- 2025-12-29

- Posted by: kimsite

- Categories: Insights, Volume Analysis

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

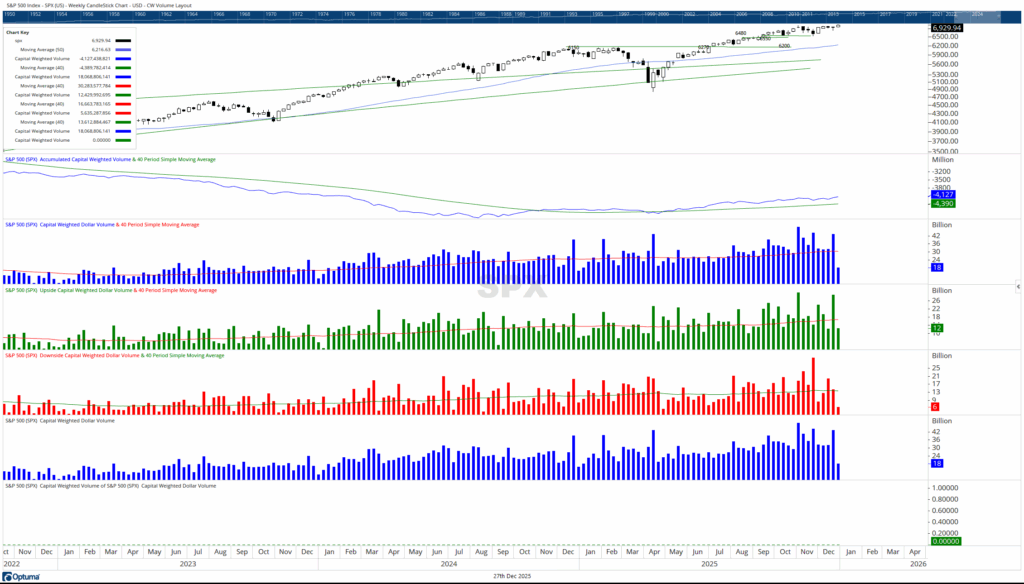

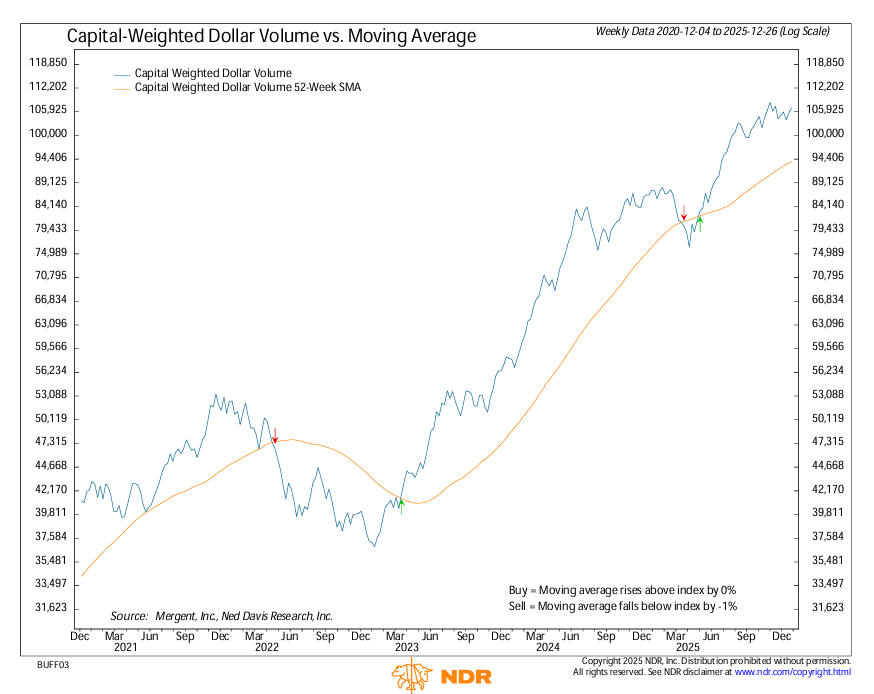

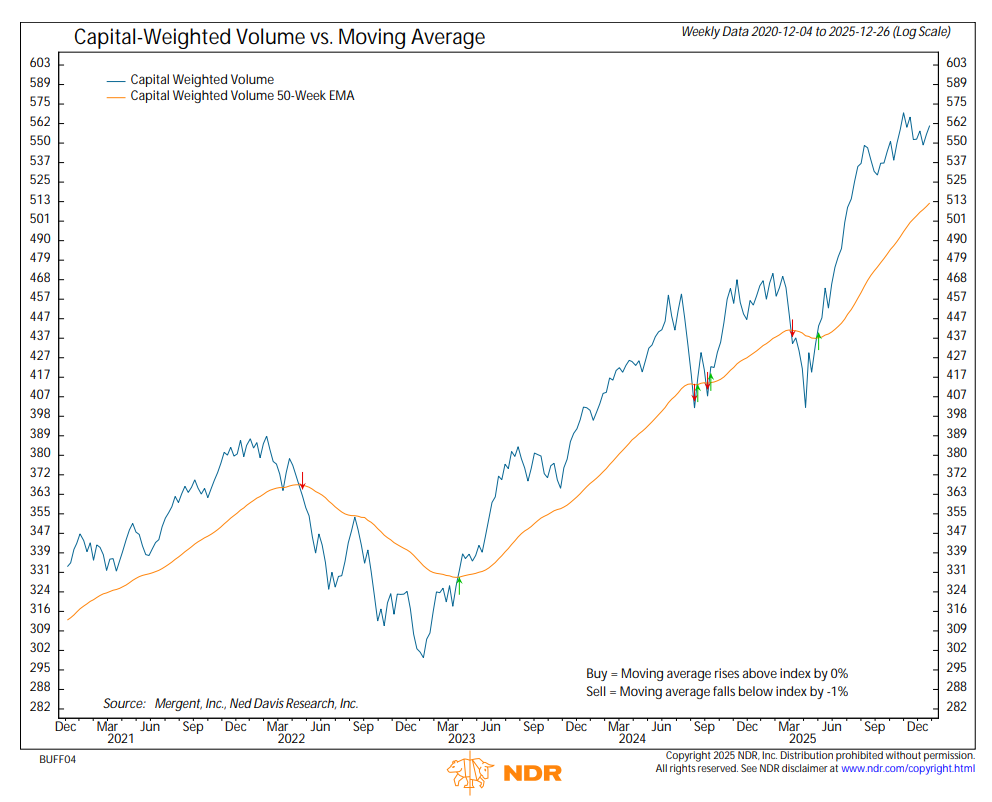

During the shortened Christmas week, most units responded with modest gains, but only the S&P 500 Index successfully broke free of its recent range to press into new all-time high territory. While the S&P 500 price index achieved fresh ground, the supply lines told a more restrained story. S&P 500 Capital Weighted Volume came in exceptionally light, even accounting for only three and a half trading sessions, marking the lowest weekly Capital Weighted Volume total since 2024’s Christmas week. Despite the light activity, participation leaned positive, with 73% of CW volume to the upside and 69% of capital flows registering as inflows.

In the week prior, both S&P 500 Capital Weighted Volume and Capital Weighted Dollar Volume successfully held support and advanced. That action continued this week to form new short-term peaks, constructive in the near term. Yet both measures remain below their respective all-time highs. The S&P 500, meanwhile, continues to exceed its prior peaks, creating a subtle divergence that suggests hesitation beneath the surface. On a longer-term basis, however, price and volume remain largely aligned. The S&P 500 Index stands roughly 10 percent above its 50-week moving average, while Capital Weighted Volume and Capital Weighted Dollar Volume remain approximately 9 percent and 11 percent above their weekly respective trend lines.

