Multi Strategy

Back to StrategiesInvestment Objective

The Multi-Strategy Portfolio Series seeks to achieve risk mitigation across all market cycles. By deploying a “Core” and “Satellite” approach, investors receive long-term asset class diversification partnered with shorter-term flexibility.

Portfolio Philosophy

We believe that investors must remain invested to achieve their financial goals. The Multi-Strategy Portfolio Series utilizes four investment ideologies to provide an enhanced return when the economy is strong and defense when the economy weakens. The flexible nature of the satellite components allows each portfolio to increase or decrease its equity exposure depending on the phase of the economy.

Product Components

- Traditional Asset Allocation

Diversified asset class exposure - Alternative Fixed Income

Investment selections with low to no correlation to traditional fixed income - Volatility Capitalization

Reactive component that adjusts asset class exposure given

the current phase of the economy - Sector Rotation

Focused on high conviction sectors

Product Profile

S&P 500 TR Index**

Lead Portfolio Managers

Scott Martin, CIMA®

Chief Investment Officer and Lead Portfolio Manager

view profile >

Neil Peplinski, CFA®

Portfolio Manager

view profile >

Yash Patel, CFA®

Portfolio Manager

view profile >

* Depending on risk tolerance

** Bloomberg US Aggregate Bond Total Return Index/S&P 500 Total Return Index, % to each index dependent on risk tolerance

