Volume Analysis Flash Update – 5.19.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Out of the Blocks

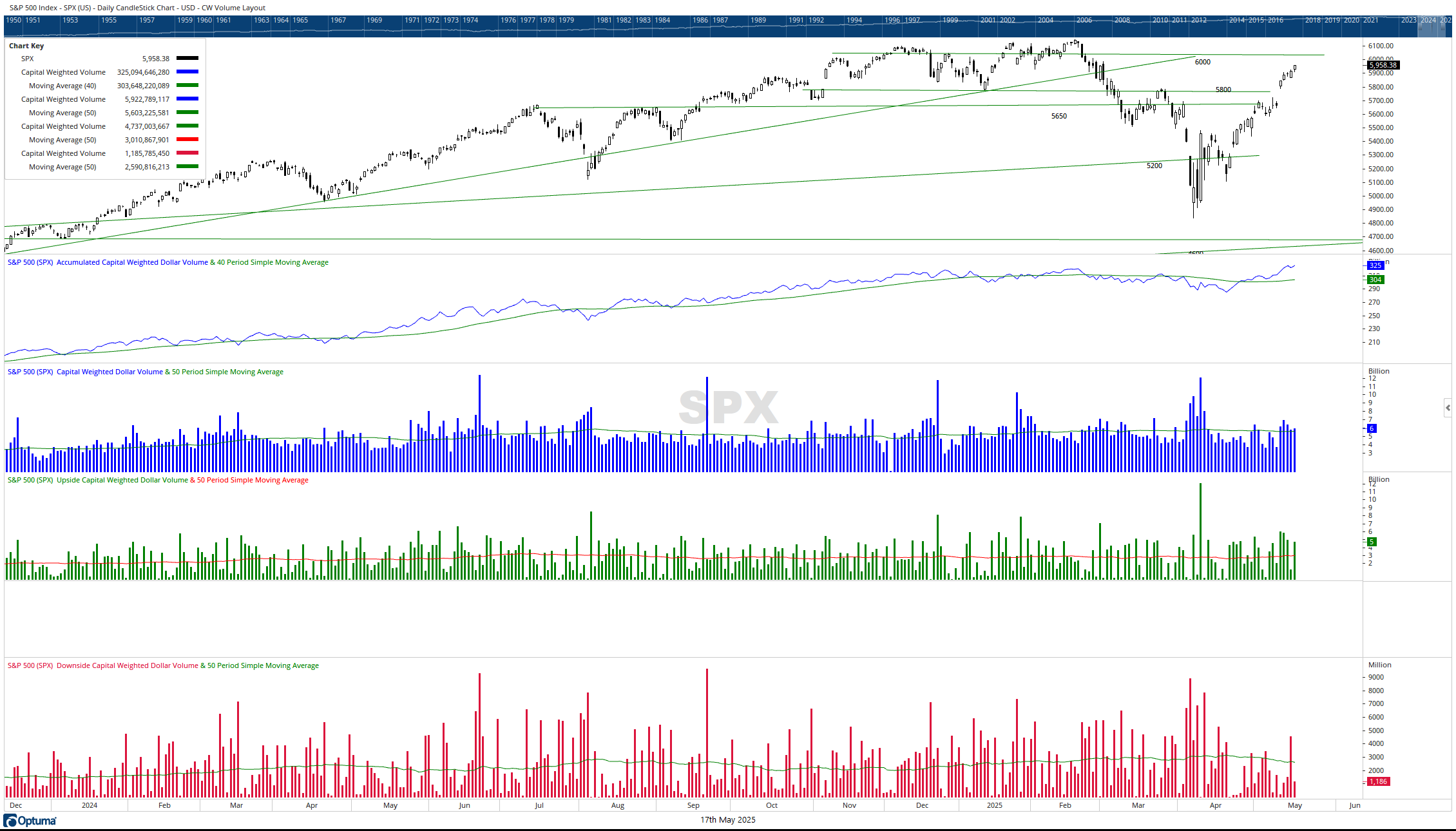

The bulls launched their offensive with the precision of a dawn raid on Monday the 12th, charging out of their blocks and seizing early momentum to begin the week. A massive 97% Capital Inflow Day served as a shock-and-awe maneuver, catching the bears flat-footed on the battlefield’s opening salvo.

