Portfolio Manager Insights | Weekly Investor Commentary - May 12, 2021

Click here to download the full commentary.

PORTFOLIO MANAGER INSIGHTS

WEEKLY INVESTOR COMMENTARY | 5.12.21

Investment Committee

As with many things in life, investing is often about managing expectations on the economy, markets and portfolio returns. Doing so can be challenging since strong market gains and solid economic growth can fuel even greater and eventually unrealistic expectations. At the same time, long-term investors understand that temporary market pullbacks and economic slowdowns are unavoidable. Preventing disappointment is often a matter of maintaining discipline and perspective as market expectations continue to rise.

Today, after a red-hot economic rebound and stock market rally, there are certainly high expectations across the entire investment landscape. For instance, last week’s jobs report severely missed economist projections. It showed that 266,000 jobs were created in April when consensus forecasts were for one million, while the unemployment rate ticked up slightly to 6.1% when many expected it to fall to 5.8%.

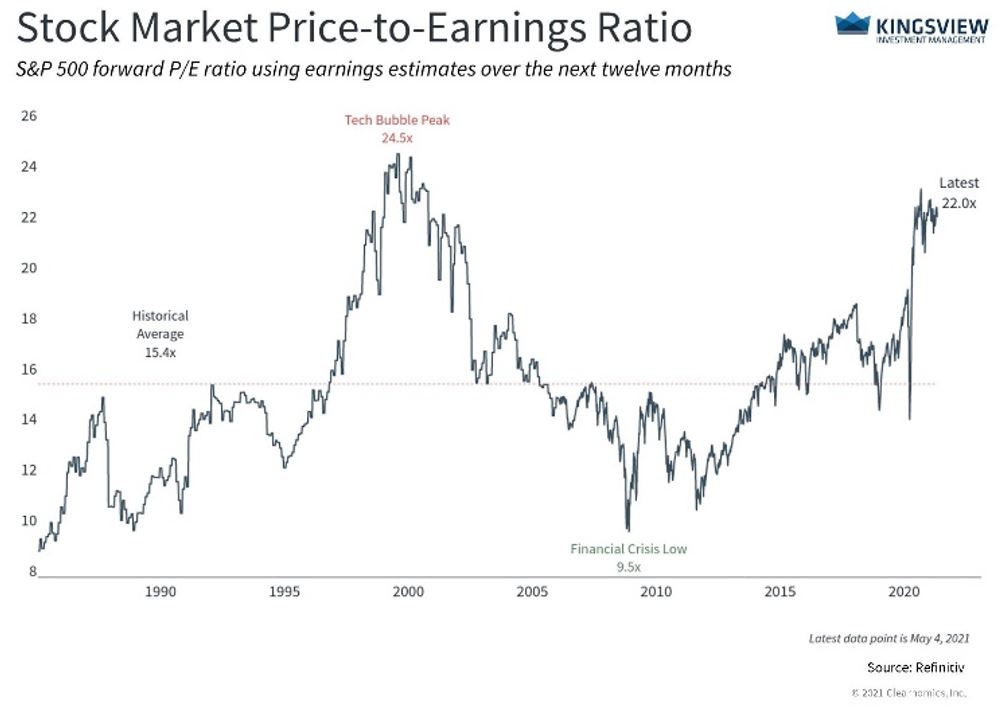

The glass-half-empty view is that the economy is not nearly as robust as many had hoped. After months of stellar economic reports – some showing the fastest growth in decades – investors have come to expect business activity and the stock market to grow at a feverish pace. If growth is weaker than anticipated, this could mean that corporate earnings expectations are too lofty and stock valuations are even more expensive than they already appear to be.

All of this is certainly possible after an extended bull run. However, there is also a simple glass-half-full view: over one million new jobs were created in just two months. During the last economic cycle this would have taken nearly six months to achieve.