Performanceas of 12/31/2025

Conservative Portfolio

5.89%Standard Deviation

0.95%QTD

7.25%YTD

7.25%1-YR

-0.15%5-YR

1.23%Since Inception

Moderate Conservative Portfolio

7.70%Standard Deviation

0.66%QTD

7.69%YTD

7.69%1-YR

2.92%5-YR

3.54%Since Inception

Balanced Portfolio

9.42%Standard Deviation

0.75%QTD

8.96%YTD

8.96%1-YR

4.86%5-YR

5.29%Since Inception

Moderate Aggressive Portfolio

11.57%Standard Deviation

0.84%QTD

10.35%YTD

10.35%1-YR

7.02%5-YR

7.28%Since Inception

Aggressive Portfolio

14.42%Standard Deviation

0.84%QTD

11.30%YTD

11.30%1-YR

10.03%5-YR

10.45%Since Inception

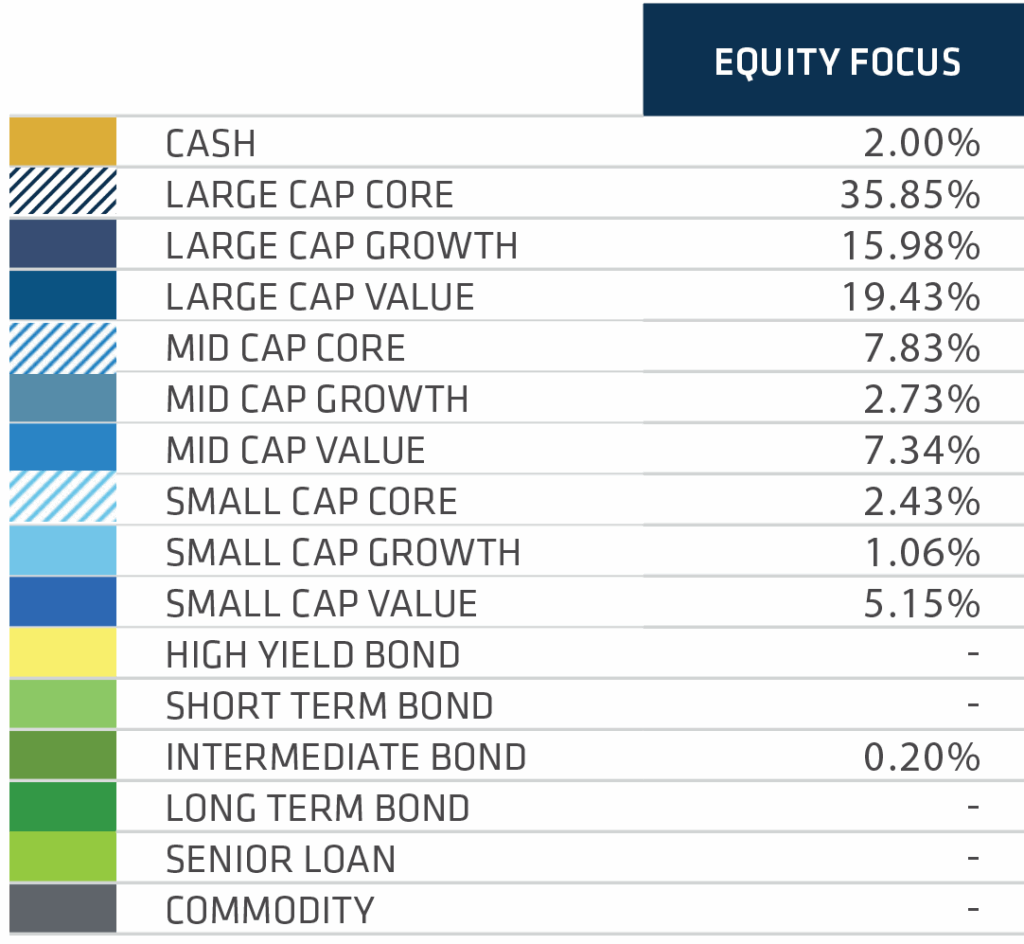

Equity Focus

0.47%QTD

0.47%YTD

The performance data shown is through the date listed above and represents past performance for the composite. The composite includes all discretionary accounts managed in accordance with the strategy. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. There is no guarantee that any investment strategy will achieve its objectives. “Net of Max Fee” represents performance that has factored in an assumed fee of 1.50% (zero Model Fee plus 1.50% Advisor Fee) for data after March 24, 2021, 1.90% (0.40% Model Fee plus 1.50% Advisor Fee) from April 1, 2020 through March 23, 2021 and 2.10% (0.60% Model Fee plus 1.50% Advisor Fee) prior to April 1, 2020.