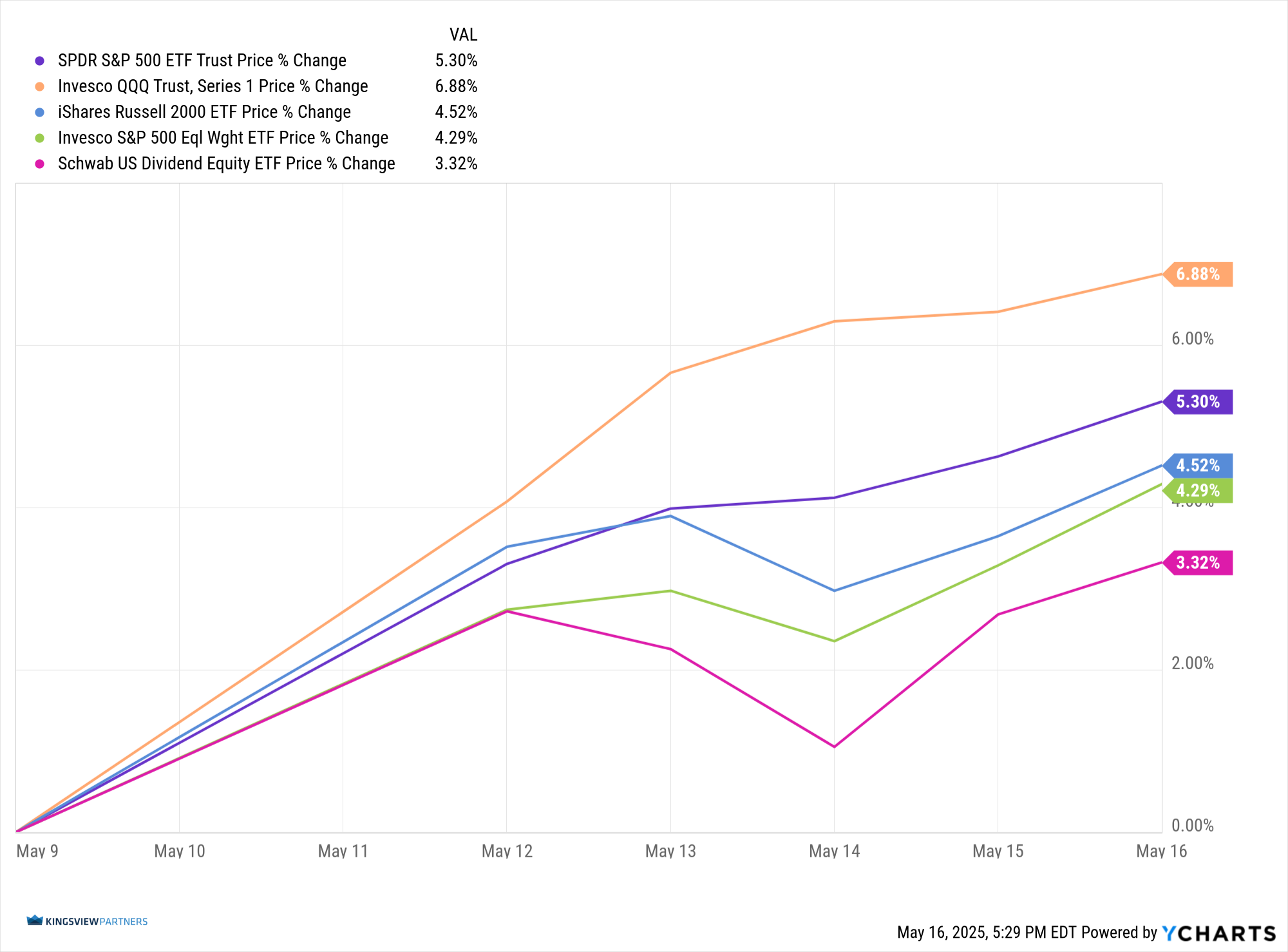

The generals (Invesco QQQ Trust) once again led the charge, advancing 6.88% for the week. Their lieutenants (SPDR S&P 500 ETF) rallied closely behind, posting a 5.30% gain. The ground troops (iShares Russell 2000 ETF) pressed forward with a 4.52% advance. The brass commanders brought up the rear, with the Invesco S&P 500 Equal Weight ETF up 4.29% and the Schwab U.S. Dividend Equity ETF advancing 3.32%, signaling a unified front in the market’s upward march.

