Volume Analysis ‘Flash Market Update’ – 9.23.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

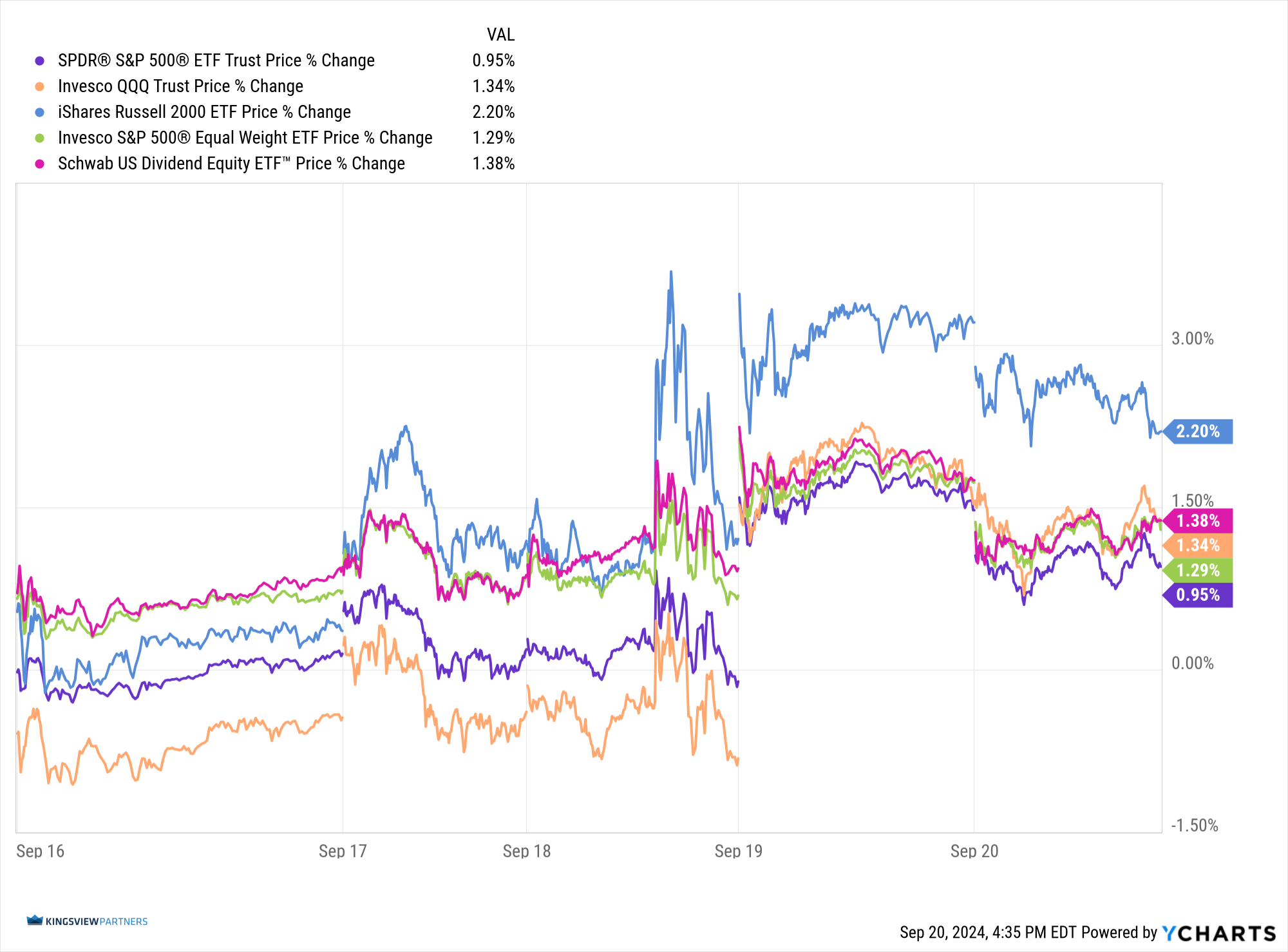

With the Federal Reserve’s promise of rate cuts providing a fresh tailwind, the troops, iShares Russell 2000 ETF (IWM), led a charge across the broad market battlefield last week, advancing 2.20%. The rest of the forces followed suit, with the generals, Invesco QQQ Trust (QQQ), gaining 1.34%. The brass commanders held their ground, as Schwab US Dividend Equity ETF (SCHD) rose 1.38% and the Invesco S&P 500 Equal Weight ETF (RSP) climbed 1.29%. The SPDR S&P 500 ETF Trust (SPY), though victorious, lagged slightly behind at 0.95%, solidifying our broadening theme.

