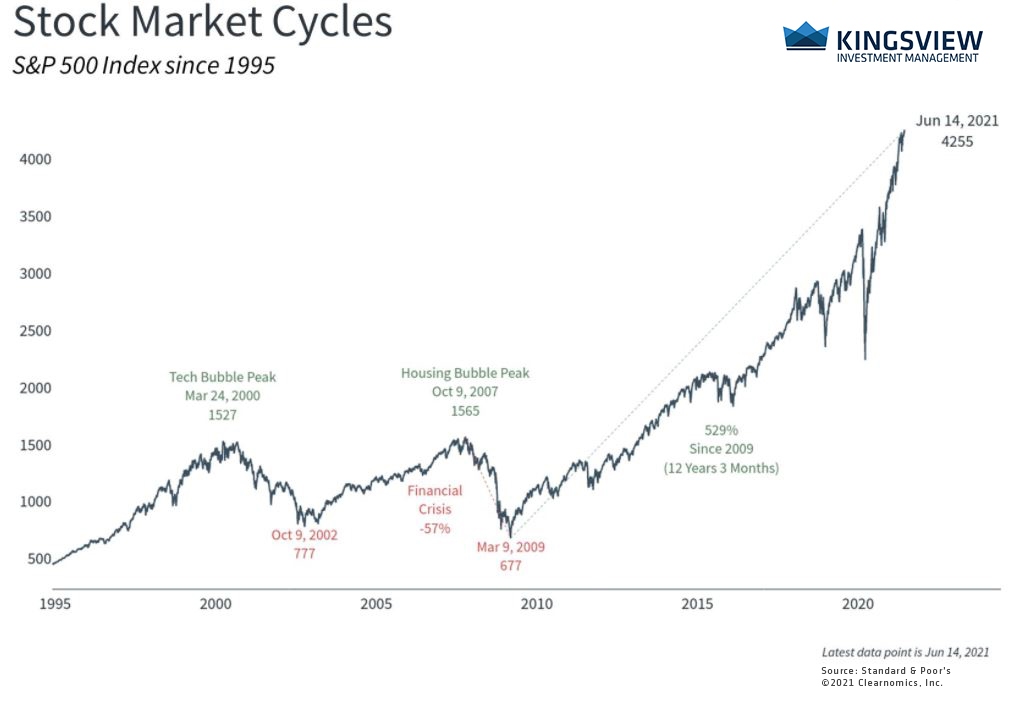

Last week, the S&P 500 reached another new all-time high while the NASDAQ and Dow Jones Industrial Average each finished within one percent of record levels. As the economy accelerates and corporate profits beat estimates, the stock market is adjusting quickly. In this environment, some investors may be enthusiastic about this momentum while others may be worried that stock prices have run too far too fast. How can all investors stay disciplined in this environment?

One source of investor concern arises from focusing too much on market prices and daily returns. While this information is easily accessible and widely reported, it does not tell the whole story. First, the fact that the stock market has risen does not guarantee it will crash in the near future. For instance, some may find it surprising that this is the 30th time the market has achieved a record level this year, while the biggest intra-year decline has been far below average at under 4%.

This is because, almost by definition, the stock market often spends most of its time at or near all-time highs as it rises during bull markets. There have been many periods when the market defied expectations for months or years, including during the decade after the 2008 financial crisis. Rather than try to avoid short-term market pullbacks, it is much more important to hold balanced portfolios that can withstand these stumbles.

THE STOCK MARKET CONTINUES TO REACH NEW ALL-TIME HIGHS

KEY TAKEAWAYS:

- The S&P 500 reached new record levels while the NASDAQ and Dow are following closely behind.

- While investors should always be ready for short-term pullbacks, the market can also defy expectations for long periods of time. Thus, staying balanced is often a better approach that trying to time the market.

