Small Account Model

Back to StrategiesInvestment Objective

Deliver a cost-effective, diversified professionally managed strategic asset allocation portfolio for accounts starting at $5,000.

Portfolio Philosophy

We believe a strategic perspective paired with periodic rebalancing will result in long-term performance matching or exceeding its benchmark.

- Passive ETF Selection – Invest in what we believe are the best possible ETFs that deliver performance and manage risk, while tightly controlling expenses.

- Risk Management – By maintaining a portfolio consistent with the desired risk category, overall reward to risk can be optimized by constructing portfolios on the efficient frontier.

- Consistency – Aim to provide investors long term growth along with the knowledge that the SAM portfolios are always fully invested and rebalanced as necessary to manage

overall risk.

Product Profile

S&P 500 TR Index**

Lead Portfolio Manager

Mitch Ehmka, CFA®, CIPM®

Chief Trading Officer and Lead Portfolio Manager

view profile >

* Depending on risk tolerance

** Bloomberg US Aggregate Bond Total Return Index/S&P 500 Total Return Index, % to each index dependent on risk tolerance

Performanceas of 3/31/2024

Conservative Portfolio

6.67%Standard Deviation

1.04%QTD

1.04%YTD

4.81%1-YR

1.92%5-YR

1.73%Since Inception

Moderate Conservative Portfolio

8.88%Standard Deviation

2.26%QTD

2.26%YTD

7.68%1-YR

3.32%5-YR

2.79%Since Inception

Balanced Portfolio

11.05%Standard Deviation

3.53%QTD

3.53%YTD

10.71%1-YR

4.95%5-YR

3.97%Since Inception

Moderate Aggressive Portfolio

13.40%Standard Deviation

4.57%QTD

4.57%YTD

13.43%1-YR

6.24%5-YR

5.19%Since Inception

Aggressive Portfolio

15.52%Standard Deviation

5.64%QTD

5.64%YTD

16.20%1-YR

7.24%5-YR

5.90%Since Inception

The performance data shown is through the date listed above and represents past performance for the composite. The composite includes all discretionary accounts managed in accordance with the strategy. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. There is no guarantee that any investment strategy will achieve its objectives. “Net of Max Fee” represents performance that has factored in an assumed fee of 1.75% (0.25% model fee plus 1.50% advisor fee).

