Opportunity Income

Back to StrategiesInvestment Objective

Deliver a better risk adjusted return than the aggregate bond benchmark by analyzing spreads between short and long-term US treasury bonds. The goal is to optimize allocations across various fixed income sectors.

Portfolio Philosophy

We believe a historically informed, fundamental approach to core fixed income investing can provide long-term superior risk adjusted return.

- Passive ETF Selection – Investments consist of Core Fixed Income exposures derived via low-cost ETFs like that of the benchmark at times, but can span a variety of classifications, quality, and duration. At times, the portfolio may take key exposures away from the benchmark in an attempt to optimize for the current environment.

- Risk Management – Opportunity Income is an overall risk framework, helping to guide fixed income asset allocation throughout the interest rate & credit cycle by analyzing current treasury spread positioning.

- Consistency – Fixed income asset class risks, returns and correlations may vary depending on where you are in this cycle. Historically there are possibly more opportune times to overweight or underweight the different fixed income exposures.

Product Profile

Portfolio Managers

Mitch Ehmka, CFA®, CIPM®

Chief Trading Officer and Co-Portfolio Manager

view profile >

Scott Martin, CIMA®

Scott Martin, CIMA®

Chief Investment Officer and Co-Portfolio Manager

view profile >

Performanceas of 12/31/2023

6.97%Standard Deviation

5.74%QTD

3.26%YTD

3.26%1-YR

-5.32%3-YR

-4.51%Since Inception

The performance data shown is through the date listed above and represents past performance for the composite. The composite includes all discretionary accounts managed in accordance with the strategy. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. There is no guarantee that any investment strategy will achieve its objectives. “Net of Max Fee” represents performance that has factored in an assumed fee of 1.75% (0.25% Model Fee plus 1.50% Advisor Fee) for data after July 31, 2023, 2.10% (0.60% Model Fee plus 1.50% Advisor Fee) from August 1, 2021 through July 31, 2023 and 1.75% (0.25% Model Fee plus 1.50% Advisor Fee) prior to August 1, 2021.

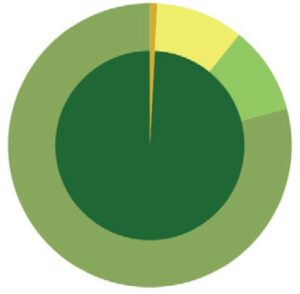

Allocationsas of 12/31/2023