Volume Factor Dividend Tree

Back to Strategies

$250,000Minimum Investment

March 31, 2020Inception Date

Investment Objective

Outperform in bull markets by identifying and investing in companies within the domestic market that are growing dividends and garnering the strongest capital inflows (the volume factor). Concurrently, it is the goal of our proprietary risk management overlay to measure the threat level of bear market cycles and attempt to strategically reposition a portion of the portfolio towards fixed income.

Portfolio Philosophy

We believe a technical perspective paired with a proprietary risk overlay framework will result in long-term outperformance.

- Active Stock Selection – Our proprietary volume factor ranking actively invests in a portfolio of approximately 40 individual stocks from a universe of 3000 companies that range across all market capitalization sizes

- Grow Income – Generate income by investing in companies that are increasing their ability to pay dividends by growing free cash flow and dividend payout.

- Risk Overlay – Aim to mitigate investor risk through lower downside volatility and capital drawdowns by reducing market exposure during perceived prolonged bear markets

Product Profile

Management StyleTactical

Number of Positions39

BenchmarkRussell 3000

Portfolio Manager

Performanceas of 12/31/2025

15.62%Standard Deviation

4.36%QTD

8.74%YTD

8.74%1-YR

9.26%5-YR

13.57%Since Inception

The performance data shown is through the date listed above and represents past performance for the composite. The composite includes all discretionary accounts managed in accordance with the strategy. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. There is no guarantee that any investment strategy will achieve its objectives. “Net of Max Fee” represents performance that has factored in an assumed fee of 2.10% (0.60% model fee plus 1.50% advisor fee).

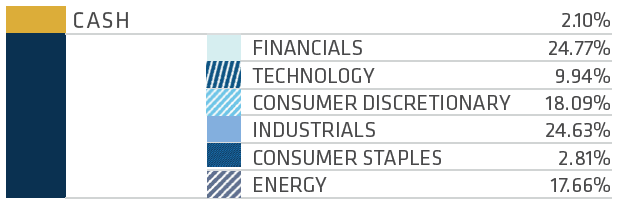

Allocationsas of 12/31/2025

Allocations are subject to change without notice.