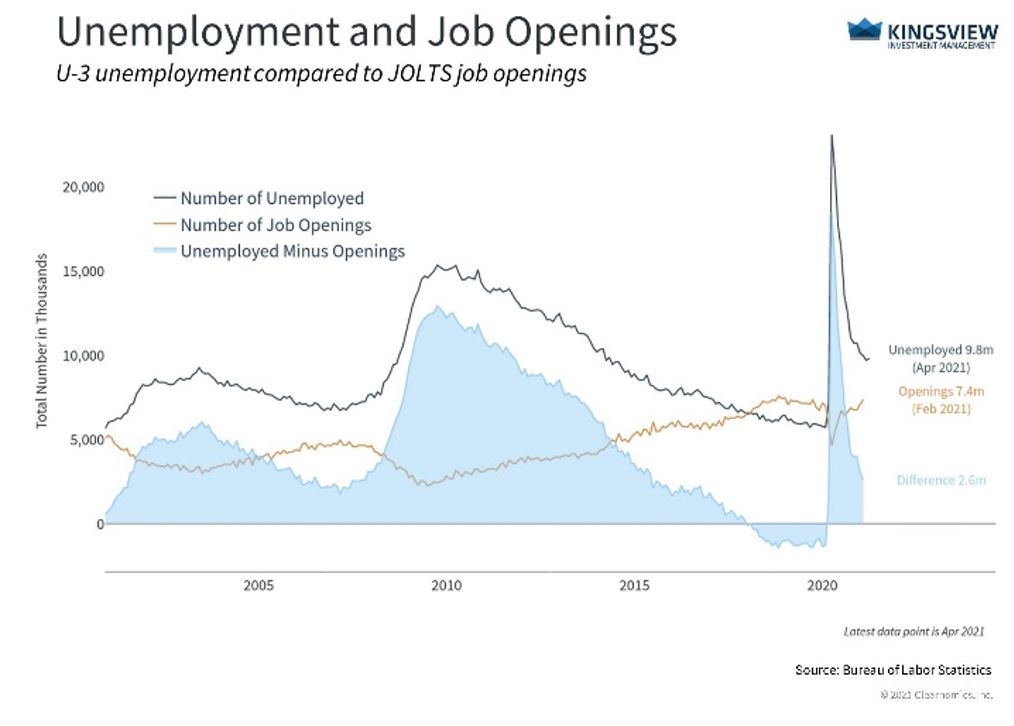

There are millions of job openings despite high unemployment

KEY TAKEAWAYS:

1. At the moment, there are over 9.8 million Americans unemployed even though job openings are close to historic highs. Not only does it take time to vet and hire workers, but there may be a mismatch between the skills and backgrounds that businesses need and available candidates.

2. This is not just in sectors such as tech but is true across the board from truckers to warehouse workers. Naturally, this places a speed limit on hiring activity that is separate from the natural economic recovery.

Just a year ago, during the depths of the economic lockdown, it was unclear whether jobs would return at all – or if there would be irreparable damage to the economy. And while there will certainly be scars left from this experience, especially for individuals and households whose financial and job security were directly impacted, the pace of the recovery has helped to minimize the damage. This is true even if one month’s jobs report failed to meet expectations.

Of course, this does not mean valuations close to dot-com era levels are justified or that investors should expect a straight-line recovery. While jobs should continue to return as business activity accelerates, there are also long-term structural challenges. For instance, with 9.8 million unemployed Americans and at least 7.4 million job openings, there is clearly a mismatch between hiring needs and the skills of available workers. This was also the case prior to the pandemic when job openings exceeded the number of unemployed workers for years.

