Minute Market Update: 3.5.25 - Trump Tariffs and a Looming Trade War

Click here to download this commentary in PDF format.

Tariffs continue to dominate the news cycle and weigh on markets as President Trump’s new tariffs on Canada, Mexico and China went into effect March 4th. President Trump had previously delayed any enactment of tariffs for 30 days, providing investors with hope that deals would be done to prevent the implementation of the planned trade moves.

The market has reacted sharply to the prospect and now we are seeing the possible beginnings of a “trade war”, as major markets have taken a negative view during recent trading sessions and have pushed the S&P 500 and Nasdaq indexes into negative territory year-to-date (through 3/4/2025). Investors fear that the tariffs will lead to further escalations, which could cloud the rosy outlook market participants exhibited when Donald Trump took office.

With Canada’s Prime Minister Justin Trudeau announcing retaliatory tariffs of 25%, there is now significant strain in the trading relationship with our neighbors to the north. Similarly, Mexico’s President Claudia Sheinbaum is set to address President Trump’s tariffs in the coming week and has suggested retaliatory action as well.

Markets tend to get most volatile during quick yet significant bouts of uncertainty, and with the situation still developing, there is ample opportunity for relations between all the countries to go in many directions. The circumstances will change, governments may compromise and then relent, making today’s assumptions almost certainly not what the final landscape will ultimately be.

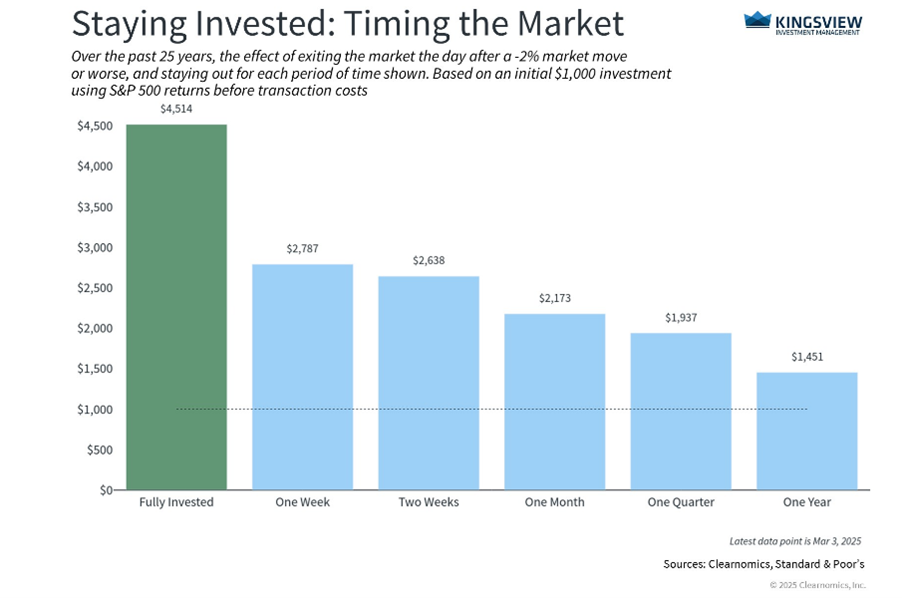

For longer-term investors, one of the biggest risks to achieving their financial goals occurs when they allow emotions to take over, overreacting to headline risk and exiting the market or straying from the long-term plan by attempting to “game” the short-term period. The chart below quantifies the effect of exiting the market following days when the S&P 500 fell -2% or more:

Perhaps contrary to logic, markets may appear “scary” at times of attractive financial opportunity and “safe” at times when risk is at its highest levels. The best time to invest in many asset classes may be when the situation appear to be most alarming, when the future is uncertain. It is our task as investment managers to remove emotion from our process and make prudent decisions for our clients.

