Volume Analysis Special Report – 8.27.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

NVDA Earnings Through Newton’s Lens: Action, Reaction, and Market Motion

As detailed in my Volume Analysis Flash Update: “A New Hope or Gathering Storm?”, market breadth has become the critical battleground. While smaller-cap ETFs our “troops” charged ahead with renewed vigor, the elite “generals” faltered, and capital-weighted volume began to stall, hinting at internal tensions beneath the surface kingsviewim.com. In this delicate backdrop, all eyes now turn to NVIDIA (NVDA). Tomorrow’s earnings could give traders a decisive clue: will NVDA’s price-volume alignment reinforce the optimism behind this broadening advance, or will it signal caution at the edge of what could become a broader inflection?

As NVIDIA (NVDA) prepares to release earnings tomorrow, markets are bracing for the reaction in one of the most consequential stocks of the AI era. While headlines will focus on revenue, margins, and chip guidance, investors should also look through a different lens: the physics of price and volume.

Just as Newton’s laws describe the forces that govern the physical world, they also provide a powerful framework for understanding market dynamics.

Newton’s First Law: Inertia and Market Trends

“An object at rest remains at rest, and an object in motion remains in motion unless acted upon by an unbalanced force.”

Applied to markets, price momentum tends to persist unless acted upon by an unbalanced force. That force is volume.

When price and volume move together, trends often sustain. When they diverge, it is often a signal that the current trajectory is losing steam. My research on price-volume asymmetry shows that volume is not noise—it is the measurable force that sustains or disrupts price.

Newton’s Second Law: Acceleration and the Power of Volume

“The acceleration of an object depends on the mass of the object and the amount of force applied.”