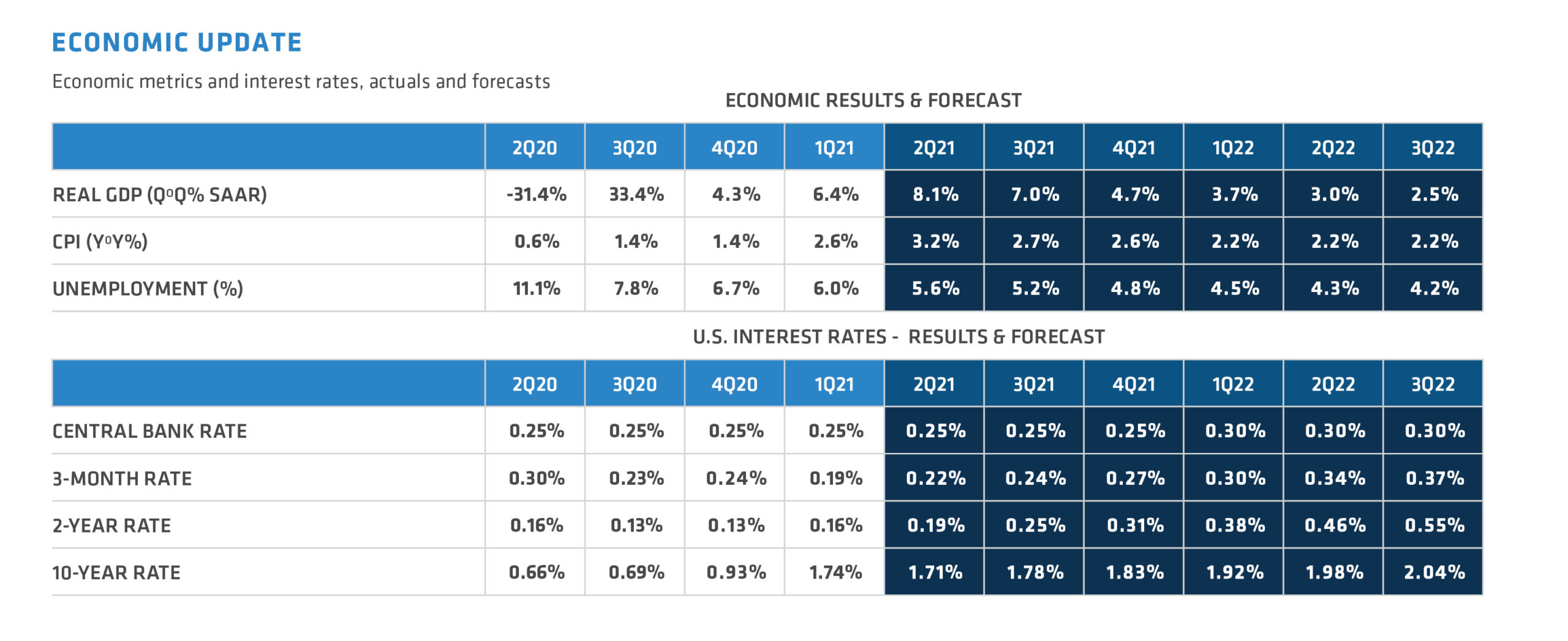

Economists expect record growth through the rest of the year

KEY TAKEAWAYS:

1. Consensus forecasts are for growth to remain well above average through the rest of the year and into 2022.

2. Inflation could rise above 3% for some time and unemployment could fall below 5% by the end of 2021.

3. Of course, these projections are speculative given the historic nature of the economic environment, especially with record levels of government and central bank stimulus.

At the moment, economists expect that growth will accelerate this quarter and remain hot in the second half of the year. This includes inflation running above 3% for some time and unemployment falling below 5% before the end of the year. This could be more than enough to restore corporate earnings to pre-pandemic levels, justifying some of the market rebound over the past year.

However, long-term investors understand that there may be short-term disappointments that call these projections into question. So while it’s fine to hope for the best, diversified portfolios are meant to also prepare for the worst. After all, the point of investing is not to succeed over months or quarters, but to achieve financial goals over years and decades. Long-term investors should remain balanced and keep a clear perspective on their own expectations and that of the broader market.

Valuations remain near historic peaks

KEY TAKEAWAY:

1. Investors continue to price-in lofty growth. Valuations remain near their historic dot-com era peaks even as corporate earnings have surged.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2021-212)