Allocationsas of 3/31/2024

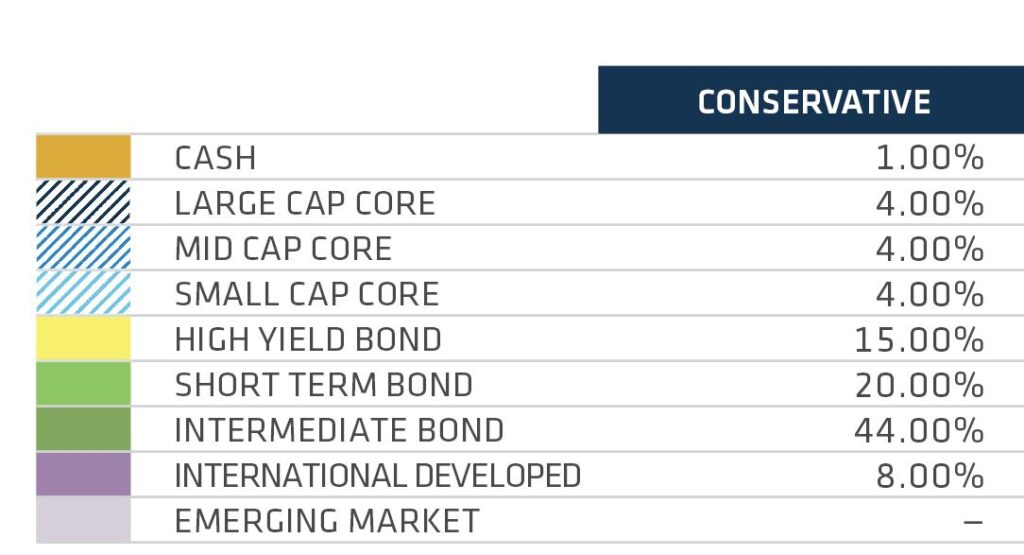

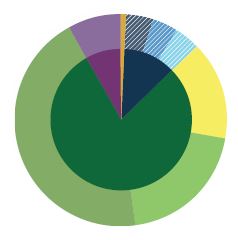

Conservative Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

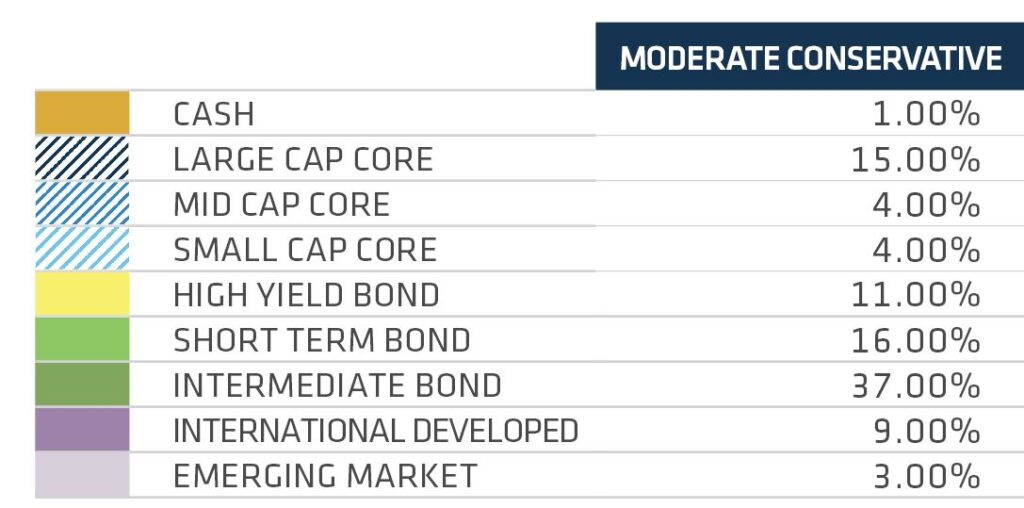

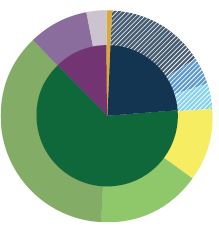

Moderate Conservative Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

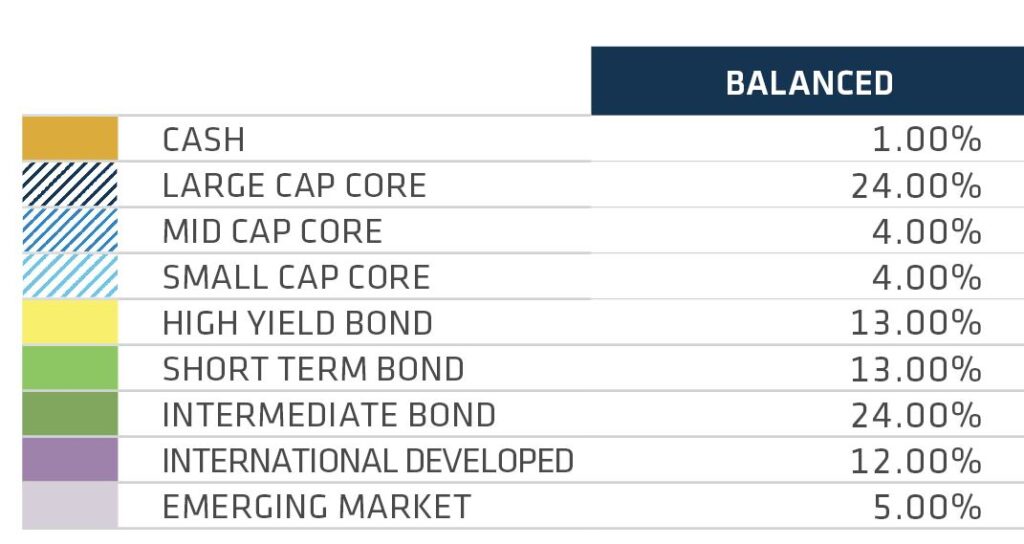