When it comes to what is happening today, we have seen nearly similar issues on trade and geopolitical policy that were eventually resolved in the past. During President Trump’s first term, in 2018, tariffs were levied against U.S. trade partners which led to retaliatory tariffs on the United States. While the tariffs strained the United States’ foreign relationships, they did accelerate new trade agreements being formed. Ultimately, while the stock market struggled in the short-term, with the S&P 500 having a down year in 2018, the market resumed its bull market uptrend in 2019.

In a theoretical all-out trade war, the United States should be well positioned when the proverbial dust settles, but only after experiencing short-term pain. The United States is still facing concerns over inflation and tariffs could add further inflationary pressure on prices. Additionally, companies may seek to move labor “home”, which will boost the U.S. economy but may also create higher labor or input costs that will be passed on to end consumers.

When zooming out longer-term, potential positives do, however, exist. An improvement in the United States trade deficit is something that has been talked about in Washington D.C., but never fully addressed with real solutions. At some point, the trade surplus that many countries currently experience with the United States may be a target for the current administration as “fair trade” is attempted with our biggest economic partners around the world. Over time, said countries would have tariffs on their exports to the U.S. to reduce the trade deficit and make efforts towards achieving a balanced budget.

Levying tariffs would likely increase the value of the dollar further, increasing the relative attractiveness of investing in the U.S. markets as compared to its international peers. Further, tariffs may bring an advantage to some local industries in the form of a reduction from the threat of cheaper global competition. Increased production costs abroad may also encourage companies to source goods locally, potentially helping to preserve and create jobs stateside.

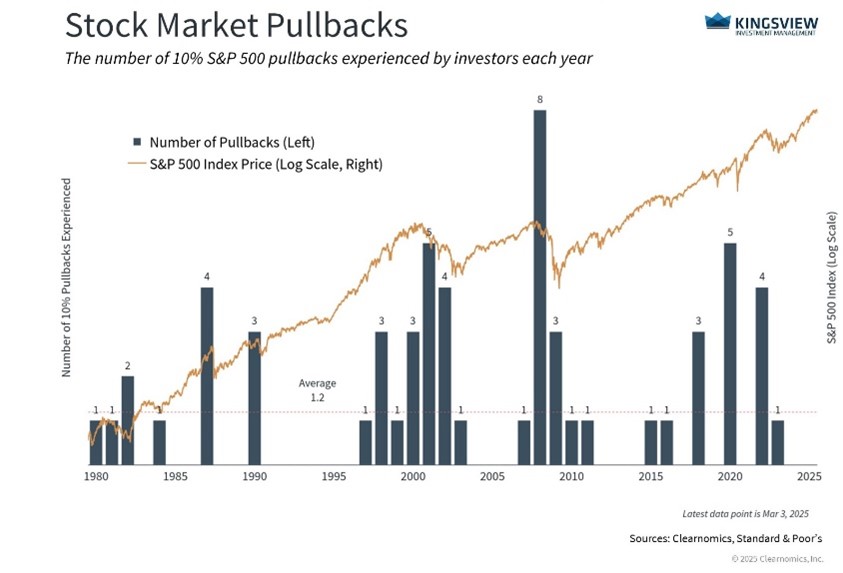

Volatile markets, whatever the driver, create inefficiencies in investments within the overall market, allowing diligent active managers with time-tested strategies to potentially take advantage of these opportunities to the benefit of clients. It is important to remember that markets rise and fall

throughout a given year for numerous reasons and to be cognizant of the short-term noisy distractions but to remain focused on the long-term plan for success.

– Kingsview Investment Committee

Kingsview Wealth Management (“KWM”) is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed.

This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term.

This information does not address individual situations and should not be construed or viewed as any typed of individual or gr oup recommendation. Be sure to first consult with a qualified financial adviser, tax professional, and/or legal counsel before implementing any securities, investments, or investment strategies discussed. Any performance shown since inception is based upon composite results of the stated portfolio. Portfolio performance is the result of the application of the KIM Volume Factor Global Unconstrained investment process. It does not reflect any investor’s actual experience with owning, trading or managing an actual investment account.