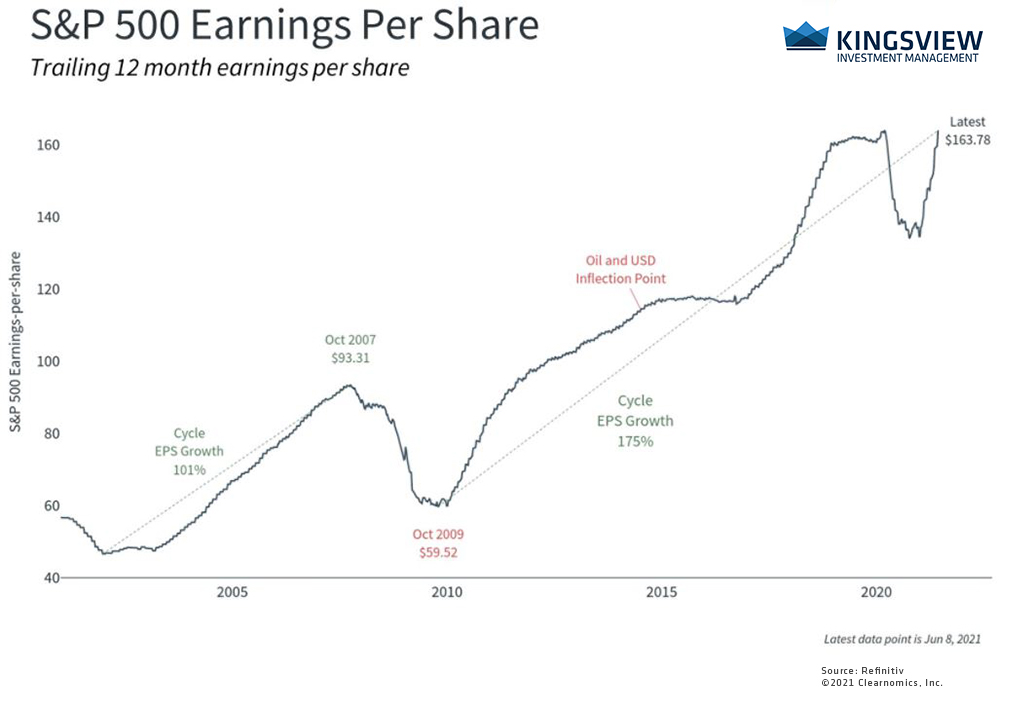

Second, what truly matters to investors is not what it costs to buy a share of stock, but what they get for that price. Stocks are one of the foundations of any portfolio because they provide investors with a “share” of corporate profits which tend to grow over time. Therefore, financial ratios such as price-to-earnings matter much more to investors since they show what it costs to buy a dollar of earnings.

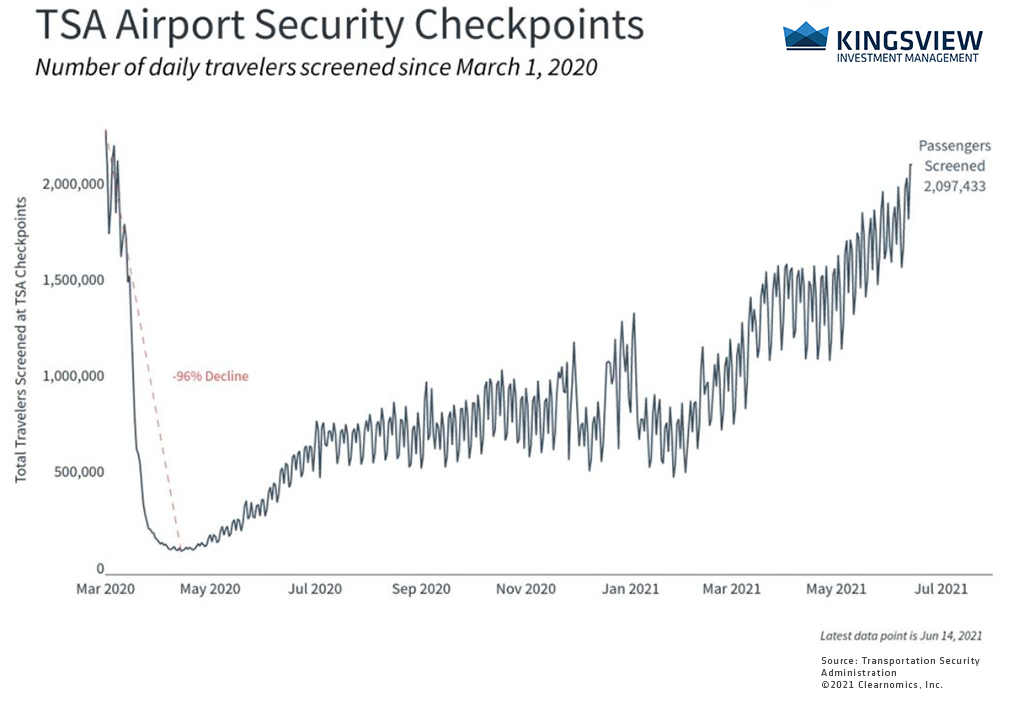

THE ECONOMIC RECOVERY IS ACCELERATING

KEY TAKEAWAY:

- Many measures confirm the ongoing economic recovery. Air travel is nearly back to pre-pandemic levels and restaurant activity in many parts of the country are nearing a full recovery.

At this stage in the recovery, corporate earnings have returned to pre-pandemic levels at least two quarters faster than originally expected. Consensus estimates suggest that earnings could continue to accelerate into 2022 as demand heats up, fiscal policy stimulates the economy and monetary policy keeps financial conditions loose.

CORPORATE PROFITS WILL SOON SURPASS PRE-PANDEMIC LEVELS

KEY TAKEAWAY:

- This economic rebound has driven corporate profits back to their 2019 year-end levels. Earnings are expected to continue to grow as demand heats up.

Finally, the stock market is forward-looking and incorporates new information quickly. Even if the market is not perfectly “efficient,” it is difficult to consistently guess what it will do next. Holding a portfolio that can balance risk and return – even when the market appears to be at a summit – is the best way to achieve financial goals. Investors should focus less on the price of the market than what they are getting for that price. Holding a diversified portfolio is the best way to take advantage of upside while protecting from downside risks.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021)