Volume Analysis Flash Update – 12.22.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

A Red-Nosed Rally Before Christmas

The market started the week before Christmas a little dull and slow,

Prices shuffled sideways while we waited Fed signals to show.

But then on Friday afternoon the generals took the lead,

The artificial intelligence trade woke up displaying speed.

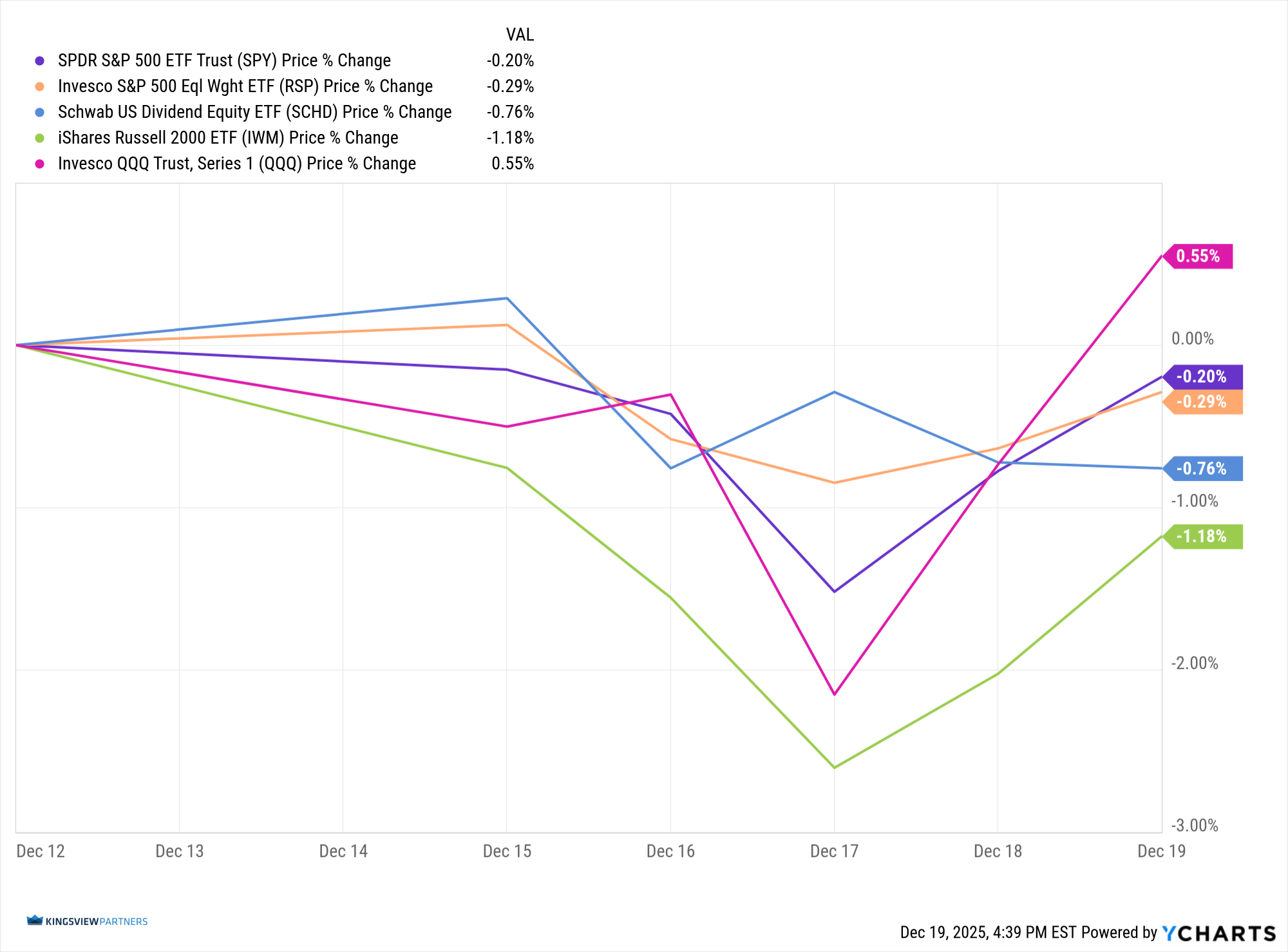

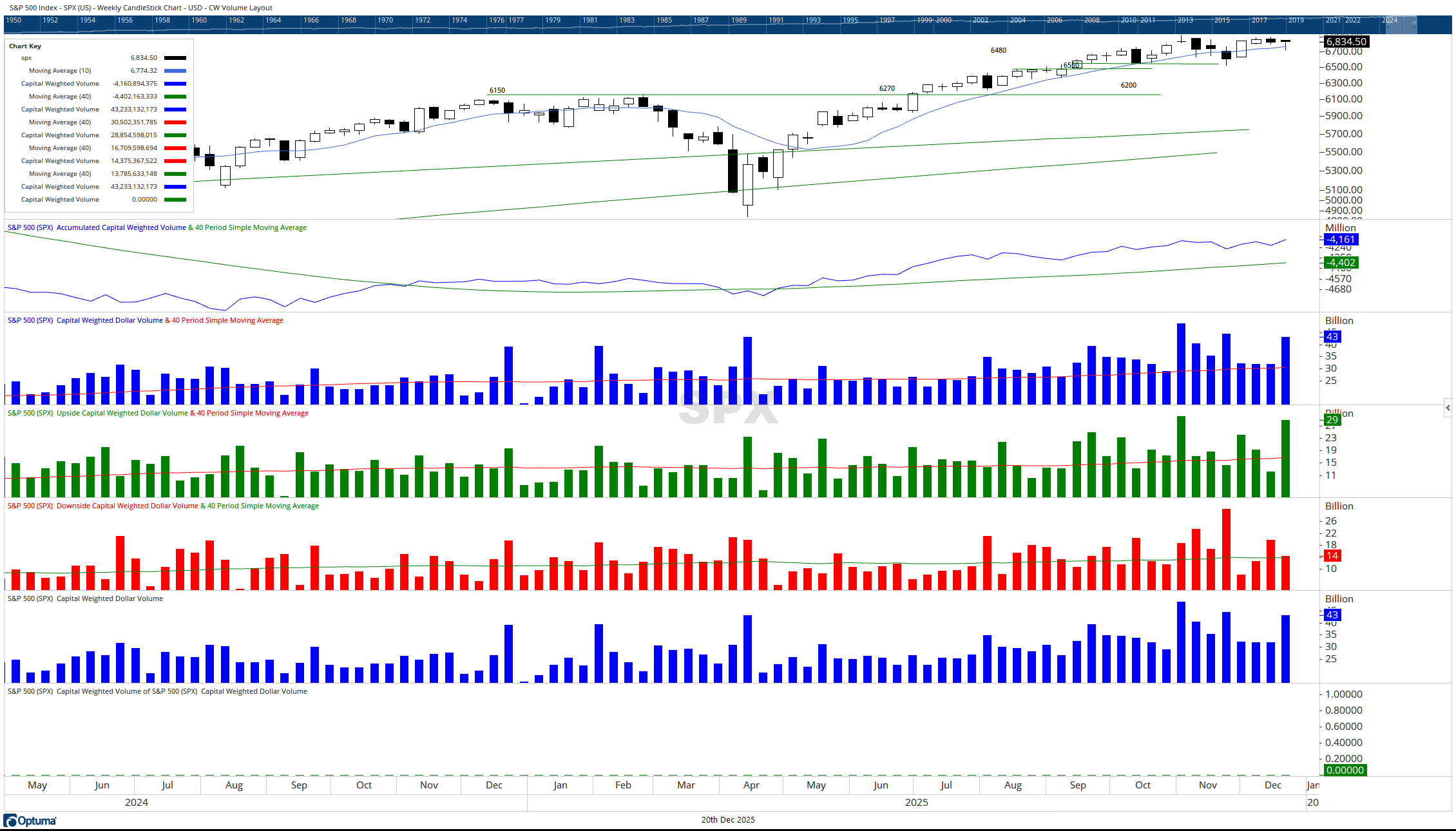

The S&P 500 closed just barely up the week,

Up a tenth of one percent though momentum felt less meek.