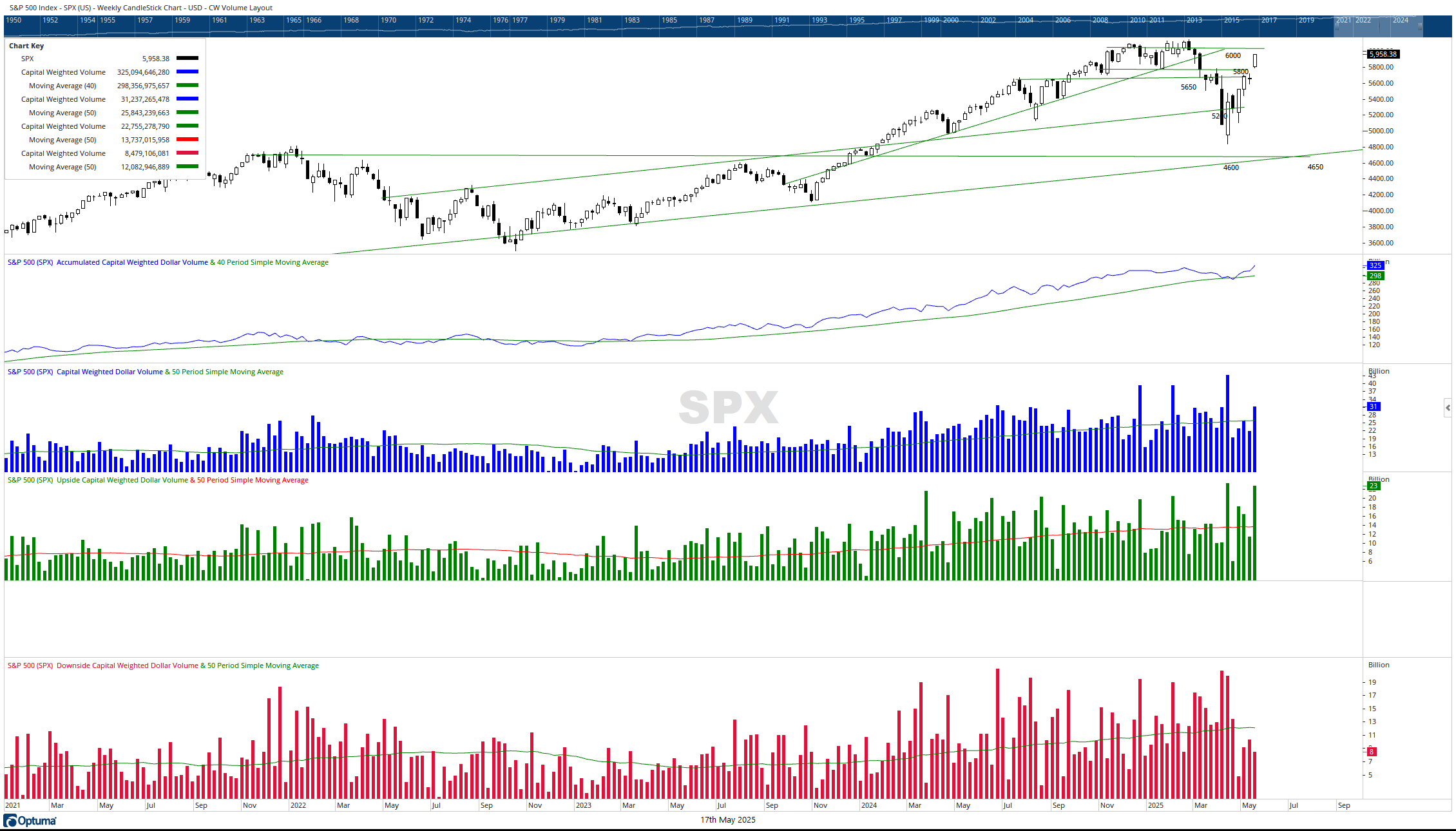

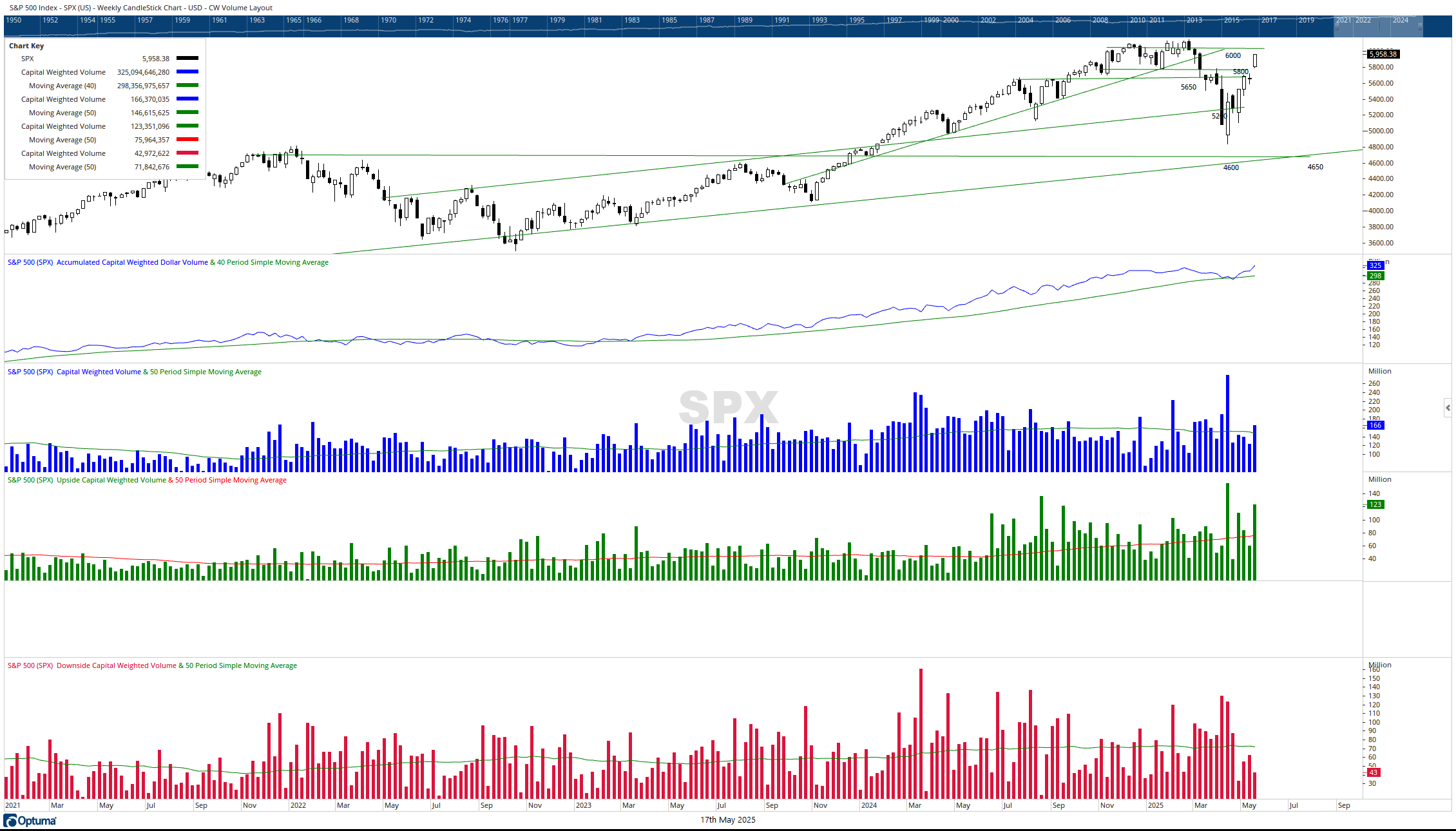

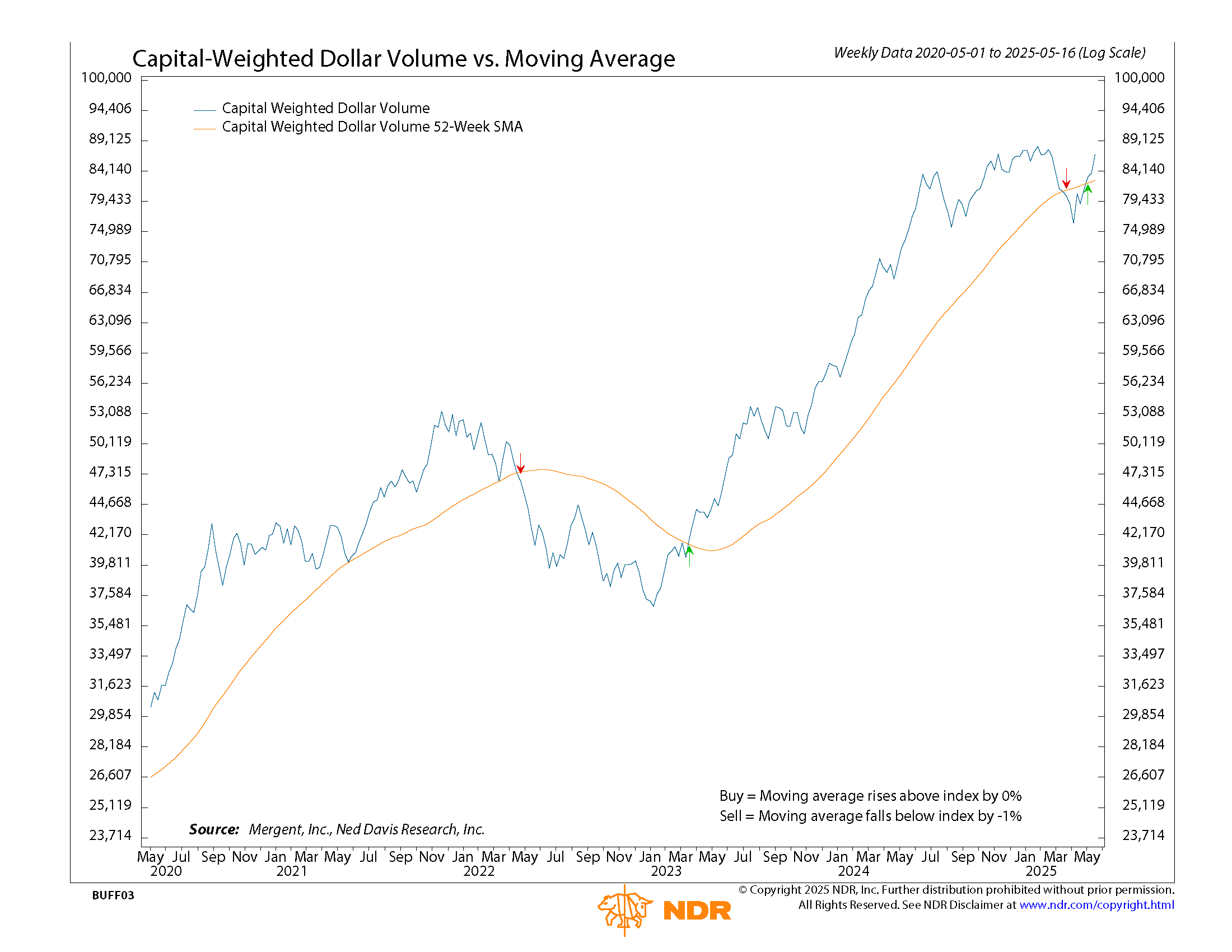

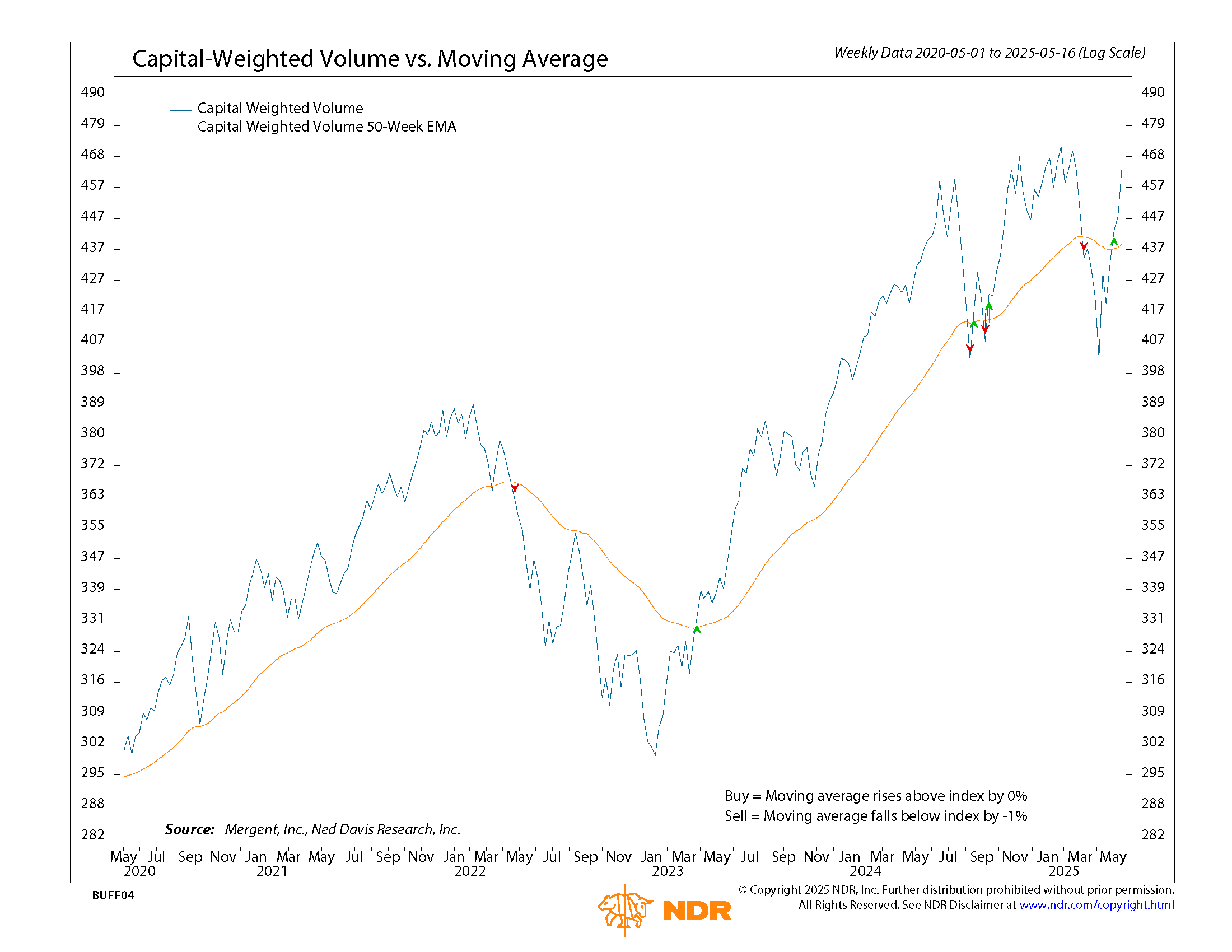

Last week, we noted the emergence of a bullish ascending triangle formation in the S&P 500, a tactical setup marked by steadily rising prices on fading volume. This week, the index broke out above the 5,800 apex, breaching the pattern’s resistance threshold. While traditional pattern rules require a breakout on heavy volume, this week’s Capital and Dollar Volume metrics, particularly Monday’s breakout, met the minimum requirement, if only marginally. However, when isolating upside volume, the move was decisively confirmed by internal strength.