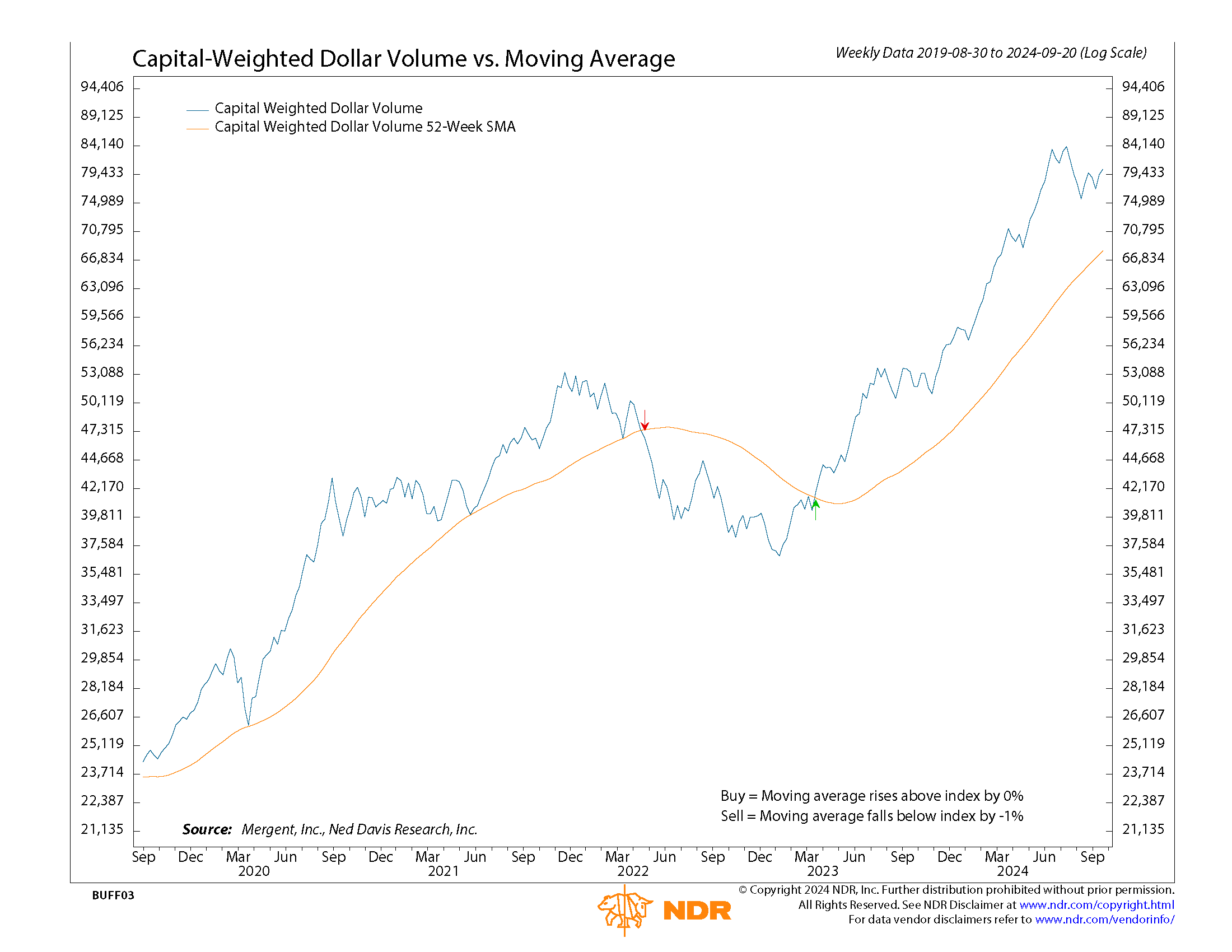

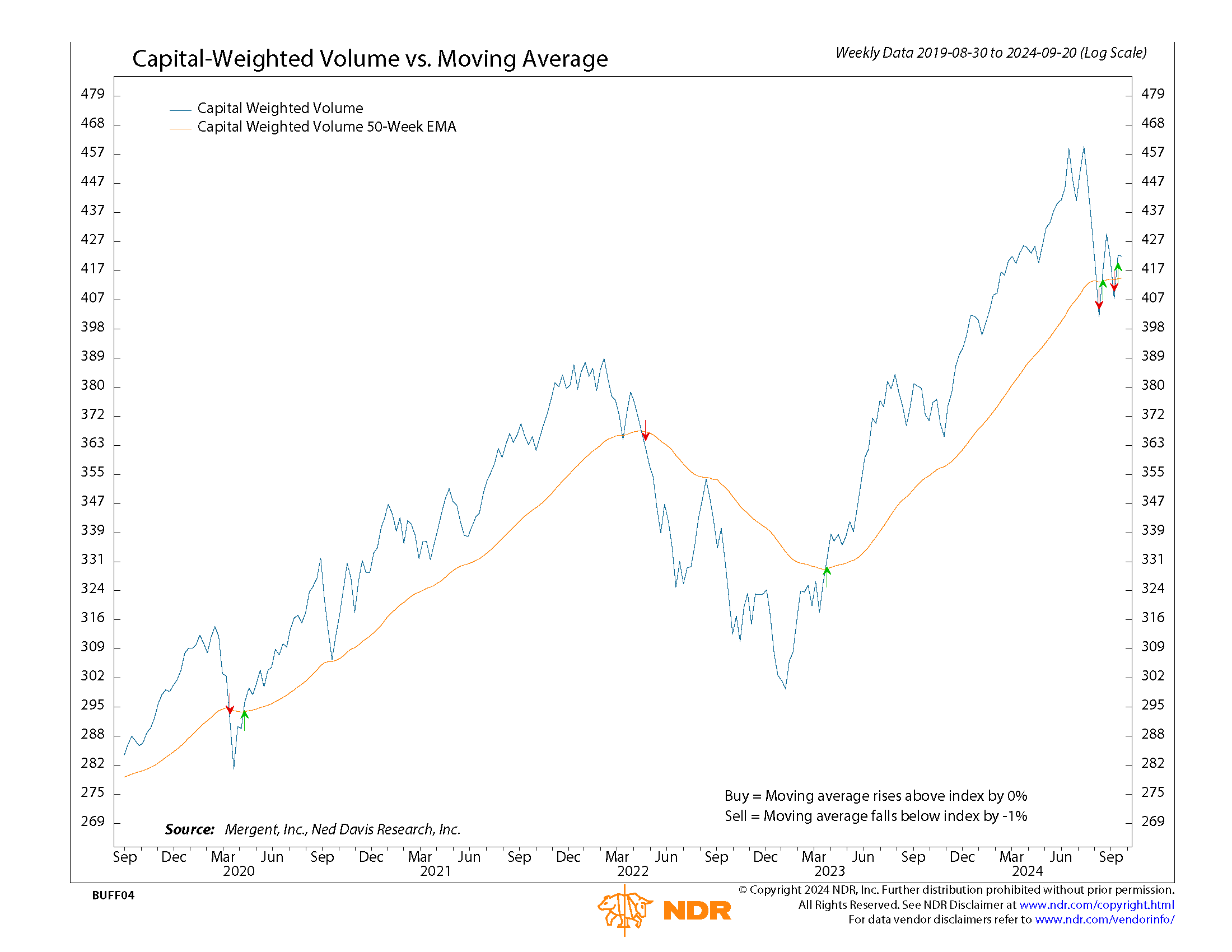

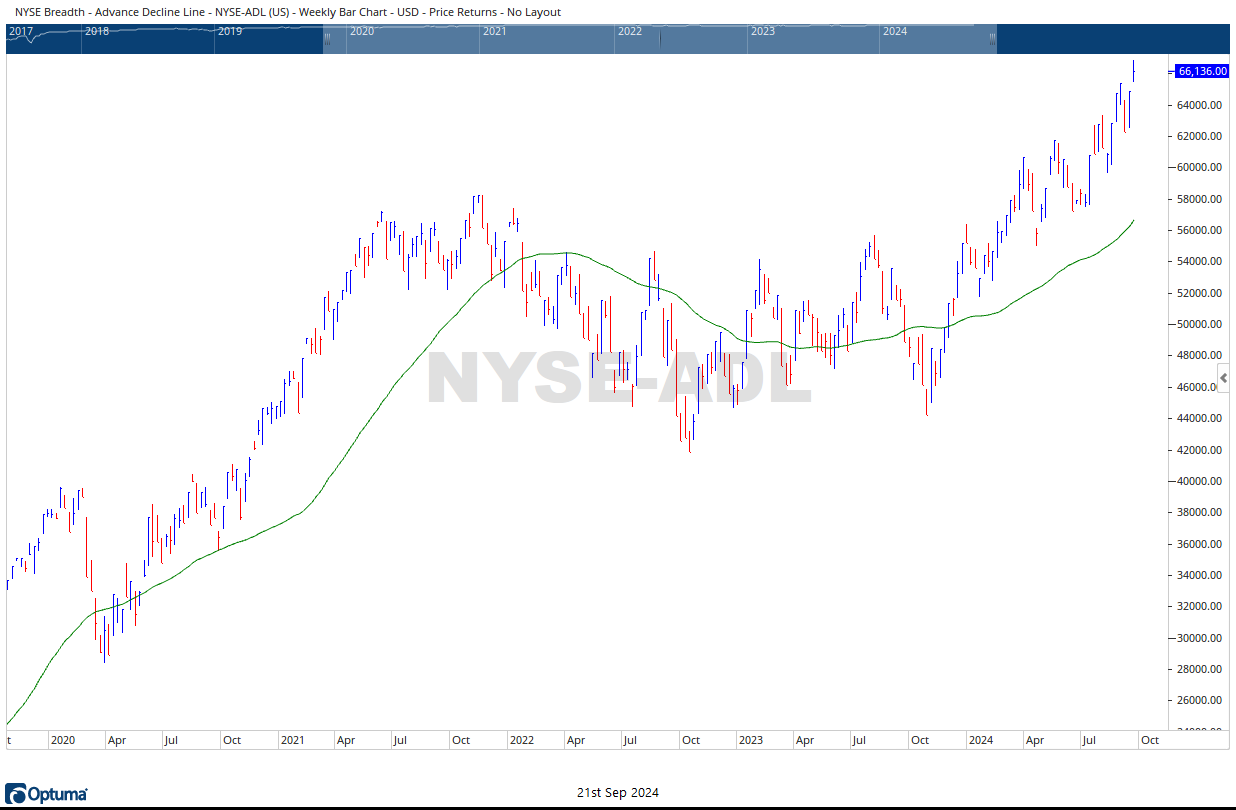

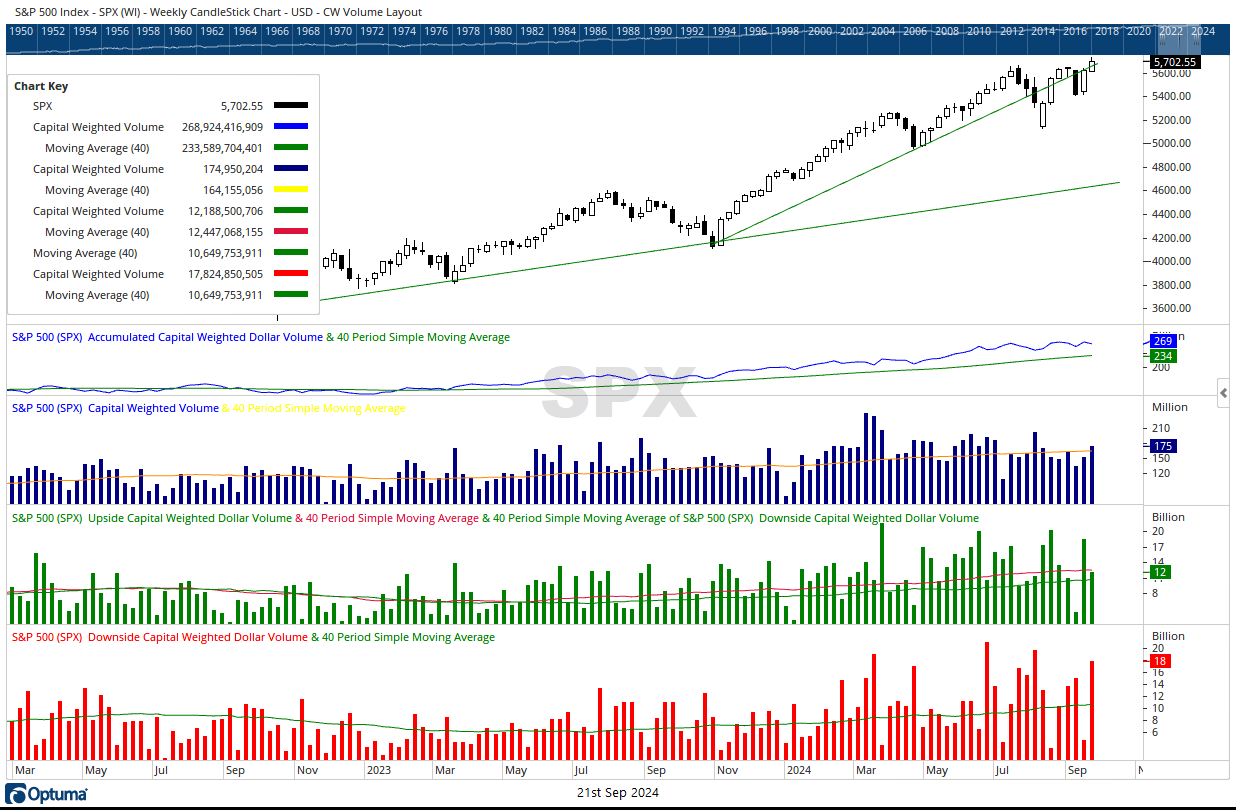

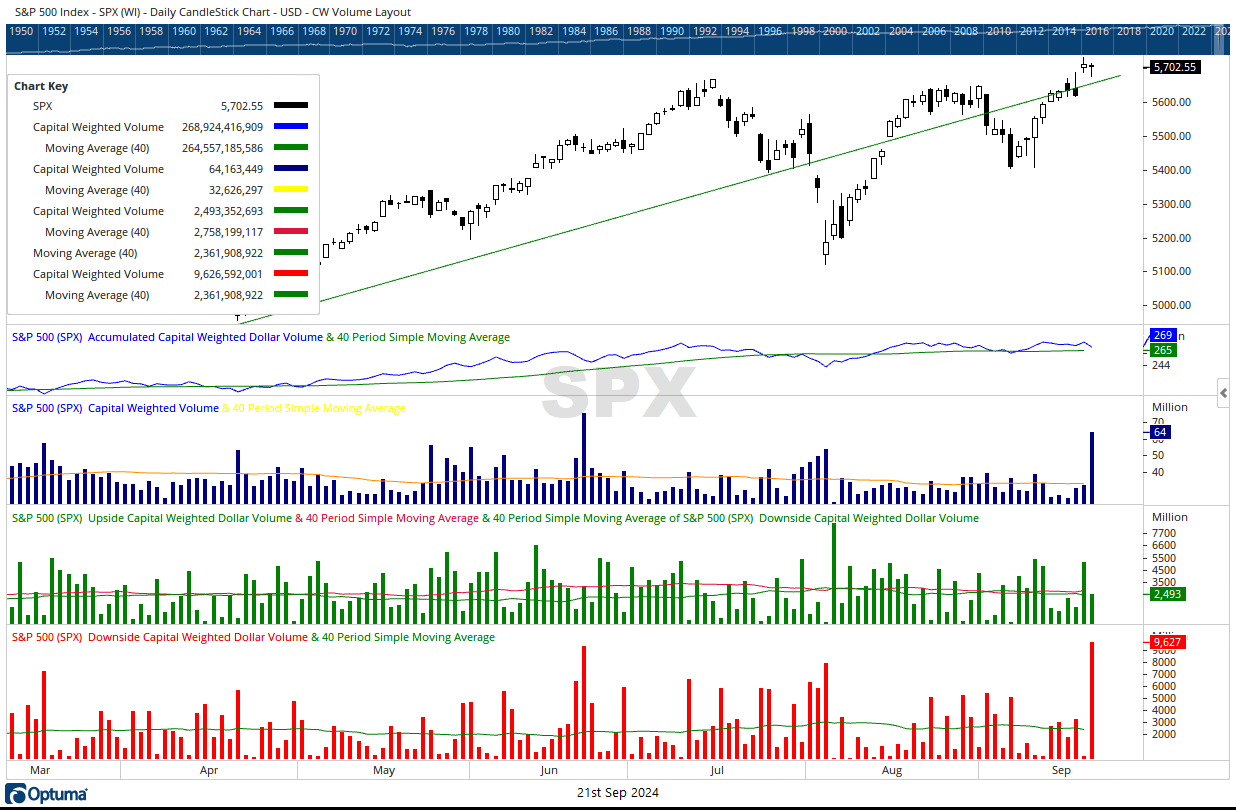

Meanwhile, the market’s breadth, represented by the NYSE Advance-Decline Line, planted its flag at new heights, signaling a potential broad offensive. The weaker relative performance of the S&P 500, coupled with the troops’ vigorous action, suggests the broadening out rotation maneuver may still be very much in play. Despite the S&P 500 breaching new