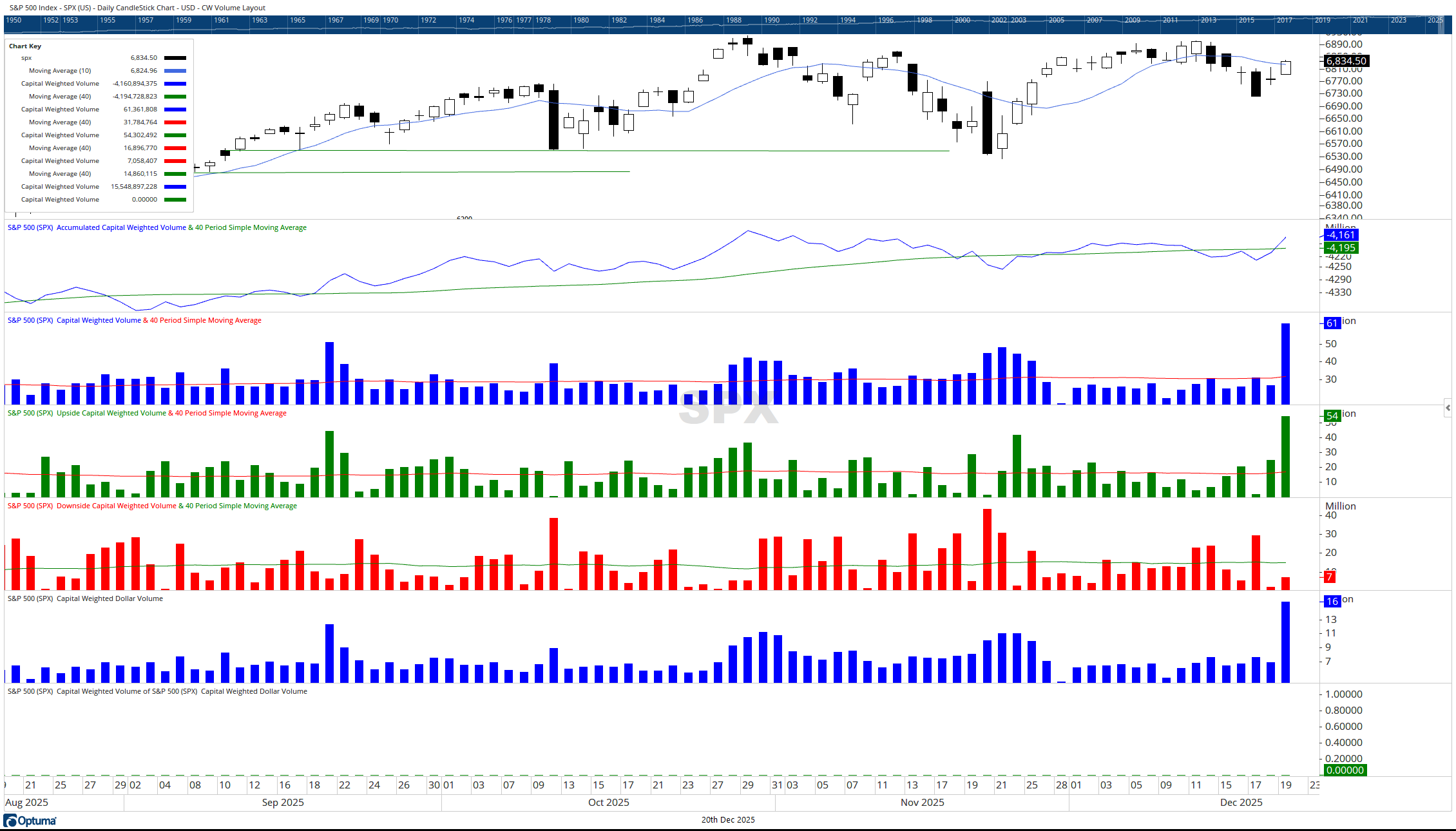

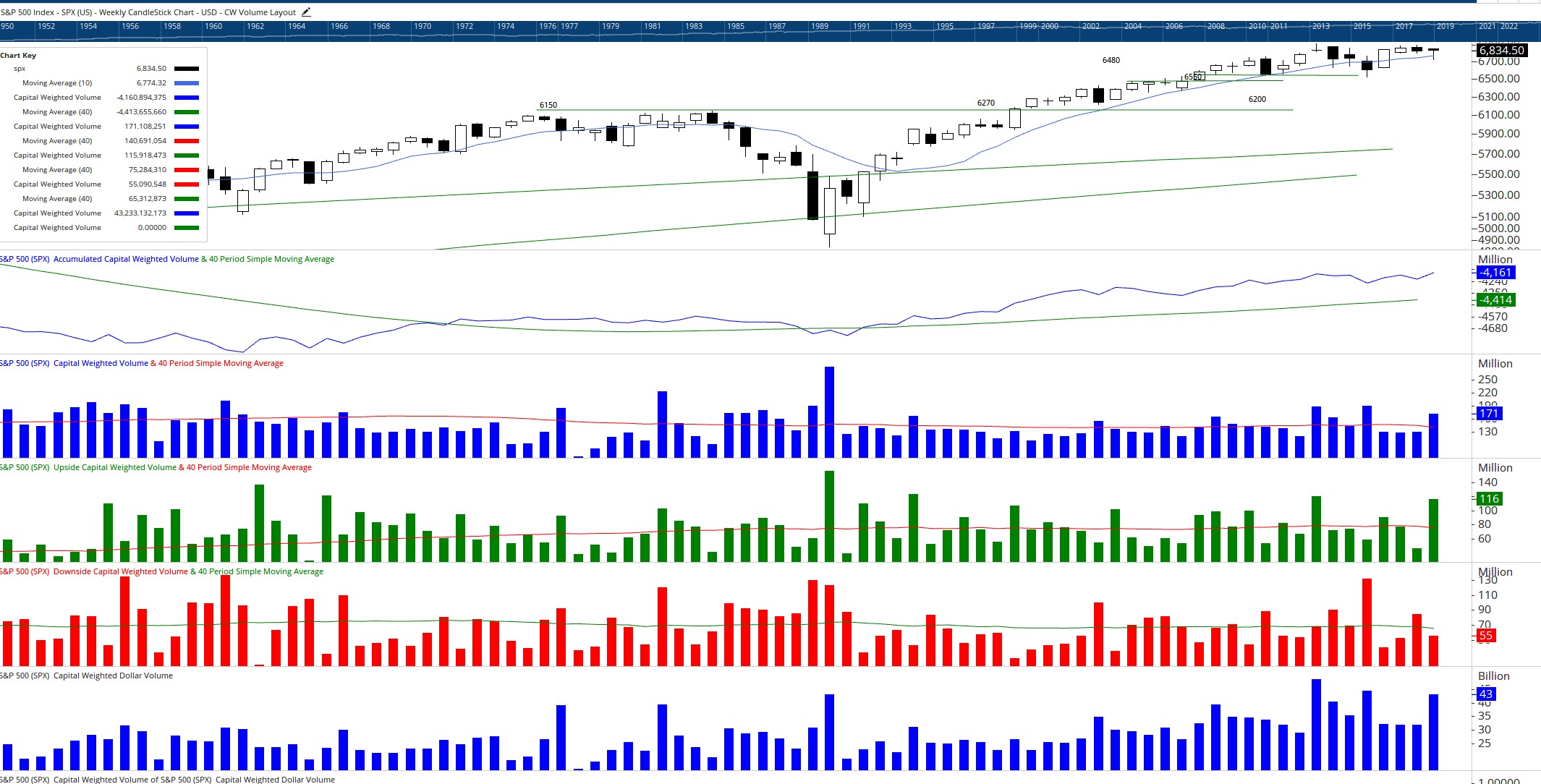

For Friday brought the biggest flows since April’s upside roar,

89% upside volume pushed opens a bullish door.