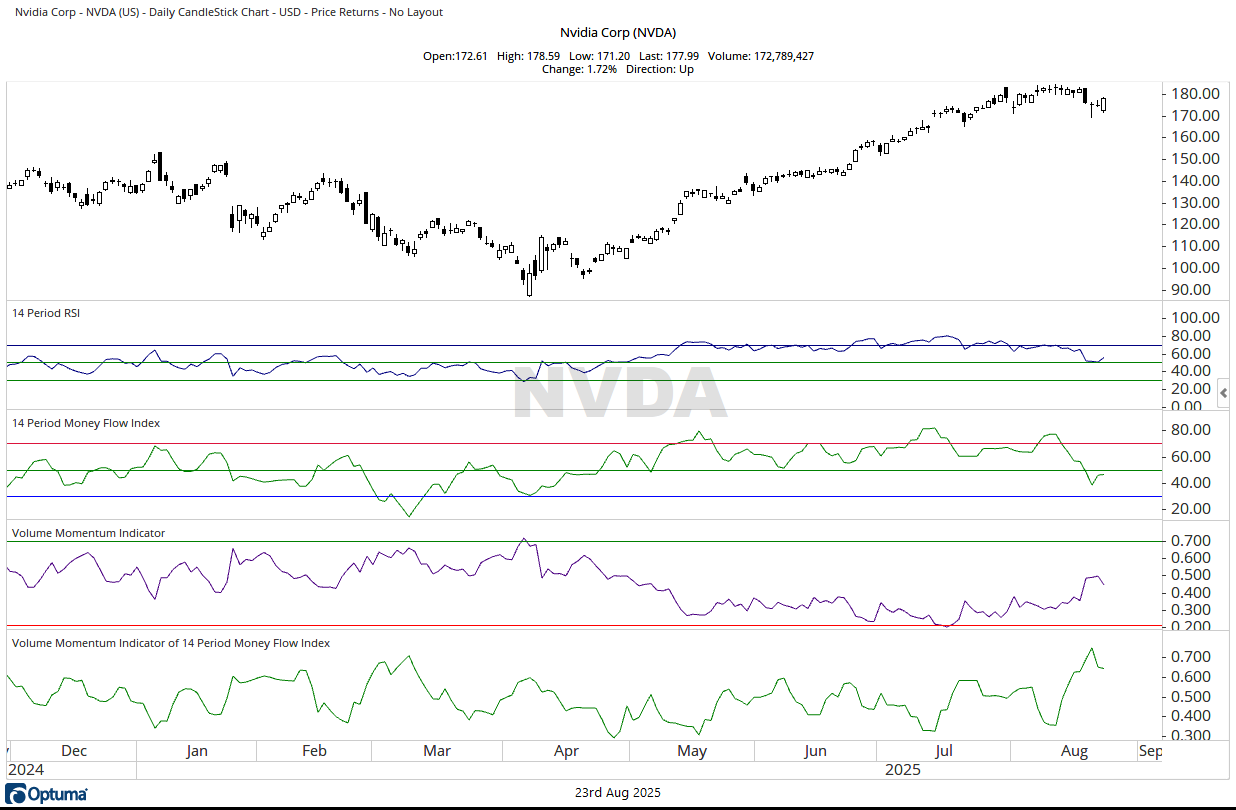

In the market, price acceleration (momentum) is powered through volume. RSI (Relative Strength Index) measures internal price momentum, but the Money Flow Index (MFI) adds the missing ingredient—volume weighting. This makes it possible to see whether a rally has real capital flow behind it or is merely price drifting upward without force.

Studies across decades show that volume-weighted momentum strategies consistently enhance returns and improve risk-adjusted performance.

Newton’s Third Law: Action, Reaction, and the Delta Force

“For every action, there is an equal and opposite reaction.”

In markets, price is the action, and volume is the reaction. When they move in harmony, momentum is reinforced. But when they diverge, hidden tensions build—what I call the Delta Force.

When volume-weighted momentum exceeds price momentum, it reveals excess force supporting the move. When volume falls short, it warns of exhaustion. This asymmetry often foreshadows reversals or extensions before price alone signals the shift.

NVDA as a Case Study

- January 12, 2024 – RSI 81, MFI 92. Strong alignment of price and volume momentum. NVDA surged from $54 to $93. When RSI cooled to the 60s and MFI collapsed to 50, volume flagged the pullback into the $70s.

- May 29, 2024 – RSI 84, MFI 93. Price sprinted from $110 to $135. Yet while RSI held, MFI sank to 55—a divergence that preceded a retracement back to $100.

- Today (short term) – On the daily chart, RSI sits around 60, while MFI lags near 52. Both are above neutral, but volume momentum trails price momentum—an early caution flag ahead of earnings.

- Intermediate term – On the weekly chart, the picture looks very different. RSI is a strong 70, but MFI is even stronger at 92. This positive asymmetry reveals a powerful Delta Force: volume confirming and amplifying price momentum. In Newtonian terms, the “reaction” from capital flows is greater than the “action” in price alone. This suggests dips may be viewed as opportunities within a durable uptrend.

What to Watch Post-Earnings

- Bullish confirmation – If price rises on earnings and MFI strengthens alongside it, NVDA’s motion could extend forcefully.

- Bearish divergence – If price spikes but MFI weakens, it may be a sign of froth without underlying force.

- Intermediate anchor – Even if short-term volatility strikes, the weekly chart’s Delta Force points to strong intermediate-term potential.

Bottom Line: Just as Newton’s laws describe motion in the physical world, they also help explain NVDA’s trajectory. Short-term caution stems from price and volume drifting slightly out of sync, but the intermediate-term signals point to a powerful, volume-backed trend. Tomorrow’s earnings may determine whether that force propels NVDA higher—or whether imbalance starts to push back.

Just as the broader market teeters between renewed breadth and lurking stress, NVIDIA’s path forward may follow a similar script. If NVDA’s earnings spark a breakout with strong volume behind it, the Delta Force of price-volume asymmetry could carry the broader advance forward. But if price strength is not met by corresponding capital flows, it may echo the storm clouds gathering under the surface of the broader trend. In times like these, not just with NVDA, but across markets, volume is the hidden force that separates sustainable moves from fleeting momentum.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 8/27/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.