Volume Factor Global Unconstrained

Back to Strategies

$250,000Minimum Investment

September 30, 2020Inception Date

Investment Objective

Outperform in bull markets by identifying and investing in the areas or sectors of the market garnering the strongest capital inflows (the volume factor). Concurrently, it is the goal of

our proprietary risk management overlay to measure the threat level of bear market cycles

and accordingly reposition the portfolio towards cash equivalents.

Portfolio Philosophy

We believe a technical perspective paired with a proprietary risk overlay framework will result in long-term outperformance.

- Active ETF Selection – Our proprietary volume factor ranking actively invests in a portfolio of 12 to 25 ETFs from a universe of approximately 600 funds that cover a wide range of regions, styles, sectors, industries, and other investment factors.

- Risk Overlay – Aim to mitigate investor risk through lower downside volatility and capital drawdowns by reducing market exposure during perceived prolonged bear markets.

- Opportunistic Reentries – Attempt to capture the returns offered in potentially developing bull markets by identifying capitulation events via our proprietary signal.

Product Profile

Management StyleTactical

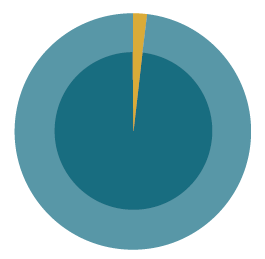

Number of Positions1

BenchmarkMSCI World Index

Portfolio Manager

Performanceas of 12/31/2025

13.31%Standard Deviation

0.14%QTD

20.40%YTD

20.40%1-YR

9.91%5-YR

12.27%Since Inception

The performance data shown is through the date listed above and represents past performance for the composite. The composite includes all discretionary accounts managed in accordance with the strategy. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. There is no guarantee that any investment strategy will achieve its objectives. “Net of Max Fee” represents performance that has factored in an assumed fee of 2.10% (0.60% model fee plus 1.50% advisor fee).

Allocationsas of 12/31/2025