Not quite a 90% day but close enough to say,

That capital was rushing in to end the week this way.

For the week before Christmas volume boosts a tale,

67% upside weekly capital weighed volume did prevail.

Capital Weighted Volume rose above its normal range,

Upside volume surged while downside stayed restrained.

Capital flows ran strong as well with inflows leading through,

Outflows stayed about average just as Santa drew.

A few weeks back on December 8th we wrote our Christmas list,

Three gifts the market needed so no rally would be missed.

The generals must clear resistance strong and true,

The troops must chase new highs with follow through,

And capital flows must hook back up to guide the sleigh right through.

So far just one of three has checked the box just right,

The troops have shown some follow through and stayed within the fight.

The other two are still in play but time is growing thin,

If Santa’s sleigh is lifting soon they must all join in.

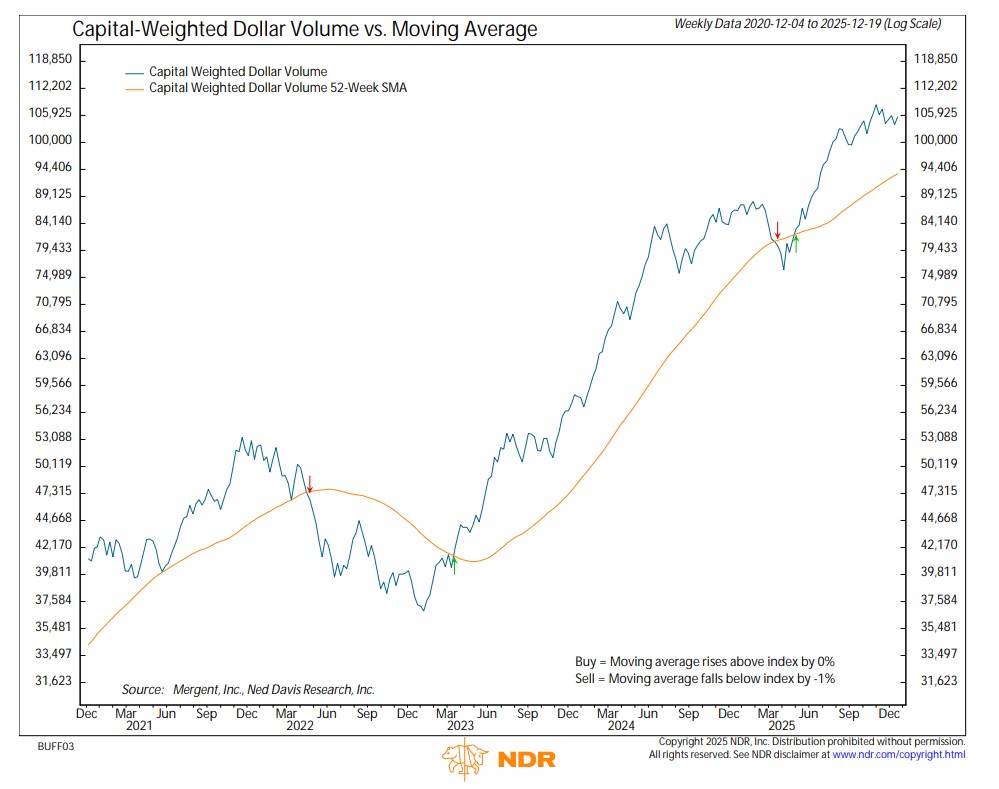

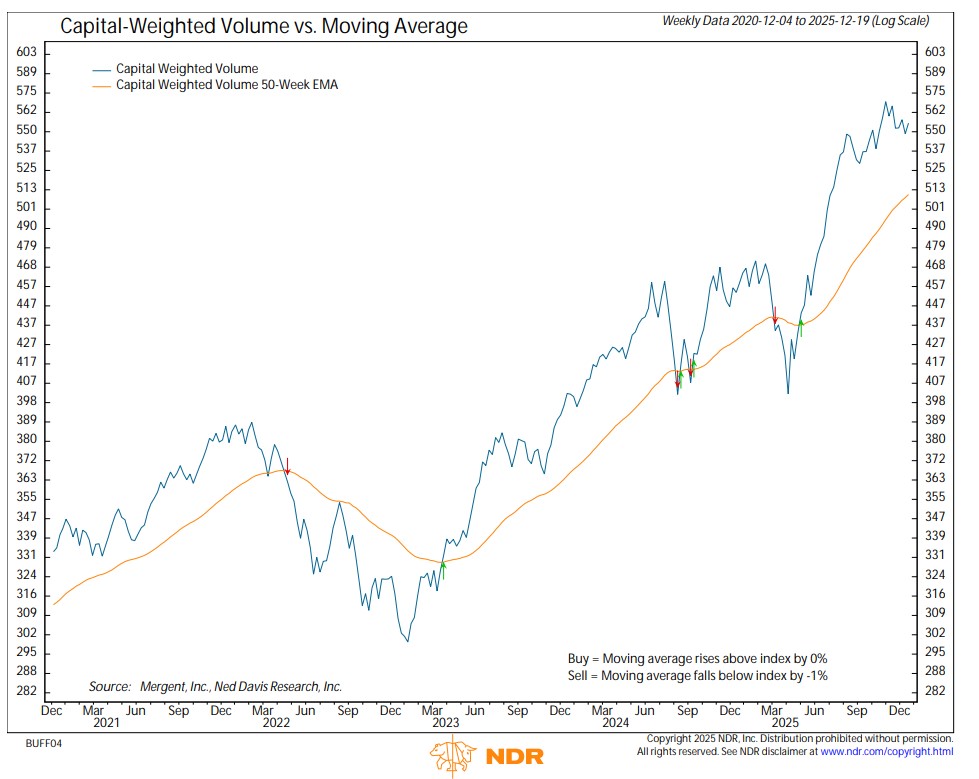

Two weeks ago the volume trends rolled over just a bit,

Those upward hooks bent downward and the market paused its fit.

This week both volume measures bounced off support instead,

Capital Weighted Volume and Dollar Volume turned Northernly ahead.

They still must clear resistance near the short-term zone,

But long term trends stay bullish strong and clearly shown.

Consolidation near the highs is not a sign of fear,

Just the market catching breath as Christmas eve draws near.