Market participation improved during the week. The NYSE Advance–Decline Line advanced beyond last week’s high but remained contained within the wide December 12th weekly bar, reflecting forward progress that has yet to fully escape consolidation.

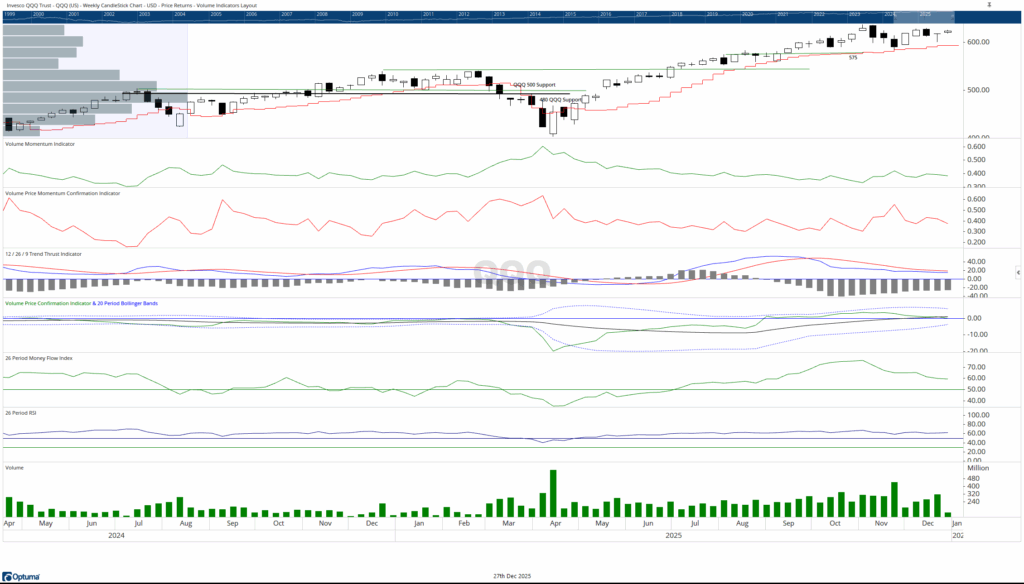

Leadership remains mixed. The generals, represented by the Invesco QQQ Trust, advanced on the week but failed to mount a decisive assault on the 625-resistance zone, where spinning-top formations continue to signal indecision. The troops, represented by the iShares Russell 2000 ETF, also advanced but stayed tightly confined within the prior week’s range. While the S&P 500 Index has moved into uncharted territory, the supporting divisions and internal measures continue to press forward cautiously, still operating inside their established boundaries.

Overall, the campaign remains constructive, but uneven. Price has taken the high ground, yet volume and capital flows have not fully followed into new territory. Leadership is advancing, participation is improving, but conviction seems more selective. In such moments, discipline matters more than enthusiasm or pessimism. Investors should consider remaining aligned with the primary trend while cautiously respecting the message of lighter volume and contained internal breakouts. Maintaining prudent position sizing, honoring key support levels, and preparing for consolidation or rotation remain essential risk management tools. Markets often reward patience at the margins, and when leadership advances alone, history reminds us that confirmation is earned, not assumed. And then there were none left without a risk management game plan.

Grace and peace,

BUFF DORMEIER, CMT

Updated: 12/29/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.