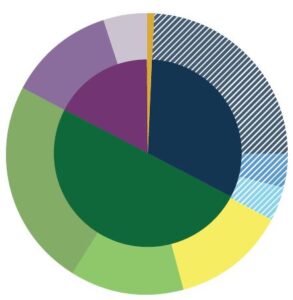

Balanced Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

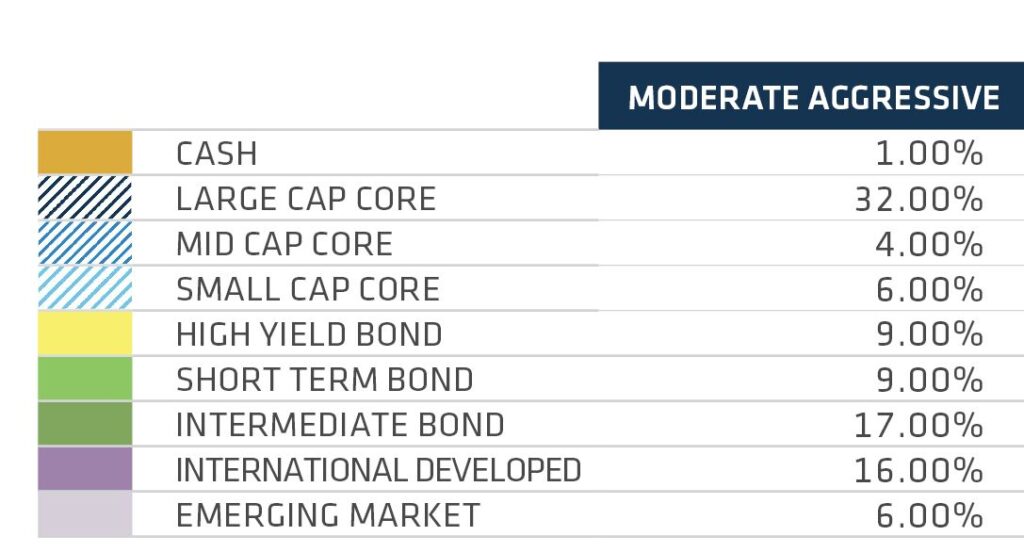

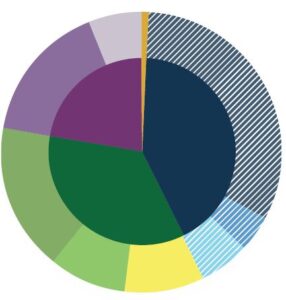

Moderate Aggressive Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

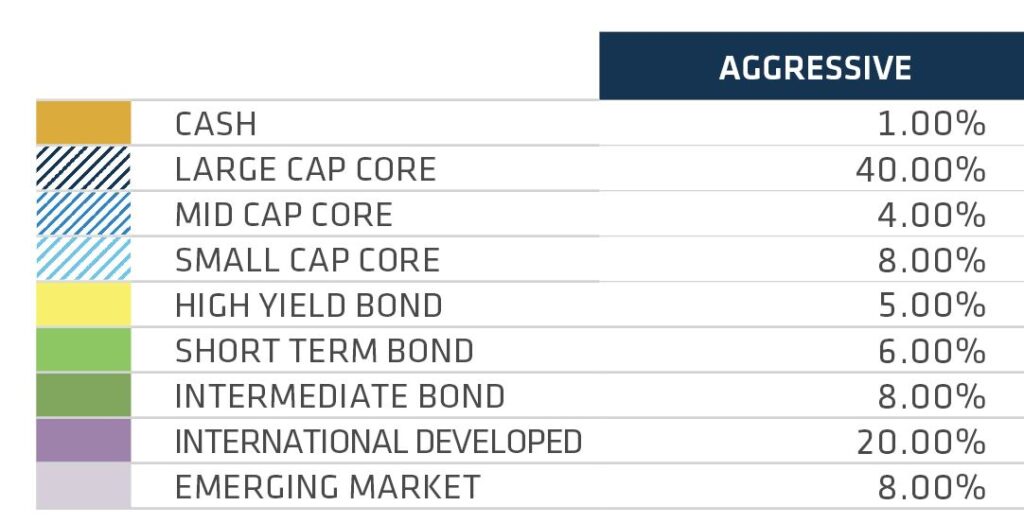

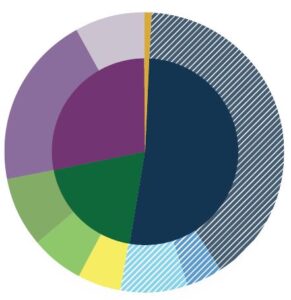

Aggressive Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.