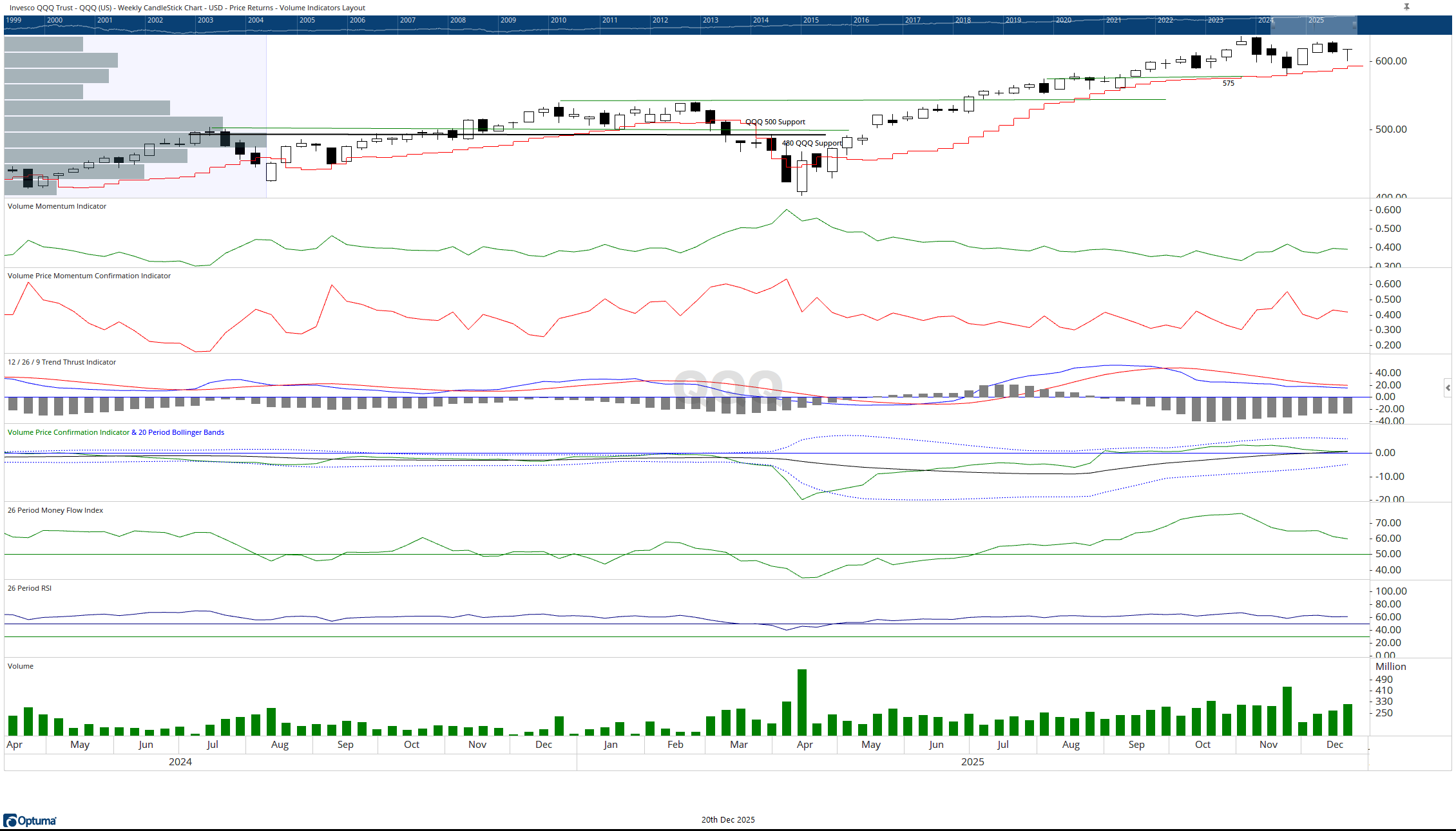

The generals led the charge at last though slowly out the gate,

But AI Nephilim finished the week up straight.

The troops slipped behind,

Down as sellers briefly chimed.

The other major units bent but did not break apart,

And Advance Decline stayed boxed in to play its part.

No breakouts or breakdowns just resting in their lanes,

Like reindeer patiently awaiting the sleigh to take reign.