Allocationsas of 12/31/2025

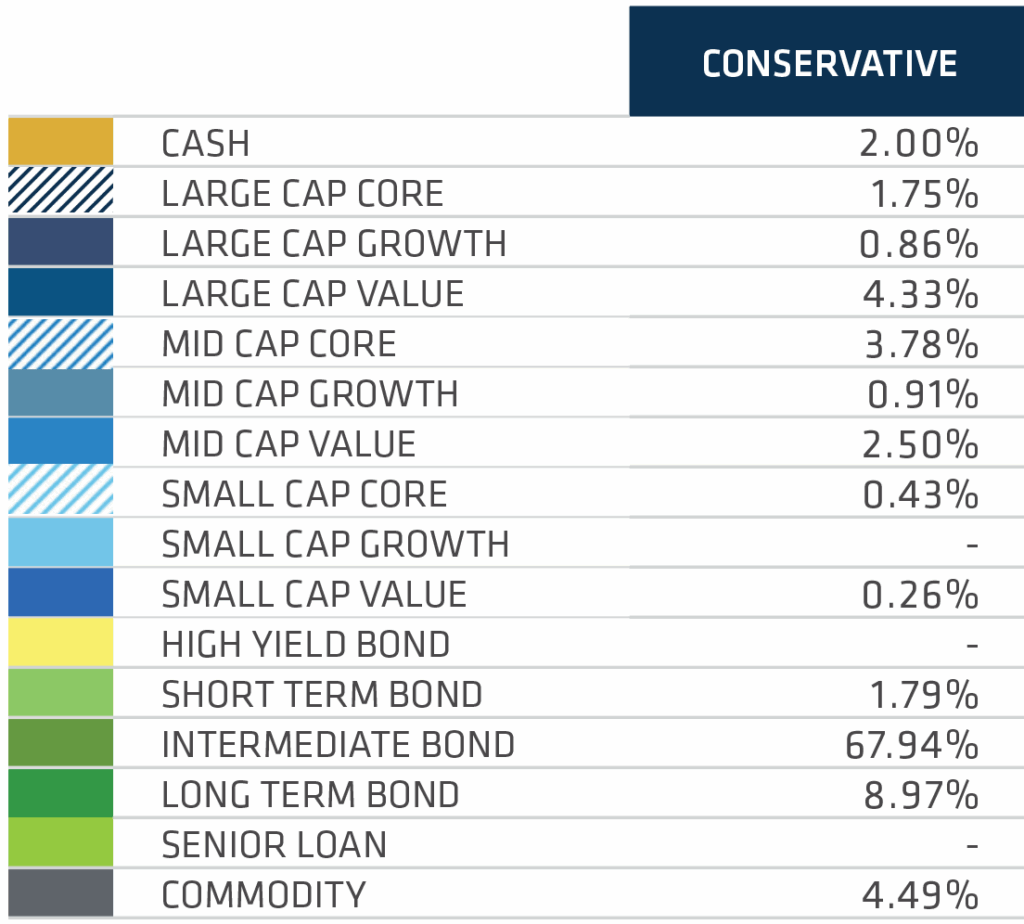

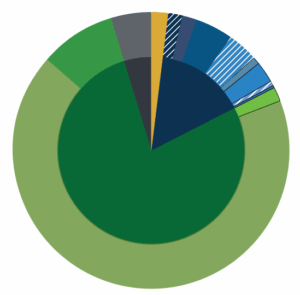

Conservative Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

Moderate Conservative Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

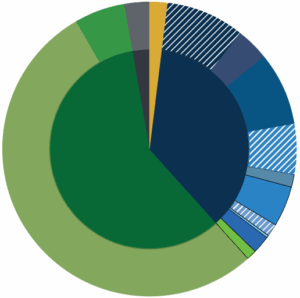

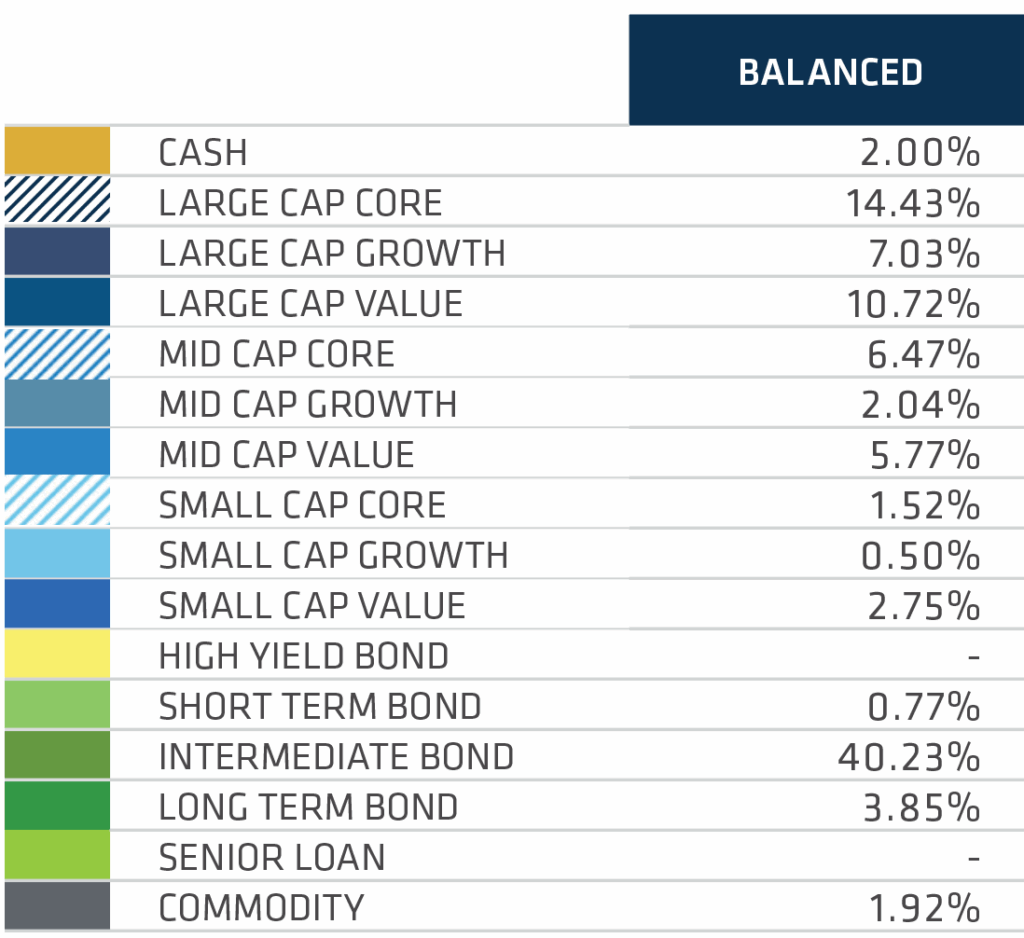

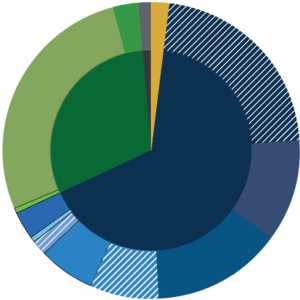

Balanced Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

