Ambassador Income

Back to Strategies

$250,000Minimum Investment

May 31, 2016Inception Date

Investment Objective

Outperform a traditional aggregate bond index by tactically positioning fixed income investments through a lens guided by economic discipline. The goal is to create a more opportunistic approach to various fixed income investments that would traditionally be subject to substantial interest rate movement risk.

Portfolio Philosophy

We believe a fundamental perspective paired with quantitative execution will result in long-term outperformance.

- Tactical ETF Selection – Fixed income investments span various durations as well as issuer and credit quality. Alternative allocations to traditional fixed income highlight a broad range from commodities to currencies, as well as inverse positioning.

- Risk Management – Provide investors with a wider, more diversified asset class range than a traditional fixed income portfolio.

- Consistency – Aim to provide investors conservative growth with reduced volatility due to investment choice flexibility and an attempt at low correlation.

Product Profile

Management StyleDynamic

Number of Positions9

BenchmarkBloomberg US Aggregate Bond TR Index

Lead Portfolio Manager

Scott Martin, CIMA®

Chief Investment Officer & Lead Portfolio Manager

view profile >

Performanceas of 9/30/2025

6.30%Standard Deviation

3.13%QTD

7.74%YTD

3.35%1-YR

-0.05%5-YR

0.69%Since Inception

The performance data shown is through the date listed above and represents past performance for the composite. The composite includes all discretionary accounts managed in accordance with the strategy. Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. There is no guarantee that any investment strategy will achieve its objectives. “Net of Max Fee” represents performance that has factored in an assumed fee of 2.10% (0.60% model fee plus 1.50% advisor fee).

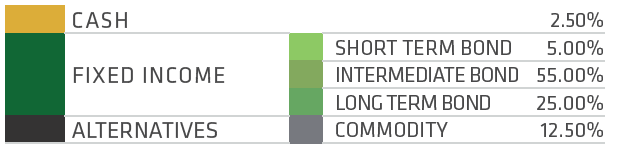

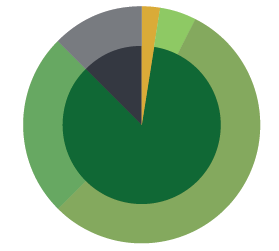

Allocationsas of 9/30/2025

Allocations are subject to change without notice.