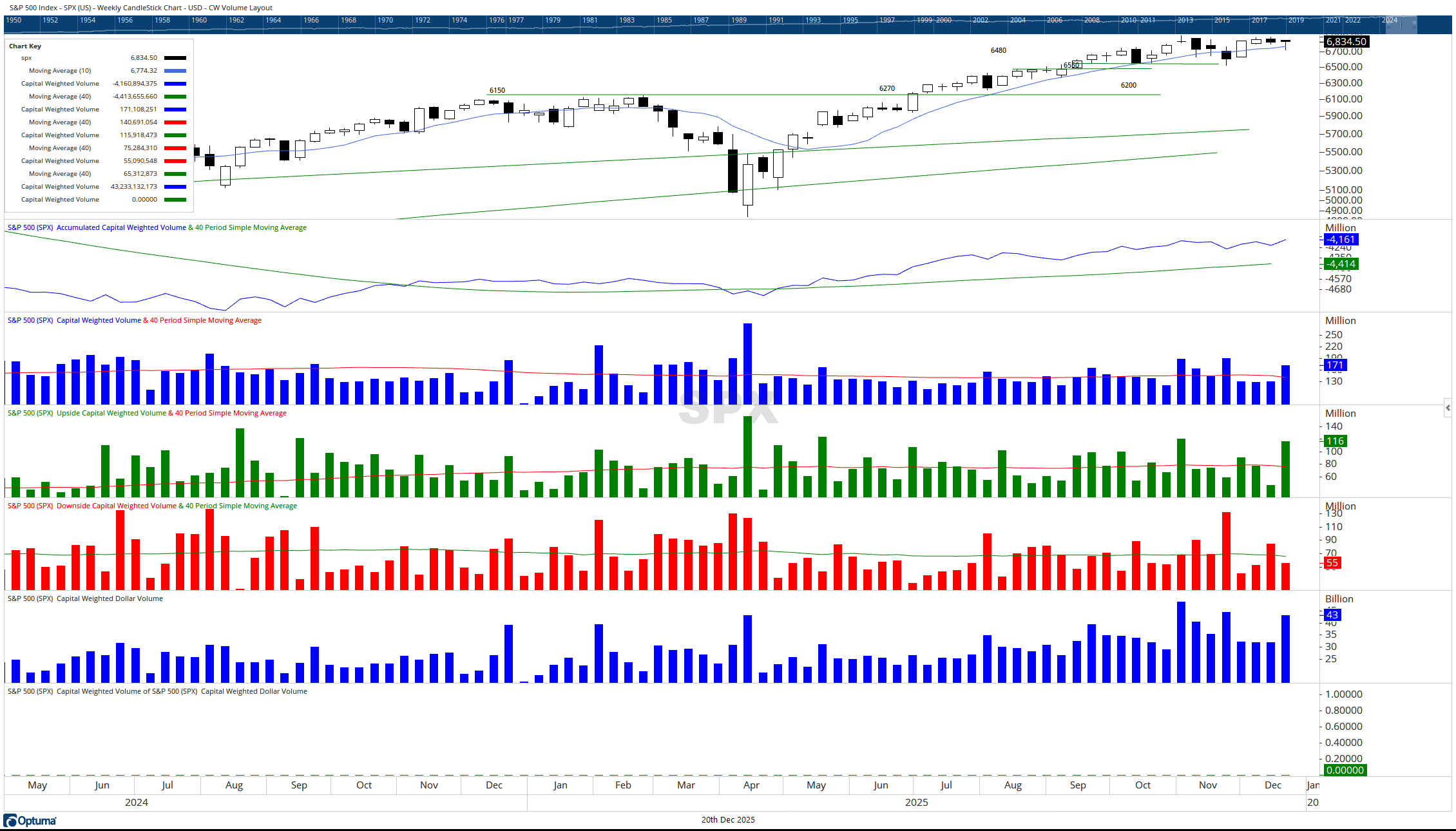

We foretold of a Halloween gravestone doji sign,

A warning from the generals back when spirits declined.

This week before Christmas a dragonfly doji appeared,

A candle hinting buyers may be growing less than feared.

Resistance waits at 625 then 630 too,

Those are the gates the generals must travel through.

The troops made lower lows and highs but held 250 strong,

Still marching in the parade though not yet leading song.

So Rudolph may be glowing but the fog is still around,

The path ahead looks promising but footing must be sound.

Volume trends are lifting now and leadership may align,

But discipline is vital in this late year in time.

Investors should stay focused keep risk in command,

Respect the lines of support like tracks in the sand.

Position size with care and keep exits in sight,

Even Santa checks the weather before each flight.

For markets move in cycles of pause and of cheer,

And preparation matters most this time of year.

Those guiding the sleigh with volume let discipline reign,

That there be a snow angel receiving its wings again.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 12/22/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.