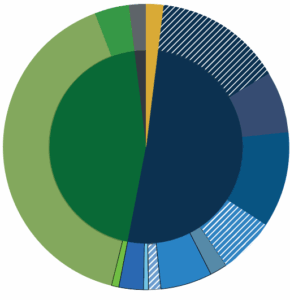

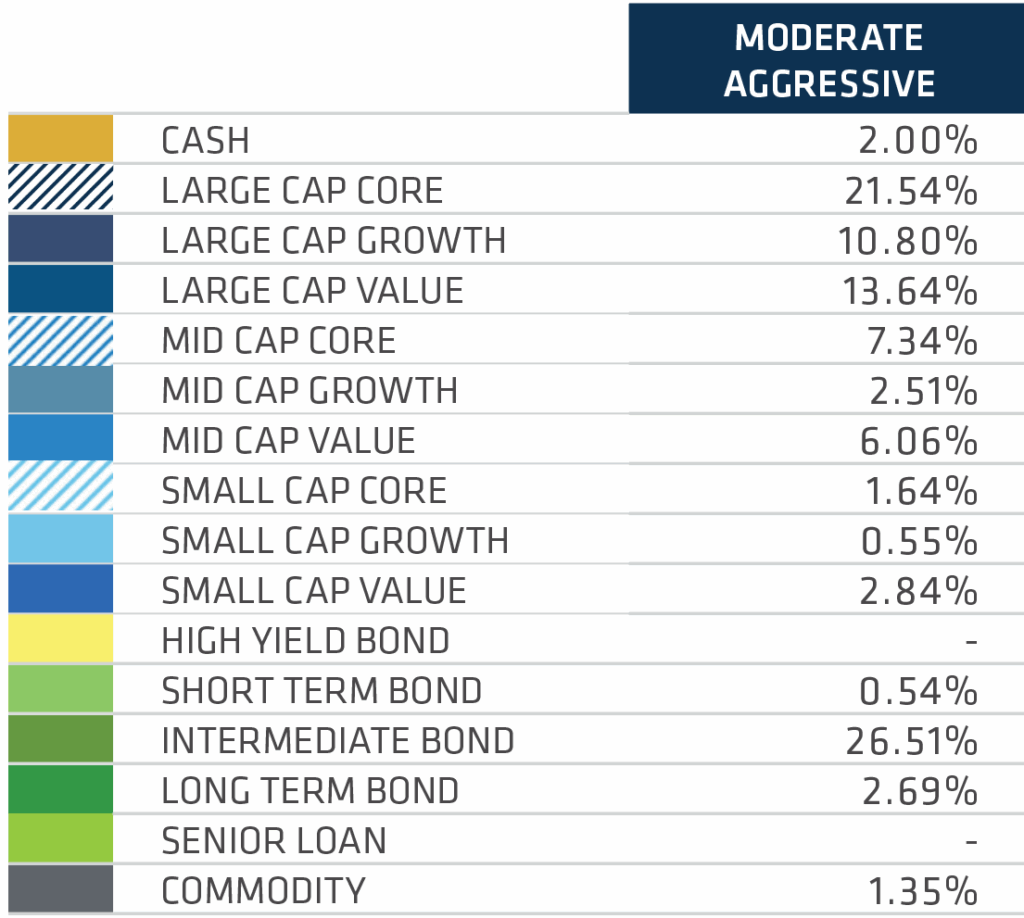

Moderate Aggressive Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

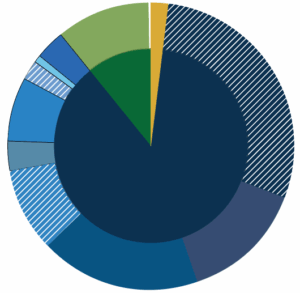

Aggressive Portfolio

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.

Equity Focus

Allocations are subject to change without notice. Allocations may not total 100% due to rounding.