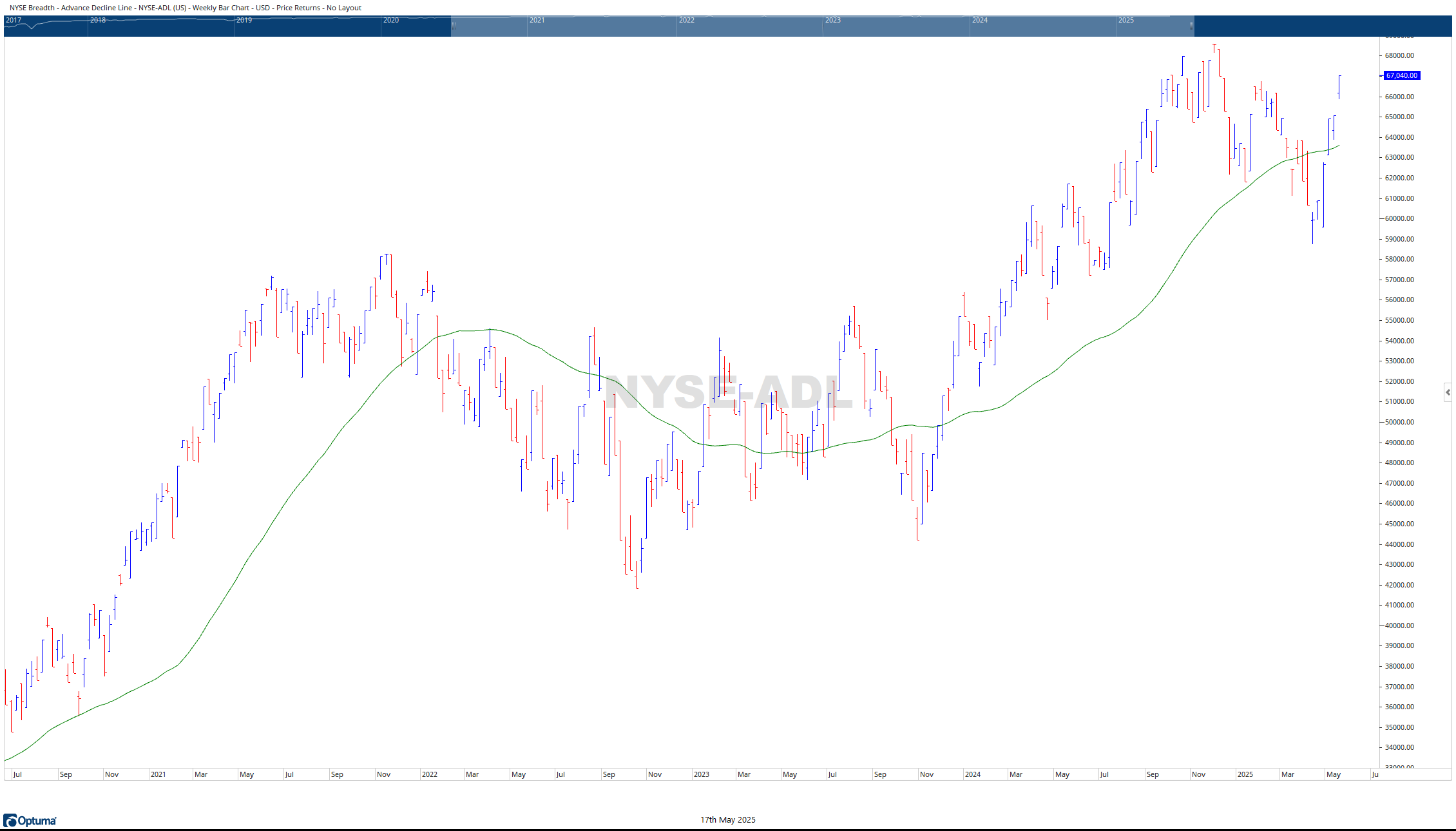

Market internals remain fortified, displaying more robust health than their price-based counterparts. Capital Weighted Volume and Dollar Volume are both marching toward all-time highs. Meanwhile, the NYSE Advance–Decline Line continues its climb, building on the momentum of Zweig’s Breadth Thrust, a momentum signal of deepening market participation.

Strategically, the S&P 500 has now completed its recovery from the recent correction, but the campaign is not yet won. The next key resistance lies at 6,000, while holding the 5,800 level is critical to maintain bullish control of the field.

Last week, the generals (QQQ) successfully hurdled the 500 resistance line, executing a gap-and-go maneuver. The troops (IWM), however, closed at a critical resistance point near 210. For the bullish advance to remain broad-based, the troops must overtake this stronghold and set their sights on 230. As for the generals, they must conquer their 530 resistance level to demonstrate enduring leadership and resume the campaign toward all-time highs.

While the bulls have seized the early lead in this latest leg of the rally, disciplined risk management may remain paramount. Just as a skilled racer knows when to push and when to ease off the throttle, successful investors may want to respect technical levels, heed volume signals, and remain vigilant against unexpected turns. Momentum may be accelerating, but maintaining control on the curves ahead is one of the keys in finishing strong.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 5/19/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.