weekly highs and overcoming trendline resistance, our intelligence reports reveal that volume is no longer leading the charge. Unlike price and the Advance-Decline, capital-weighted volume is now relatively diverging from the S&P 500’s strength, raising concerns about the sustainability of this advance.

Thursday, the day following the 50 basis point cut announcement, saw an impressive 97% upside volume day. However, this victory was hollow, with below-average participation given such remarkable price action. Then, on Friday, despite only marginal losses for the S&P 500, our forces witnessed a massive retreat of $9.6 billion in capital. This massive tactical withdrawal echoed the volume action that sparked our “And Then There Were None” series.

Yet, the most significant weakness in this bullish narrative lies within the volume trends. Although the S&P 500 has claimed new territory, our volume indicators are now lagging behind their previous strongholds. This is particularly concerning as these indicators had previously led our forces since the birth of this bull market on October 3rd, 2022. Previously, each capital-weighted volume indicator made new highs months before the price index finally hit a new high. Finally, when the S&P 500 made a new high, both of our volume indicators were significantly above their former highs. Please note, this week represents the first time the S&P 500 has made a new high without the volume indicators confirming and well above their highs since the beginning of this bull market.

While this development raises a yellow cautionary flag, remember that our volume indicators still hold the high ground above their trend lines. The S&P 500 has just broken through enemy lines to form a new high, and the Advance-Decline has also claimed new territory, now leading the price advance.

In conclusion, while our forces remain in a bullish formation, their overall health has weakened compared to earlier campaigns. The bull market continues to march on, but increased vigilance is now more crucial than ever. Stay alert, for in the fog of market war, risk management may be our most valuable ally.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 9/23/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.